- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- How Psycho is FICO?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

How Psycho is FICO?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How Psycho is FICO?

I have made several posts when I have seen changes in my scores which defy understanding. Here is another one.

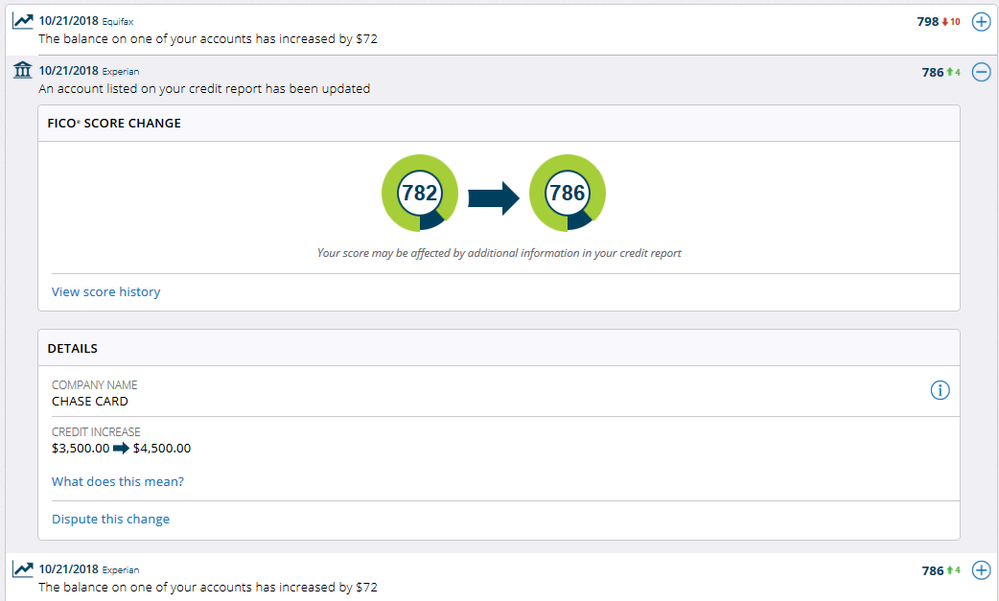

Chase increased my CL from $3,500 to $4,500. On 10/21 Experian increased my score by 4 points for that. On the same day Chase reported that my balance had gone from $0 to $72, or 1.6% Utuil on the new credit line and 2.0% of my old line. I also have two Amex cards (Lines $12,000 and $10,000 with $0 balance on each, so my actual total utilization is below 1%). That $72 was also reported to TU. How did Experian and TU recalculate my score for a $72 balance?

Experian gave me 4 more points, and TU docked me 10 points. Keep in mind both reports are identical.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How Psycho is FICO?

@AnonymousChase increased my CL from $3,500 to $4,500. On 10/21 Experian increased my score by 4 points for that.

You're making a very common mistake on this forum in believing that a score change is related to the alert you received. When you receive an alert as you did, you are provided with a new score at that time. The change to your score doesn't have to be at all related to the alert. A change from 1.6% utilization to 2.0% utilization or vice versa isn't going to impact your score at all, so the 4 point shift you saw came from something else.

Similarly, if you see one of your scores increase by 4 points, but another one of your scores decrease by 10 points, it's from different events happening. One single change isn't going to cause one of your scores to go +4 and the other -10.