- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Least no. of accts w/bal and rec neg reason co...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Least no. of accts w/bal and rec neg reason code?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Least no. of accts w/bal and rec neg reason code?

My 4 are:

1 - Time since most recent account opening is too short

2 - Length of time revolving accounts have been established

3 - Too many inquiries in the last 12 months

4 - Too many accounts with balances

I know that the first 3 can have an adverse impact on my score (specific to my profile) but I don't believe the "too many account with balances" is impacting my score at all. Even though I'm at 4 of 10 accounts now, I've been at 3 of 10 before and as I stated in the original post will be at 2 of 9 in about a week once a few things update on my report. I suppose then that a negative reason statement can exist without having any adverse impact to score.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Least no. of accts w/bal and rec neg reason code?

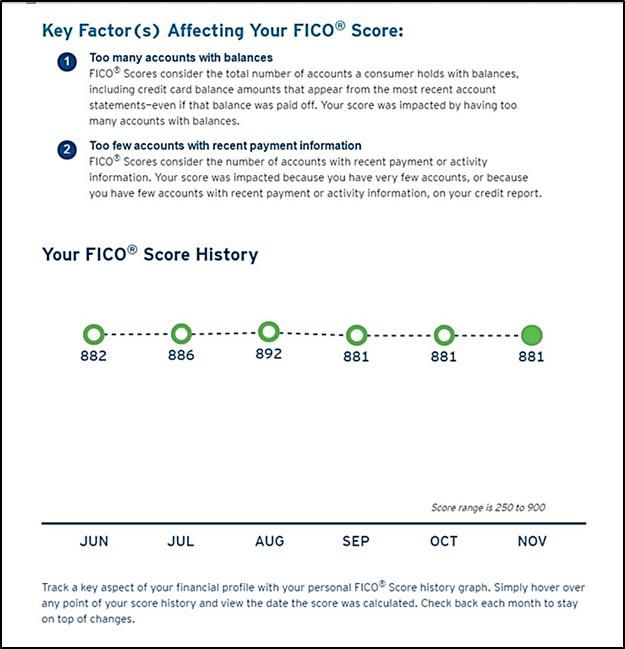

My EQ Fico 8 bankcard score went from 886 to 892 dropping from 4 of 7 (loan, AU card and two personal cards) reporting balances to 3 of 7 (loan, AU card and one personal card) reporting balances. The too many accounts with balances was listed as the #1 reason statement when 4 accounts were reporting. [Citi only lists 2 reason statements on their Fico summary] Did not check reason statements when # accounts reporting dropped to 3.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Least no. of accts w/bal and rec neg reason code?

TT, do you think, though, that the percentage of accounts with balances could have played a role in your case, as going from 4 of 7 to 3 of 7 crossed the 50% mark on number of accounts with balances?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Least no. of accts w/bal and rec neg reason code?

That's certainly possible. Also, since Fico 8 does not count my AU card, my accounts may really have been scored based on (3 of 6) and (2 of 6) vs (4 of 7) and (3 of 7).

As mentioned in other posts I lost quite a few points on industry enhanced Fico 8 models due to "no recent revolving account activity" even though the AU revolver and an AMEX charge card reported balances. I did not lose points on the older Fico 04 and Fico 98 models. As we know, the older Fico models always count AU cards.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Least no. of accts w/bal and rec neg reason code?

Understood.

Wells Fargo is giving me a hard time regarding an off-cycle reporting of my recently closed auto loan, so I'm probably about 2 weeks away here from being able to provide a meaningful data point. I will report back, though.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Least no. of accts w/bal and rec neg reason code?

@Anonymouswrote:I gotcha. So, perhaps HO is an outlier example. HO, if you have time can you provide some of your profile data to go along with the data point of receiving the "too many accounts with balances" reason statement with just 1 account with a balance? As TT suggests, it could be something scorecard or profile specific here that you have going on.

6 open credit card accounts

2 closed credit card accounts

1 open gas/electric account reporting to two bureaus (TU and EX)

1 closed gas/electric account reporting to one bureau (TU)

No loans, either open or closed

Of the credit cards, three are 14 to 16 years old. The rest, including the two closed cards, are between 1 and 1.5 years old. The gas/electric accounts are both a little under 4 years old.

The gas/electric accounts always report positive balances. However, I see the reason on at least one score on all three bureaus, including the bureau that doesn't include either utility account.

This isn't the strangest thing that I see with my scores. The one that makes me scratch my head is that my EQ mortgage score goes up a point when I let a second card report a positive balance. I've watched that score zig-zag like that for about six months. The EQ FICO8 goes down about four points, which makes sense.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Least no. of accts w/bal and rec neg reason code?

@Anonymouswrote:My 4 are:

1 - Time since most recent account opening is too short

2 - Length of time revolving accounts have been established

3 - Too many inquiries in the last 12 months

4 - Too many accounts with balances

I know that the first 3 can have an adverse impact on my score (specific to my profile) but I don't believe the "too many account with balances" is impacting my score at all. Even though I'm at 4 of 10 accounts now, I've been at 3 of 10 before and as I stated in the original post will be at 2 of 9 in about a week once a few things update on my report. I suppose then that a negative reason statement can exist without having any adverse impact to score.

Good. The first three are a variation on the theme that you have new accounts. I suspect you will have a hard time shaking the “Too Many Accounts” reason because your balances are already low.

An interesting change would be to let a small limit card report 30% and see where a utilization Reason code lands in here.

Another is if you stop apping for a full 12 months, see if some of the other three drop, and what replaces them.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Least no. of accts w/bal and rec neg reason code?

@NRB525Good. The first three are a variation on the theme that you have new accounts. I suspect you will have a hard time shaking the “Too Many Accounts” reason because your balances are already low.

An interesting change would be to let a small limit card report 30% and see where a utilization Reason code lands in here.

Another is if you stop apping for a full 12 months, see if some of the other three drop, and what replaces them.

In 6 weeks my AoYA will cross the 1 year mark and my inquiries will become unscoreable, so I hope to see all of the first 3 reason statements go away. I also hope for my first shot at a 850 score ![]()

As far as utilization, my 2 revolvers with reported balances are at 26% and 7% (aggregate 4%). That data can be paired with my reason statements referenced above. My 7% util revolver will be reporting $0 by this time next week, leaving me with the one card at 26% reported (aggregate 2%). Then, the following week, my 26% utilization card will be reporting a balance likely in the 56%-61% utilization range as far as I can tell; it will definitely fall somewhere in that 48.9%-68.9% range. Aggregate utilization will be 5% when that happens. I've never rocked AZEO with the AZEO card being at 50%+ utilization, so this will be interesting for me. I am curious if I do get any different reason statements here and definitely if the too many accounts with balances goes away with just 1 revolver and 1 installment loan (2 of 8 accounts) with balances reported.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Least no. of accts w/bal and rec neg reason code?

Ok, that changes the discussion yet again. You will probably continue to see “Too Many Accounts With Balances”, because nothing else aside from maybe a high balance note, is likely after those new accounts age a year. You won’t have enough other Reasons to push this one off.

Your original question should be: For anyone over 800, approaching 850, did you ever get away from the “Too Many Accounts With Balances” message while any messages were displayed? At 850 I believe all Reason Codes drop.

Others below 800 are going to be more likely to get other Reason Codes that will crowd out “Too Many Accounts”. They are not in your score class, not comparable.

Congrats on getting so so close to 850

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Least no. of accts w/bal and rec neg reason code?

Thanks. I'm not there yet, though... we'll see what happens in May.

TT, curious with you and your 850 scores - Did you ever have a negative reason statement with an 850 score? I figure they could still in theory exist, because due to the > 850 buffer, someone in theory could still possess an 850 score with 1 inquiry from the last year present (for example) so I would think a "too many inquiries" reason code could still be generated. I'm just wondering if at 850 it is ommitted or not?