- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: FICO Scoring Risk Rate

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

FICO Scoring Risk Rate

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

FICO Scoring Risk Rate

Greetings,

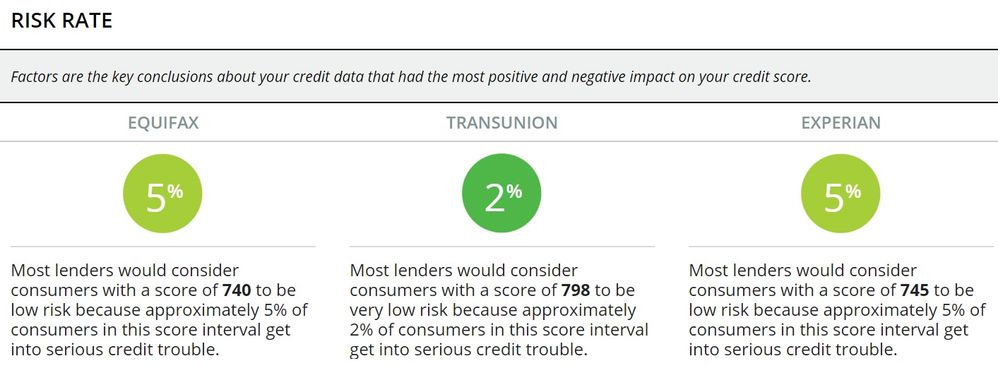

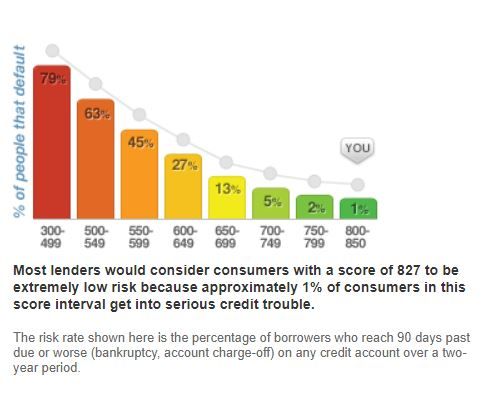

I was just looking at my "Risk Rate" according to MyFICO on my recent 3B report. It shows my EX and EQ Risk rate at 5% and TU at 2%. This had me wondering what the best and worst Risk Rate's may be, according to MyFICO reports. Is 2% the best that it gets, or is there a 1%. I assume there is no 0%, since I would think everyone has at least *some* risk of credit trouble. How about the highest Risk Rate we have seen? What is the percentage that shows when a scores are in say the 500 range?

Thanks!

Sept 2024: EX8: 847; EQ8: 850; TU8: 848 -- Middle Mortgage Score: 821

In My Wallet: Discover $73.7K; Cap1 Venture $51.7K; Amex ED $38K; Amex Optima $2.5K; Amex Delta Gold $18K; Citi Costco $24.5K; Cap1 Plat $8.4K; Barclay $7K; Chase Amazon $6K; BoA Plat $21.6K; Citi TY Pref $22K; US Bank $4K; Dell $5K; Care Credit $6.5K. Total Revolving CL: $300K+

My UTIL: Less than 1% - Only allow about $20 a month to report, on one account. .

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Scoring Risk Rate

I suppose "risk rate" is just another way to quantify a FICO score, perhaps allowing someone to better understand what it means. Outside of us hardcores, your average person probably doesn't know the difference betwen a 600 score, 700, 800, etc. other than higher means better.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Scoring Risk Rate

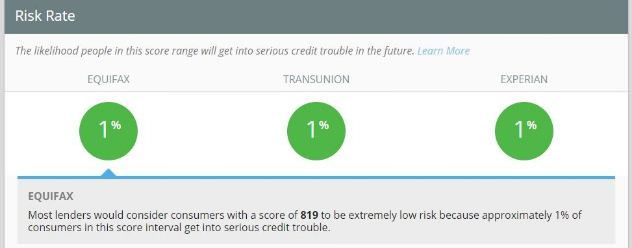

I am sure there are people will scores in the 820s or higher who also subscribe to the myFICO Ultimate Product. I think I remember seeing 1% the last time I had an Ultimate report done and my FICO 8 scores have been in the 830s or 840s for a while.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Scoring Risk Rate

@EW800 wrote:Greetings,

I was just looking at my "Risk Rate" according to MyFICO on my recent 3B report. It shows my EX and EQ Risk rate at 5% and TU at 2%. This had me wondering what the best and worst Risk Rate's may be, according to MyFICO reports. Is 2% the best that it gets, or is there a 1%. I assume there is no 0%, since I would think everyone has at least *some* risk of credit trouble. How about the highest Risk Rate we have seen? What is the percentage that shows when a scores are in say the 500 range?

Thanks!

Yes there is a 1% risk rate, if your fico 08 score is 800 or better. Looks like 1 of your scores is 2 points away from seeing that. 800-850 is 1% risk rate.

EX fico08=815 06/16/24

EQ fico09=809 06/16/24

EX fico09=799 06/16/24

EQ fico bankcard08=838 06/16/24

TU Fico Bankcard 08=847 06/16/24

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Scoring Risk Rate

EX fico08=815 06/16/24

EQ fico09=809 06/16/24

EX fico09=799 06/16/24

EQ fico bankcard08=838 06/16/24

TU Fico Bankcard 08=847 06/16/24

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Scoring Risk Rate

Thanks for the confirmation that there is a 1% as well.

Yes, it appears that my TU FICO 8 score is just two points away from the 1%. My TU scores are higher than my EX and EQ scores because I had a foreclosure and a CC settlement get EE's from TU. The two baddies should be coming off of Experian in September. EQ probably around the end of the year.

Along the lines of FICO scoring, can anyone confirm that 30 and 60 day lates have no scoring impacting after a few years? I believe we have proven that a single 30-day late is no longer a factor after two years, but what about a 60-day late? I ask this because I have one 30-day late and one 60-day late from 2012 that were part of a second mortgage. When my foreclosure and settlement fell off of TU, I actually expected my TU scores to go higher than they are, based on my wife's FICO 8 scores being in the 830-835 range. The foreclosure did not hit her credit reports, and all other accounts are basically the same. As far as my TU FICO 8 score being about 30-35 points lower than hers, all I can figure is that the one 60-day late from 2012 must still carry a bit of weight to it, or have me in a negative bucket, at the least. Thoughts?

Sept 2024: EX8: 847; EQ8: 850; TU8: 848 -- Middle Mortgage Score: 821

In My Wallet: Discover $73.7K; Cap1 Venture $51.7K; Amex ED $38K; Amex Optima $2.5K; Amex Delta Gold $18K; Citi Costco $24.5K; Cap1 Plat $8.4K; Barclay $7K; Chase Amazon $6K; BoA Plat $21.6K; Citi TY Pref $22K; US Bank $4K; Dell $5K; Care Credit $6.5K. Total Revolving CL: $300K+

My UTIL: Less than 1% - Only allow about $20 a month to report, on one account. .

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Scoring Risk Rate

@EW800 wrote:Thanks for the confirmation that there is a 1% as well.

Yes, it appears that my TU FICO 8 score is just two points away from the 1%. My TU scores are higher than my EX and EQ scores because I had a foreclosure and a CC settlement get EE's from TU. The two baddies should be coming off of Experian in September. EQ probably around the end of the year.

Along the lines of FICO scoring, can anyone confirm that 30 and 60 day lates have no scoring impacting after a few years? I believe we have proven that a single 30-day late is no longer a factor after two years, but what about a 60-day late? I ask this because I have one 30-day late and one 60-day late from 2012 that were part of a second mortgage. When my foreclosure and settlement fell off of TU, I actually expected my TU scores to go higher than they are, based on my wife's FICO 8 scores being in the 830-835 range. The foreclosure did not hit her credit reports, and all other accounts are basically the same. As far as my TU FICO 8 score being about 30-35 points lower than hers, all I can figure is that the one 60-day late from 2012 must still carry a bit of weight to it, or have me in a negative bucket, at the least. Thoughts?

I'd be interested to see that proof: that was historical conventional wisdom that I think I actually debunked. 60D lates count full monty for full 7 years and apparently keep you sorted into one of the derogatory scorecards for FICO 8.

30D lates are in the top 8 clean and apparently "cleanish" scorecards for FICO 8 as a minor deliquency; I got to 779 on TU not quite 3 years out on a 30D late but I still had this:

You have one or more accounts showing missed payments or derogatory indicators.

I did not have this reason code though, I should go look to see when this went away actually:

- Time since delinquency is too recent or unknown.

Edit: at roughly the 1 year mark this above reason code on a 30D late slipped from the #2 spot to the #3 spot (appears to track DOFD identically), and it looks like it dropped out of the list altogether 6/1/17 which is like 21 months from DOFD. The actual late was 10/2015, DOFD precedes that by a month of course.

Actually that appears to have been the only complaint at all on that FICO 8 pull from back in January '18, which is kinda weird but it was an awfully clean file otherwise. I now have 30D lates on both EX and EQ too from a few months ago and you can see where my scores are now though they're already starting to recover on FICO 8, looks to be non-trivial aging even early once you get righteous on the account.

60D late on TU now, which I know is a full monty 7 year penalty... oddly my TU 04 is still north of 740 and the reason codes correctly state serious deliquency, don't know why that one's on life support when my EQ 04 got slapped hard and fast with the 30D late and nothing else wrong with it other than a CFA.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Scoring Risk Rate

Thank you very much, Revelate. I think you are spot-on in regard to 60-day lates counting for the full seven years. Based on what I see on my other-wise completely clean TU report, as compared to that of my wife's, it does appear that even over the six year mark I am still feeling the sting. I thought I had read previously that 60-day lates no longer sting after x years, however that does not appear to be true in our cases.

It will be interesting to see if FICO 8 will allow me to hit 800 or anything north of that, having the 60-day late and being in a dirty scorecard.

Just in case you or anyone else is interested in how the rest of my scores look, again with one 30-day late and one 60-day late showing, and everything else perfectly clean, and presumably being in a naughty scorecard...

FICO 8 - 798

FICO 9 - 827

FICO Mortgage 4 - 802

FICO Auto 4 - 857

FICO Auto 8 - 821

FICO Auto 9 - 845

FICO Bancard 8 - 823

FICO Bancard 4 - 829

FICO Bancard 9 - 836

Thanks again for sharing all your insight and experiences.

Sept 2024: EX8: 847; EQ8: 850; TU8: 848 -- Middle Mortgage Score: 821

In My Wallet: Discover $73.7K; Cap1 Venture $51.7K; Amex ED $38K; Amex Optima $2.5K; Amex Delta Gold $18K; Citi Costco $24.5K; Cap1 Plat $8.4K; Barclay $7K; Chase Amazon $6K; BoA Plat $21.6K; Citi TY Pref $22K; US Bank $4K; Dell $5K; Care Credit $6.5K. Total Revolving CL: $300K+

My UTIL: Less than 1% - Only allow about $20 a month to report, on one account. .

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Scoring Risk Rate

Regarding a 60 day late and the 7 years thing... do we have any data points on this forum of someone with a single 60 day late hitting the 7 year mark and what positive impact it had on score? We all know that a single major delinquency (90+ day)/derog coming off that's aged typically results in a 60-80 point gain give or take, but do we know about a 60? Are we talking around half the amount of points? Less? I'd be very curious to know.

Say it is half the points just to assign some sort of value to it. If one can achieve a 760+ score with a single major present (like a 90 day) would that mean one can achieve a 790+ score with a single (aged) 60 day present? I'd also be curious to see the highest reported FICO 8 score with the presence of a single 60 day late payment.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Scoring Risk Rate

As Sarge posted, it does appear anything over 800 is 1%