- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- FICO score flatlining

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

FICO score flatlining

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

FICO score flatlining

Occasionally we get posts regarding FICO scores not improving / moving at all... and it's generally explained that without a material change FICO scores will stay fixed.

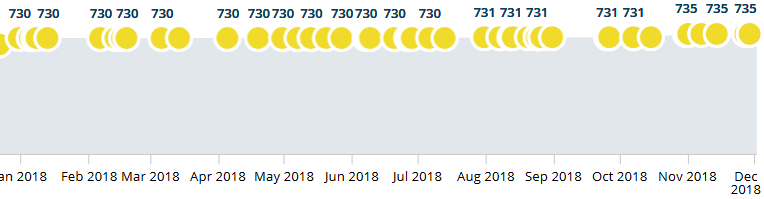

Was poking around in the Discover app today and got a beautiful illustration of this exact phenomenon: for the last six months my TU FICO 8 score has been utterly flatlined, with the one exception of my AAOA ticking over 5 years. Pretty clear when, and yep, it was worth 8 points on this scorecard (thick, mature, 60D late). Nothing else changed with utterly trivial revolving utilization and no installment utilization breakpoints or anything else as there weren't any inquiries on TU to begin with. 1 change, one shift in scores, that's it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO score flatlining

TU cemented for me. New accounts 😐

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO score flatlining

Until recently, and with a considerable amount of credit cards added, my scores on all three bureaus have been consistently between 660 and 680 for the past ten years.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO score flatlining

If I can keep my score consistently in the 750s, I would be very glad.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO score flatlining

My TU FICO 8 has been rock solid at 740 for the past 4 months, in stark contrast to Synchrony's VS 4 or whatever it is now. FICO has been steady, even with me going over the 9% threshold in December.

Meanwhile, VS 4 had me around 770 when Care Credit switched to it around October, then dropped to 680's for a couple of months (balance going up on one card caused this I guess), then today it is in the 750's after bringing the one card with a balance down. FICO 8 still holding strong at 740 though...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO score flatlining

Try going a whole year for 5 pts. When the others smoked right past TU and fell in the 740's. It happens.

BK Free Aug25

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO score flatlining

@donkort wrote:If I can keep my score consistently in the 750s, I would be very glad.

Oh I'm not complaining, just pointing out that basically there's always a reason that FICO moves and it isn't capricious and if you can't change the information you're stuck with time passing with the score just sitting there over time.

Ultimately my TU file has 3 things wrong with it:

- 60D late

- Ugly installment utilization

- Everyone could use more file age, but 5 years AAOA isn't bad.

That's it. Admittedly if I were clean I'd have to deal with some new accounts issues too but small mercies being in a derogatory scorecard. As a result beyond the 60D late it's scrupulously clean: no inquiries, no CFA like the other two bureaus, it'd probably be my best FICO 8 score actually without the late, and without the high installment loan balances it would be darned close to 850 I suspect.

So it's still a strong file, which is the only reason I have a consistent 750+ even with a less than 2 year old 60D.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO score flatlining

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO score flatlining

Mine have been on the rise, so that's my reminder to add new accounts! lol

775+ apply, -760 garden.