- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: FICO Auto Score 8-what's a good score?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

FICO Auto Score 8-what's a good score?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

FICO Auto Score 8-what's a good score?

FICO auto score 8 has a range of 250-900. Does anyone know how these score compare to a standard FICO 8 score? What auto score would be equivalent to a 720 FICO 8, say.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Auto Score 8-what's a good score?

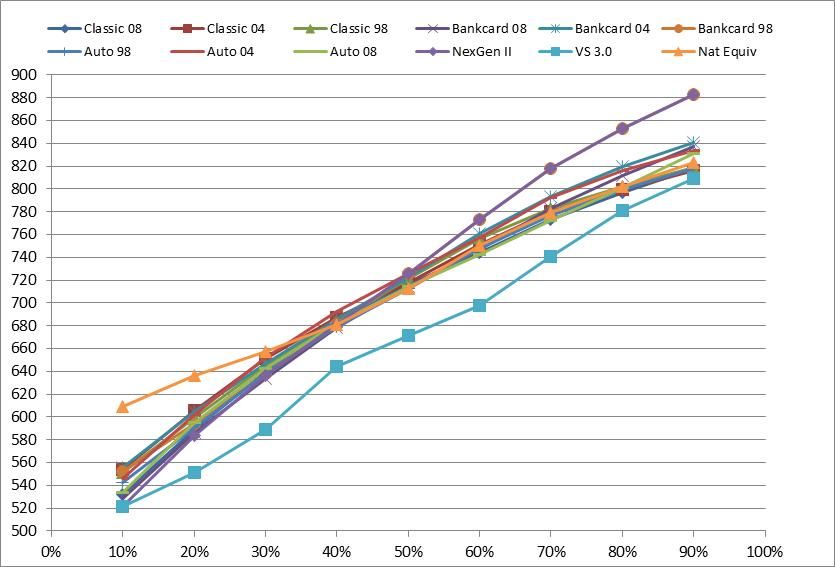

See table below (added Auto score data). This is all from Experian

| EX Model | 10% | 20% | 30% | 40% | 50% | 60% | 70% | 80% | 90% |

| Classic 08 | 532 | 589 | 640 | 683 | 716 | 744 | 773 | 797 | 818 |

| Classic 04 | 554 | 606 | 651 | 687 | 718 | 751 | 780 | 799 | 816 |

| Classic 98 | 551 | 599 | 645 | 684 | 721 | 756 | 783 | 802 | 819 |

| Bankcard 08 | 528 | 586 | 634 | 678 | 714 | 747 | 783 | 812 | 837 |

| Bankcard 04 | 556 | 605 | 647 | 685 | 722 | 761 | 797 | 823 | 844 |

| Bankcard 98 | 552 | 594 | 638 | 681 | 723 | 761 | 793 | 820 | 841 |

| Auto 98 | 542 | 591 | 638 | 679 | 713 | 748 | 777 | 799 | 818 |

| Auto 04 | 546 | 602 | 652 | 692 | 726 | 757 | 792 | 816 | 834 |

| Auto 08 | 534 | 595 | 642 | 682 | 714 | 742 | 772 | 801 | 831 |

| NexGen II | 521 | 584 | 636 | 681 | 726 | 773 | 818 | 853 | 883 |

| VS 3.0 | 521 | 551 | 589 | 644 | 671 | 698 | 741 | 781 | 809 |

| Nat Equiv | 609 | 636 | 657 | 681 | 713 | 750 | 779 | 802 | 823 |

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Auto Score 8-what's a good score?

Maybe I'm missing something, but I don't see Auto Score 8 mentioned in those charts.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Auto Score 8-what's a good score?

Yes, I had overlooked Auto scores in my summary. I noticed that after I had posted. Take another look at the prior post - Auto scores added.The EX Classic Fico 08 and EX Auto Fico 08 scores match closely in the 10% to 80% range.

Please note Auto scoring models are listed in reverse order in the summary table. The data does line up with the model so no need for concern from that regard.

Also, pasted the data and a busy graph directly into the thread and deleted link to other post.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Auto Score 8-what's a good score?

| Total CL: $321.7k | UTL: 2% | AAoA: 7.0yrs | Baddies: 0 | Other: Lease, Loan, *No Mortgage, All Inq's from Jun '20 Car Shopping |

BoA-55k | NFCU-45k | AMEX-42k | DISC-40.6k | PENFED-38.4k | LOWES-35k | ALLIANT-25k | CITI-15.7k | BARCLAYS-15k | CHASE-10k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Auto Score 8-what's a good score?

Thanks for the info, T_T. I've searched all over for this without success. My auto score is indeed lagging considerably behind my FICO8. Hopefully the savings secured loan bumps it up some. Not much else I can do at this point except wait for my accounts to age, and it will take a good 18 months before I hit the 2 year AAoA, which I understand gives a noticeable score boost.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Auto Score 8-what's a good score?

I'm rather curious in what factor in the Auto enhanced version could be judging your file so harshly.

The majority of posted data listing both scores and the score percentile tables from EX don't reflect lower Auto scores relative to Classic scores (above single digit percentiles).

Check out below links for additional detail

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Auto Score 8-what's a good score?

I'm really not sure, but I'm assuming it's the lack of any installment data on my EX file. It's completely clean, but with a very young AAoA (6 m. and about to go down as I recently added two new trade lines).

I received the letter from them yesterday, and it listed only the number (690) and the range (350 to 850) as far as credit score information. My actual FICO8 from CCT is and was at the time of the pull 725. I talked to at least four different people trying to get the actual score model they used, and it was like trying to pull teeth, I explained as clearly as I could what information I was looking for, and was finally told it was FICO auto 8. I asked why it listed the score range as 350 to 850 and could not get an answer. The guy in the loan department seemed annoyed that I was asking these questions. I got the feeling this is a rare occurrence for them.

All in all, there was no real harm done in all this, and I learned some valuable information about FICO scoring for auto loans, and the general lack of competence of this CU. They really came across as uninformed and unprofessional. I'll keep my credit card open with them as a positive trade line, but I doubt I'll do any further business with them.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Auto Score 8-what's a good score?

Sad to say, but it's been my experience that most finance guys are uninformed, and unaware of the specific credit model they pull. Unfortunately, this ignorance is not specific only to your credit union.

Current Scores 3/2016 Equifax 676 Transunion 697 Experian 648 Goal Scores: 720's accross the board. Gardening Goal: 3/2017

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Auto Score 8-what's a good score?

@Anonymous wrote:I'm really not sure, but I'm assuming it's the lack of any installment data on my EX file. It's completely clean, but with a very young AAoA (6 m. and about to go down as I recently added two new trade lines).

I received the letter from them yesterday, and it listed only the number (690) and the range (350 to 850) as far as credit score information. My actual FICO8 from CCT is and was at the time of the pull 725. I talked to at least four different people trying to get the actual score model they used, and it was like trying to pull teeth, I explained as clearly as I could what information I was looking for, and was finally told it was FICO auto 8. I asked why it listed the score range as 350 to 850 and could not get an answer. The guy in the loan department seemed annoyed that I was asking these questions. I got the feeling this is a rare occurrence for them.

All in all, there was no real harm done in all this, and I learned some valuable information about FICO scoring for auto loans, and the general lack of competence of this CU. They really came across as uninformed and unprofessional. I'll keep my credit card open with them as a positive trade line, but I doubt I'll do any further business with them.

Are you certain that the lower bound was 350? I don't know any FICO model which uses that as a lower bound. Does it say FICO anywhere on there? If it doesn't.... well a quack doesn't always imply a duck.

Sure auto enhanced scores, which do get pulled by the dealerships typically (it's be vanishingly unlikely that a CU would use an auto enhanced score anyway TBH) anecdotally appear to have a "first time buyer penalty" with regards to no installment lines; however, short of somone without installment lines doing a before and after pull of a 1B or a 3B with the share secured loan trick, it'd be hard to pin down and most people aren't interested in doing that. Guess we can go look but most of the people simply look at their FICO 8 scores and I suppose trust that Jamie / I / others did the assessments right on which models were affected, but all of us had prior installment loans so we never got the datapoint around auto enhanced industry options.

Anyway it's vanishingly unlikely more than call it 5 people at the CU know what they're pulling and it won't likely be anyone in the customer support arm; I worked at a near billion dollar lender for a bit, and the only reason I was able to find out what they used was because I sat next to the dude who was in charge of implementing the UW guidelines heh and he wasn't hard to shine on given my plethora of knowledge here.

Anyway there's valid reasons for that: the more the CSR's know about the UW guidelines and where the soft spots are, the easier it is to run scams. Internal fraud can be non-trivial. While it's hard to argue that with regards to FICO (either you clear the hurdle or you don't), it gets obfuscated under the same policy.

I wouldn't be too harsh on them over this, unless someone is a physicist or similar if I start badgering them with questions regarding Quantum Mechanics they'll probably get annoyed regardless of their potential nomination for sainthood. Ultimately that's your choice but if they have good products, use them for that.