- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: How low will my scores go?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

How low will my scores go?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How low will my scores go?

@Thomas_Thumb wrote:I don't think all revolving is lumped together from a mix perspective. PLOCs and HELOCs are a different subclass than revolving credit cards. Auto loans, student loans and SSLs may be lumped together for mix but, Auto is called out specifically on some reason codes/statements.

Regarding my revolving accounts and bankcard count...

One is an AU card which is excluded and a second is an AMEX charge which is likely excluded. A third probable exclusion is a Best Buy store card (not their co-branded Visa card) which should be excluded. The remaining three cards which are probably being categorized as my 3 bank cards are:

1) AT&T Universal Mastercard

2) Fidelity Visa card.

3) Discover card.

@Thomas_Thumb I apologize, I'm a habitual editor and edited my above post several times.

May I ask why you feel they are considered different sub types for mix purposes? That auto is specifically called out in a reason code I don't believe is indicative of it relating to Mix, is it? Couldn't it be for Amounts Owed for example?

I think it is a code for industry versions only, if I IIRC.

Am I missing something?

The AU should not be excluded from Mix because of its CL should it? I thought that only excluded from Amounts Owed?

Edited.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How low will my scores go?

@Thomas_Thumb wrote:

@Anonymous wrote:

@Anonymous wrote:

@SouthJamaica wrote:Once I added my first installment loan, a reindeer games Alliant SSL loan, I moved up from "Very Good" in credit mix to "Exceptional", and have been there ever since. For most of the time, I've had either one open installment loan or no open installment loan.

Understood. So it appears then that one can grab an exceptional with just 2 types of credit as originally believed, but in order to do so one must have more than just a few accounts (say 9+). Does that sound like a fair assessment? In the references that Cassie provided of members with exceptional ratings, all of them had 2+ types of different accounts (open or closed) on their CR.

I would agree, but I don't know what the number is.

SJ had the following types of accounts before adding the SSL:

1) Revolving credit cards

2) PLOCs

3) Retail store cards

I have revolving credit cards, a store card, a charge card and a mortgage. What keeps me from an Exceptional rating is lack of another account type (such as a PLOC) and being below a TBD total account QTY threshold - IMO. With regard to critical mass, I have yet to see a profile rate exceptional with under 10 accounts total (including closed accounts)

@Thomas_Thumb yeah I definitely believe a few more revolvers would make you excellent. Another type might, that would be interesting to test.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How low will my scores go?

@Thomas_Thumb wrote:

What keeps me from an Exceptional rating is lack of another account type (such as a PLOC) and being below a TBD total account QTY threshold - IMO. With regard to critical mass, I have yet to see a profile rate exceptional with under 10 accounts total (including closed accounts)

BM back in post 54 suggested that a PLOC wouldn't be another account type, just another revolver... which, if you need more to satisfy the quantity metric could in theory bump you to excellent.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How low will my scores go?

Unfortunately, I'll likely never have an Exceptional mix.

I am a credit minimalist. My closed accounts are all dropping off and no new accounts are being opened.

I am still puzzled by my reduction in revolving accounts from 6 in 2018 to 5 in early 2020 and now 4 on TU in late 2020. I have the same 6 open cards - all active.

I'll check CK and Credit.com tomorrow to confirm my mortgage has been closed across all three CRAs. If confirmed, I'll pull another 3B report next Monday to see how my mortgage payoff/closure is affecting my various Fico scores.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How low will my scores go?

There's nothing wrong with being a credit minimalist and your profile/scores prove that one can make out just fine that way. You'll always have the credit available to you if/when you need it, which is what it's really all about.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How low will my scores go?

@Anonymous wrote:

@Thomas_Thumb wrote:

What keeps me from an Exceptional rating is lack of another account type (such as a PLOC) and being below a TBD total account QTY threshold - IMO. With regard to critical mass, I have yet to see a profile rate exceptional with under 10 accounts total (including closed accounts)BM back in post 54 suggested that a PLOC wouldn't be another account type, just another revolver... which, if you need more to satisfy the quantity metric could in theory bump you to excellent.

@Anonymous I'm pretty sure the quantity metric is for number of bankcards, due to it being called out in the fico slide at the beginning of the Mix category of the Primer:

It's also in the sample scorecard a little bit further down. But, that could be different across versions? I don't know of an award for number of revolvers overall. Not saying it couldn't exist, though.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How low will my scores go?

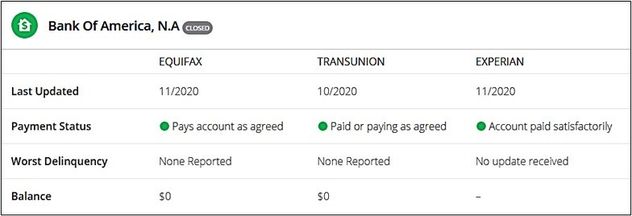

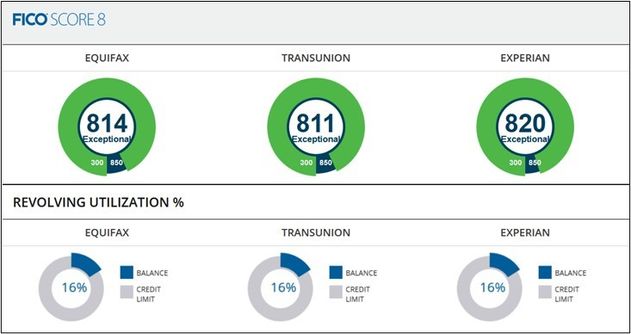

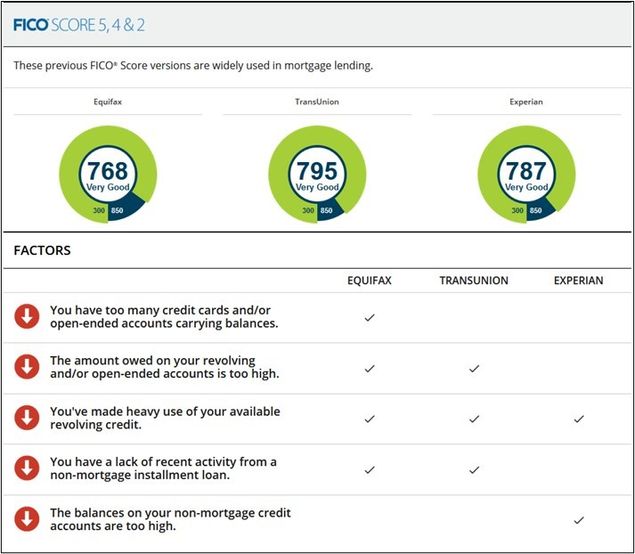

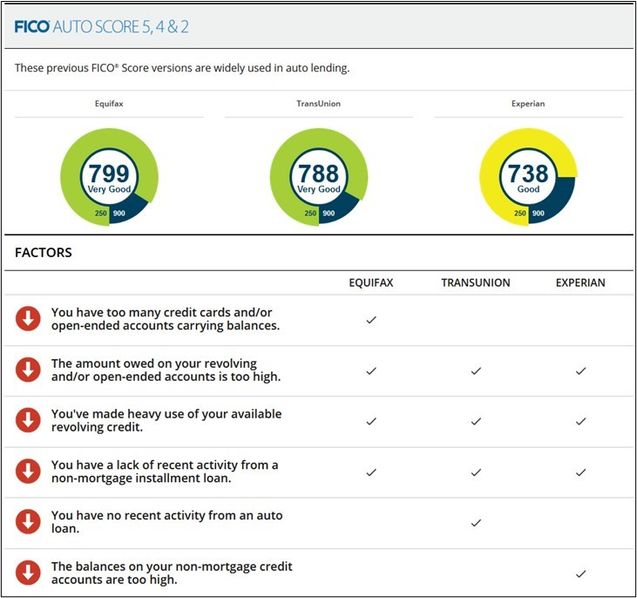

Confirmed all CRAs are reporting my mortgage as closed. So I pulled another 3B report with no open installment loans. Many scores, but not all, took a big hit. Accounts reporting a balance dropped from 6 to 4 but, aggregate utilization increased from 11% to 13%. Regardless, the big influencer for Fico 8 & Fico 9 is closing of the mortgage.

Results are provided below with some pastes from the report. A few really big drop in some scores such as EX Auto Fico 98 (score 2).

I have observed a lot of interesting cause/effect relationships among scores by model and CRA relative to changes in my profile. Clear differences in behavior. I will try to summarize by conclusions in a follow-up post.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How low will my scores go?

Link to 3B screen shot of posted old scores (2017) before the late 2020 decline.

Observations of recent events:

1) EX AUTO Fico 98 (score 2) was strongly impacted by the loan closure (score in bold red). The EX Fico 98 Classic and BCE scores were not (scores in bold purple).

2) Comparing the two November reports indicates closing a single open loan dropped Classic Fico 8 score 24 to 29 points. Larger drops were seen on the Fico 8 industry enhanced Auto and BCE versions.

3) A review the October and November 2020 reports specific to Classic Fico 04 shows some notable differences among the CRAs. All three CRA scores dropped in early November from October due to the increase in revolving utilization. The TU and EX scores dropped further (scores in orange) on the 11/30 report but, the EQ score went up substantially (score in blue)! Why?

- EQ Fico 04 (score 5) is highly sensitive to # cards reporting balances - much more so than TU Fico 04 (score 4) and EX Fico 04 (score 3) from my experience. The reduction in # cards reporting had a substantial positive impact on Both Classic EQ score 5 and its BCE counterpart. In both cases the boost more than offset a increase in utilization and loss of an open loan. Conversely, TU and EX scores continued lower.

4) Lack of an open loan appears to have little, if any, influence on Classic EQ score 5 or its BCE industry option counterparts.The same is true for Classic EX score 2 and its BCE industry option counterpart. In contrast, TU scores dropped across the board.

5) For all CRAs, there was a score drop associated closure of my only open installment loan (a mortgage) on all Auto Fico versions except EQ Auto score 5.

| Description | 11/30/2020 | 11/5/2020 | 10/13/2020 | 4/7/2020 | 4/16/2018 | 3/25/2017 |

| Open loans (Mortgage) | 0 | 1 | 1 | 1 | 1 | 1 |

| Ag UT $ (Exclude AU) | $13,395 | $11,005 | $2,951 | $285 | $620,$506 | $354 |

| Ag UT % (Exclude AU) | 16% | 13% | 3% | 1% | 1% | 1% |

| High card $ (no AU) | $9,664 | $9,664 | $1,829 | $165 | $469 | $270 |

| High card UT % (no AU) | 54% | 54% | 15% | 1% | 2% | 1% |

| AU card UT $ | $1,034 | $2,658 | $908 | $775 | $5,707 | $918 |

| AU card UT % | 3% | 8% | 3% | 2% | 17% | 3% |

| AG UT $ (inc AU) | $14,429 | $13,663 | $3,859 | $1,060 | $6,327 | $1,272 |

| AG UT % (inc AU) | 12% | 11% | 3% | 1% | 6% | 2% |

| INQ by CRA | 0,0,0 | 0,0,0 | 0,0,0 | 0,0,0 | 1,1,0 | 0,0,0 |

| Accts with bal (no AU) | 4,4,4 | 6,6,6 | 6,6,6 | 5,5,5 | 4,4,3 | 3,3,3 |

| EQ Fico 8 | 814 | 843 | 850 | 850 | 850 | 850 |

| TU Fico 8 | 811 | 835 | 850 | 850 | 850 | 850 |

| EX Fico 8 | 820 | 846 | 850 | 850 | 850 | 850 |

| EQ Fico 04 (score 5) | 768 | 749 | 764 | 790 | 777 | 804 |

| TU Fico 04 (score 4) | 795 | 806 | 818 | 823 | 801 | 823 |

| EX Fico 04 (score 3) | 771 | 791 | 819 | 830 | 809 | 830 |

| EX Fico 98 (score 2) | 787 | 787 | 820 | 839 | 842 | 839 |

| EQ Fico 9 | 814 | 830 | 850 | 850 | 850 | 850 |

| TU Fico 9 | 815 | 834 | 850 | 850 | 850 | 850 |

| EX Fico 9 | 806 | 842 | 850 | 850 | 850 | 850 |

| EQ BCE Fico 8 | 816 | 850 | 878 | 881 | 881 | 887 |

| TU BCE Fico 8 | 826 | 862 | 880 | 880 | 891 | 899 |

| EX BCE Fico 8 | 834 | 878 | 900 | 900 | 900 | 900 |

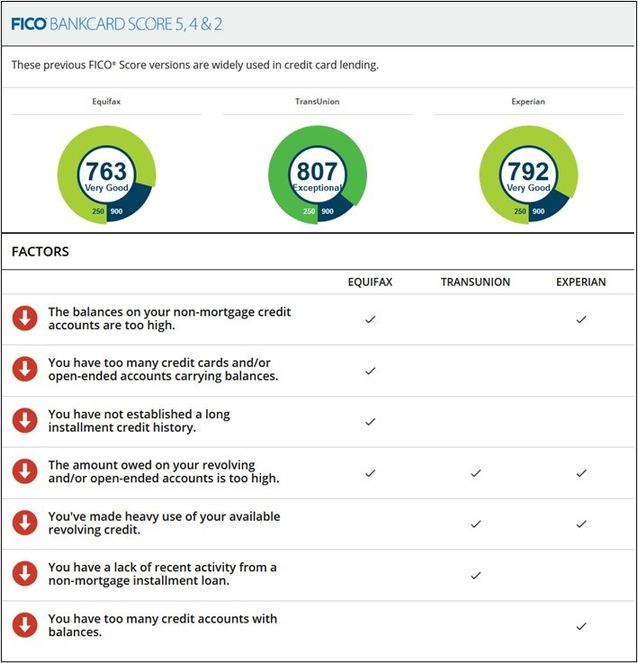

| EQ BCE Fico 04 (score 5) | 763 | 743 | 776 | 808 | 786 | 822 |

| TU BCE Fico 04 (score 4) | 807 | 817 | 853 | 858 | 812 | 858 |

| EX BCE Fico 98 (score 2) | 792 | 792 | 845 | 861 | 867 | 864 |

| EQ BCE Fico 9 | 819 | 838 | 867 | 873 | 868 | 876 |

| TU BCE Fico 9 | 819 | 839 | 869 | 870 | 873 | 879 |

| EX BCE Fico 9 | 809 | 844 | 874 | 874 | 878 | 879 |

| EQ Auto Fico 8 | 809 | 857 | 878 | 884 | 881 | 887 |

| TU Auto Fico 8 | 829 | 861 | 879 | 879 | 882 | 891 |

| EX Auto Fico 8 | 828 | 871 | 899 | 899 | 895 | 897 |

| EQ Auto Fico 04 (score 5) | 799 | 778 | 795 | 818 | 807 | 831 |

| TU Auto Fico 04 (score 4) | 788 | 822 | 867 | 872 | 837 | 872 |

| EX Auto Fico 98 (score 2) | 738 | 787 | 832 | 858 | 861 | 858 |

| EQ Auto Fico 9 | 825 | 836 | 867 | 878 | 870 | 885 |

| TU Auto Fico 9 | 821 | 842 | 871 | 871 | 870 | 880 |

| EX Auto Fico 9 | 819 | 856 | 882 | 882 | 886 | 887 |

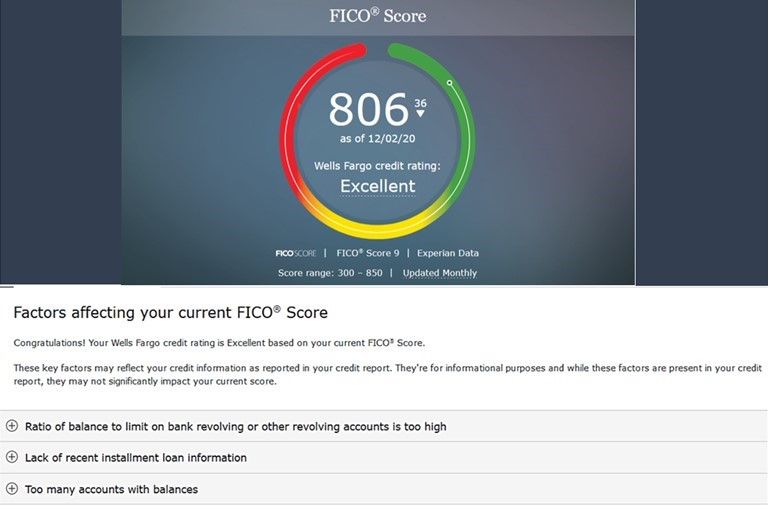

Added below: Paste from WF showing EX Fico 9 reason codes for score drop to 806:

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How low will my scores go?

Oooh 5-7 negative reason statements? That's cool, as it seems 4 is usually the norm.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How low will my scores go?

@Anonymous wrote:Oooh 5-7 negative reason statements? That's cool, as it seems 4 is usually the norm.

It's still only 4 on each. That's just the way FICO formats it in the monthly 3B PDF file.

In the web front-end each score will have the usual 4, listed in order for each bureau as shown on that PDF.

(I've never seen 5, though that is possible if an inquiry affected the score in some significant way.)