- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Experian insufficient amount of accounts BS!!!

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Experian insufficient amount of accounts BS!!!

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian insufficient amount of accounts BS!!!

@Anonymous wrote:OP, impossible to say if it's BS without knowing what your CR looks like.

Slab I have not heard of someone having that negative reason statement present without having late payments on their CR, so that's interesting that you've seen it on a clean file.

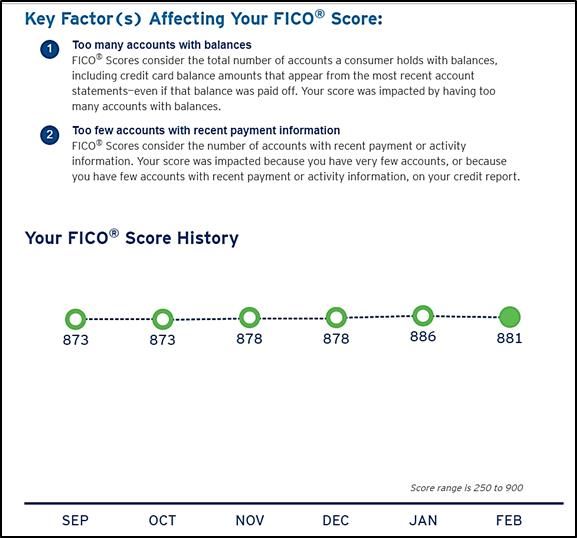

I get a "Too few accounts with recent payment information" reason statement every month on my EQ Bankcard Fico 8 from Citi (2016 to date - except when I had an INQ on file). I never had a late payment. I lack a critical mass of accounts so Fico 8 assigns my profile this negative reason statement. [Note: I have 6 open credit card accounts and one open mortgage].

Example pasted below (top paste 2018 screen shot).

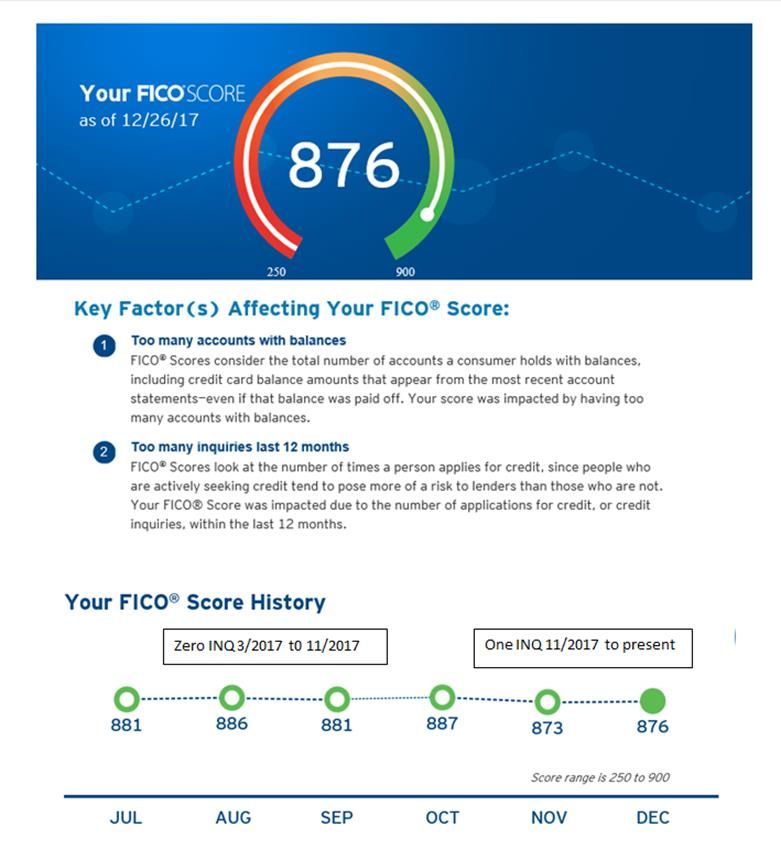

The "Too few" reason code is trivial and not worth worring about. When I took a single inquiry on EQ in Nov 2017, it was bumped down and off the list (bottom paste 2017 screen shot)

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian insufficient amount of accounts BS!!!

@Anonymous wrote:

@LP007 wrote:Is this some bull, or is this some bull?

@LP007 aging metrics please?

Any ideas on how to age my rent boost? TU shows a $(0.00) balance with the $(rent amount) paid as agreed each month, but EX shows a $(rent amount) balance with the $(rent amount)t paid as agreed each month. Are these monthly installment loans? how do you age and allocate %s for rent boost into the metric?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian insufficient amount of accounts BS!!!

@Thomas_Thumb wrote:The "Too few" reason code is trivial and not worth worring about. When I took a single inquiry on EQ in Nov 2017, it was bumped down and off the list (bottom paste)

That's interesting. I don't even see it on my monthly 3Bs with EQ Bankcard 8, and I only have 4 cards with 1 closed SSL.

Citi only shows the top 2, and they match the top 2 on my 3B. The remaining 2 are always:

- (3) "You have not established a long revolving and/or open-ended account credit history"

- (4) "You have too many credit accounts with balances." (50% or 2 of 4)

Of course, I did see it on my also perfectly clean file at various times on EX 8, EX BC8, EX AUTO8, and EQ5. But never on anything since moving from 2 to 4 cards in February.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian insufficient amount of accounts BS!!!

It's still lurking in the shadows for you but, too low on the list now - given your added accounts. Not surprisingly, your newish accounts and limited credit history are at the forefront.

I'm on a different score card (long credit history & no new accounts), The main weakness for my file is a low QTY of accounts. I have seen the "lack of an installment loan" on 3B reports from time to time but, never on my EQ Fico 8 Bankcard from Citi.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian insufficient amount of accounts BS!!!

@Thomas_Thumb wrote:

@Anonymous wrote:OP, impossible to say if it's BS without knowing what your CR looks like.

Slab I have not heard of someone having that negative reason statement present without having late payments on their CR, so that's interesting that you've seen it on a clean file.

I get a "Too few accounts with recent payment information" reason statement every month on my EQ Bankcard Fico 8 from Citi (2016 to date - except when I had an INQ on file). I never had a late payment. I lack a critical mass of accounts so Fico 8 assigns my profile this negative reason statement. [Note: I have 6 open credit card accounts and one open mortgage].

Example pasted below (top paste 2018 screen shot).

The "Too few" reason code is trivial and not worth worring about. When I took a single inquiry on EQ in Nov 2017, it was bumped down and off the list (bottom paste 2017 screen shot)

@Thomas_Thumb I could be wrong, but I think that that is a different reason code TT. One is too few paid as agreed where the other is lacking recent payment information.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian insufficient amount of accounts BS!!!

@LP007 wrote:

@Anonymous wrote:

@LP007 wrote:Is this some bull, or is this some bull?

@LP007 aging metrics please?

Any ideas on how to age my rent boost? TU shows a $(0.00) balance with the $(rent amount) paid as agreed each month, but EX shows a $(rent amount) balance with the $(rent amount)t paid as agreed each month. Are these monthly installment loans? how do you age and allocate %s for rent boost into the metric?

@LP007 sorry I know nothing about the rental Metrics.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian insufficient amount of accounts BS!!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian insufficient amount of accounts BS!!!

@Thomas_Thumb wrote:It's still lurking in the shadows for you but, too low on the list now - given your added accounts. Not surprisingly, your newish accounts and limited credit history are at the forefront.

I'm on a different score card (long credit history & no new accounts), The main weakness for my file is a low QTY of accounts. I have seen the "lack of an installment loan" on 3B reports from time to time but, never on my EQ Fico 8 Bankcard from Citi.

Yes, I believe that as well about it being too low on the list. I won't be surprised if it suddenly reappears on this next 3B in a few weeks after I reach AoOA 3yr 0mo on Decemeber 1st.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian insufficient amount of accounts BS!!!

@Thomas_Thumb wrote:The "Too few" reason code is trivial and not worth worring about. When I took a single inquiry on EQ in Nov 2017, it was bumped down and off the list (bottom paste 2017 screen shot)

Even though it is trivial, it's presence means it's impacting score at least 1 Fico point, right? If an inquiry bumped it down and off the list, we can conclude that its value is worth less than that of the inquiry, which perhaps you can't quantify with top end buffer (or maybe you can)?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian insufficient amount of accounts BS!!!

BBS, I don't quantitatively know the effect of "too few" on my score - it could be conditional . My view on presence of a negative reason statements is:

1) It can be costing points directly or...

2) It could be identifying a shortcoming or gap that has the potential to cost points. In this case points may not be lost if an alternate attribute has the ability to fill the gap.

I know what the inquiry is costing me based on comparative analysis. It is 5 to 8 points on BCE at the same # of cards reporting balances. (refer to 2nd paste below).

* I excluded the AU card in count reporting from the above graph. It reports a balance every month but, is not being considered in the Fico 8 algorithm.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950