- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Experian Mortgage Score DROPPED for now reason

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Experian Mortgage Score DROPPED for now reason

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian Mortgage Score DROPPED for now reason

@UpAndComing74 can we get your bankcard and auto Reason and Codes for both dates please?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian Mortgage Score DROPPED for now reason

@Anonymous wrote:

@Anonymous wrote:

@dragontears wrote:They were always classified as CFA. The reason code was just buried beneath other factors that have a larger impact on your scores.

That would then mean that between his pull on the 14th and his pull on the 16th, whatever was causing the "bad payment history" reason code to be present would have had to go away. Also accounts with balances would have had to drop for that to vanish from the list as well.

@Anonymous not necessarily, CFA could've became more important for some reason. And now that he's bringing up the date it was opened and it coincides, that's a little much to overlook.

@UpAndComing74 What is the age of your youngest Revolver? What's the age of your youngest Account? Do you know your average age of loan accounts?

Youngest Revolver is: 07/2020-6 months

Youngest Account is: 09/2020-4 months--AFFIRM

AAoA--4.8 years

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian Mortgage Score DROPPED for now reason

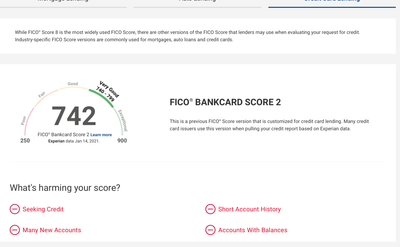

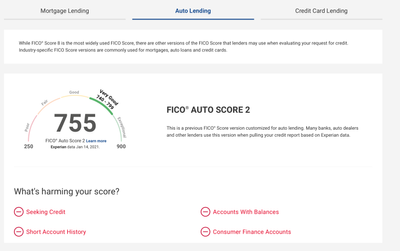

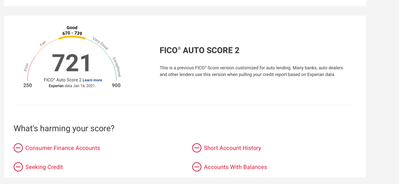

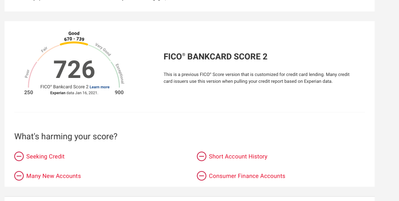

@Anonymous wrote:@UpAndComing74 can we get your bankcard and auto Reason and Codes for both dates please?

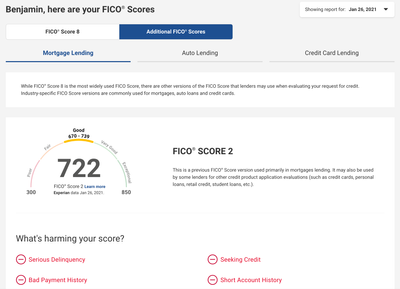

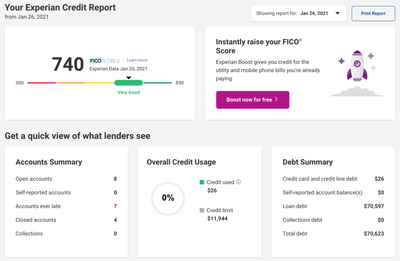

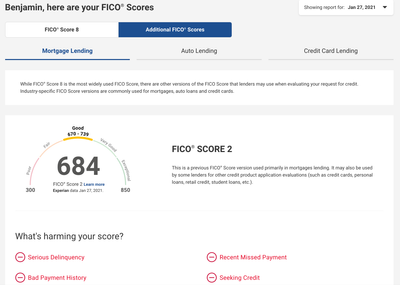

Jan 14

Jan 16

Note.Its been 734 EX2 for over 6 months...I did 3 INQ between 1/12-1/14. Could the INQ have dropped the score that much??? But alas, the drop was not identified on the 14th pull and all INQ are on that report.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian Mortgage Score DROPPED for now reason

@UpAndComing74 average age of loan accounts please?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian Mortgage Score DROPPED for now reason

@UpAndComing74 wrote:

@Anonymous wrote:@UpAndComing74 can we get your bankcard and auto Reason and Codes for both dates please?

Jan 14

Jan 16

Note.Its been 734 EX2 for over 6 months...I did 3 INQ between 1/12-1/14. Could the INQ have dropped the score that much??? But alas, the drop was not identified on the 14th pull and all INQ are on that report.

@UpAndComing74 Well that rules out the bad payment theory. It's definitely connected to the CFA.

to your question about the inquiries, mortgage inquiries are buffered and therefore do not take points for 30 days. And even if they were miscoded and the score hit was delayed by a couple days, CFA would not have went to number one above seeking credit (inquiries), as it would've tried to go higher. That tells me it has to do with the CFA.

it's very odd that all of a sudden that would become important unless you switched Scorecards. You could not have had an age related Scorecard change in the middle of the month, which leaves thick/thin and clean/dirty. With the number of accounts you have, you've been thick and that hasn't changed.

As for clean/dirty you said you only have one 30 day late which is not enough to make you dirty. And it gives back points as it gets older, it doesn't take them.

it has something to do with that CFA, but I cannot explain it. And considering the other number of seemingly unexplainable drops we had around that date, I'm tempted to think they did a update to the algorithm or database.

it might pay for you to call Experian and have them look into it, because if you can tell them you have examined reports from top to bottom and it did not change but the score did, somethings funny.

I just find it really odd the date on that opening is the 15th.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian Mortgage Score DROPPED for now reason

@Anonymous wrote:@Anonymous not necessarily, CFA could've became more important for some reason. And now that he's bringing up the date it was opened and it coincides, that's a little much to overlook.

I can't think of a reason why it would become more important outside of scorecard reassignment unless I'm missing something. I would imagine CFAs if anything become less impactful over time... the only fluke thing I could think of is the CFA(s) being reported with a incorrect/more recent date, but that would be easily visible.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian Mortgage Score DROPPED for now reason

My EX FICO 2 dropped today by 38 points and nothing changed. The only change is that some of my accounts have officially become a month older today. Is this a glitch that is being fixed or is this an update to the calculation? Any help that can be offered is very much appreciated.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian Mortgage Score DROPPED for now reason

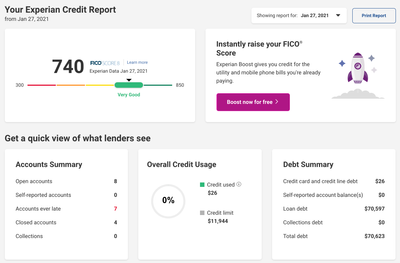

@juggernaut9 wrote:My EX FICO 2 dropped today by 38 points and nothing changed. The only change is that some of my accounts have officially become a month older today.

Accounts only grow in age by 1 month on the 1st of any given month, so it is not possible that they became a month older today (the 27th). They will however all grow by 1 month of age next Monday on the 1st, so if you check your scores then you can see if there's any possible impact from aging.

Looking at your negative reason statements, you've got "recent missed payment" present with your pull that's 38 points lower, where that statement isn't there previously. That suggests to me that a payment was reported as late between when you took that first pull and the second.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian Mortgage Score DROPPED for now reason

@Anonymous wrote:

@juggernaut9 wrote:My EX FICO 2 dropped today by 38 points and nothing changed. The only change is that some of my accounts have officially become a month older today.

Accounts only grow in age by 1 month on the 1st of any given month, so it is not possible that they became a month older today (the 27th). They will however all grow by 1 month of age next Monday on the 1st, so if you check your scores then you can see if there's any possible impact from aging.

Looking at your negative reason statements, you've got "recent missed payment" present with your pull that's 38 points lower, where that statement isn't there previously. That suggests to me that a payment was reported as late between when you took that first pull and the second.

I actually thought the same thing as far as the account age growing at the first of the month, but for some reason Experian and Equifax don't change the age of my account until the day of the month that it was opened. For example, I opened my AMEX on 2/26/20 and this account was considered 10 months old until 1/26/21 when it was changed to 11 months old.

I see the "recent missed payment", but I haven't had a missed and/or late payment since September 2019 (student loan) so I'm not understanding what recent payments are being referenced.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian Mortgage Score DROPPED for now reason

@Anonymous wrote:

@UpAndComing74 wrote:

@Anonymous wrote:@UpAndComing74 can we get your bankcard and auto Reason and Codes for both dates please?

Jan 14

Jan 16

Note.Its been 734 EX2 for over 6 months...I did 3 INQ between 1/12-1/14. Could the INQ have dropped the score that much??? But alas, the drop was not identified on the 14th pull and all INQ are on that report.

@UpAndComing74 Well that rules out the bad payment theory. It's definitely connected to the CFA.

to your question about the inquiries, mortgage inquiries are buffered and therefore do not take points for 30 days. And even if they were miscoded and the score hit was delayed by a couple days, CFA would not have went to number one above seeking credit (inquiries), as it would've tried to go higher. That tells me it has to do with the CFA.

it's very odd that all of a sudden that would become important unless you switched Scorecards. You could not have had an age related Scorecard change in the middle of the month, which leaves thick/thin and clean/dirty. With the number of accounts you have, you've been thick and that hasn't changed.

As for clean/dirty you said you only have one 30 day late which is not enough to make you dirty. And it gives back points as it gets older, it doesn't take them.

it has something to do with that CFA, but I cannot explain it. And considering the other number of seemingly unexplainable drops we had around that date, I'm tempted to think they did a update to the algorithm or database.

it might pay for you to call Experian and have them look into it, because if you can tell them you have examined reports from top to bottom and it did not change but the score did, somethings funny.

I just find it really odd the date on that opening is the 15th.

It is very strange and frustrating. I tried called EXP and first of all the person is overseas so the language barrier is there. Then they cannot pull the reports for 01/14 nor 01/16. They can only tell me my score as of now. I ran a program line by line of the two reports and nothing is different. On that 01/15 Affirm account it says Duration 12 months.. I wonder if it thinks it fell off.. but even so.. AAoA would still be counting..