- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: FICO 8 Dropped when Discover TL was added?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

FICO 8 Dropped when Discover TL was added?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO 8 Dropped when Discover TL was added?

@JLK93 wrote:

@Revelate wrote:

@Anonymous wrote:

Any new account general drops your score a couple points but it normally rebounds in a few months if you don't keep adding new accountsFor me I don't take a drop in score unless I cross an AAOA boundary or it reports a balance and it shifts my # of revolving tradelines with balance metric.

Then again I've never been clean for 2 years at a time which has been theorized as another reason for a drop (new account).

I would have to agree. I've never seen a new account cause a score drop without crossing a threshold.

Of course, AAoA is not the only threshold. Some profiles will experience a significant point increase when the youngest account ages to 1 year.

When my youngest account aged to 1 year, my EX08 Auto Enhanced score picked 19 points. My EX08 Bankcard Enhanced scored topped out at 900 and was therefor limited to a 10 point gain. Likewise, my EX08 Classic topped out a 850 and was limited to 9 points.

So, anyone who has a youngest account over 1 year will cross a threshold when a new account reports. The amount of point loss for crossing this threshold may be Scorecard dependent.

Crossing a youngest account threshold, as well as an AAoA threshold, could theoretically produce a greater point loss. However, I've never experienced that double whammy.

Hmm, obviously your file is different than mine but I got exactly 0 across every score version during my mortgage process last year when my then youngest account ticked over a year confirmed through 3B/1B pulls. Are you positive it was this rather than some other change?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO 8 Dropped when Discover TL was added?

@Revelate wrote:

@JLK93 wrote:

@Revelate wrote:

@Anonymous wrote:

Any new account general drops your score a couple points but it normally rebounds in a few months if you don't keep adding new accountsFor me I don't take a drop in score unless I cross an AAOA boundary or it reports a balance and it shifts my # of revolving tradelines with balance metric.

Then again I've never been clean for 2 years at a time which has been theorized as another reason for a drop (new account).

I would have to agree. I've never seen a new account cause a score drop without crossing a threshold.

Of course, AAoA is not the only threshold. Some profiles will experience a significant point increase when the youngest account ages to 1 year.

When my youngest account aged to 1 year, my EX08 Auto Enhanced score picked 19 points. My EX08 Bankcard Enhanced scored topped out at 900 and was therefor limited to a 10 point gain. Likewise, my EX08 Classic topped out a 850 and was limited to 9 points.

So, anyone who has a youngest account over 1 year will cross a threshold when a new account reports. The amount of point loss for crossing this threshold may be Scorecard dependent.

Crossing a youngest account threshold, as well as an AAoA threshold, could theoretically produce a greater point loss. However, I've never experienced that double whammy.

Hmm, obviously your file is different than mine but I got exactly 0 across every score version during my mortgage process last year when my then youngest account ticked over a year confirmed through 3B/1B pulls. Are you positive it was this rather than some other change?

Absolutely positive it was the youngest account aging to 1 year. I had pulls a couple of days before and then again on September 1st. I wanted to make sure that I would be able to document any score changes. It was an anticipated event.

The first time I saw someone document a score increase on FICO 8 for youngest account aging to 1 year was somewhere around 2014. This was my first chance to observe it. It don't believe there is a 1 year scoring benefit for the older models.

I also experience a rebucketing of my FICO 9 scores on the same date. My TU and EQ FICO 9 scores dropped approximately 15 points. FICO 8 and FICO 9 moved in opposite directions for the first time.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO 8 Dropped when Discover TL was added?

@JLK93 wrote:

@Revelate wrote:

@JLK93 wrote:

@Revelate wrote:

@Anonymous wrote:

Any new account general drops your score a couple points but it normally rebounds in a few months if you don't keep adding new accountsFor me I don't take a drop in score unless I cross an AAOA boundary or it reports a balance and it shifts my # of revolving tradelines with balance metric.

Then again I've never been clean for 2 years at a time which has been theorized as another reason for a drop (new account).

I would have to agree. I've never seen a new account cause a score drop without crossing a threshold.

Of course, AAoA is not the only threshold. Some profiles will experience a significant point increase when the youngest account ages to 1 year.

When my youngest account aged to 1 year, my EX08 Auto Enhanced score picked 19 points. My EX08 Bankcard Enhanced scored topped out at 900 and was therefor limited to a 10 point gain. Likewise, my EX08 Classic topped out a 850 and was limited to 9 points.

So, anyone who has a youngest account over 1 year will cross a threshold when a new account reports. The amount of point loss for crossing this threshold may be Scorecard dependent.

Crossing a youngest account threshold, as well as an AAoA threshold, could theoretically produce a greater point loss. However, I've never experienced that double whammy.

Hmm, obviously your file is different than mine but I got exactly 0 across every score version during my mortgage process last year when my then youngest account ticked over a year confirmed through 3B/1B pulls. Are you positive it was this rather than some other change?

Absolutely positive it was the youngest account aging to 1 year. I had pulls a couple of days before and then again on September 1st. I wanted to make sure that I would be able to document any score changes. It was an anticipated event.

The first time I saw someone document a score increase on FICO 8 for youngest account aging to 1 year was somewhere around 2014. This was my first chance to observe it. It don't believe there is a 1 year scoring benefit for the older models.

I also experience a rebucketing of my FICO 9 scores on the same date. My TU and EQ FICO 9 scores dropped approximately 15 points. FICO 8 and FICO 9 moved in opposite directions for the first time.

Interesting, thanks for the datapoints!

I would ask, just EX scores? Stupid sanity check but the inquiry wasn't there from a similar time frame?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO 8 Dropped when Discover TL was added?

@Revelate wrote:

@JLK93 wrote:

@Revelate wrote:

@JLK93 wrote:

@Revelate wrote:

@Anonymous wrote:

Any new account general drops your score a couple points but it normally rebounds in a few months if you don't keep adding new accountsFor me I don't take a drop in score unless I cross an AAOA boundary or it reports a balance and it shifts my # of revolving tradelines with balance metric.

Then again I've never been clean for 2 years at a time which has been theorized as another reason for a drop (new account).

I would have to agree. I've never seen a new account cause a score drop without crossing a threshold.

Of course, AAoA is not the only threshold. Some profiles will experience a significant point increase when the youngest account ages to 1 year.

When my youngest account aged to 1 year, my EX08 Auto Enhanced score picked 19 points. My EX08 Bankcard Enhanced scored topped out at 900 and was therefor limited to a 10 point gain. Likewise, my EX08 Classic topped out a 850 and was limited to 9 points.

So, anyone who has a youngest account over 1 year will cross a threshold when a new account reports. The amount of point loss for crossing this threshold may be Scorecard dependent.

Crossing a youngest account threshold, as well as an AAoA threshold, could theoretically produce a greater point loss. However, I've never experienced that double whammy.

Hmm, obviously your file is different than mine but I got exactly 0 across every score version during my mortgage process last year when my then youngest account ticked over a year confirmed through 3B/1B pulls. Are you positive it was this rather than some other change?

Absolutely positive it was the youngest account aging to 1 year. I had pulls a couple of days before and then again on September 1st. I wanted to make sure that I would be able to document any score changes. It was an anticipated event.

The first time I saw someone document a score increase on FICO 8 for youngest account aging to 1 year was somewhere around 2014. This was my first chance to observe it. It don't believe there is a 1 year scoring benefit for the older models.

I also experience a rebucketing of my FICO 9 scores on the same date. My TU and EQ FICO 9 scores dropped approximately 15 points. FICO 8 and FICO 9 moved in opposite directions for the first time.

Interesting, thanks for the datapoints!

I would ask, just EX scores? Stupid sanity check but the inquiry wasn't there from a similar time frame?

All FICO 8 scores increased. TU08 and EX08 increased to 850. i'll post before and after scores tonight or tomorrow. Only FICO 8 increased.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO 8 Dropped when Discover TL was added?

@Revelate wrote:Hmm, obviously your file is different than mine but I got exactly 0 across every score version during my mortgage process last year when my then youngest account ticked over a year confirmed through 3B/1B pulls. Are you positive it was this rather than some other change?

Youngest account at one year for FICO 9 and youngest account at 6 months for FICO 04 are strongly suggested to be rebucketing events. Youngest account a 1 year may also be a rebucketing event for FICO 8.

If you don't have anywhere to realistically be rebucketed to, then there would seem to be no reason to expect a score change. I assume that you are in the highest Scorecard for dirty reports. There is nowhere else to go.

There doesn't always have to be an increase. My TU and EQ FICO 9 scores took a dive.

The rebucketing of FICO 04 when youngest account ages to 6 months has been known for several years. There is a night a day difference in the way # of card with a balance are handled when crossing this threshold. I have experienced it a few times now.

However, you won't be able to see for yourself, until your reports are clean and you have a realistic place to be rebucketed to.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO 8 Dropped when Discover TL was added?

@JLK93 wrote:I would have to agree. I've never seen a new account cause a score drop without crossing a threshold.

Of course, AAoA is not the only threshold. Some profiles will experience a significant point increase when the youngest account ages to 1 year.

When my youngest account aged to 1 year, my EX08 Auto Enhanced score picked 19 points. My EX08 Bankcard Enhanced scored topped out at 900 and was therefor limited to a 10 point gain. Likewise, my EX08 Classic topped out a 850 and was limited to 9 points.

So, anyone who has a youngest account over 1 year will cross a threshold when a new account reports. The amount of point loss for crossing this threshold may be Scorecard dependent.

Crossing a youngest account threshold, as well as an AAoA threshold, could theoretically produce a greater point loss. However, I've never experienced that double whammy.

I don't believe I crossed any thresholds with the addition of new accounts back in June, yet my scores dropped after all 3 new accounts reported. My AAoA decreased from 7.X years to 7.Y years, so in the eyes of FICO it was still 7. I several other accounts opened within the previous year, so I didn't go from youngest account being > 1 year to < 1 year. From the inquiries hitting I lost a couple of points at most from my FICO 08 scores, but once the accounts reported my scores dropped about 12-15 points. Those 12-15 points were back within 2-3 cycles and by the 4th month my scores were higher than the were before my mini "spree." I chalked that score drop up to the addition of new accounts, not to any other factor(s).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO 8 Dropped when Discover TL was added?

@Anonymous wrote:

@JLK93 wrote:I would have to agree. I've never seen a new account cause a score drop without crossing a threshold.

Of course, AAoA is not the only threshold. Some profiles will experience a significant point increase when the youngest account ages to 1 year.

When my youngest account aged to 1 year, my EX08 Auto Enhanced score picked 19 points. My EX08 Bankcard Enhanced scored topped out at 900 and was therefor limited to a 10 point gain. Likewise, my EX08 Classic topped out a 850 and was limited to 9 points.

So, anyone who has a youngest account over 1 year will cross a threshold when a new account reports. The amount of point loss for crossing this threshold may be Scorecard dependent.

Crossing a youngest account threshold, as well as an AAoA threshold, could theoretically produce a greater point loss. However, I've never experienced that double whammy.

I don't believe I crossed any thresholds with the addition of new accounts back in June, yet my scores dropped after all 3 new accounts reported. My AAoA decreased from 7.X years to 7.Y years, so in the eyes of FICO it was still 7. I several other accounts opened within the previous year, so I didn't go from youngest account being > 1 year to < 1 year. From the inquiries hitting I lost a couple of points at most from my FICO 08 scores, but once the accounts reported my scores dropped about 12-15 points. Those 12-15 points were back within 2-3 cycles and by the 4th month my scores were higher than the were before my mini "spree." I chalked that score drop up to the addition of new accounts, not to any other factor(s).

IIRC, in June, you said that your youngest account was 15 months.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO 8 Dropped when Discover TL was added?

BBS -

As with Revelate, you are on a dirty scorecard. Based on what I read above YMMV may vary regarding scorecard change associated with age of youngest account reaching 1 year. In fact, with Fico 08 the following was stated on page 24 of: Your Credit Score 4th edition:

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO 8 Dropped when Discover TL was added?

@JLK93 wrote:

@Revelate wrote:Hmm, obviously your file is different than mine but I got exactly 0 across every score version during my mortgage process last year when my then youngest account ticked over a year confirmed through 3B/1B pulls. Are you positive it was this rather than some other change?

Youngest account at one year for FICO 9 and youngest account at 6 months for FICO 04 are strongly suggested to be rebucketing events. Youngest account a 1 year may also be a rebucketing event for FICO 8.

If you don't have anywhere to realistically be rebucketed to, then there would seem to be no reason to expect a score change. I assume that you are in the highest Scorecard for dirty reports. There is nowhere else to go.

There doesn't always have to be an increase. My TU and EQ FICO 9 scores took a dive.

The rebucketing of FICO 04 when youngest account ages to 6 months has been known for several years. There is a night a day difference in the way # of card with a balance are handled when crossing this threshold. I have experienced it a few times now.

However, you won't be able to see for yourself, until your reports are clean and you have a realistic place to be rebucketed to.

Heh, not sure I'm in the highest one but I'm probably fairly close given the scores posted over time with folks and dirty reports.

That's a good point though as it might be a scorecard segmentation bit for clean files as there are a lot more clean than dirty buckets. It's something I'll look into when the tax liens and lates are gone whenever I dust off the credit report for something.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO 8 Dropped when Discover TL was added?

@Thomas_Thumb wrote:BBS -

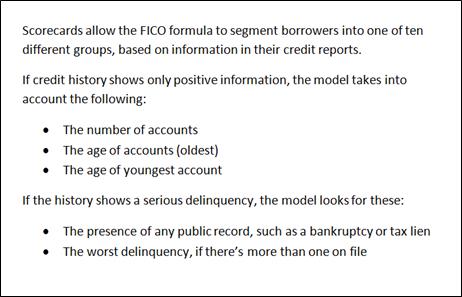

As with Revelate, you are on a dirty scorecard. Based on what I read above YMMV may vary regarding scorecard change associated with age of youngest account reaching 1 year. In fact, with Fico 08 the following was stated on page 24 of: Your Credit Score 4th edition:

TT, good info there. If that's the case, and I'm understanding it correctly, since I have a dirty scorecard the age of my youngest account wouldn't be factored into scoring since I possess a serious delinquency.