- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- How does "Fail to Pay" affect score?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

How does "Fail to Pay" affect score?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How does "Fail to Pay" affect score?

I understand that a 30 day late 6 years ago isn't going to do much to my score but a 60 or 90 will ding me for the entire 7 years. How does a "FP-Fail to pay" affect me? I included a car in my Chapter 13 in 2013 and never failed to pay my loan. It just was included in the plan and paid directly by the Trustee. In fact, its paid off entirely. This is not on my EQ or TU accounts. I have disputed with EX and they say its correct. Experian is by far my lowest score and I believe this is why.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How does "Fail to Pay" affect score?

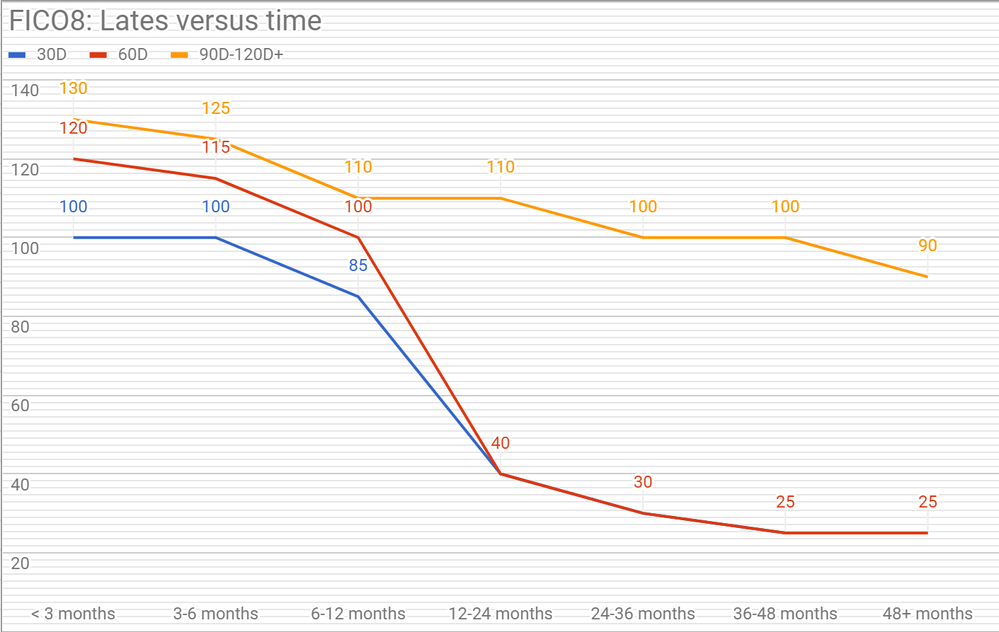

Would assume counts similarly to a 120D or CO.

Is that report from Experian directly?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How does "Fail to Pay" affect score?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How does "Fail to Pay" affect score?

I would say that the account referenced above would hold back your FICO scores around 80 points for 7 years.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How does "Fail to Pay" affect score?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How does "Fail to Pay" affect score?

I would think that "failed to pay" by default means that the account must have been late. If you're saying that it wasn't, that sounds like it should be able to be disputed with success. That being said, if you have a BK on your reports your scores are going to be severely held back until it's gone. A failed to pay or other major negative item or items would IMO have greatly diminishing returns/impact if you're considering that it's being coupled with a BK.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How does "Fail to Pay" affect score?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How does "Fail to Pay" affect score?

Interesting. I have two failed to pay on Experian too. both of those were included in my BK13 and they were paid. Attempts to get them removed have failed, so I'm going to have to wait until next MAy to get those gone.

First Goal Score: 750+ Reached 3/2019

Next Goal all over 800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How does "Fail to Pay" affect score?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How does "Fail to Pay" affect score?

@WD2005 wrote:

If I remember correctly I didn't make my December 2013 payment because I filed for Chapter 13 on 12/2/13. The payment was included in the plan payment so I can't see how it could be reported as any worse than a 30 day late. I know a BK is a huge derogatory but this is compounding the situation.

Shouldn't even be that as for a 30D to be reported in December you would've had to miss November too; however, it's possible the plan payment didn't cover it?

I've heard of timing issues and one should always continue to make payments until the transfer of responsibility is absolutely 100% verified, but I don't know if that reporting is appropriate at all for a CH 13. I'd post the reporting over in the BK forum as that does look passing strange.