- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Is this rebucketing? Strange Discover TU

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Is this rebucketing? Strange Discover TU - Updated

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is this rebucketing? Strange Discover TU

@Thomas_Thumb wrote:It's a bit of guesswork, yes.

I do believe 2 years is a significant milestone for AAoA and for age of oldest account. Why the 2 step drop, rather not speculate on it at this time.

The nice thing is you make a good test case given how close you are to that for your oldest account. First let's see if your EX score converge when AMEX updates and then see what happens when your oldest account reaches 2 years. Have patience and let things settle a bit.

Please do report back with updates as they become available.

Dirty file but since I managed to cross it 3 times, AAOA 1->2 years was worth 4 points for me. Expand for pretty files as usual ![]() . Wasn't a big deal in my case.

. Wasn't a big deal in my case.

I am hoping 2->3 years in another month and change will be more helpful as I have a non-trivial financing decision coming up in roughly September and the higher my score at that time, the more options I have.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is this rebucketing? Strange Discover TU

@Thomas_Thumb wrote:axlm - I checked out your 3rd post. At the bottom you state:

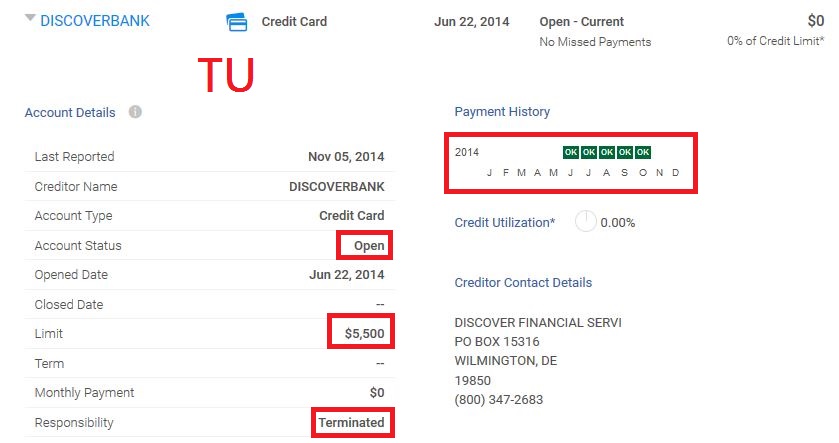

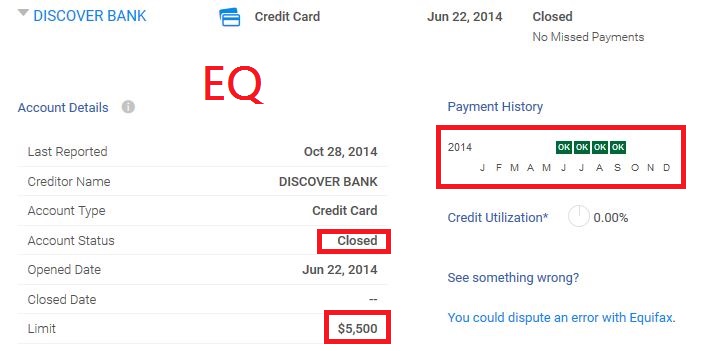

"Edit: difference in AAoOA between both bureaus in CK is because the TU reports shows my closed AU account as open but Responsibility terminated, in EQ is just closed. So my guess is they are using that account for age calculations in TU."

Perhaps that plays into your scoring difference - especially given your short credit history..

Hmmm, that's actually a completely different account (also AU from wife) that was opened 6/2014 but then I asked to be cut from it in 10/2014 (was a new account at 98% util that was doing me no good, as I learned when I found myFICO around that date). The card is actually still open in my wife's name, and for some reason it reports as open in EX and TU with responsibility terminated while in EQ it shows as closed instead. Is the one thing -aside from inquiries- different in my CK reports and the reason Average Age of Open Accounts is off between Vantage scores. It never seemed to make much difference in my scoring, and if you look at the original graph, TU and EX always followed the same approximate trend until today**.

Will report back as soon as I get new data from Amex and Credit.com.

** I always thought biggest difference between my TU and EX were because I get TU scores the 4th each month, with my Discover card closing on the 10th. Amex EX is dated around 9-12 each month, perhaps accounting for the Discover card which of course just reported data from that statement on 10th. Hope that makes sense.

Last update: NOV 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is this rebucketing? Strange Discover TU

@axlm wrote:

@Thomas_Thumb wrote:axlm - I checked out your 3rd post. At the bottom you state:

"Edit: difference in AAoOA between both bureaus in CK is because the TU reports shows my closed AU account as open but Responsibility terminated, in EQ is just closed. So my guess is they are using that account for age calculations in TU."

Perhaps that plays into your scoring difference - especially given your short credit history..

** I always thought biggest difference between my TU and EX were because I get TU scores the 4th each month, with my Discover card closing on the 10th. Amex EX is dated around 9-12 each month, perhaps accounting for the Discover card which of course just reported data from that statement on 10th. Hope that makes sense.

Other than general direction can't correlate the two, they are different algorithms albeit not hugely but enough to make a difference. EX has always been my highest bureau even with a worse report than EQ (two tax liens vs 1 for a 2 year period) and an equivalent file to TU until recently, only exceptions were TU 04 during my mortgage run, and EQ FICO 9 which is stupidly high somehow.

FICO's stated goal was to have the scores within +/- 30 points of each other for all three bureaus for FICO 8 anyway, but nobody has ever really been able to tease the differences between the bureaus out.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is this rebucketing? Strange Discover TU

@axlm wrote:

@Thomas_Thumb wrote:axlm - I checked out your 3rd post. At the bottom you state:

"Edit: difference in AAoOA between both bureaus in CK is because the TU reports shows my closed AU account as open but Responsibility terminated, in EQ is just closed. So my guess is they are using that account for age calculations in TU."

Perhaps that plays into your scoring difference - especially given your short credit history..

Hmmm, that's actually a completely different account (also AU from wife) that was opened 6/2014 but then I asked to be cut from it in 10/2014 (was a new account at 98% util that was doing me no good, as I learned when I found myFICO around that date). The card is actually still open in my wife's name, and for some reason it reports as open in EX and TU with responsibility terminated while in EQ it shows as closed instead. Is the one thing -aside from inquiries- different in my CK reports and the reason Average Age of Open Accounts is off between Vantage scores. It never seemed to make much difference in my scoring, and if you look at the original graph, TU and EX always followed the same approximate trend until today**.

Will report back as soon as I get new data from Amex and Credit.com.

** I always thought biggest difference between my TU and EX were because I get TU scores the 4th each month, with my Discover card closing on the 10th. Amex EX is dated around 9-12 each month, perhaps accounting for the Discover card which of course just reported data from that statement on 10th. Hope that makes sense.

@axlm wrote:

@Thomas_Thumb wrote:axlm - I checked out your 3rd post. At the bottom you state:

"Edit: difference in AAoOA between both bureaus in CK is because the TU reports shows my closed AU account as open but Responsibility terminated, in EQ is just closed. So my guess is they are using that account for age calculations in TU."

Perhaps that plays into your scoring difference - especially given your short credit history..

Hmmm, that's actually a completely different account (also AU from wife) that was opened 6/2014 but then I asked to be cut from it in 10/2014 (was a new account at 98% util that was doing me no good, as I learned when I found myFICO around that date). The card is actually still open in my wife's name, and for some reason it reports as open in EX and TU with responsibility terminated while in EQ it shows as closed instead. Is the one thing -aside from inquiries- different in my CK reports and the reason Average Age of Open Accounts is off between Vantage scores. It never seemed to make much difference in my scoring, and if you look at the original graph, TU and EX always followed the same approximate trend until today**.

Will report back as soon as I get new data from Amex and Credit.com.

** I always thought biggest difference between my TU and EX were because I get TU scores the 4th each month, with my Discover card closing on the 10th. Amex EX is dated around 9-12 each month, perhaps accounting for the Discover card which of course just reported data from that statement on 10th. Hope that makes sense.

If this card is still at a high UT% and open in your file perhaps TU is somehow considering the individual card UT in your scoring. Anything above 90% can ding score due to max out as well as high UT%. Since designated as closed on EQ, can't factor into utilization calculations.

Again, all speculation but something to investigate.

I tend to think your score offset must relate to an account status difference between CRAs. I saw that with my AMEX charge card that EQ has been classifying as a revolver - Fico 04 score dinged every time I allowed "significant charges" to report. EQ looked at UT% as a ratio to HB since card was NPSL. Other CRAs ignored it - these CRAs also list it as a credit card but show terms as 1 month, wqhich translates to a charge card that has an option for payment over time.

I always PIF and was unaware that option was added in 2011. I had AMEX delete it to avoid any confusion with CRAs viewing the account as a credit card. I site this example because all the #s were correct in my credit report review among the 3 CRAs but only EQ reacted "wildly" to charges on my AMEX card. [Note: the difference associated with my EQ Fico 04 score did not show up in my EQ VS 3.0 score]

Perhaps this is in play with your AU account.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is this rebucketing? Strange Discover TU

@Thomas_Thumb wrote:

@axlm wrote:

@Thomas_Thumb wrote:axlm - I checked out your 3rd post. At the bottom you state:

"Edit: difference in AAoOA between both bureaus in CK is because the TU reports shows my closed AU account as open but Responsibility terminated, in EQ is just closed. So my guess is they are using that account for age calculations in TU."

Perhaps that plays into your scoring difference - especially given your short credit history..

Hmmm, that's actually a completely different account (also AU from wife) that was opened 6/2014 but then I asked to be cut from it in 10/2014 (was a new account at 98% util that was doing me no good, as I learned when I found myFICO around that date). The card is actually still open in my wife's name, and for some reason it reports as open in EX and TU with responsibility terminated while in EQ it shows as closed instead. Is the one thing -aside from inquiries- different in my CK reports and the reason Average Age of Open Accounts is off between Vantage scores. It never seemed to make much difference in my scoring, and if you look at the original graph, TU and EX always followed the same approximate trend until today**.

Will report back as soon as I get new data from Amex and Credit.com.

** I always thought biggest difference between my TU and EX were because I get TU scores the 4th each month, with my Discover card closing on the 10th. Amex EX is dated around 9-12 each month, perhaps accounting for the Discover card which of course just reported data from that statement on 10th. Hope that makes sense.

If this card is still at a high UT% and open in your file perhaps TU is somehow considering the individual card UT in your scoring. Anything above 90% can ding score due to max out as well as high UT%. Since designated as closed on EQ, can't factor into utilization calculations.

Again, all speculation but something to investigate.

I tend to think your score offset must relate to an account status difference between CRAs. I saw that with my AMEX charge card that EQ has been classifying as a revolver - Fico 04 score dinged every time I allowed "significant charges" to report. EQ looked at UT% as a ratio to HB since card was NPSL. Other CRAs ignored it - these CRAs also list it as a credit card but show terms as 1 month, wqhich translates to a charge card that has an option for payment over time.

I always PIF and was unaware that option was added in 2011. I had AMEX delete it to avoid any confusion with CRAs viewing the account as a credit card. I site this example because all the #s were correct in my credit report review among the 3 CRAs but only EQ reacted "wildly" to charges on my AMEX card. [Note: the difference associated with my EQ Fico 04 score did not show up in my EQ VS 3.0 score]

Perhaps this is in play with your AU account.

@I don't think this card is affecting anything other than AAoOA in CK. It hasn't reported to my files since late 2014 when I was removed as AU, and is still showing the original limit (current limit is 10k @ 0-1% utilization monthly). FWIW see below how it reports in CK:

ETA: Again, we are talking here about a totally different AU account, not my oldest one (that one's from Chase). In case you are starting to find this thread as confusing as I do ![]()

Last update: NOV 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is this rebucketing? Strange Discover TU

Update time: Received my EX from Amex and it's also down 7 points, from 770 -> 763.

Nowhere as dramatic as TU, but still down. After checking all data again, only thing I noticed is Feb and March both reported 5 cards with balances**, out of 8 total revolving lines (plus the installment loan). This is the most cards ever reporting for me, and the only thing I see has changed in my profile. My previous worst was from Dec/2015, where 4 cards reported (including one at 51% individual util). And TU was not as bad as now.

So for now I'm going to assume that was the cause, and control the amount of reporting cards for a couple of months to see how it reacts. Game on! ![]()

** You can see utilization tables following the link in the very first post in this thread.

Last update: NOV 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is this rebucketing? Strange Discover TU

@axlm wrote:Update time: Received my EX from Amex and it's also down 7 points, from 770 -> 763.

Nowhere as dramatic as TU, but still down. After checking all data again, only thing I noticed is Feb and March both reported 5 cards with balances**, out of 8 total revolving lines (plus the installment loan). This is the most cards ever reporting for me, and the only thing I see has changed in my profile. My previous worst was from Dec/2015, where 4 cards reported (including one at 51% individual util). And TU was not as bad as now.

So for now I'm going to assume that was the cause, and control the amount of reporting cards for a couple of months to see how it reacts. Game on!

** You can see utilization tables following the link in the very first post in this thread.

On my data I'm nearly 100% confident there's a breakpoint at 50% of revolving tradelines reporting a balance. Whether that occurs at 50% or above 50% not sure, but I've seen it both at 4/9->5/9 and 6/14->8/14 for drops (I missed a good datapoint for 7/14 unfortunately, have to catch that later)'

Really looks simple: 25% / 50% for breakpoints, not sure on higher than that.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is this rebucketing? Strange Discover TU

@axlm wrote:Update time: Received my EX from Amex and it's also down 7 points, from 770 -> 763.

Nowhere as dramatic as TU, but still down. After checking all data again, only thing I noticed is Feb and March both reported 5 cards with balances**, out of 8 total revolving lines (plus the installment loan). This is the most cards ever reporting for me, and the only thing I see has changed in my profile. My previous worst was from Dec/2015, where 4 cards reported (including one at 51% individual util). And TU was not as bad as now.

So for now I'm going to assume that was the cause, and control the amount of reporting cards for a couple of months to see how it reacts. Game on!

** You can see utilization tables following the link in the very first post in this thread.

Oh well why didn't you say so!? ![]()

I haven't been confident on where "number of lines reporting" comes in to have effect and on whom, but lots of folks think there are a few steps, including "more than half"... and I am certain is has the potential to have the effect you described.

Do you know your SuperFICO?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is this rebucketing? Strange Discover TU

Ha, sorry about that. Sometimes is confusing to analyze all data I keep track of, especially when tired. Guess we will soon have more data points on number of tradelines reporting ![]()

Last update: NOV 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is this rebucketing? Strange Discover TU

Update: Discover just reported and TU is back up, now at 769. I think this is a good datapoint for my profile, since Alliant strangely hasn't reported yet last month balance, so loan utilization is still at 48%, but number of cards reporting a balance went down from 5 to 4 (aggregate util from still at 2%). Crazy how many points that represents!

On the other hand, I applied and got Citi DC late last month, so the experiments about installment loan breakpoints should be over now: too much noise in the profile, me thinks (and certain lack of willpower, I will admit ![]() )

)

Edit: but on the flip side, I now have a free EQ score to track, even if Bankcard ![]()

Last update: NOV 2022