- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: How high can I score with a small number of tr...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

How high can I score with a small number of tradelines?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How high can I score with a small number of tradelines?

@Anonymous wrote:The highest you can go is 990 with Fico, however a new acount will hinder you not help you because it will deminish the age of the oldest account. On the other hand if you were to open a tradeline that is not a revolving account with a large down payment say a home or other that can appreciate and not depreciate it can help as long as the DTI ratio is not more than 50%.

Hello and welcome.

Which FICO scoring model is this?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How high can I score with a small number of tradelines?

@Anonymous wrote:The highest you can go is 990 with Fico, however a new acount will hinder you not help you because it will deminish the age of the oldest account. On the other hand if you were to open a tradeline that is not a revolving account with a large down payment say a home or other that can appreciate and not depreciate it can help as long as the DTI ratio is not more than 50%.

@Anonymous,

Welcome to MYFICO. There are several types scoring models out there. FICOs goes up to 850- The highest achieved. This is a forum where people come for info. and we want to make sure they are the right info. We are all here to learn and if something differs from the norm, then proof to solidify statement will help.

If you think the highest number is 990 for a FICO, back it with a link/proof so that we can all learn from it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How high can I score with a small number of tradelines?

@CH-7-Mission-Accomplished wrote:FICO doesn't count closed loans in credit mix. They do help with AAofA until they fall off at the 10 year mark. Their payment history doen't matter unless there are lates.

You can have 800 scores with just three cards. I would be concerned though because with so few cards, should you want to ever add another card or should one of your lenders close your card for some reason, one card will now be 33% of your AAofA. That would be a huge hit if you ever needed or wanted to open a new account.

I would add a few more cards slowly. Maybe one a year for 3 years And just get something like Nordstrom or Macy's or something that you can put a charge on at Christmas and ignore for the next year.

That's what I would do.

But three cards is plenty for scoring.

For this reason i am thinking i just made a mistake. I was added as an authorized user to a family members sears credit card, its like 40 years old, and my oldest card is less than 2 year so i figured great it will help, but it also had one late payment, (two by some measures) that was 30/60 days late but didnt hit 90 days late, by everything i read payment history is weighted far more than AAoA, even considering it was the highest limit at $4,000 and all of my 2 cards are about 500$, so i had my status terminated but it was still effecting my AAoA by some scoring sites and models so i had it removed from my Equifax account & it dropped my FICO to ~750 from ~780. Also noticed when checking my Capitol One Pre qualified offers this month that its reccomending slightly lesser cards than it was last month when it was offering the best cards they have...not its suggesting cards of a lower tier. Did i just shoot myself in the foot? And should i add that account back? the Late payments were from 2012 so maybe they werent impacting my score much anymore, i dont know. By the math i have seen i was positive it would help more than hurt, especially since my AU status had already been terminated for months, but now that i have gotten it completely off my report and seen my equifax FICO drop a little I am feeling stupid again.

2020: FICO Score 9 850/850 (Equifax) (I still only have ~4 cards)

2018 FICO: EQ: 820 TU: 807 EX: 806

First Credit Card in 2016 (2 secured cards)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How high can I score with a small number of tradelines?

@Anonymous wrote:Does anyone know any hard evidence of how high a person can (in practice) score with a small number of tradelines?

I have three open credit cards (the oldest is 11 years old, the newest is 7 years old) and an open student loan that is 14 years old -- no other open accounts. All my other factors are great (1 inquiry, perfect payment history, high AAoA, etc.). My FICO is really high right now, but part of why that is the case is that a have a LOT of closed accounts: three old car loans, an old mortgage, two other student loans, three closed credit cards). In other words, I have many accounts of many types all showing that they were handled well.

In the next five years or so, all of these old closed accounts will drop off (as they exceed ten years since closure) and I will be left with a thinner/leaner credit profile: the three credit cards and the student loan. Obviously my AAoA and age of oldest account will be great then, but does anyone have any hard evidence for how high one can score with essentially a few credit cards and an installment loan? I'd prefer not to open extra accounts that I don't really need or want, just for the purpose of keeping FICO's credit mix and depth factors in top scoring condition.

I only have 2 credit cards, both are secured cards, and less than 2 years old and all three of my FICO scores are in the 700's. 777, 755, & 734 (734 should go up soon since my last collection was just deleted) , so yes you can absolutely do well.

2020: FICO Score 9 850/850 (Equifax) (I still only have ~4 cards)

2018 FICO: EQ: 820 TU: 807 EX: 806

First Credit Card in 2016 (2 secured cards)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How high can I score with a small number of tradelines?

@MarineVietVet wrote:

@Anonymous wrote:The highest you can go is 990 with Fico, however a new acount will hinder you not help you because it will deminish the age of the oldest account. On the other hand if you were to open a tradeline that is not a revolving account with a large down payment say a home or other that can appreciate and not depreciate it can help as long as the DTI ratio is not more than 50%.

Hello and welcome.

Which FICO scoring model is this?

really wish i had looked more into it but all info i saw indicated that i would be better off as payment history was weighted higher than AAoA & total credit available but i guess not

2020: FICO Score 9 850/850 (Equifax) (I still only have ~4 cards)

2018 FICO: EQ: 820 TU: 807 EX: 806

First Credit Card in 2016 (2 secured cards)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How high can I score with a small number of tradelines?

@FiveOhFour wrote:

@MarineVietVet wrote:

@Anonymous wrote:The highest you can go is 990 with Fico, however a new acount will hinder you not help you because it will deminish the age of the oldest account. On the other hand if you were to open a tradeline that is not a revolving account with a large down payment say a home or other that can appreciate and not depreciate it can help as long as the DTI ratio is not more than 50%.

Hello and welcome.

Which FICO scoring model is this?

really wish i had looked more into it but all info i saw indicated that i would be better off as payment history was weighted higher than AAoA & total credit available but i guess not

@FiveorFour,

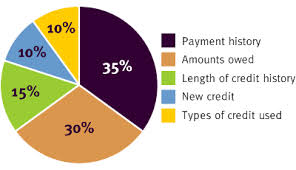

I am not understaning your question. But Payment history weighs higher than AAoA and total available credit... See pie chart below...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How high can I score with a small number of tradelines?

@yes-its-me

sorry i was speaking as if you'd have already read the reply i left a couple posts up a few minutes ago, about how i removed an account from my report that had a late payment a few years back and my score dropped.

2020: FICO Score 9 850/850 (Equifax) (I still only have ~4 cards)

2018 FICO: EQ: 820 TU: 807 EX: 806

First Credit Card in 2016 (2 secured cards)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How high can I score with a small number of tradelines?

@FiveOhFour wrote:@Anonymous

sorry i was speaking as if you'd have already read the reply i left a couple posts up a few minutes ago, about how i removed an account from my report that had a late payment a few years back and my score dropped.

No need to apologize![]() That sucks .. It seems you have recovered nicely judging from your current FICOs. Very impressive those scores...

That sucks .. It seems you have recovered nicely judging from your current FICOs. Very impressive those scores...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How high can I score with a small number of tradelines?

@yes-its-me well the transunion score is now 750 because when i asked TU to remove the Sears card account entirely, even though it already showed my responsibility as AU as terminated, my score dropped from 780 to 750, i was sure it was be higher because i wouldnt have any missed payments on my report any more, even if from 2012, but apparently given the huge hit to my AAoA & my overall available credit outweighed the single late payment that was late by 60 days. I'd add it back and put me as an authorized user on it again but with my luck my score would drop again.

2020: FICO Score 9 850/850 (Equifax) (I still only have ~4 cards)

2018 FICO: EQ: 820 TU: 807 EX: 806

First Credit Card in 2016 (2 secured cards)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How high can I score with a small number of tradelines?

@FiveOhFour wrote:@Anonymous well the transunion score is now 750 because when i asked TU to remove the Sears card account entirely, even though it already showed my responsibility as AU as terminated, my score dropped from 780 to 750, i was sure it was be higher because i wouldnt have any missed payments on my report any more, even if from 2012, but apparently given the huge hit to my AAoA & my overall available credit outweighed the single late payment that was late by 60 days. I'd add it back and put me as an authorized user on it again but with my luck my score would drop again.

750 is NOT a bad score... It will eventually go back up. With a 750 TU score you are with the elites when it comes score ratings. I wouldn't even bother if I were you but it is entirely up to you.