- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- How to get an 822 FICO without really trying (My d...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

How to get an 822 FICO without really trying (My dad's story)

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to get an 822 FICO without really trying (My dad's story)

My dad is 90 years old and hasn't had a penny of revolving debt in decades. When I went with him to the dealer to help him buy a new car this past February (yes, he still has 20/20 vision and good reaction time for his age if you're wondering!) the salesperson at the dealer congratulated him on his 800+ FICO score.

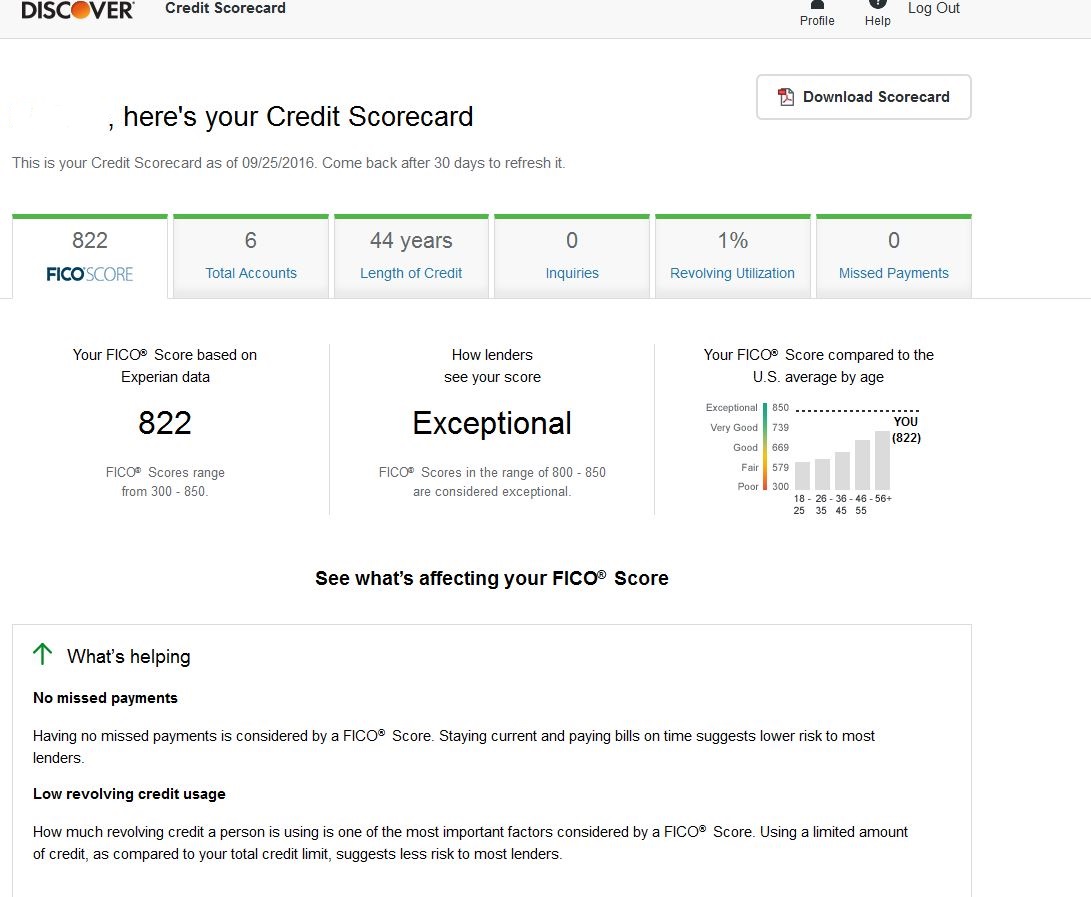

We pulled Dad's EX FICO on the Discover site today and it is 822. I just thought I'd share some data points on how he got there.

- Oldest account: 44 years. He's an AU on my mother's Amex card, opened in 1971, plus has an Amex revolver in his own name, opened 2001 and backdated to 1971.

- Two Visa cards with other banks (opened 1999 and 2002) - both have $10K+ limits and each get one <$100 recurring charge per month, PIF.

- 1% revolving utilization.

- Two car loans (one closed/paid, one current that was opened this year).

- No mortgage (house is long paid off).

Both of my parents have had excellent financial discipline for most of their lives. I didn't practice what they taught when I was younger, but seeing this kind of score gives me even more hope that I'm going to get there myself soon enough. The FICO "trick" of having 3-4 cards and charging 1% of the limit every month seems to work wonders for my dad's score. Of course the history on the Amex cards helps too.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to get an 822 FICO without really trying (My dad's story)

Solid profile, good score. I suspect balance on his car loans are holding his score down.

It would be interesting to know what his balance to loan ratio % is (in aggregate) for the car loans.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to get an 822 FICO without really trying (My dad's story)

My mother has 802, it was as high as 816 and as low as 746 in the last 16 months.

She has no loans of any type, 5 credit cards, the oldest is 29Y and although she PIF it usually shows a balance.

I did use her zero interest BT on a Chase card (it's her card but we are joint owners) to pay some high interest credit cards I had, the util on that card went to 70% and I don't recall how high her ovedrall util went, it probaby was about 30%. I used $10K, the card CL was up $15K, and her discover is $13.5K, and a couple of store cards. I have since paid that off. so that drove the score down to 746 but paying it off brought it back to 802.

Her newest card is 6 months old, it's a JCP card, she openned it becaue her old JCP card got closed down for no use, and when she tried to use that was when she found out it was closed. Her problem with store cards is she never uses them so they get close down. She wanted to use some discount at JCP they were running, we had to open back up a new card, it was a lot of trouble to open it up on a fly as she couldn't remember some of the ID questins they wanted to ask for ID Fraud prevention. We got it opened for 2k limit.

I just now checked her credit file, I see today they closed a khols account for inactivity, I spose we can call to get it back open since it was only today.

Her score usually floats from 800-816.

Long history, no baddies, 2% util, 2 recent inquiries, it isn't rocket science, but maybe a little tricky to get it to 850, however there isnt any real point to get it that high outside of ego or doing it as a hobby.

Since I used her BT, now she does get mailers for new credit cards, before that she never got offers.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to get an 822 FICO without really trying (My dad's story)

@Thomas_Thumb wrote:Solid profile, good score. I suspect balance on his car loans are holding his score down.

It would be interesting to know what his balance to loan ratio % is (in aggregate) for the car loans.

LOL

Yes, of course the balance on the car loans is "holding his score down". He's got borrowing, any borrowing, any open balances. FICO cannot score an 850 if there is any risk. Therefore, any open balances = reduced FICO from 850.

I would, however, take issue with characterizing this as "holiding his score down"... to 822 ![]()

OP, Thanks for sharing DD success. His profile fits the pattern of how to get to 850:

1) Borrow money

2) Never miss a payment

3) Pay it all off

4) Do not borrow any more money.

Since DD has not completed step 4 yet, due to the auto loans, that accounts for the "ding" to his credit keeping him "down" at 822. #crocodile_tears

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to get an 822 FICO without really trying (My dad's story)

@NRB525 wrote:

@Thomas_Thumb wrote:Solid profile, good score. I suspect balance on his car loans are holding his score down.

It would be interesting to know what his balance to loan ratio % is (in aggregate) for the car loans.

LOL

Yes, of course the balance on the car loans is "holding his score down". He's got borrowing, any borrowing, any open balances. FICO cannot score an 850 if there is any risk. Therefore, any open balances = reduced FICO from 850.

I would, however, take issue with characterizing this as "holiding his score down"... to 822

OP, Thanks for sharing DD success. His profile fits the pattern of how to get to 850:

1) Borrow money

2) Never miss a payment

3) Pay it all off

4) Do not borrow any more money.

Since DD has not completed step 4 yet, due to the auto loans, that accounts for the "ding" to his credit keeping him "down" at 822. #crocodile_tears

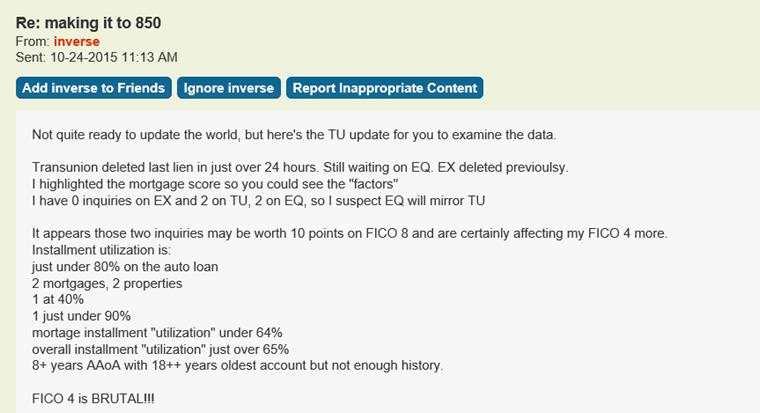

This is not true. It is not at all uncommon to have sizeable open balances on mortgages and car loans while achieving Fico 08 scores of 850. Inverse did with two open mortgages and 2 open car loans - aggregate balance all combined was around 65%. See paste below. At the time his scores were 850/845/840 based on CRA reports having 0, 1 and 2 inquiries, respectively.

I have a rather sizeable mortgage and my score has been at 850 as well. Actually, it appears one typically needs an open installment loan with a balance to have a Fico 08, 850.

What I am trying to find out from the OP is whether B/L ratio is over 70% - which might be a installment loan threshold.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to get an 822 FICO without really trying (My dad's story)

TT: What I am trying to find out from the OP is whether B/L ratio is over 70% - which might be a installment loan threshold.

Interesting, but I think that is a weakness in FICO when one takes it to imply your finaicial situation.

If I buy a car for total $30K and have $9K to put down, to achieve the highest FICO score, I am better off to finance the entire 30K and make an initial $9K payment rather than reduce the total financed to 21K. I look more solvent to the dealer to put 9K down but it's better FICO wise to hold off and reduce the loan to 70% of initial balance after financing the car.

Both are equivalent financially, but one makes me look better AKA FICO.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to get an 822 FICO without really trying (My dad's story)

Dad only has 1 open auto loan and it's 7 months old - balance is roughly $17,600 out of around $20K originally financed. The previous auto loan is paid and closed.

I didn't know B/L ratio mattered in terms of FICO for installment loans. I'm wondering if the lack of a mortgage has anything to do with his FICO not being 850, since all of the other factors are there for a "perfect" score.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to get an 822 FICO without really trying (My dad's story)

@Anonymous wrote:Dad only has 1 open auto loan and it's 7 months old - balance is roughly $17,600 out of around $20K originally financed. The previous auto loan is paid and closed.

I didn't know B/L ratio mattered in terms of FICO for installment loans. I'm wondering if the lack of a mortgage has anything to do with his FICO not being 850, since all of the other factors are there for a "perfect" score.

He's got a great score thats all that matters. While I aim to get over 800 and will in the next year it's not much more than a novelty as anything past 760 will beget the best rates. Probably 740 really. I see folks with great rates and limits in the low 700s all the time here.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to get an 822 FICO without really trying (My dad's story)

@Anonymous wrote:Dad only has 1 open auto loan and it's 7 months old - balance is roughly $17,600 out of around $20K originally financed. The previous auto loan is paid and closed.

I didn't know B/L ratio mattered in terms of FICO for installment loans. I'm wondering if the lack of a mortgage has anything to do with his FICO not being 850, since all of the other factors are there for a "perfect" score.

Thanks for the follow-up. It looks like B/L is 88% based on your information. That is impacting score. Many on the forum appreciate good quantitative so keep it coming.

Generally, the more you know how models work the better you can manage your credit score.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to get an 822 FICO without really trying (My dad's story)

@Credit_hawk wrote:

@Anonymous wrote:Dad only has 1 open auto loan and it's 7 months old - balance is roughly $17,600 out of around $20K originally financed. The previous auto loan is paid and closed.

I didn't know B/L ratio mattered in terms of FICO for installment loans. I'm wondering if the lack of a mortgage has anything to do with his FICO not being 850, since all of the other factors are there for a "perfect" score.

He's got a great score thats all that matters. While I aim to get over 800 and will in the next year it's not much more than a novelty as anything past 760 will beget the best rates. Probably 740 really. I see folks with great rates and limits in the low 700s all the time here.

Credit Hawk, I completely agree with you that 800+ credit scores are almost purely for bragging rights. The one exception being is having the ability to max out a credit card temporarily and still have an excellent score. My dear father is in the 825+ range and was able to max out a card temporarily and his score "tanked" to 785. He still qualifies for all the best rates despite being maxed out. Nice!

Current Scores 3/2016 Equifax 676 Transunion 697 Experian 648 Goal Scores: 720's accross the board. Gardening Goal: 3/2017