- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: How low will it go?????

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

How low will it go?????

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How low will it go?????

@sarge12 wrote:Just an update for anyone following my postings here, or anywhere on this forum....many changes the last 3 months. My 93yo Mother fell and cracked her hip, and after 3 weeks in the hospital and restorative care we had to move her in with my sister. It was not broken completely in two, so she can still walk with a walker, but we must watch her to prevent further falls. My 2003 Impala was not sufficient for constant drives to my sisters house, so I paid off my house and financed a 2022 Camry LE. I also took a 200 buck bribe to PC one of my 2 Bank of America Cash reward cards to the Unlimited Cash rewards with 1.5% cash back. I also have a paypal credit card coming with 2% cash back. This is my first ever card with Synchrony, but it is a mastercard, so I figured...why not? The car loan was at 1.99%, and I could have paid cash for it, but the taxes from withdrawing over 30K from my 401K would be more than the interest on the loan. All these changes have yet to show up on my credit scores yet, so I will not update my scores for a while. I am expecting a fairly significant drop in all my scores, especially when the mortgage shows as being paid off. My free time has been drasticly reduced, which is why I have not posted in a while. My Mother also has dementia, so I have to handle her finances, with her money. I hope 2022 is a much better year.

Sorry for all your issues, and best wishes for '22. Just one suggestion. Synchrony is a real blast to deal with if you have heavy usage(#SarcasmFont). If you're like most, until you develop a decent history with them, they take forever to post large payments, and if you exceed a certain threshold, will often report midcycle. For a while as I was rebuilding, this was my primary card and it was a handful until I had about a year or 18 months with them. If you're playing AZEO, be sure this isn't your reporter and keep usage moderate. OTOH, they were very generous with CLIs which eventually made life easier.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How low will it go?????

@Phana24 wrote:

@sarge12 wrote:Just an update for anyone following my postings here, or anywhere on this forum....many changes the last 3 months. My 93yo Mother fell and cracked her hip, and after 3 weeks in the hospital and restorative care we had to move her in with my sister. It was not broken completely in two, so she can still walk with a walker, but we must watch her to prevent further falls. My 2003 Impala was not sufficient for constant drives to my sisters house, so I paid off my house and financed a 2022 Camry LE. I also took a 200 buck bribe to PC one of my 2 Bank of America Cash reward cards to the Unlimited Cash rewards with 1.5% cash back. I also have a paypal credit card coming with 2% cash back. This is my first ever card with Synchrony, but it is a mastercard, so I figured...why not? The car loan was at 1.99%, and I could have paid cash for it, but the taxes from withdrawing over 30K from my 401K would be more than the interest on the loan. All these changes have yet to show up on my credit scores yet, so I will not update my scores for a while. I am expecting a fairly significant drop in all my scores, especially when the mortgage shows as being paid off. My free time has been drasticly reduced, which is why I have not posted in a while. My Mother also has dementia, so I have to handle her finances, with her money. I hope 2022 is a much better year.

Sorry for all your issues, and best wishes for '22. Just one suggestion. Synchrony is a real blast to deal with if you have heavy usage(#SarcasmFont). If you're like most, until you develop a decent history with them, they take forever to post large payments, and if you exceed a certain threshold, will often report midcycle. For a while as I was rebuilding, this was my primary card and it was a handful until I had about a year or 18 months with them. If you're playing AZEO, be sure this isn't your reporter and keep usage moderate. OTOH, they were very generous with CLIs which eventually made life easier.

This Synchrony card is just one of about 20 cards I have, and my credit scores are so high, that really a drop in score only hurts my pride. The closed mortgage is likely to cause the largest drop. I always PIF unless there is a 0% interest promotion, so AZEO is not really needed. Not really even concerned. I do plan to post updated scores once the mortgage payoff has fully hit my reports, mainly to provide data points on what paying off a mortgage might do to very high scores. The Auto loan has already hit, but really did not drop my scores more than 15 points max. All my fico 08 scores are still around 815-830 range. I have never gotten a Synchrony issued card, because most are store cards without a MC or Visa designation, and the posts I see on account closures has discouraged me. This one is Paypal, MC, and 2% cash back everywhere with a 12,000 dollar limit. I do plan on having only 1 Synchrony card, and as a rule, never have more than 2 cards from any single issuer. I will likely close my Barclaycard at some point, or just wait for them to do so for non-use. I paid off the house Dec. 17, so it will likely take a month or so to really hit my scores, but I do expect a fairly large drop. With so much happening, my scores are the very least of my concerns. I am 63, and in fairly poor health myself, and really do not even need credit at all anymore.

EX fico08=815 06/16/24

EQ fico09=809 06/16/24

EX fico09=799 06/16/24

EQ fico bankcard08=838 06/16/24

TU Fico Bankcard 08=847 06/16/24

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How low will it go?????

Lost 20 points, average.

Old, moderate thick file, Ficos ~840.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How low will it go?????

@Kforce wrote:Lost 20 points, average.

Old, moderate thick file, Ficos ~840.

If the mortgage payoff only cost me 20 points, that will be good. With my house paid for, and a 2022 Toyota Camry LE just financed, I really can't forsee any need for any new credit for years anyway. To be honest though, a year ago I had no plans to ever buy a new car either. Then, my Mothers falling, and my 2003 Impala exhibiting what appears to be transmission problems combined to change everything. I went from driving maybe 2 times a month, to doing so about every other day. I was not liking the thoughts of the car breaking down at 1 in the morning. Used cars have increased so much that there was little savings to buying a late model used car. I, of course could have withdrawn enough from my 401K to pay cash, but being on Social Security Disability, doing so would have cost a fortune in taxes. All my savings of about 350K is pretax, and as such, large withdrawals count as regular income. Too much income not only raises my tax bracket, but also makes up to 50% of my Social Security taxable.

The key to withdrawing 401K funds is to do so gradually, and the low 1.99% interest rate is actually less costly than paying cash. The car itself has about every option available on a Camry LE without going the hybrid route. With lane departure, auto braking, Dynamic cruise, cameras, radars, backup camera, etc., I swear that car is smarter than me. It almost drives itself, but can also rat me out if I am ever in an accident that is my fault. The accident, and all paramaters such as speed, braking, and even a video is recorded, and it is not open for users to disable...basically, a black box for cars. It can easily prove me innocent of fault, but can also prove my guilt, and can be extracted with a court order. I am not sure how to feel about my car being able to be used as a witness against me. Not that I would ever lie about my driving, because I would not, but my own car actually being allowed to be used against me is just crazy. The technology in these newer cars is both amazing, and a bit of a concern. It both can protect me, but also seems a bit like big brother is in my car.

EX fico08=815 06/16/24

EQ fico09=809 06/16/24

EX fico09=799 06/16/24

EQ fico bankcard08=838 06/16/24

TU Fico Bankcard 08=847 06/16/24

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How low will it go?????

Sorry about your mother, few years back went to a hack fest and we won with an idea to create a system that would develop data points on elderly people walking for doctors. Broken hips are usually not good in the elderly. Just paid my house off and my old pickup so I know how nice that felt. I hope she gets better and you have a great new year.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How low will it go?????

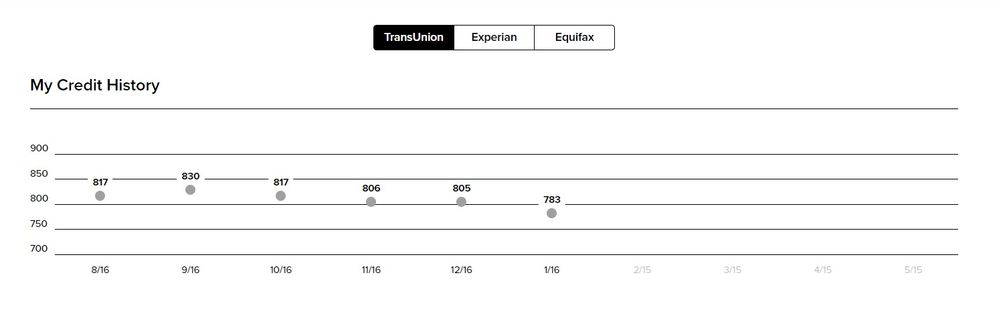

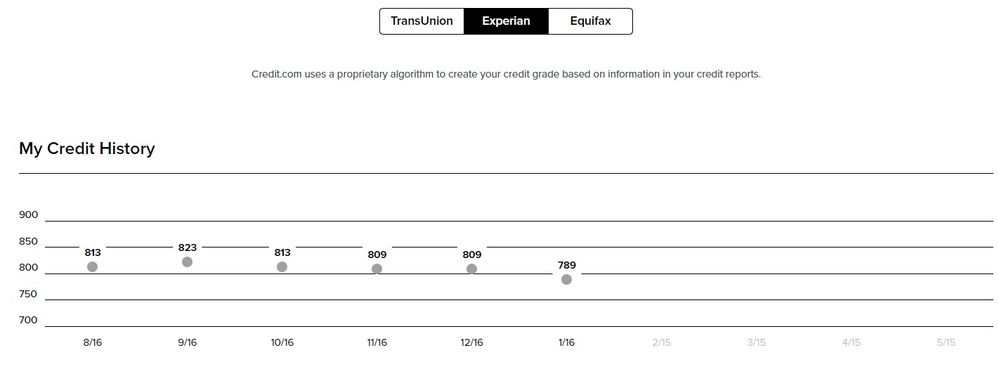

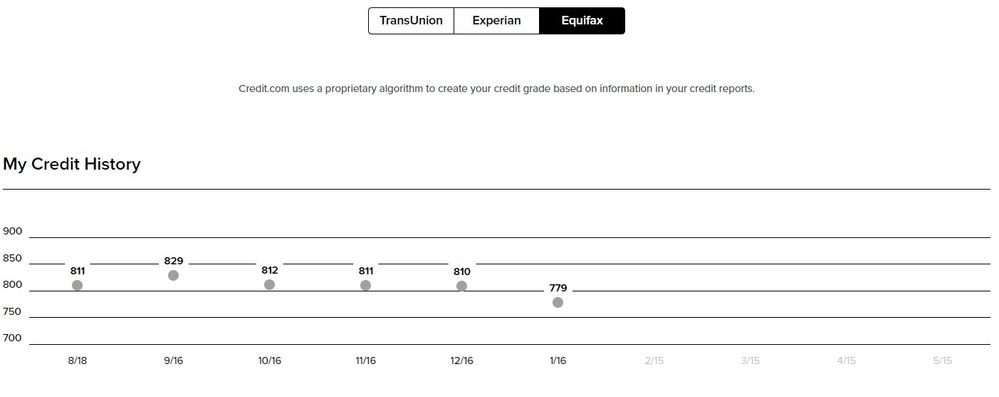

I now have answers to what the new car loan, and paying off the mortgage did to my fico 08 at experien. It dropped from 826 on January 01 to 816 on January 09 due to the new car loan showing. Then I recieved notice of the major change in my credit profile of the paid off mortgage...actually reporting as positive activity. It did not however have a positive affect on my score...it dropped a whopping 34 points to 782 for experien fico 08. It actually congratulated me for the positive activity of paying off my mortgage. The drastic score drop was due to a very small installment loan utilization with less than 4000 dollars on the mortgage vs 70,000 beginning balance before the payoff. Then 29400 showed as balance on 29400 starting balance, for a combined 34000 vs about 100,000 starting balances. Now with the payoff it has just the car that is over 90% utilization. Now, I expected the drastic drop, and viewed it as worth it, so I am not upset at all, but this is a data point for those who would care. A total of 44 points in 15 days is pretty significant. I fully expect all my fico 08 scores to drop below 800.

EX fico08=815 06/16/24

EQ fico09=809 06/16/24

EX fico09=799 06/16/24

EQ fico bankcard08=838 06/16/24

TU Fico Bankcard 08=847 06/16/24

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How low will it go?????

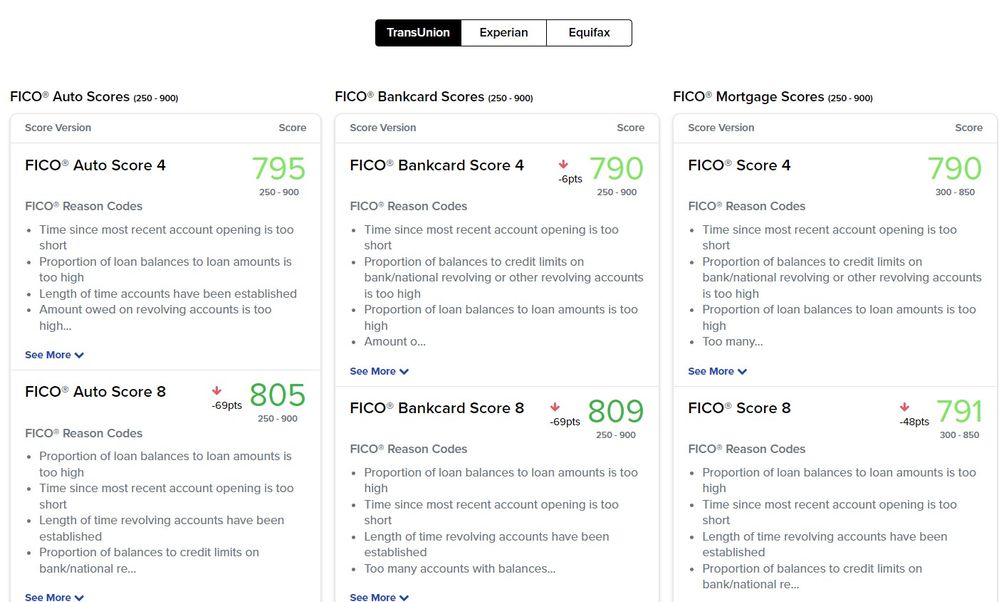

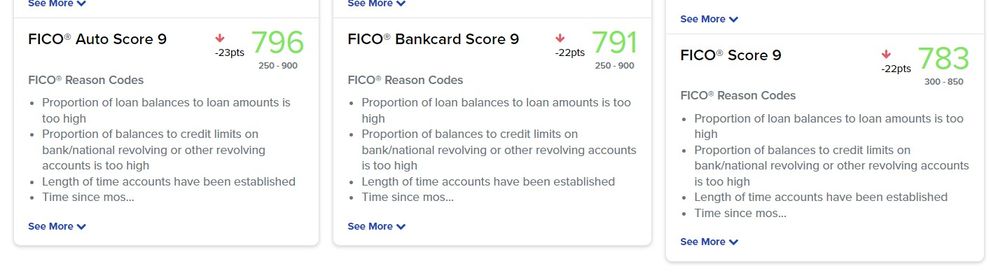

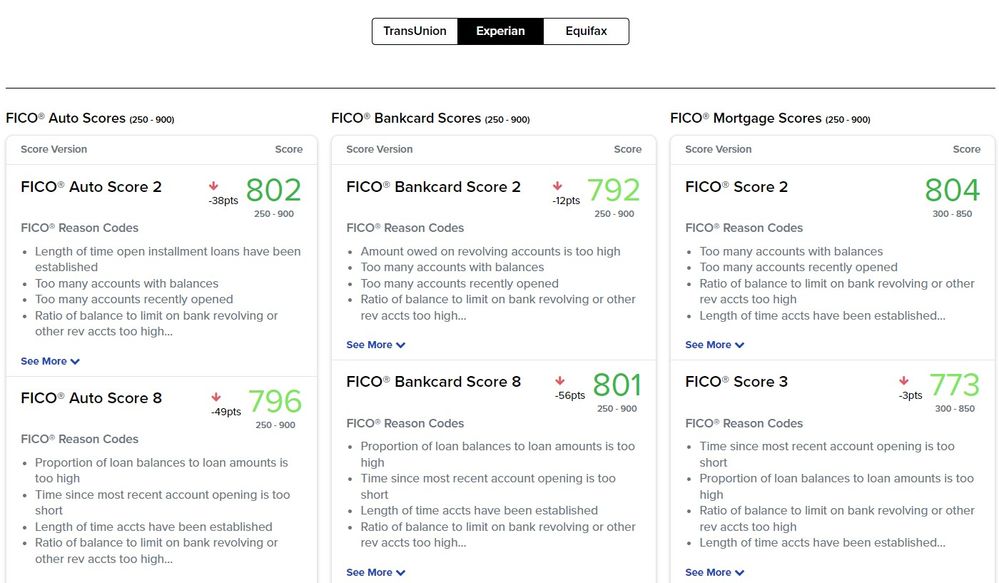

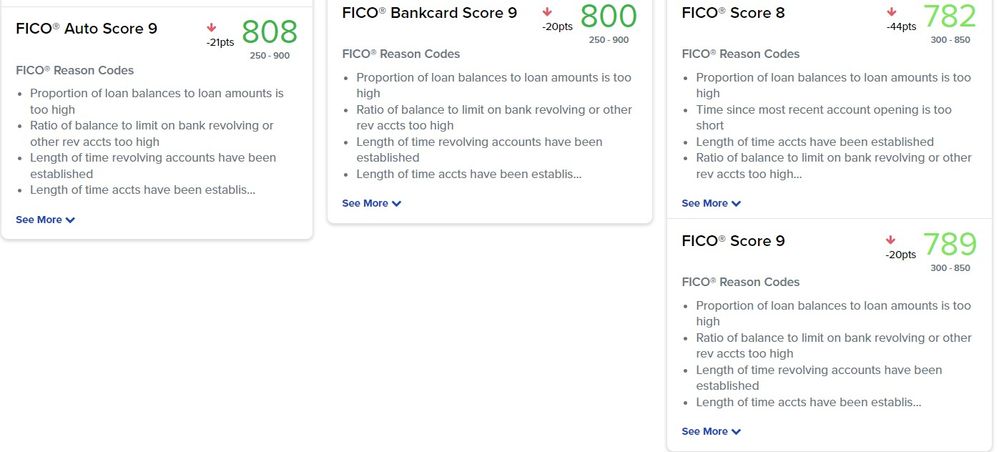

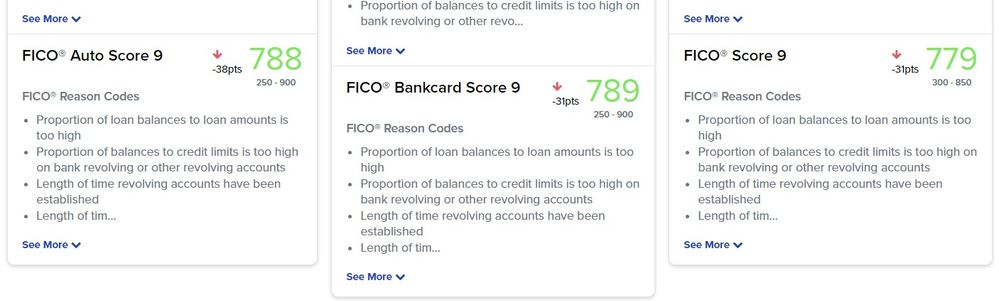

OK, today I recieved all my scores from Credit.com extracredit, and will sometime soon post all scores here in this thread. Every single fico 08, and fico 09 is now below 800, some dropping as much as 48 points. Keeping in mind that my scores were very close to being maxed out, it is far from a catastophy, and was actually expected. My 2 TU fico auto 08 and bankcard 08 scores both dropped 69 points, but both are still over 800 barely on a 900 scale. It might help some know exactly what the hit might be from such major changes from a new auto loan, paid off mortgage, and new credit card opening in a short time fram might be. Due to that, these can be valuable data points, so I will likely include screen shots of all scores as well as the 6 months of the history timeline. I plan to do this in 3 posts of screenshots, but must take great care not to include any peronally identifiable info, so great care must be taken. There are some on this forum that keep up with many data points so referring those members to take a look at this post might be advisable. I figure this much change in such a short time frame on a clean credit file is somewhat rare. I plan to do 1 post for each of the 3 CRA's, because the screenshots will be quite large. The data in my siggy, will also be updated at some point. I hope members find this data valuable.

EX fico08=815 06/16/24

EQ fico09=809 06/16/24

EX fico09=799 06/16/24

EQ fico bankcard08=838 06/16/24

TU Fico Bankcard 08=847 06/16/24

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How low will it go?????

EX fico08=815 06/16/24

EQ fico09=809 06/16/24

EX fico09=799 06/16/24

EQ fico bankcard08=838 06/16/24

TU Fico Bankcard 08=847 06/16/24

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How low will it go?????

EX fico08=815 06/16/24

EQ fico09=809 06/16/24

EX fico09=799 06/16/24

EQ fico bankcard08=838 06/16/24

TU Fico Bankcard 08=847 06/16/24

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How low will it go?????

EX fico08=815 06/16/24

EQ fico09=809 06/16/24

EX fico09=799 06/16/24

EQ fico bankcard08=838 06/16/24

TU Fico Bankcard 08=847 06/16/24

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20