- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Discover Discoveries

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Discover Discoveries

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover Discoveries

@CA4Closure wrote:

Discover scores were historically always low with me. Citi Costco is always higher than Chase, Discover and NFCU. Now NFCU is my lowest FICO score at 826!

Again, it isn't a "Discover score." If it's from your Discover account, it's your TU Fico 8 score. If it's from [Discover] creditscorecard, it's your EX Fico 8 score. Citi provides you with a EQ BCE Fico 8 score and through Chase you get your EX VS3. You'd therefore say that your EQ BCE Fico 8 score is higher than your TU Fico 8 and EX VS3, for example.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover Discoveries

@Slabenstein wrote:

@CA4Closure wrote:

@Anonymous wrote:

@CA4Closure wrote:I found out what part of your credit report Discover hits you hard on. For two years I was stuck on their FICO 801, 802, 800, 802 . . . then last month my Discover FICO shot up to 845! It so happened that my one and only inquiry fell off their report!

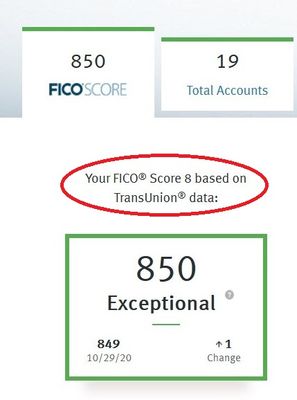

A couple of points. First, "Discover" isn't hitting you hard on anything. They are just providing you with a Fico score, which if it's from your CC account is a TU Fico Score 8 (pictured below). An inquiry would not impact your score 40-45 points. If your score increased that amount, it was due to another factor or factors improving. When you say the inquiry fell off your report, do you mean it reached 2 years of age or that it reached 1 year of age and became unscorable? If the latter, did you open an account associated with that inquiry and did that account just hit 12 months of age? That profile change is often worth 20-25 points on a clean file.

You'd have to compare your before and after credit reports to see what exactly changed that may have resulted in that score boost. Discover unfortunately doesn't provide you with reports to go along with that monthly score/summary update.

That inquiry was the only thing that dropped. My last credit card I applied for was over 2 years ago (Barclay's Hawaiian Airlines Mastercard Elite). My Costco (Citi) score is currently 861. Chase is my lowest 830.

Only thing I did was close my Capital One credit card (Platinum that had no rewards and a AF of $60). This card was 20 years old.Just closing the Cap1 Plat probably didn't have any effect on your score since it's still counting toward aging metrics. As said above, the inquiry falling off didn't cause this score gain as the gain from that 1) would have been much smaller and 2) occurred a year ago. Some things I can think of that could have contributed to a gain like yours would be paying down high revolving balances, crossing the lowest agg installment b:l threshold, and aging-related gains. But whether any of those apply here would depend on your particular profile and credit activities. If you're interested in trying to find out the actual cause of the gain, you can post your profile information from before and after and we can help you look it over for pertinent changes.

Also, just FYI, when you're comparing the scores that Disco, Citi, and Chase give you you're comparing different versions and models, which is kind of apples to oranges. Discover gives FICO TU8 and Chase gives EX VS3. Citi I'm not sure, but if the scores go above 850 it's either one of the FICO industry scores or an older Vantage.

Data Points:

AAoA: 20 years

<1% at any given time

FICO scores range from lowest 830 to 861

1 new account (14 months old)

Total Line of Credit: $210k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content