- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- EQ FICO08 Dropped 42pts for adding Bank CC

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

EQ FICO08 Dropped 42pts for adding Bank CC

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

EQ FICO08 Dropped 42pts for adding Bank CC

My Equifax FICO8 was 640 and Synchrony reported my PPMC @ 300 limit. Checked my EQ FICO now 598 (-42) with 3 inquiries showing. TU FICO8 655 and EX FICO8 571. My EX FICO2 is 657/FICO3 629. Why is my EX8 so low and why did my EQ drop 42 pats with new bank card tradeline. I have CapOne (300) reporting soon and Comenity/Toyota (2000). Will I see increases? Avg Age now

EX8-F9-F2 682-696-714

TU8-F9-F4 660-712-690

EQ8-F9-F5 688-714-667

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: EQ FICO08 Dropped 42pts for adding Bank CC

@44Rebuild2Ball wrote:

Hey all,

My Equifax FICO8 was 640 and Synchrony reported my PPMC @ 300 limit. Checked my EQ FICO now 598 (-42) with 3 inquiries showing. TU FICO8 655 and EX FICO8 571. My EX FICO2 is 657/FICO3 629. Why is my EX8 so low and why did my EQ drop 42 pats with new bank card tradeline. I have CapOne (300) reporting soon and Comenity/Toyota (2000). Will I see increases? Avg Age now

I'm afraid I can't understand your question(s).

1. What do you mean "Synchrony reported my PPMC @300 limit"

2. How would we know why your EX8 is low?

3. I seriously doubt that EQ FICO 8 dropped 42 points because a new account was reported.

4. What does it mean "I have CapOne (300) reporting soon"?

5. What does it mean "Comenity/Toyota (2000)?

6. What do you mean "Will I see increases?" Increases of what? Caused by what?

7. What does "Avg Age now" mean?

Total revolving limits 569520 (505320 reporting) FICO 8: EQ 699 TU 696 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: EQ FICO08 Dropped 42pts for adding Bank CC

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: EQ FICO08 Dropped 42pts for adding Bank CC

Not enough profile information to be able to answer any questions or offer any advice.

OP could have a 10 account file with a 60 month AAoA that drops only to 55 months AAoA with the addition of a new account. Conversely, OP could have a 2 account file with a 60 month AAoA that drops to 40 months with the addition of a new account. This is just 1 small example of how not having enough info can mean wildly different possibilities.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: EQ FICO08 Dropped 42pts for adding Bank CC

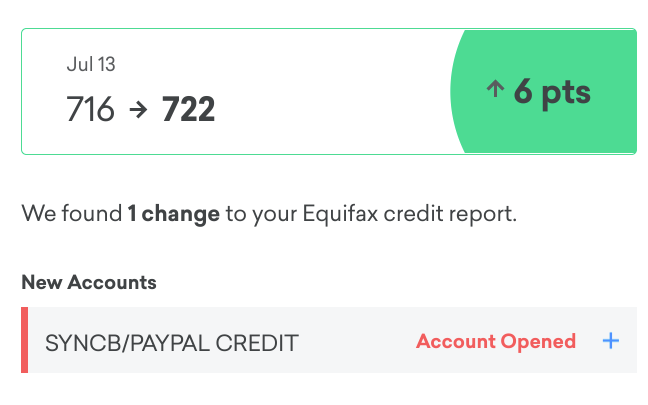

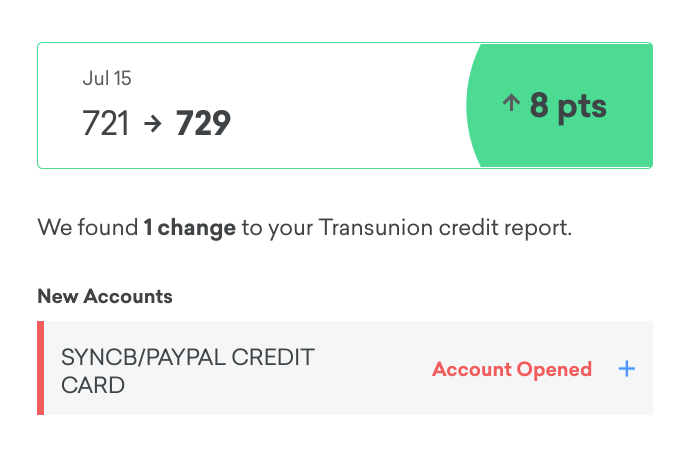

That's odd OP, I gained +6 points for opening my PPMC.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: EQ FICO08 Dropped 42pts for adding Bank CC

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: EQ FICO08 Dropped 42pts for adding Bank CC

@Anonymous wrote:That's odd OP, I gained +6 points for opening my PPMC.

It's not at all likely that the statement above is correct. It's also extremely difficult to know in many cases when you open an account what exactly impacts your score (and how much) because there are multiple variables that change at that moment in time. You may end up being able to determine the net gain or loss, but knowing how much the different variables played into that net change is quite difficult.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: EQ FICO08 Dropped 42pts for adding Bank CC

@Anonymous wrote:

How did you come to that conclusion? This is probably another example of a misattributed conclusion as a result of those alerts that don’t correlate.

I agree....I have no idea when, if ever that will not be misunderstood. An alert lets you know an alertable action has happened and pulls a current score. The new score might have changed because of the alerted action, or anything else that has shown up on your report. Bottom line....the alert and the score are not necessarily related at all. They are 2 different pieces of information. If you get an alert because of a paid tradeline, and your score has went down, it is likely due to something else, because a paid trade line usually increases your score.

EX fico08=815 06/16/24

EQ fico09=809 06/16/24

EX fico09=799 06/16/24

EQ fico bankcard08=838 06/16/24

TU Fico Bankcard 08=847 06/16/24

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: EQ FICO08 Dropped 42pts for adding Bank CC

@Anonymous wrote:

@Anonymous wrote:That's odd OP, I gained +6 points for opening my PPMC.

It's not at all likely that the statement above is correct. It's also extremely difficult to know in many cases when you open an account what exactly impacts your score (and how much) because there are multiple variables that change at that moment in time. You may end up being able to determine the net gain or loss, but knowing how much the different variables played into that net change is quite difficult.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: EQ FICO08 Dropped 42pts for adding Bank CC

Nevertheless this far from proves your hypothesis. You did not gain any points for adding an account, at least not in the short run.