- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

FICO SIM

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

FICO SIM

Hello,

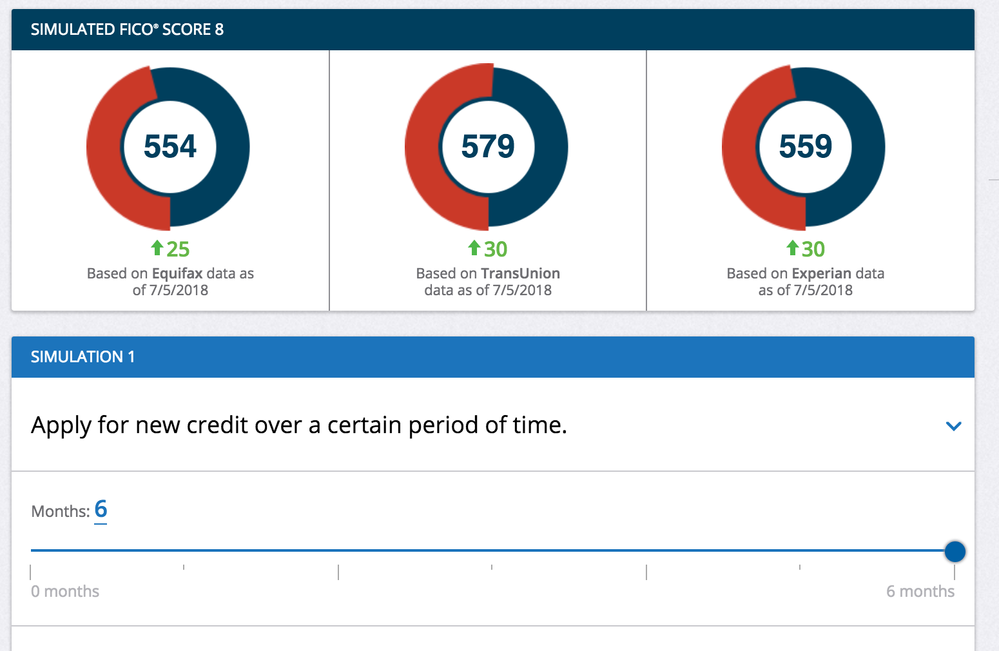

I have a question. I just tried the FICO Simulator it is saying that if I apply to new credit over a period of 6 months once per a month that my score will go up 30 points. Why is this? My scores are 529 539 and 529. Is it time for me to get new credit cards more so secured credit cards?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO SIM

The simulators aren't always accurate. However, In my experience I did find them accurate with forcasting score increases based on lowering my utilization. I started with scores simular to yours, or maybe lower. I'm 760 across the board today. I started with a secured card from Capitol One, then added a few more non secured cards as time went on to create a mix of revolving lines. I have 8 cards total. I keep my utlization very low on 1 card (about $5 reporting ) and let all others report $0. It's taken about 2 years, i'm hoping to reach scores in the 800 range with time. How many cards do you currently have?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO SIM

I have THE FOLLOWING

Brooks Brothers 0 balance

Taget 0 Balance

Macys 0 Balance

Barclays 0 balance

Wells Fargo 385 out of 700. I am going to pay them off this month. Do you think I should get another secured card?

These are my active accounts.

The other cards are closed and charged off.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO SIM

I think you have a pretty good mix of cards to build with. Opening too many cards can ding your score due to the hard pull to open the new card as well as the factors below:

Age of Youngest Account = (AoYA)

Average Age of Account = (AAoA)

Age of Oldest Account = (AoOA)

You will see score increases as your cards age and also by keeping your utilization low. You'll want to use your current cards and let them grow. This should also help you get larger starting credit limits in the future. I believe I started with a $250 limit on a secured card and my 2nd card was only about a $500 limit. I was stuck in the toy limit zone until I let the accounts age. These days my starting limit is $5000+, still a work in progress but it takes time.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO SIM

Okay, thanks. I did apply for the Citi Secured Credit Card on yesterday. I got 7-10 day message. I am staying in the garden for sure.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Fico simulator says the following? WHY?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fico simulator says the following? WHY?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO SIM

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO SIM

will do! Thanks for the info.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fico simulator says the following? WHY?

How many revolving trade lines do you have today? If less than 3, you're missing out on some points right there.