- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: FICO Auto 5 and Equifax

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

FICO Auto 5 and Equifax

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

FICO Auto 5 and Equifax

Hi all.. Before I get started -- this is really just a trivial question. It doesn't impact me in any way - more just curiosity.. Quick question about scoring and factors shown on my report for FICO Auto 5.. My FICO Score 8 scores are EQ 850, TU 850, EX 849. My scores have been stable at this level for around 2 years.

When I view the FICO AUTO SCORE 5, 4 & 2 -- EQ 825, TU 847, EX 848. The Equifax seems to be an outlier.. If I go into detail on the Equifax one, it shows 4 negative factors that have no basis in reality:

- You opened a new credit account relatively recently

- The amount owed on your revolving and/or open ended accounts is too high

- Youve made heavy use of your available revolving credit

- The remaining balance on your mortgage or non-mortgage installment loans is relatively high.

So to address the above - Equifax FICO Score 8 reports the following:

- Age of most recent is 31 months

- Amount owed on revolving is ~ $2858, with 3% revolving utilization.

- No mortgage, and amount remaining on installment loans is ~ 2600.

- Avg age of accounts is 124 months

- No lates/delinquents

Additionally, under FICO Score 8, Equifax factors show only positive factors leading to the score:

- You have no missed payments on your credit accounts

- You've limited the use of your available revolving credit

- You have an established credit history

- Youve shown recent use of credit cards and/or bank-issued open-ended accounts

So why does the Equifax FICO Auto 5,4,2 seem to be off? Like I said - really just a trivia question..

Oh, and for comparison sake - FICO Auto 8 has EQ: 873, TU: 887, and EX: 878

Thanks

Rick

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Auto 5 and Equifax

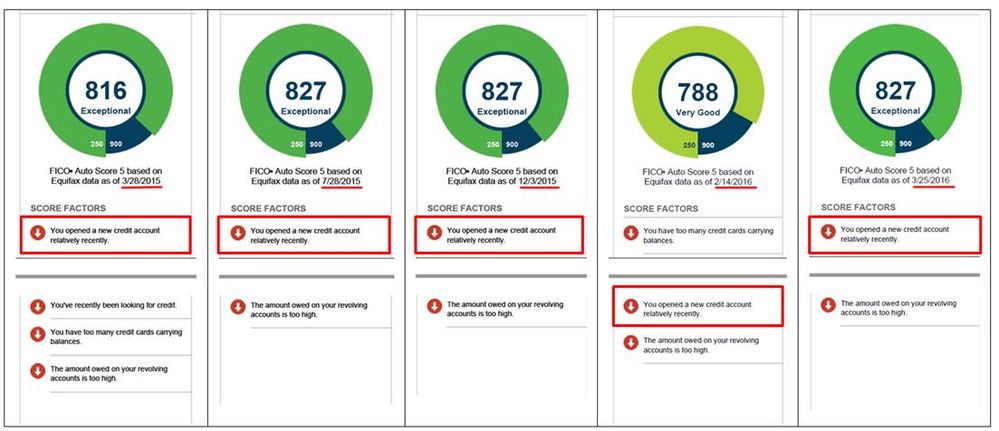

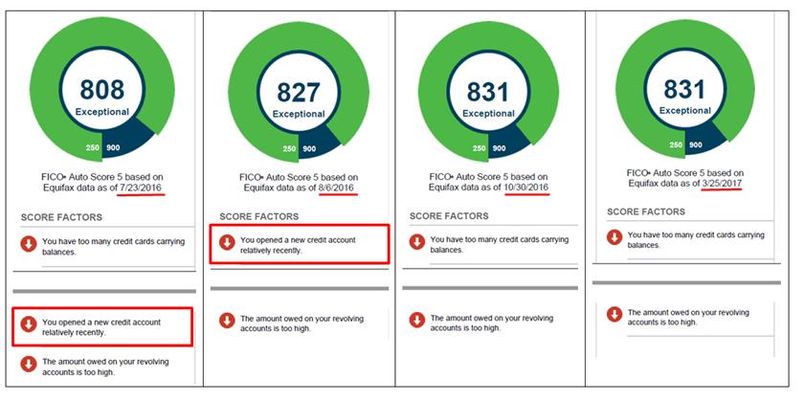

The: "you have opened an account relatively recently" remains as a negative reason code on EQ Fico o4 (score 5) until your youngest account has reached 5 years. Is your youngest account older than 5 years? NO

*** My most recent account was opened 9/2011. Code dropped off on 10/2016 report. ***

The "heavy use" for amount owed revolving can be triggered with an aggregate balance under $3k. Not sure the minimum for getting that - perhaps $1k. The "recently looking for credit" relates to having a HP on file for whatever reason. Note: The older Fico models always look at AU accounts and you should include those in your totals (if you have any). Open account refers to accounts with 1 month PIF terms such as an AMEX charge card.

When Fico scores are top tier, reason statements can become trivial and have no actionable changes that would improve score further. One I came across, on Auto EX Fico 98 (score 2) is "no auto loan history". Not having an auto loan will impact Auto score. Positive statements have no correlation to Fico score and are best ignored.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Auto 5 and Equifax

Thanks.. I figured it was something related to the differences in scoring across the 3 agencies for that model.. As I posted - my youngest account is less than 5 years (31 mos, an auto lease). Thats also when the last HP was noted, which fell off back in February.. And, I'm well aware that the reason statements have zero impact on decisions at this level - like I said, more of a curiosity of how it comes up with them.

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Auto 5 and Equifax

Curious, do you have an AMEX charge card? If so what was your (current balance)/(highest reported balance) ratio? Also, what was your highest individual card utilization?

In my experience the heavy use statement gets triggered by elevated individual card utilization. I have always kept aggregate utilization under 9%.

I never carry a balance but, I typically report a balance on 50% or more of my cards and then PIF the statement balance. EQ does not like it when over half your cards report a balance and lists: "you have too many accounts carrying a balance" when I go over 50%. What % of your cards reported a balance?

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Auto 5 and Equifax

I have both an AMEX charge as well as 2 AMEX revolving accounts.. If you go back around 4-5 years when my scores were in the low-mid 700s, I easily had utilization on individual cards that was 90%+, with overall utilization rates of 55-60% across everything.

I cleaned up a bit ![]()

Also - now I use a Chase revolving card for everything and pay the statement balance in full just to maintain activity. I also occasionally will tap into either PayPal Credit (Sync) or Citi when I want to take advantage of 0% offers on larger purchases, and they get paid before the promo period ends.

Currently have 9 open revolving/open accounts. Latest report has Chase with a $1100 balance (11%), and PPC with $1700 (24%) -- everything else is 0