- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: From 1% to 5% ulitzation cost me 23 points

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

From 1% to 5% ulitzation cost me 23 points

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: From 1% to 5% ulitzation cost me 23 points

One thing which we have done a bad (or nonexistent) job at controlling for here on the forums is the raw dollar amount of CC debt. There's no question that percentage of credit limit (total or individual) is very important. And perhaps it is the only thing that matters.

But perhaps not. Perhaps some FICO models care primarily about percentages but also look secondarily at the actual dollar value as well. If so, then that would begin to explain why someone like my friend SouthJ seems to be able to see a difference between a utilization of 0.1% and 7.8% (say). Because he has a ginormous total credit limit (over 500k) that means going from $500 in CC debt to 40k. If FICO 8 (say) partly looks at the actual dollar value, then it's likely that the model flags 40k of revolving debt as a risk. A person with a much lower total credit limit (10k) would not trigger that.

This wouldn't be too hard to test, if somebody had a handful of cards with high credit limits and then exactly two cards with tiny credit limits. He could switch from having the two tiny CL cards at 48% each (all other cards at zero) to two huge cards at 48%. If the total U stayed at < 8.9% even for the big cards, then in theory there should be no score change. But if there was a score change it would be hard to explain except as FICO looking at the vastly higher dollar value one month vs. the other.

I can certainly imagine that statistically people with 40k of revolving debt are riskier than those with $500, even if the utilization percentage is the same. So I wouldn't be surprised if FICO considered it. I also wouldn't be surprised if FICO doesn't. Either strikes me as a priori quite possible.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: From 1% to 5% ulitzation cost me 23 points

@kiea wrote:

Nothing else changed. I got a new card last month but my score only went down by 2 points. I checked my score on the 1st and it was 647. I checked today after my balance updated and it is 623. So it came from my ulitzation

What about individual utilization?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: From 1% to 5% ulitzation cost me 23 points

@Anonymous wrote:

@kiea wrote:

Nothing else changed. I got a new card last month but my score only went down by 2 points. I checked my score on the 1st and it was 647. I checked today after my balance updated and it is 623. So it came from my ulitzationWhat about individual utilization?

So ... You got a new card and minimal change in score. That's not unexpected. Now the new card reports its first balance and score drops significantly - is that correct? If so, this behavior has been reported before - primarily for thin files that are somewhat new to revolving credit. Regardless of file thickness, new accounts 1st reporting balances can drop score even at low utilization levels. The newness influence will dissipate within 90 days - IMO.

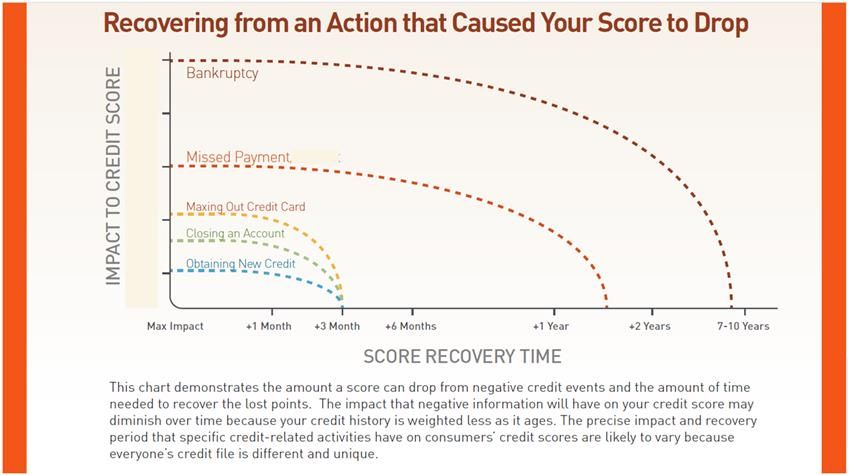

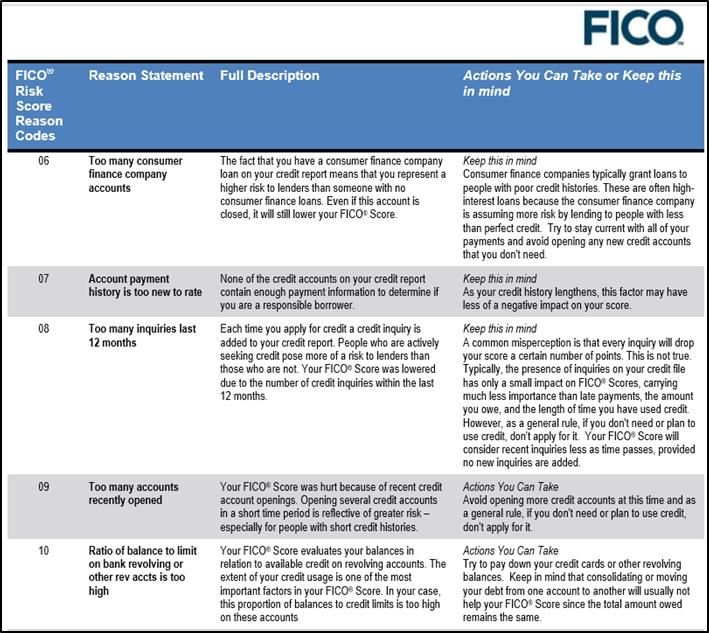

See the below forobtaining new credit. Although it is in reference to VantageScore, Fico may treat new credit cards 1st reporting balances as a score ding for a cycle or two.

The below "time since most recent account opening is too short" specifies Fico 98/Fico 04 but I believe it carries over to Fico 8

Also see below for Fico reason codes from Experian. Note the "especially for people with short credit histories" associated with accounts recently opened. If file is thin and young, one account might be considered too many.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: From 1% to 5% ulitzation cost me 23 points

OP, prior to opening this most recent credit card, when was the last time you opened an account before that?

If your previous opened account was > 1 year ago, it means your AoYA dropped from > 1 year to 0, which commonly results in a 15-20 point FICO score drop.

TT, this fact above is something that the graphic you posted above doesn't really take into consideration. Someone who last opened an account 2 months ago that opens a new one today verses someone that hasn't opened one in over a year that opens one today are going to see different impacts on their score, all other things being equal of course. I think it's impossible to suggest as a blanket statement that adverse impact from a new account can be overcome in 3 months. IMO, the ability to recover from new accounts is very profile-specific.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: From 1% to 5% ulitzation cost me 23 points

BBS - Please delete the multiple quotes in your above post!

Regarding the 90 day new account penalty, I think one likely exists with Fico and yes that particular deduct likely drops off in 90 days. That factor is independent from AOYA factor - IMO and I recall mentioning that it primarily affects young/thin files.

AoYA clearly influences score until one year age is reached - I have stated as much many times. However, I can see how my wording in the my prior post can be misconstrued

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: From 1% to 5% ulitzation cost me 23 points

Yikes, good call on the edit of my previous post; not sure how that happened!

Regarding the 90 day new account penalty that you spoke of, how would you quantify it? I wouldn't think that it's significant under most circumstances. It never was on my profile, anyway, both when it was dirty and when it was clean. You mentioned how it's independent from AoYA. If that's the case and AoYA dropping under 1 year results in a 15-20 point loss on most profiles, a 90 day new account penalty on top of that would mean a score loss of > 15-20 points (on most profiles) wouldn't it? I can only quantify anything at 90 days on my profile to result in a 1-5 point impact when clean and a 2-4 point impact when dirty in looking at my 90 day point following the opening of new accounts in 2016 and 2017. I guess my point here, again based on my profile, is that 90 days being some sort of threshold here is quite insignificant relative to the impact of crossing the AoYA 1 year threshold.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: From 1% to 5% ulitzation cost me 23 points

Oh okay. I opened 2 cards in December 2017 so that makes sense. I'm not going to opened no more until my cards age a little. I didn't even think of the AoYA.

January 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: From 1% to 5% ulitzation cost me 23 points

@kieaOh okay. I opened 2 cards in December 2017 so that makes sense. I'm not going to opened no more until my cards age a little. I didn't even think of the AoYA.

That's sort of the double edged sword here. With your AoYA at say 6 months now, if you don't open any new accounts until the ones you have age a little more, say your AoYA goes past 1 year. Then opening them will cause a greater score drop (when AoYA goes from > 1 year to 0). If you open them now you'd see less of a score drop, but you'd incur whatever that drop is sooner. Ultimately when the smoke clears (long term) it doesn't really matter, but in the short term you can see the plus and minus of opening new account(s).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: From 1% to 5% ulitzation cost me 23 points

@Anonymous wrote:Yikes, good call on the edit of my previous post; not sure how that happened!

Regarding the 90 day new account penalty that you spoke of, how would you quantify it? I wouldn't think that it's significant under most circumstances. It never was on my profile, anyway, both when it was dirty and when it was clean. You mentioned how it's independent from AoYA. If that's the case and AoYA dropping under 1 year results in a 15-20 point loss on most profiles, a 90 day new account penalty on top of that would mean a score loss of > 15-20 points (on most profiles) wouldn't it? I can only quantify anything at 90 days on my profile to result in a 1-5 point impact when clean and a 2-4 point impact when dirty in looking at my 90 day point following the opening of new accounts in 2016 and 2017. I guess my point here, again based on my profile, is that 90 days being some sort of threshold here is quite insignificant relative to the impact of crossing the AoYA 1 year threshold.

BBS, The 90 days is highly significant on a C8 scorecard (thin/young), perhaps more so than the change at AoYA crossing 12 months. Of course this is not something you or I can test. The impact has been communicated by those with young files - with greatest impact coming from young/thin and opening more than 1 account "at the same time".

I'm working my way toward thin but, will never be young again ![]()

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: From 1% to 5% ulitzation cost me 23 points

Interesting regarding thin/young files and the impact at 90 days. Like you said, definitely not something we can test. I'd like to hear it quantified, though, by someone with a thin/young file that crossed the 90 day mark on their youngest account.