- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Inactive account becomes active

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Inactive account becomes active

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Inactive account becomes active

@Shadowfactor wrote:

Question

Does a card have to report a balance every so often in order to be considered active ?

I have 4 cards I use throughout the month but pay off to zero before statement closing so they don’t report a balance. It’s always the same cards that I let report a zero balance.

I was under the impression that the payment activity would keep the cards active ?

Looking at HO's first/initial post in this thread, I would say that yes, it does need to report a balance to be considered active. He was saying that while his Amex card didn't report a balance for 2-3 months, he was using the card pretty heavily. The FICO algorithm doesn't see usage though, simply a snapshot of the reported balance on the account. If it only sees $0 for month after month, from the viewpoint of the algorithm I can understand why it wouldn't see that account as being active.

Usage of cards will keep cards active from the standpoint of the creditor, though... meaning that you don't have to worry about your creditor closing down your card if they report a $0 balance every month for months or even years so long as you are using the card regularly, as they can see your use of the card internally of course. FICO doesn't have the ability to see that internal stuff, though.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Inactive account becomes active

@Anonymous wrote:The FICO algorithm doesn't see usage though, simply a snapshot of the reported balance on the account. If it only sees $0 for month after month, from the viewpoint of the algorithm I can understand why it wouldn't see that account as being active.

Except that Equifax did seem to see usage on the cards that reported a "date of last payment," despite the fact that they reported zero for months at a time.

I wonder if this alert has anything to do with FICO at all. Maybe it's offered simply as protection, kind of like the identity and address alerts. If one didn't actually use the card and saw the alert, he'd know to follow up with some type of action.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Inactive account becomes active

I suppose that could be the case. I've got a card that I haven't used in 3+ months that I'll make a swipe on today, as I'm curious if I'll get an alert.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Inactive account becomes active

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Inactive account becomes active

@Thomas_Thumb wrote:More than a few posters have made mention of losing points when an inactive account 1st reports activity.

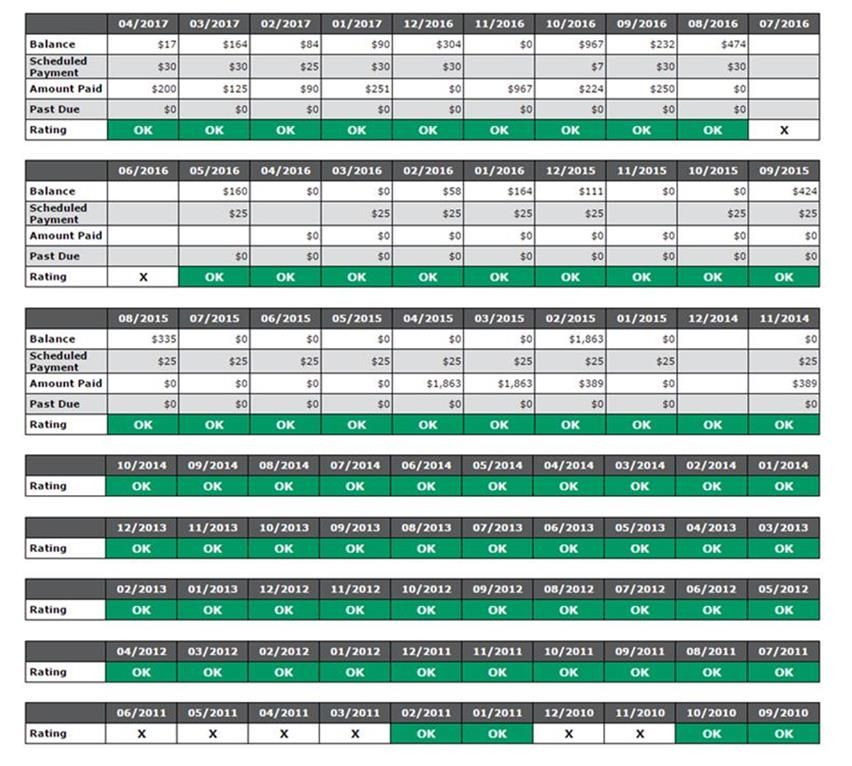

I believe various credit card issuers report accounts differently. On my CRA report summaries some of my accounts report a zero balance each month when not used but others show a blank. This may be why accounts get classified as inactive differently by various monitoring services. The below is from my Experian credit report. My TransUnion report shows the same except an "X" is used instead of "ND". Card activity is based on data as reported by the creditors.

Fidelity Visa Account - Most non use months are blank (no data) which represents inactivity but some show $0.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Inactive account becomes active

I assume this alert would only come following the reporting of the card that "became active" again, correct? Until it reports, I see no way that a CMS would know. Like HO stated above, if it doesn't report a balance the date of last payment would still change (if paid off immediately) so I would guess that the alert presents itself when the card reports?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Inactive account becomes active

@HeavenOhio wrote:I've heard about this alert, but I've never seen it myself.

I got the alert today from Equifax, pertaining to my AMEX card: "An account that has been inactive for more than 3 months has become recently active… Date of last activity: 12/01/2017 --> 03/01/2018."

It was accompanied by a four-point score drop. But we know about alerts; I'm 99% certain that the alert wasn't tied to the score change. Rather, I'd pin it to a second card reporting a positive balance. My Equifax score always shifts predictably whenever I go from one to two cards or vice versa.

I'd call "more than three months" to be a stretch as I only had two statements that didn't report positive balances. The last positive balance on this card was in December. But arguing the system isn't the point. The card gets used every month, though, generally pretty heavily.

I've let my Barclays card go for up to about six months without reporting a positive balance, and I've never seen the alert. Like the AMEX card, it gets used each month. The difference I see is that Barclays reports my "Date of Last Payment." Actually, all my cards except AMEX do that.

If things go as planned, I'm going to let my next card to report cut a zero balance. At the end of the month, I'll let a card report a positive balance that hasn't done so in over a year. Like the Barclays card, it's been used every month and has a current "Date of Last Payment." I'll bet that I don't see the alert.

I don't think reporting a zero balance and being reported as inactive are synonymous. I've had plenty of accounts which never report a positive balance but which are not reported as inactive.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Inactive account becomes active

@SouthJamaicaI don't think reporting a positive balance and being reported as inactive are synonymous. I've had plenty of accounts which never report a positive balance but which are not reported as inactive.

But, are you using those accounts and thus making payments? If so, the date of last payment is getting updated and therefore it can be seen that the account is indeed active.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Inactive account becomes active

My Amex PRG reported a balance today for the first time since December 15th.

No Alert. I have been using this card but have always let it cut with a 0 balance except the 2nd statement and now the 6th

Will report back when Delta Gold closes on the 23rd. Its never reported a balance so that will be interesting to see if I get an alert. The card gets used for Pandora once a month and paid off immediately.

Total Revolving Limits $254,800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Inactive account becomes active

That's a further data point above that simply making a payment constitutes activity. Reported balance [always being $0] seems to be a non-factor here.