- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Is Authorized User Dinged For Adding New Accou...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Is Authorized User Dinged For Adding New Accounts?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is Authorized User Dinged For Adding New Accounts?

If the purpose of the AU is to build or rebuild credit, choose a card that's at least two years old and one where it's relatively convenient to report a balance of zero if the need arises. Avoid AMEX altogether as it'll report as a brand new account.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is Authorized User Dinged For Adding New Accounts?

@jdbkiang wrote:Wait, you got a double HP for being added as an AU? I didn't think that was possible.

+1, I would be interested to hear if others have experienced this.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is Authorized User Dinged For Adding New Accounts?

@grower1 wrote:My husband added me to his Chase Freedom Unlimited and it did impact my score negitively. He did it as a "surprise", but if I had of known I would have told him not to add me. He didn't do it to help build my credit, it was more so to give me an extra card to use in case I wanted to shop etc..

I can't recall exactly how much it dropped my score but if you really need to know I can try to go back and check my records. I was actually sad about it because I was so focused on my score growth. My scores were in the 770 range at the time, they are now in the 759 - 763 range.

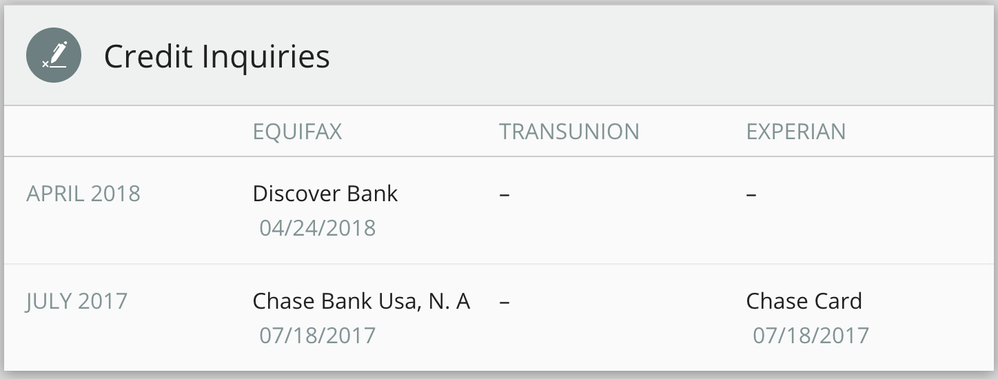

Chase also did a hard pull on Experian and Equifax. So I was dinged for the new account, and 2 credit pulls.

Was this a result of being added as an Authorized user or a joint account holder?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is Authorized User Dinged For Adding New Accounts?

@HeavenOhio wrote:If the purpose of the AU is to build or rebuild credit, choose a card that's at least two years old and one where it's relatively convenient to report a balance of zero if the need arises. Avoid AMEX altogether as it'll report as a brand new account.

Thanks for the Amex heads up. My Amex is new so I am not planning to add her now and maybe never. With her scores in the 620 range right now I don't want her to lose any points until she has had her own cards for a while. The two I want to add her to have zero balances/large limits and are two of my oldest accounts (but my cards were issued within the last three years so they are not very old). I cleaned up my mess first and then moved on to her this past month.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is Authorized User Dinged For Adding New Accounts?

@Anonymous wrote:

@HeavenOhio wrote:If the purpose of the AU is to build or rebuild credit, choose a card that's at least two years old and one where it's relatively convenient to report a balance of zero if the need arises. Avoid AMEX altogether as it'll report as a brand new account.

Thanks for the Amex heads up. My Amex is new so I am not planning to add her now and maybe never. With her scores in the 620 range right now I don't want her to lose any points until she has had her own cards for a while. The two I want to add her to have zero balances/large limits and are two of my oldest accounts (but my cards were issued within the last three years so they are not very old). I cleaned up my mess first and then moved on to her this past month.

Actually, if they're 3 years old with zero balance and a large limit, adding her as an AU will bring her AoOA to 3 years, lower her utilization, and up her limit overall. It still would benefit her score.

![Chase Southwest Premier 3K 10/17 [canceled]](https://i.imgur.com/66R5N3K.png)

![American Express Hilton Honors Ascend 3K 04/18 [canceled]](https://i.imgur.com/iJxp0t4.png)

![Petal Card 3.25K 07/18 [closed for inactivity 04/20]](https://i.imgur.com/rGjGptU.jpg?1)

![American Express Hilton Honors Card 3.6 K 11/18 [canceled]](https://i.imgur.com/jmINR11.jpg)

[2/2019]

[2/2019]

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is Authorized User Dinged For Adding New Accounts?

@jdbkiang wrote:

@Anonymous wrote:

@HeavenOhio wrote:If the purpose of the AU is to build or rebuild credit, choose a card that's at least two years old and one where it's relatively convenient to report a balance of zero if the need arises. Avoid AMEX altogether as it'll report as a brand new account.

Thanks for the Amex heads up. My Amex is new so I am not planning to add her now and maybe never. With her scores in the 620 range right now I don't want her to lose any points until she has had her own cards for a while. The two I want to add her to have zero balances/large limits and are two of my oldest accounts (but my cards were issued within the last three years so they are not very old). I cleaned up my mess first and then moved on to her this past month.

Actually, if they're 3 years old with zero balance and a large limit, adding her as an AU will bring her AoOA to 3 years, lower her utilization, and up her limit overall. It still would benefit her score.

Thats what we need so hopefully it works out. Thanks for info.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is Authorized User Dinged For Adding New Accounts?

![Chase Southwest Premier 3K 10/17 [canceled]](https://i.imgur.com/66R5N3K.png)

![American Express Hilton Honors Ascend 3K 04/18 [canceled]](https://i.imgur.com/iJxp0t4.png)

![Petal Card 3.25K 07/18 [closed for inactivity 04/20]](https://i.imgur.com/rGjGptU.jpg?1)

![American Express Hilton Honors Card 3.6 K 11/18 [canceled]](https://i.imgur.com/jmINR11.jpg)

[2/2019]

[2/2019]

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is Authorized User Dinged For Adding New Accounts?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is Authorized User Dinged For Adding New Accounts?

Here is my recent story with Chase.

DW apped for the Chase FU with 0% APR for 15 months. Since all my daily drivers are have an APR of 11.74 or higher, she added me as an AU. As it turns out, Chase winded up HP'ing my EQ dinging me about 2 points. I have 2 Chase cards, with my first one going back to 2011.

Now I am thinking what I could possibly do to leverage this new HP. Should I call and ask them to give me a CLI on my older cards? The HP is dated 09/12. Maybe its too late?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is Authorized User Dinged For Adding New Accounts?

When I hear people talk about leveraging a single HP for several things, the multiple things are almost always on the same day. I can conceive that 48 hours might work. Over a month? I am pretty darn doubtful, but I know far less than many folks here about applying for lots of stuff. Perhaps they can chime in.