- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: FICO 8 vs FICO 2

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

FICO 8 vs FICO 2

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

FICO 8 vs FICO 2

I have too many accounts with balances.

And I have high revolving balances on certain of my larger credit limit revolving accounts with credit unions.

Possibly confirming the views that:

(a) larger limit revolving accounts are disregarded in FICO 2 utilization computations

(b) credit union revolving accounts are disregarded in FICO 2 utilization computations

(c) number of accounts with balances is more critical in FICO 2 than in FICO 8

(d) FICO 8 is more sensitive to revolving utilization in dollars

are

(I) the fact that my FICO 8 is at an all time low while my FICO 2 is at an all time high

and

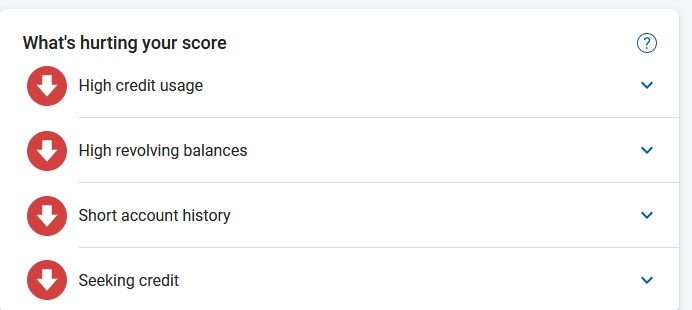

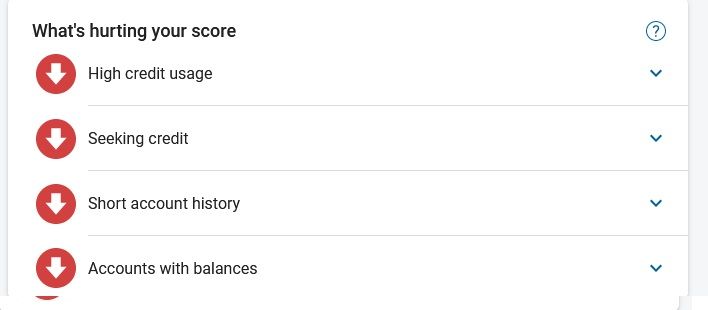

(II) a comparison of the reason codes, in which FICO 8 notes the "high revolving balances"

while FICO 2 says nothing of that but points out number of "accounts with balances":

FICO 8:

FICO 2:

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO 8 vs FICO 2

Cool info.

What does the "high credit usage" reason code point to specifically? Do we know if it's percentage related? Dollars? Accounts?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO 8 vs FICO 2

@Anonymous wrote:Cool info.

What does the "high credit usage" reason code point to specifically? Do we know if it's percentage related? Dollars? Accounts?

My worst percentage accounts are also my highest balance and limit accounts, so it's impossible to say definitively, but I am a believer that percentages trump dollar amounts.

One of the things I find most amazing is that my FICO 2 is at an all time high at the same time that my FICO 8 is at an all time low. One would expect them to run more or less in tandem.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO 8 vs FICO 2

I find it interesting that your top negative reason code for EX2 is still high credit use. If you eliminate the high credit limit accounts that would be ignored, what are the remaining percentage(s) that the algorithm is going by?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO 8 vs FICO 2

@Anonymous wrote:I find it interesting that your top negative reason code for EX2 is still high credit use. If you eliminate the high credit limit accounts that would be ignored, what are the remaining percentage(s) that the algorithm is going by?

Sufficiently high to create a problem.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO 8 vs FICO 2

@SouthJamaica wrote:I have too many accounts with balances.

And I have high revolving balances on certain of my larger credit limit revolving accounts with credit unions.

Possibly confirming the views that:

(a) larger limit revolving accounts are disregarded in FICO 2 utilization computations

(b) credit union revolving accounts are disregarded in FICO 2 utilization computations

(c) number of accounts with balances is more critical in FICO 2 than in FICO 8

(d) FICO 8 is more sensitive to revolving utilization in dollars

are

(I) the fact that my FICO 8 is at an all time low while my FICO 2 is at an all time high

and

(II) a comparison of the reason codes, in which FICO 8 notes the "high revolving balances"

while FICO 2 says nothing of that but points out number of "accounts with balances":

FICO 8:

FICO 2:

@SouthJamaica Yes, EX2 excludes revolvers over ~$27000-$29000. Yes, # of accounts with a balance is more important on 2 than 8. And 8 is more sensitive to utilization.

high credit usage is revolving utilization I believe.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO 8 vs FICO 2

Right, which is why I asked SJ what his utilization percentages were with the high credit limits excluded, to see what the algorithm (percentage wise) is considering high.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO 8 vs FICO 2

@Anonymous wrote:Right, which is why I asked SJ what his utilization percentages were with the high credit limits excluded, to see what the algorithm (percentage wise) is considering high.

@Anonymous typically anything over 5% or 10% aggregate or 30% individual will trigger the code and as the utilization goes up so does the code.

As you know, many people don't see it because it's not high enough until the utilization gets high enough. So it wouldn't take much to get the code, but how high it gets can be instructive.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO 8 vs FICO 2

Yeah I'm interested since it's at the top of the lists.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO 8 vs FICO 2

@Anonymous wrote:Right, which is why I asked SJ what his utilization percentages were with the high credit limits excluded, to see what the algorithm (percentage wise) is considering high.

@Anonymous Excluding all accounts with limits > 25k, I had 8 accounts with > 30% utilization, one of which had > 50% utilization.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682