- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Lower UTIL for a boost. Need Advice

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Lower UTIL for a boost. Need Advice

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Lower UTIL for a boost. Need Advice

@Thomas_Thumb wrote:I mentioned Auto and Mortgage specifically but do lump them together from a payment history perspective. What is common between Mortgages and most Auto loans are payments extending out over many years.

Open loan payment history is mentioned in a reason statement as a scoring considereation. Two years is not mentioned anywhere by Fico - that's a hypothesis on my part. I have seen data points that support the aging theory. Unfortunately, the data is not rigorous. For example, a poster reports Fico 8 scores dropping 30 points after paying off a car loan with over 2 years payment history. The loan had over 30% B/L prior to paydown and was the only open loan on file. The result indicates points had already been realized, IMO, without having to drop below the 9% SSL benchmark.

For mortgages fairly high B/L ratios do not appear to harm score. There are various data points out there with slightly different results. Conservatively I'd say dropping below 70% B/L is all that's needed for favorable treatment by Fico - assuming at least a couple years of payment history. Is two years an important threshold for mortgage payment history? Not sure. Is five years important, again not sure?

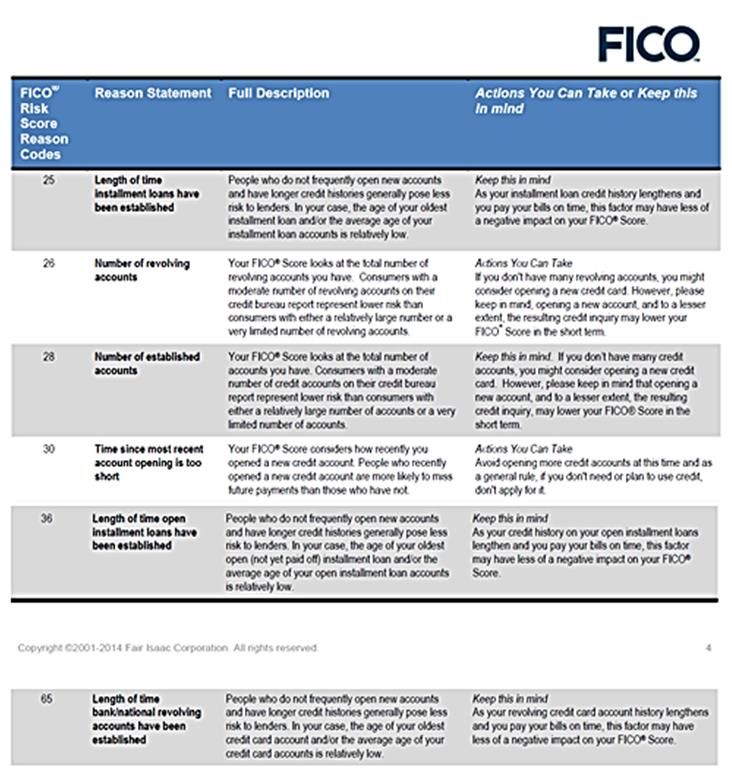

The below speaks to length of time for installment loans and length of time for open installment loans. There particular attributes only refer to installment loans in general - other Fico reason statements speak to Auto and "non mortgage".

@Anonymous info @Tom_Thumb

Where do you get this stuff?

There aren't enough kudoes in the book for the valuable material you provide.

Total revolving limits 569520 (505320 reporting) FICO 8: EQ 699 TU 696 EX 673

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Lower UTIL for a boost. Need Advice

Thanks for the kind words.

Most charts and article excerpts come from internet searches. I save the article to an electronic library. Specific areas of interest are copied as screen prints into Word, cropped, converted to Jpeg images, and the jpeg is subsequently pasted into posts.

Early on I did not copy article links when saving files. I do that now but, some saved links have become dead over time. Fortunately info was captured/saved before the reference articles disappeared from public view ![]()

For those that have their own company; limited access information from various sources is available for a fee as a service to "subscriber" companies. I could not justify the expense when I owned a registered LLC. Furthermore, a condition of being a subscriber would likely include restrictions on sharing data which I view as problematic. An example of a restricted access service is pasted below:

If you click on the files they won't open unless you are a subscriber. However some risk based pricing data, particularly EX related files, have found their way to general domain. Kind of like how paywalls for access to articles - where the same articles can be accessed through alternate, independent, links.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Lower UTIL for a boost. Need Advice

Thanks again ladies and gents! I'm constantly learning here.

I think we'll be ok. On the Barclay's that closed on 7/16/18 the statement balance shows $172.53. I paid it on the 16th not knowing the statement would close that day. Payment was applied today 7/18/18. That's a 1% utilization rate on that card. This should be enough right?

I thought a LOC counted like a cc revolving account.

Today my TU FICO 8 went up 3pts, and EX up 2pts. I'm waiting for the other card balances to hit this week. We'll do a rapid rescore at the end of the month right before we turn in all docs to the underwriter. It seems like mortgage fico scores are a toss up in regards to what can raise them. I'm hopeful that the old short sale removal will be exactly what I need to qualify for a better rate.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Lower UTIL for a boost. Need Advice

My Fico scores dropped about 3-8 points each CB! I did the AZEO method. I paid everything off except for one (Barclay statement $173). The credit union loc hasn’t hit yet, but all cc statements have. I thought AZEO would work.

On on the other hand, My wife’s scores jumped 12-26 pts each CB. I’m so confused.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Lower UTIL for a boost. Need Advice

@Anonymous, you might have been hit with the "all accounts at zero" penalty, which is fairly large.

LOCs are generally considered revolving credit and count toward utilization. But as mentioned, using them as the one account that reports a positive balance isn't reliable. That's why a couple of us suggested reporting a small balance on a major credit card in addition to the balance on your LOC. That result is preditable. There may be no ding at all, or the ding will be small.

It looks like you'll have a credit card reporting a small balance relatively soon. Keep us updated on how that transpires.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content