- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: How low will my scores go?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

How low will my scores go?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How low will my scores go?

@Thomas_Thumb wrote:

All as expected. My mortgage was still reporting as open. However, I had no other installment loans.

The "lack of recent installment loan information" is present because this particular metric excludes mortgages..

So is that metric costing you points? I mean, the presence of a negative reason code means it's adversely impacting score... is that a Fico 9 thing? To me that suggests credit mix isn't being satisfied... does that mean you have no other non-mortgage installment loans (closed included) on your CR?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How low will my scores go?

@Anonymous wrote:

@Thomas_Thumb wrote:

All as expected. My mortgage was still reporting as open. However, I had no other installment loans.

The "lack of recent installment loan information" is present because this particular metric excludes mortgages..

So is that metric costing you points? I mean, the presence of a negative reason code means it's adversely impacting score... is that a Fico 9 thing? To me that suggests credit mix isn't being satisfied... does that mean you have no other non-mortgage installment loans (closed included) on your CR?

@Anonymous My credit mix has always been Very Good, never Excellent/Exceptional. According to Fico representatives, the front end software accuractly reflects the Fico scoring algorithm's assessment of various profile metrics. Certainly my profile is not optimized with respect to credit mix and it is leaving some points on the table for that metric. The situation is not specific to Fico 9.

As you know, mix is a minor contributor to score. I never had an issue holding 850 on Fico 8 or Fico 9 with a VG mix. My recent point drops (Fico 8 and Fico 9) are undoubetedly due to a rise in revolving utilization above a critical threshold.

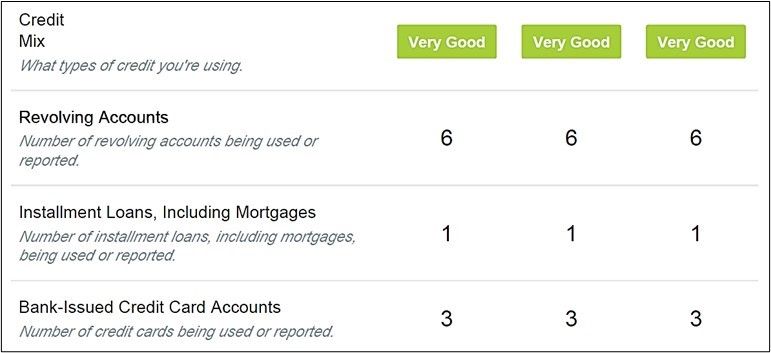

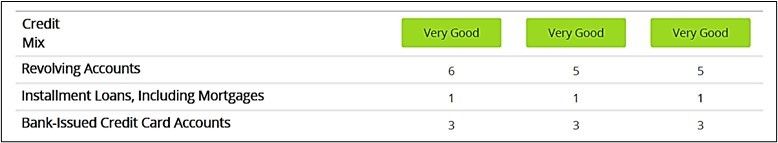

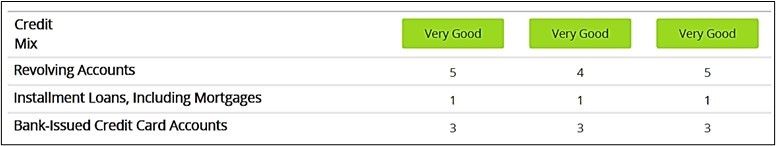

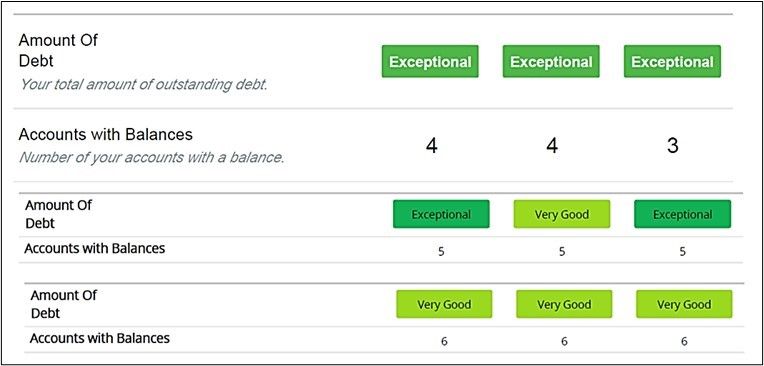

My open card accounts (1 charge card, 4 credit cards and 1 AU credit card) have remained constant since 2014. No changes in any CLs since 2017. All accounts are listed in each report and all are being used. However, the # of revolving accounts LISTED ON THE 3B SUMMARY has dropped from (EQ=6, TU=6, EX=6 in 4/2018) to (EQ=6, TU=5, EX=5 in 4/2020) to (EQ=5, TU=4, EX=5 in 10/2020). See below pastes (top to bottom 4/2018, 4/2020, 10/2020):

For reference, # of accounts with balances (4/2018, 4/2020, 10/2020 top to bottom):

Why the drop in # of Revolving Accounts as shown in the summary? All accounts being reported and are in active use. Furthermore, the # of accounts showing balances has increased.

I suspect the front end software was updated this year to no longer include the AU card in the count total for any of the CRAs. In addition, I suspect the charge card (which is an open account with 1 month terms as opposed to a revolving account) is now not included in the TU count. Alternatively, my AMEX charge card is not included on any CRA with the AU card being excluded from count on TU only.

I would appreciate input from others that get 3B reports on whether or not their AMEX charge card and/or AU credit cards are included in the "Revolving Accounts" number and/or "Accounts With Balance" number.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How low will my scores go?

My credit mix has always been Very Good, never Excellent/Exceptional. According to Fico representatives, the front end software accuractly reflects the Fico scoring algorithm's assessment of various profile metrics. Certainly my profile is not optimized with respect to credit mix and it is leaving some points on the table for that metric. The situation is not specific to Fico 9................

I would appreciate input from others that get 3B reports on whether or not their AMEX charge card and/or AU credit cards are included in the "Revolving Accounts" number and/or "Accounts With Balance" number.

I find it perplexing indeed that you're not "Exceptional" in Credit Mix. Despite my various FICO inadequacies my "credit mix" has consistently been "Exceptional" since I added my first reindeer games loan. And it stayed at "Exceptional" even during the periods in which I had no open installment loan, demonstrating that even a closed account is factored into that metric.

Racking my brain, the only thing I can think of that I have -- that you do not have -- is a personal line of credit. So if you ever get one of those, see if it changes your "Credit Mix" ![]()

I did have a store card for a matter of weeks, and another card -- Care Credit -- which seems to be scored as a store card, for around a year. Perhaps those have something to do with it.

I have never had an AU card, and have never in recent times had a personal Amex charge card, so can't respond to that question.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How low will my scores go?

@SouthJamaica - I suspect a PL or PLOC could boost my rating to excellent but, no plans for one in the forseeable future. I believe you have closed SSL and Auto loans on your file as well as the PLOC. I don't have any of those either. FYI - open and closed loans count toward mix equally even though they affect score differently.

Back in 2015 I surmized that there might be some overall count minimum (open + closed) as well as having multiple types of credit to reach Excellent/Exceptional mix status. There was a thread on this - Inverse may have started it. We never zeroed in on exact requirements. Link to thread pasted below (too bad some external links in that thread are broken/gone).

... I am still puzzled by the reported drop in total revolving accounts in 2020 even though I have the same # of cards and no change in any card status...

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How low will my scores go?

@Thomas_Thumb wrote:@Anonymous My credit mix has always been Very Good, never Excellent/Exceptional. According to Fico representatives, the front end software accuractly reflects the Fico scoring algorithm's assessment of various profile metrics. Certainly my profile is not optimized with respect to credit mix and it is leaving some points on the table for that metric. The situation is not specific to Fico 9.

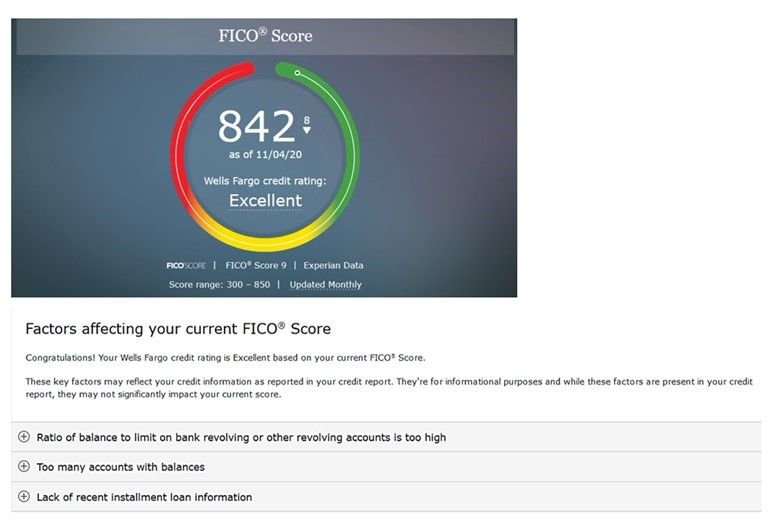

Which front end software are you referring to? I believe your graphic above came from WF, where SJ of course references EX. We can't just assume that all front end software from all sources that provide a Fico score are equal, can we?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How low will my scores go?

I am referring to all my 3B pastes in this thread which were from reports purchase directly from Fico.

The WF front end software only reports score, which is of course correct, and negative reason statements. The negative reason statements come from the Fico reason code list as provided by the Fico 9 algorithm. My WF summary does not look at amount of debt, cards reporting balances or rate anything except score.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How low will my scores go?

Oh gotcha, I didn't realize you were referring to MF front end. I thought that perhaps WF provided some sort of fluff front end along with whatever they give monthly. I do not have any WF accounts so I was unaware.

Anyone have any theories as to how many levels of credit mix there are and/or what may go into them?

Are we thinking that one installment loan type (open or closed) gets one a "very good" and 2 or more yields an "excellent?" Does anyone with 2 installment loan types not have an excellent, suggesting it may require 3?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How low will my scores go?

I believe Fico uses 5 classifications of ratings universally regardless of the scoring category. They are:

Poor, Fair, Good, Very Good and Exceptional. Refer to the following thread for some background info on mix & ratings:

I'm not overly concerned about in mix thresholds at the moment. My most pressing question is:

Why has the number of "Revolving Accounts" on my 3B reports dropped in 2020? Again, I have the same exact cards as in 2018 with exactly the same credit limits. All cards are active, in use and listed individually in the account section.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How low will my scores go?

@Thomas_Thumb wrote:@SouthJamaica - I suspect a PL or PLOC could boost my rating to excellent but, no plans for one in the forseeable future. I believe you have closed SSL and Auto loans on your file as well as the PLOC. I don't have any of those either.

Yes but I feel certain that your mortgage covered that area just fine. I was "Exceptional" in credit mix before I got my auto loan. I touched the last base when I got my SSL.

FYI - open and closed loans count toward mix equally even though they affect score differently.

Yes I've come to the same conclusion.

Back in 2015 I surmized that there might be some overall count minimum (open + closed) as well as having multiple types of credit to reach Excellent/Exceptional mix status. There was a thread on this - Inverse may have started it. We never zeroed in on exact requirements. Link to thread pasted below (too bad some external links in that thread are broken/gone).

I doubt it because I went from Very Good to Exceptional when I got my $500 Alliant SSL.

... I am still puzzled by the reported drop in total revolving accounts in 2020 even though I have the same # of cards and no change in any card status...

On that I have nothing to contribute

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How low will my scores go?

I see, TT. From that thread it sounds like when looking at credit mix your take on it is not just the different types of credit accounts, but also the quantity of credit accounts. I always took mix as to mean types... like if you have just revolvers and add an installment loan, credit mix improves due to having another type. I would then think that in order to further improve credit mix one would need to add additional types (if that's a thing). From what I'm reading though perhaps it isn't different types, but simply more total accounts? Perhaps some combination of the two?

I guess the question would be could someone achieve an exceptional credit mix with only (say) 5 accounts, but all 5 were of different types? Conversely, could someone with what Fico would consider to be an optimal number of accounts (say 20) achieve an exceptional credit mix if it only included 2 different types of credit accounts?