- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: My AZEO experiment

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

My AZEO experiment

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My AZEO experiment

So, I paid all of my balances down to $0 excpet 1 card.

Discover Card $0/$2500.00

Regions Card $0/$2000.00

Capital One $8.00/$300.00

I guess my total aggregate Utilization is less than 1%. To be exact .16%

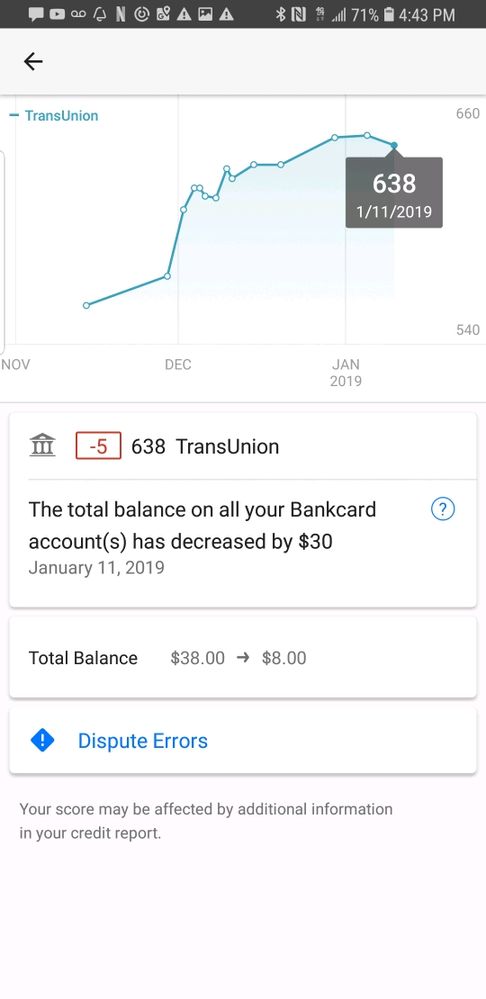

As a result of paying my balances down that low, my TU Fico score dropped 5 pts from 643 to 638. So to get the full benefit of AZEO, one card has to post a higher balance than what I had. I'm not sure what % has to be posted..

Does anyone have any idea? Maybe the sub 1% is reporting as a $0 balance in the scoring algorithm?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My AZEO experiment

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My AZEO experiment

What was the "reported" balance of the Capital One card on your credit report? Some lenders will report extremely low balances as $0 which would, in turn, cause a scoring penalty for all balances being at $0.

If I recall correctly, it is recommended to have your "Except One" card report a balance >$20 but I will let the AZEO experts chime in

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My AZEO experiment

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My AZEO experiment

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My AZEO experiment

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My AZEO experiment

No such $20 rule, what you need to worry about is that some lenders will forgive super low balance and report $0, for example Discover will zero out < $2. Once a balance is reported to CRAs, even if it's just $1, UTI will be rounded up to 1%.

@Caardvark wrote:What was the "reported" balance of the Capital One card on your credit report? Some lenders will report extremely low balances as $0 which would, in turn, cause a scoring penalty for all balances being at $0.

If I recall correctly, it is recommended to have your "Except One" card report a balance >$20 but I will let the AZEO experts chime in

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My AZEO experiment

@tparks5961 wrote:So, I paid all of my balances down to $0 excpet 1 card.

Discover Card $0/$2500.00

Regions Card $0/$2000.00

Capital One $8.00/$300.00

I guess my total aggregate Utilization is less than 1%. To be exact .16%

As a result of paying my balances down that low, my TU Fico score dropped 5 pts from 643 to 638. So to get the full benefit of AZEO, one card has to post a higher balance than what I had. I'm not sure what % has to be posted..

Does anyone have any idea? Maybe the sub 1% is reporting as a $0 balance in the scoring algorithm?

Something else caused the small point loss.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My AZEO experiment

Is that from myFICO? If so, we get this question multiple times a week.

The problem is that not all alertable events are score changing, and not all score changing events are alertable, therefore very often when an alertable event triggers a scoring update, it has nothing to do with the change in score, it could have changed days or weeks ago but remains unknown because it was not an alertable event. (Hence the disclaimer "Your score may be affected by additional information in your credit report")

To accurately attribute individual events to scoring changes you really need access to daily reports and scores update like Experian subscriptions, myFICO alerts are too inconsistent, incomplete and often too slow for accurate results.