- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- MyFico Score vs Experian site score

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

MyFico Score vs Experian site score

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MyFico Score vs Experian site score

So my Experian Fico Score jumped to 672 from 638 on 10/31 and is now in line with my EQ and TU scores, which are currently 679 and 682 respectively. But Myfico didn't tell me the reason for the jump and my next report isn't due until Jan. I had a similar jump in score in October for EQ and TU because three bad accounts fell off and MyFico told me that was the reason for the jump in the Alert. I can only assume that these 3 accounts have now dropped off of my Experian report as well, but when I check my Experian score on the Experian site, it's still 638. I had also called Experian on the advice of this forum in mid October to ask if they could take the three bad accounts off my report given they had already fell off of EQ and TU. No dice. No biggie as it was due to fall off of all three reports in December or January. I'm gardening, I could wait even though I just wanted to be through with all three of those accounts on all three of my reports to see what work I needed to do to get to the 700 club. In any event, do you think the score jump at Experian on MyFico must be because those three accounts fell off and if so why is the Experian score on the Experian site not reflecting the change? Thanks!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: MyFico Score vs Experian site score

It sounds like your Experian score on their site simply didn't update yet. There should be a date provided along with the score, likely on the same screen letting you know the date that the score was generated based on your Experian data at that moment in time. No doubt that date is earlier than the date your score updated from the other source where you're seeing it as being higher.

If you want to know right away, you can just do a $1 trial at Credit Check Total and get your 3 FICO 8 scores instantly based on your file data at this exact current moment in time.

Also you mentioned in your post an "alert" telling you why your score changed. Keep in mind this isn't the case. Alerts simply tell you that something on your credit report changed, which may or may not involve a score change. Many times it does, but there are also plenty of instances where it doesn't and score changes are actually caused by something else that isn't "alertable."

A quick example: You pay down a balance on your only revolver, a $1000 limit credit card from $40 to $10 and that change reports as changed on your Experian report on the 15th of the month. This is an alertable event and would say something along the line of "a balance on one of your revolving accounts decreased by $30." The day prior though on the 14th, an inquiry you had on Experian crossed 365 days in age and became unscoreable. This is not an alertable event. The inquiry becoming unscoreable perhaps raised your score 6 points on the 14th, but you were unaware of this. Your score on the 14th went from (say) 680 to 686. On the 15th when you receive the alert from the balance paydown, you wrongly assume from the alert that your score went up 6 points from the new [lower] reported balance, when in fact that balance change would not have had any impact on your score at all. Since you're under the false belief that the minor balance paydown improved your Experian score, you're fully expecting to see a similar score gain on your TU and EQ reports. The thing is, that inquiry that actually caused the score bump on EX is not present on TU or EQ, so neither of those scores would increase the way EX did. This is just one of many examples on how an alert can have nothing to do with a score change and how it can be misleading with respect to score change.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: MyFico Score vs Experian site score

Thanks! I didn't know about Credit Check Total. Will check it out.

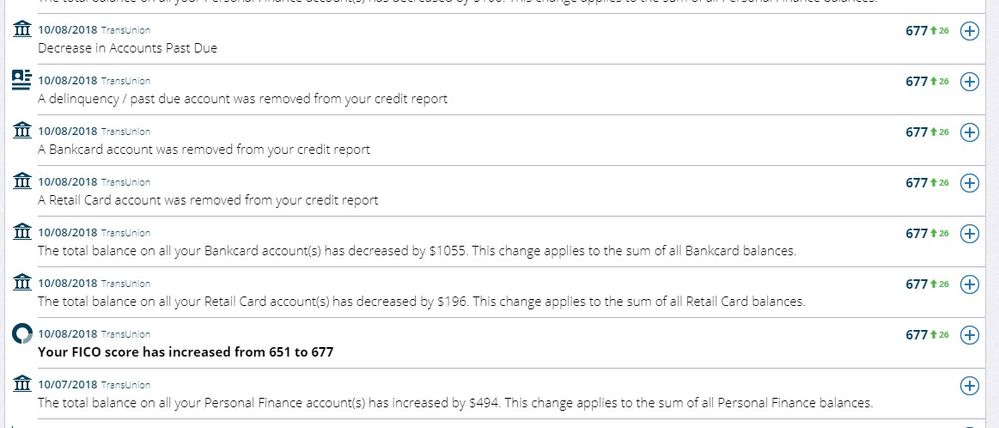

Re the alerts, thanks for that explantaion. I did sort of understand that before, but it helps to have that laid out so specifically. However, the alerts from both TU and EQ were specifically related to the three accounts dropping off. See screen shot. I received the same kind of alerts for EQ. Nothing else had happened around the updates and even if there was something that was not reported per se as an alert, I doubt it would result in a 26 point lift in score. But when it came to EX just the alert of the score increase. No mention of accounts being deleted as with EQ and TU. And as you can see in the screenshot, the only other TU update was the day before, which was actually an increase in my balances which didn't result in a score increase or decrease.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: MyFico Score vs Experian site score

Thanks again for the tip on Credit Check Total! I just checked it and it does indeed seem like the three bad accounts have been finally deleted from Experian. Whoohoo! Hopefully, now I am well on my way to the 700 club. Thanks again! It feels so good just to know for sure. Will await updates on both the Experian site and on my next MyFico report come Jan. Back to the garden I go. I think now all I need is more age. Two credit cards will hit a year in April and my plan then is to ask Discover for a APR reduction per the advice on this board. Whoo!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: MyFico Score vs Experian site score

@Anonymous wrote:So my Experian Fico Score jumped to 672 from 638 on 10/31 and is now in line with my EQ and TU scores, which are currently 679 and 682 respectively. But Myfico didn't tell me the reason for the jump and my next report isn't due until Jan. I had a similar jump in score in October for EQ and TU because three bad accounts fell off and MyFico told me that was the reason for the jump in the Alert. I can only assume that these 3 accounts have now dropped off of my Experian report as well, but when I check my Experian score on the Experian site, it's still 638. I had also called Experian on the advice of this forum in mid October to ask if they could take the three bad accounts off my report given they had already fell off of EQ and TU. No dice. No biggie as it was due to fall off of all three reports in December or January. I'm gardening, I could wait even though I just wanted to be through with all three of those accounts on all three of my reports to see what work I needed to do to get to the 700 club. In any event, do you think the score jump at Experian on MyFico must be because those three accounts fell off and if so why is the Experian score on the Experian site not reflecting the change? Thanks!

MyFICO doesn't tell you the reasons for score changes.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: MyFico Score vs Experian site score

Sweet and congratulations.

Don't forget to cancel that $1 trial so that you don't get charged for a full monthly membership. You can do that as soon as right now or wait up to 7 days... you just don't want to forget about it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: MyFico Score vs Experian site score

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: MyFico Score vs Experian site score

Nice, congratulations! I can't wait until next May, when my only negative will fall off.

“Most people work just hard enough not to get fired and get paid just enough not to quit.”

“Most people work just hard enough not to get fired and get paid just enough not to quit.”Take the myFICO Fitness Challenge

Inquiries: Experian - 4 | Equifax - 3 | TransUnion - 3