- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: How Long Until Score of 800?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

How Long Until Score of 800?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How Long Until Score of 800?

My AAoA of 4.5 years. My current Experian FICO 08 score is 774. It increased from 752 after I decreased my debt from 9% to 2%. My Experian FICO 08 score was 736 at 9% utilization 9 days ago.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How Long Until Score of 800?

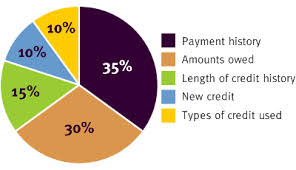

Welcome to the board. The info. you provided isn't enough to get you the response you are seeking. The info. you provided is only one part of the ratio that is used in calculating scores. Here is how scores are calculated so be more forthcoming about your credit profile.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How Long Until Score of 800?

@10022016 wrote:My AAoA of 4.5 years. My current Experian FICO 08 score is 774. It increased from 752 after I decreased my debt from 9% to 2%. My Experian FICO 08 score was 736 at 9% utilization 9 days ago.

As YIM mentions, welcome! And as YIM says, you'll need to tell us more.

You'll also need to be clearer about what you do tell us. For example, it seems clear that your EX FICO 8 is 774 now. But this sentence...

"It increased from 752 after I decreased my debt from 9% to 2%"

seems to say that your score was 752 when your debt was at 9%

whereas this sentence

"My Experian FICO 08 score was 736 at 9% utilization 9 days ago."

seems to say that your score was 736 when your debt was at 9%.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How Long Until Score of 800?

A good place to start as far as info would be this........

How many open credit cards do you have?

What is your CC utilization?

How many of your cards are showing a $0 balance?

What is the age of your oldest account?

What is your average age of accounts?

How many accounts do you have total? (Closed and open)

How many inquiries do you have? How old is each one?

Do you have any open installment loans? (That includes personal loans, student loans, mortgages, auto loans, etc.)

If so, what is the total amount owed (all together)? Also, how much were all the loans originally for (all together)? Include only open loans in these numbers.

Do you have any derogs? (lates, charge offs, liens, judgments, bankruptcies, etc.)

The answers to all of these should be based on your report.

Once you give people this kind of info, they might be able to make a guess as to when you might break 800. Even then it will only be a guess.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How Long Until Score of 800?

My previous comment may seem contradictory, but Experian didn't increase the credit score instantly. Anyhow, I am amazed that my Experian FICO 08 score increased by 38 points when my utilization merely dropped from 9% to 2%. I do not have any derogatory, and mosts of my 7 inquiries will drop off in 6 months, and the few that are left, will drop off by next Oct.

I don't think I should expect a 16 point increase anytime soon to reach a score of 800. Nevertheless, I am still amazed how the 7% deduction in utlization would gain me 38 points. Perhaps, my score was temporarily dropped because my utilization for Citi Double Cash was nearly 60% at one time.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How Long Until Score of 800?

@10022016 wrote:My previous comment may seem contradictory, but Experian didn't increase the credit score instantly. Anyhow, I am amazed that my Experian FICO 08 score increased by 38 points when my utilization merely dropped from 9% to 2%. I do not have any derogatory, and mosts of my 7 inquiries will drop off in 6 months, and the few that are left, will drop off by next Oct.

I don't think I should expect a 16 point increase anytime soon to reach a score of 800. Nevertheless, I am still amazed how the 7% deduction in utlization would gain me 38 points. Perhaps, my score was temporarily dropped because my utilization for Citi Double Cash was nearly 60% at one time.

Utilization only affects the here and now, so what your utilization once was on that card has 0 effect.

EX fico08=815 06/16/24

EQ fico09=809 06/16/24

EX fico09=799 06/16/24

EQ fico bankcard08=838 06/16/24

TU Fico Bankcard 08=847 06/16/24

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How Long Until Score of 800?

@10022016 wrote:My AAoA of 4.5 years. My current Experian FICO 08 score is 774. It increased from 752 after I decreased my debt from 9% to 2%. My Experian FICO 08 score was 736 at 9% utilization 9 days ago.

I suspect you reduced # of cards reporting a balance as well as reducing aggregate utilization. How many cards were reporting a balance before/after? Also, were any of the cards reporting balances over 50% utilization before and now under 30%?

Really no way to tell when/if you will get to 800. If you avoid seeking new credit any inquiries under 12 months will age off within a year and your AAoA will continue to rise. That plus avoiding any delinquencies (late payments) should enable you to reach the 800 milestone.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950