- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Does Closing a Credit Card Help or Hurt Credit...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Does Closing a Credit Card Help or Hurt Credit Score?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does Closing a Credit Card Help or Hurt Credit Score?

It's totally fine to close accounts you no longer want/need. The negative effects are honestly overhyped and temporary.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does Closing a Credit Card Help or Hurt Credit Score?

@CreditMagic7 wrote:

wrote:Even if it is closed, it remains on your report for 10 years. Also, if there is no annual fee, it is good to keep it open. A number of factors affect your score such AAOA among other things. With a thin file, it may drop your score temporarily and then bounce back.

I'm sorry but I've never understood this. No matter how many times I see it written around here (and I see it plenty) it still doesn't make sense to me. Why? I had/have a thin file and there was no score drop when I closed any of my three cards. There were small decreases from inquiries and new accounts reporting but scores are still steadily rising and made those drops insignificant. There was actually a 10-15 point increase when Cap One was closed and I took that as myFICO's way of saying, Congrats for dropping the dead weight!

Honestly if the loss of a card isnt causing a spike in utilization I truly dont understand the purpose of keeping a card open solely bc there's no annual fee especially considering this part >>> Even if it is closed, it remains on your report for 10 years. Call me crazy

OP I'm sure you'll be fine whatever you decide

That's NOT crazy. More like WISE in my eyes. I couldn't have done any better laying that out as very nice & to the point the way that you done just now HeavenlyFlower .

Kinda sums it up in a nutshell. I feel the same way. The advantages far outweigh the negatives when it comes to letting go of as you say "dead weight!"

I agree, although the 10-15 point increase was presumably due to other factors (I don't know of a way closing a card can increase a score, much more like to do nothing).

I think that most of the "keep it open for ever" comes from people either newish to credit or recent rebuilders, where each new TL is a victory, so giving it up for no purpose doesn't appear ro make sense. Later on in credit history, these things are much more likely to have no value (utilization wise for example) and the small negatives (needing to monitor, keeping them open with periodic payments better done on other cards etc) dominate, making it preferable to close.

One of those arguements where it seems hard to convince the other side

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does Closing a Credit Card Help or Hurt Credit Score?

I agree, although the 10-15 point increase was presumably due to other factors (I don't know of a way closing a card can increase a score, much more like to do nothing).

I thought it was a little strange myself but nothing else was going on at the time so I went with what 3B told me. Cuold have been a delay from a different change I suppose. Anything is possible ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does Closing a Credit Card Help or Hurt Credit Score?

I haven't figured it out how to use "Quote".

Thanks, everyone! ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does Closing a Credit Card Help or Hurt Credit Score?

@kdm31091 wrote:It's totally fine to close accounts you no longer want/need. The negative effects are honestly overhyped and temporary.

Yep... I closed my $2200 Apple, $650 76 and $650 Chevron cards when I picked up my $4500 + $2200 Apple = $6700 Sallie Mae.

None of the 3 cards would EVER get used again... and a closed account in good standing stays on your report 10 years.

No reason not to close them.

Hard INQs last 12 months: EQ: 0 | TU: 0 | EX: 0

Verizon Visa $8500 Amex Delta Reserve $10,000 Care Credit $18,000

NFCU CashRewards $7500 Apple Card $7000 Best Buy $8000 Amazon $5000

NFCU auto loan (2022 Ford Bronco Sport Badlands - Cactus Gray) 6.95%

NFCU motorcycle loan (2024 Harley Davidson Road Glide - Alpine Green & Chrome) 9.45%

Total CL: $64,000 --- Total CC UTI: 31% --- AAoA: 6.5 years --- Income: $200k

Last app: 4-6-24

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does Closing a Credit Card Help or Hurt Credit Score?

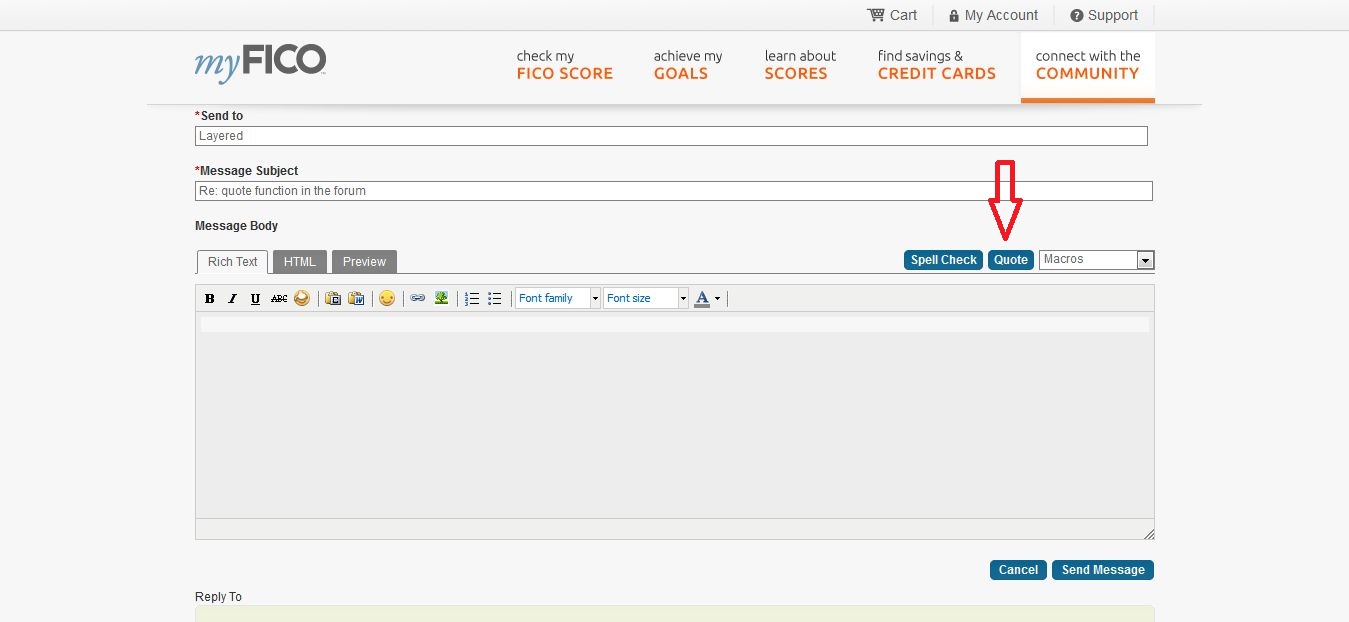

@Anonymous wrote:I haven't figured it out how to use "Quote".

Thanks, everyone!

Welcome to the forum. I notice that you might not know how to respond to posts by using our quote feature.

1. Click "reply" on the post you want to respond to.

2. To the right of the toolbar, next to the MACRO drop down-- and above the message post window -- you will see the quote button. It should look like this:

3. Tap the quote bubble to insert the text of the post you are responding to and the block of text will appear in the message post window.

4. Type your response below the quoted block of text and then click preview if you'd like to proof the post before submitting, or click "Post" at the bottom of the message post window.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does Closing a Credit Card Help or Hurt Credit Score?

One thing I was wondering, does having multiple closed accounts look bad if those accounts are only a few months old or less? I closed a Slate the other day after transferring the limit, I didn't even receive the card yet. I did the same with my Amazon Rewards and that card was only around three months old. I was going to close my Barclays card when my BT is complete, but again that card is only about a month old.

So, is closing new accounts viewed as a bad thing? I doubt it, but figured I'd see what kind of experience others have had doing this.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does Closing a Credit Card Help or Hurt Credit Score?

@dapps06 wrote:One thing I was wondering, does having multiple closed accounts look bad if those accounts are only a few months old or less? I closed a Slate the other day after transferring the limit, I didn't even receive the card yet. I did the same with my Amazon Rewards and that card was only around three months old. I was going to close my Barclays card when my BT is complete, but again that card is only about a month old.

So, is closing new accounts viewed as a bad thing? I doubt it, but figured I'd see what kind of experience others have had doing this.

You aren't helping your AAoA closing 1-3 month old accounts.

I'd love to hear what Chase had to say about you closing the Slate before you even got the card... let us know how your next Chase app goes.

Hard INQs last 12 months: EQ: 0 | TU: 0 | EX: 0

Verizon Visa $8500 Amex Delta Reserve $10,000 Care Credit $18,000

NFCU CashRewards $7500 Apple Card $7000 Best Buy $8000 Amazon $5000

NFCU auto loan (2022 Ford Bronco Sport Badlands - Cactus Gray) 6.95%

NFCU motorcycle loan (2024 Harley Davidson Road Glide - Alpine Green & Chrome) 9.45%

Total CL: $64,000 --- Total CC UTI: 31% --- AAoA: 6.5 years --- Income: $200k

Last app: 4-6-24

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does Closing a Credit Card Help or Hurt Credit Score?

@TRC_WA wrote:

@dapps06 wrote:One thing I was wondering, does having multiple closed accounts look bad if those accounts are only a few months old or less? I closed a Slate the other day after transferring the limit, I didn't even receive the card yet. I did the same with my Amazon Rewards and that card was only around three months old. I was going to close my Barclays card when my BT is complete, but again that card is only about a month old.

So, is closing new accounts viewed as a bad thing? I doubt it, but figured I'd see what kind of experience others have had doing this.

You aren't helping your AAoA closing 1-3 month old accounts.

I'd love to hear what Chase had to say about you closing the Slate before you even got the card... let us know how your next Chase app goes.

I'll bet they didn't care. They saved themselves a 0% interest period and there was no signup bonus involved.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does Closing a Credit Card Help or Hurt Credit Score?

@TRC_WA wrote:

@dapps06 wrote:One thing I was wondering, does having multiple closed accounts look bad if those accounts are only a few months old or less? I closed a Slate the other day after transferring the limit, I didn't even receive the card yet. I did the same with my Amazon Rewards and that card was only around three months old. I was going to close my Barclays card when my BT is complete, but again that card is only about a month old.

So, is closing new accounts viewed as a bad thing? I doubt it, but figured I'd see what kind of experience others have had doing this.

You aren't helping your AAoA closing 1-3 month old accounts.

I'd love to hear what Chase had to say about you closing the Slate before you even got the card... let us know how your next Chase app goes.

The guy on the phone actually sounded like he agreed with what I was doing. I've put a pretty good amount of money through my Freedom already and I've only had it a month, I told him I wasn't going to use the Slate because of the low limit they gave me and he agreed it was best to just transfer the limit. He's the one who asked if I wanted to do my Amazon Rewards as well.

I'm not worried about my AAoA, my student loans go back 14 years and my closed Wells Fargo auto loan goes back 9. Those accounts will keep me in the respectable AAoA range for awhile.