- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: How low will it go?????

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

How low will it go?????

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How low will it go?????

In about 2 months, the vehicle financed in my name for my Niece will be paid off. In January 2022 my mortgage will be paid off. That will leave me with revolvers, and only revolvers. I never carry a balance on them. Taking guesses as to how much my score will drop due to no non-mortgage installment loans, and then in January no mortgage either. I expect a hard hit due to these being lost in my credit mix. Nothing but mostly 0 balance credit cards will be reporting. I think I will lose all these 800+ scores I have become so used to seeing.

EX fico08=815 06/16/24

EQ fico09=809 06/16/24

EX fico09=799 06/16/24

EQ fico bankcard08=838 06/16/24

TU Fico Bankcard 08=847 06/16/24

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How low will it go?????

Following. I'm keeping my fingers crossed I can be in the same position before too long (old cars willing)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How low will it go?????

I'm kind of new to the FICO game, but if I understand correctly, if you apply for a Secured Chared Loan, the interest is minimal and that will keep at least one installment loan on your record.

The above said, I'll lurk in this thread to see what the (much more knowledgable) collective has to say.

Congratulations on being (nearly) debt free!

Chapter 13:

- Burned: AMEX, Chase, Citi, Wells Fargo, and South County Bank (now Bank of Southern California)

- Filed: 26-Feb-2015

- MoC: 01-Mar-2015

- 1st Payment (posted): 23-Mar-2015

- Last Payment (posted): 07-Feb-2020

- Discharged: 04-Mar-2020

- Closed: 23-Jun-2020

I categorically refuse to do AZEO!

In the proverbial sock drawer:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How low will it go?????

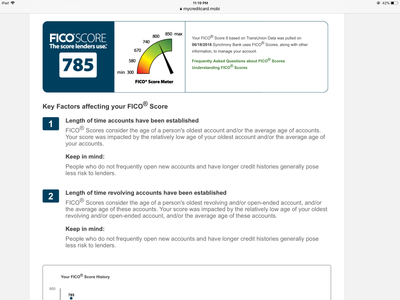

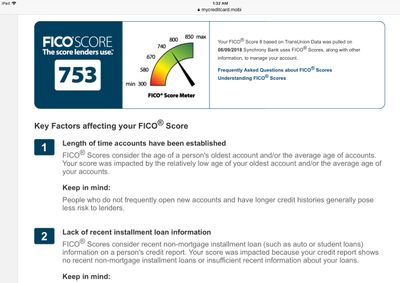

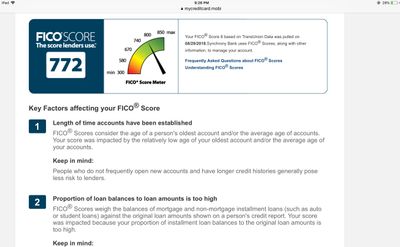

Below were my TU F8 reacting to a auto loan reporting paid off and then new one being reported, I only have one installment loan, no mortgage.

.

.

Two months before paid,

.

.

Reporting paid off...

.

.

Then new auto loan being reported...

.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How low will it go?????

@Horseshoez wrote:I'm kind of new to the FICO game, but if I understand correctly, if you apply for a Secured Chared Loan, the interest is minimal and that will keep at least one installment loan on your record.

The above said, I'll lurk in this thread to see what the (much more knowledgable) collective has to say.

Congratulations on being (nearly) debt free!

With a total lack of debt and about 400,000 in 401k, plus drawing 2200 a month in SSDI, I really do not need high scores. I am 62 and have a damaged spinal cord that disabled me at 54. I will not play the keep an installment loan at all cost game. I might even close all except 5 of my 20 credit card to really tank my scores. I just can't really make myself care too much about a credit score for credit I do not need. The secured loan would work, if I needed credit, but I don't. Shoot, I might just run all 20 cards up to 5 bucks and default on all of them, just for kicks and giggles. Not really, the credit cards are needed for Amazon, but it would be hilarious. Not even a late payment on anything in 25 years, and suddenly go 3+ months late on 100 bucks total over 20 cards. I can't say I am not tempted, and I could try to set them up on a buck a month payment plan just to drive them nuts. It would be fun just talking to them, and if they offered to forgive the debt, I would threaten to sue...It is my debt, you leave that on there, I earned it, and I am shooting for low score.

EX fico08=815 06/16/24

EQ fico09=809 06/16/24

EX fico09=799 06/16/24

EQ fico bankcard08=838 06/16/24

TU Fico Bankcard 08=847 06/16/24

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How low will it go?????

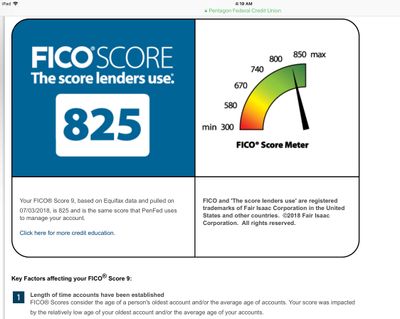

Good chance your scores may not dip below 800 at least with F9. Before and after for my EQ F9...

.

.

.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How low will it go?????

Hey there Sarge, long time no see! Good to see you posting.

First, congrats on nearing the payoff of your mortgage. That's always a great feeling!

Any points lost from the payoff of a loan is not due to any change in credit mix. Credit mix takes into consideration both open and closed accounts on your CR, so assuming the loan(s) stay on your reports for ~10 years following closure there will be no change to your credit mix and no score loss from that factor. The common loss of points seen from the payoff of an only loan is due to the boost from having an almost-paid-off installment loan being eliminated with the closure of the loan. This is part of the Amounts Owed sector of the Fico pie. Depending on the scoring model you're looking at, once your mortgage reports closed you could be looking at score drops of 10-25 points in most cases.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How low will it go?????

@Anonymous wrote:Hey there Sarge, long time no see! Good to see you posting.

First, congrats on nearing the payoff of your mortgage. That's always a great feeling!

Any points lost from the payoff of a loan is not due to any change in credit mix. Credit mix takes into consideration both open and closed accounts on your CR, so assuming the loan(s) stay on your reports for ~10 years following closure there will be no change to your credit mix and no score loss from that factor.

I know this is accepted fact, but if closed accounts count why is number one reason code on both EX and EQ "Lack of recent installment loan information"?

EQ FICO 9 - 770

EX FICO 9 - 758

Citi (2) | Discover | HSBC | BOA | NFCU (2) | WF (2) | Simmons Bank | FNBO (2) | PENFED | BBVA | US Bank | Lowes | Care Credit | Home Depot AU

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How low will it go?????

Zero, because you still have the open mortgage.

My scores didn't move when I paid off my auto loan at least on none of the classic scores I have access to. Only way it would to my knowledge is if it meaningfully impacted your installment utilization which seems unlikely. Actually in general I don't think any of the classic scores differentiate between installment loan types at all, similar to how revolvers aren't differentiated either (Amex charge cards not withstanding). Some Auto-enhanced (AU) industry scores do look specifically at auto loan history but I don't pay attention to those as a general rule.

When your mortage closes next year, that is where I would expect a ding.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How low will it go?????

@Revelate wrote:Zero, because you still have the open mortgage.

My scores didn't move when I paid off my auto loan at least on none of the classic scores I have access to. Only way it would to my knowledge is if it meaningfully impacted your installment utilization which seems unlikely. Actually in general I don't think any of the classic scores differentiate between installment loan types at all, similar to how revolvers aren't differentiated either (Amex charge cards not withstanding). Some Auto-enhanced (AU) industry scores do look specifically at auto loan history but I don't pay attention to those as a general rule.

When your mortage closes next year, that is where I would expect a ding.

In either case, I look forward to being debt free for the first time since I first went into debt, and it only took 47 years to do it.

EX fico08=815 06/16/24

EQ fico09=809 06/16/24

EX fico09=799 06/16/24

EQ fico bankcard08=838 06/16/24

TU Fico Bankcard 08=847 06/16/24

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20