- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Finally an 850 (EX8)...with some reference DP'...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Finally an 850 (EX8)...with some reference DP's

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Finally an 850 (EX8)...with some reference DP's

@babygirl1256 Thanks, and for sure, you'll be there sooner than you know it...Incredible to see how far you've come looking at your starting scores, way to go!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Finally an 850 (EX8)...with some reference DP's

@SouthJamaica wrote:

@PullingMeSoftly wrote:Time and patience is the name of the game, although reaching an 850 is not something I've specifically worked toward, I was pleasantly surprised to see my EX8 just bumped to 850. This is at least a brief moment of satisfaction, since my EQ8 is a point shy and has been totally bugging me (OCD!). My first time reaching an 850, although it will be fleeting as I'm anticipating a couple card apps in June.

For what it's worth, here are some DP's for this score:

AoOA: 27 years, 10 months

AAoA: 11 years, 8 months

UT: 2%

Revolving Accounts: 29

Accounts w/Balances: 27

Installment Loans (student loans in my case): 14

Bank-Issued Credit Card Accounts: 26 (18 open, 8 closed)

Total Balance of Revolving Accts: $4804

Total CL: $286,400

Inq's/12: 1

New Accounts: 0/6, 1/12, 15/24

Great seeing no negative reasons being listed for once:

1. Congratulations!!!

2. Thanks for the very interesting data points. If I'm not mistaken several of them challenge some of the "conventional wisdom".

E.g.,

(a) 14 open student loans

(b) 27 of 29 accounts reporting balances

(c) a new account in past 12 months

(d) 15 new accounts in past 24 months.

We (the community) are nearly confident that there is a buffer. 850 doesn't mean perfect it just means good enough to max out the scorecard. Admittedly even I have seen BBS I think post on his own F8 AWB or RWB probably metrics with no penalty. I also don't think this is anywhere near a minimum 850 file when the age metrics are above even what we have seen for others to be fair.

As always need more datapoints, I lost some on EX recently for what seems like minor revolving utilization changes so I don't really think the conventional wisdom is utterly wrong on this point.

OP: any idea what changed for the final +11 to get to 850? Many congrats and thank you for your data point!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Finally an 850 (EX8)...with some reference DP's

Congratulations on reaching 850 and those other two high scores! Also thank you for all the data points. So nice to see how you can add a bunch of accounts within 24 months and still obtain very high scores! Thank you for making this post! Best wishes to you on your future applications in June!

![Capital One Quicksilver | $4000 | July 2013 [AU]](https://ecm.capitalone.com/WCM/card/products/quicksilver-card-art.png)

![Capital One Venture X | $40,000 | September 2023 [AU]](https://ecm.capitalone.com/WCM/card/products/venturex-cg-static-card-1000x630-2.png)

![Chase Amazon Prime | $17,400 | March 2020 [AU]](https://creditcards.chase.com/content/dam/jpmc-marketplace/card-art/prime_visa.png)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Finally an 850 (EX8)...with some reference DP's

@SouthJamaica wrote:

@PullingMeSoftly wrote:Time and patience is the name of the game, although reaching an 850 is not something I've specifically worked toward, I was pleasantly surprised to see my EX8 just bumped to 850. This is at least a brief moment of satisfaction, since my EQ8 is a point shy and has been totally bugging me (OCD!). My first time reaching an 850, although it will be fleeting as I'm anticipating a couple card apps in June.

For what it's worth, here are some DP's for this score:

AoOA: 27 years, 10 months

AAoA: 11 years, 8 months

UT: 2%

Revolving Accounts: 29

Accounts w/Balances: 27

Installment Loans (student loans in my case): 14

Bank-Issued Credit Card Accounts: 26 (18 open, 8 closed)

Total Balance of Revolving Accts: $4804

Total CL: $286,400

Inq's/12: 1

New Accounts: 0/6, 1/12, 15/24

Great seeing no negative reasons being listed for once:

1. Congratulations!!!

2. Thanks for the very interesting data points. If I'm not mistaken several of them challenge some of the "conventional wisdom".

E.g.,

(a) 14 open student loans

(b) 27 of 29 accounts reporting balances

(c) a new account in past 12 months

(d) 15 new accounts in past 24 months.

@PullingMeSoftly congratulations!!! Btw, unless I'm reading it wrong, it's not 27 of 29 accounts reporting balances. There are 29 revolving accounts and 14 installment loans and 27 accounts with a balance, right?

27/43?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Finally an 850 (EX8)...with some reference DP's

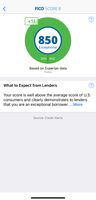

Thanks @Anonymous, here are my screenshots as of today, which should help clarify:

As a sidenote, the EX8 score has remained steady regardless of various balance changes, whereas TU and EQ fluctuate with just a couple hundred bucks here and there. EQ has been bouncing 849-50-49-50, and TU swings +/- 4ish points if even $20 posts to my Target account (as "retail account"), or basically any balance change whether it be an increase or decrease, TU is more stringent with me:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Finally an 850 (EX8)...with some reference DP's

@PullingMeSoftly wrote:Thanks @Anonymous, here are my screenshots as of today, which should help clarify:

As a sidenote, the EX8 score has remained steady regardless of various balance changes, whereas TU and EQ fluctuate with just a couple hundred bucks here and there. EQ has been bouncing 849-50-49-50, and TU swings +/- 4ish points if even $20 posts to my Target account (as "retail account"), or basically any balance change whether it be an increase or decrease, TU is more stringent with me:

@PullingMeSoftly thank you for the data points!! May I ask how many total open accounts do you have please? How many total accounts are on your credit report both open and closed included please?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Finally an 850 (EX8)...with some reference DP's

@Anonymous wrote:@PullingMeSoftly thank you for the data points!! May I ask how many total open accounts do you have please? How many total accounts are on your credit report both open and closed included please?

@Anonymous I've got 43 total open accounts (29 revolving + 14 student loans), which you surmised correctly, and 31 closed accounts, for a grand total of 74 open & closed combined:

(One of the Inq's above was from 5/7/20, which is a year on the dot when the report generated, so it was included on the 3B. So only 1 scorable Inq on TU, which falls off on 7/1)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Finally an 850 (EX8)...with some reference DP's

@PullingMeSoftly wrote:

@Anonymous wrote:@PullingMeSoftly thank you for the data points!! May I ask how many total open accounts do you have please? How many total accounts are on your credit report both open and closed included please?

@Anonymous I've got 43 total open accounts (29 revolving + 14 student loans), which you surmised correctly, and 31 closed accounts, for a grand total of 74 open & closed combined:

(One of the Inq's above was from 5/7/20, which is a year on the dot when the report generated, so it was included on the 3B. So only 1 scorable Inq on TU, which falls off on 7/1)

@PullingMeSoftly thank you very much for the data points! We are grateful! I thought that's what you meant!

that's strange, exactly a year later should've been the day it was gone! Very interesting.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Finally an 850 (EX8)...with some reference DP's

@Anonymous wrote:

@PullingMeSoftly wrote:

@Anonymous wrote:@PullingMeSoftly thank you for the data points!! May I ask how many total open accounts do you have please? How many total accounts are on your credit report both open and closed included please?

@Anonymous I've got 43 total open accounts (29 revolving + 14 student loans), which you surmised correctly, and 31 closed accounts, for a grand total of 74 open & closed combined:

(One of the Inq's above was from 5/7/20, which is a year on the dot when the report generated, so it was included on the 3B. So only 1 scorable Inq on TU, which falls off on 7/1)

@PullingMeSoftly thank you very much for the data points! We are grateful! I thought that's what you meant!

that's strange, exactly a year later should've been the day it was gone! Very interesting.

Not sure if this is what @PullingMeSoftly is experiencing, but I'm seeing some delay/inconsistency in how MF is showing inquiries. I have one on TU from 5/17/2021, which they show correctly in the Reports -> Credit Data -> Inquiries section. But the they aren't showing that on the Insights tab. Screenshots below reflect my 6/1 3B pull.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Finally an 850 (EX8)...with some reference DP's

@Curious_George2 wrote:Not sure if this is what @PullingMeSoftly is experiencing, but I'm seeing some delay/inconsistency in how MF is showing inquiries. I have one on TU from 5/17/2021, which they show correctly in the Reports -> Credit Data -> Inquiries section. But the they aren't showing that on the Insights tab. Screenshots below reflect my 6/1 3B pull.

Hmmm....

myFICO already has a pattern of not showing inquiries once they hit the 1-year mark (because they are no longer scoreable...), even when the actual CRA report continues to show them up to the 2-year mark.

I wonder if the Insights section is not displaying inquiries while they are still under 30 days old? (and thus excluded from scoring...)

If so, that's not a delay, but a display choice (matching the stats shown to the ones that actually affect the score), which isn't a bad thing, but can be confusing if not clearly described.

If that's the case, I'd expect that inquiry to show up on Insights for any report pulled after 6/16 (+30 days from 5/17), but not at any point prior to then.

EQ9:847 TU9:847 EX9:839

EQ5:797 TU4:807 EX2:813 - 2021-06-06