- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- New Utilization Breakpoint?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

New Utilization Breakpoint?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Utilization Breakpoint?

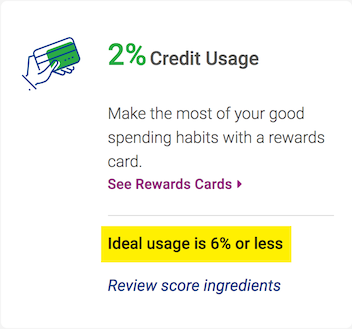

Using Experian CreditWorks Premium to monitor my credit scores. For the last week I've noticed a card relating to my credit usage on the Dashboard with a comment stating "Ideal usage is 6% or less." So I'm wondering if 6% is a new aggregate utilization breakpoint.

I'm quite sure that in the past the card read something along the lines of "Great job keeping your usage below" a stated percentage or words to similar effect. And of course 8.9% utilization is the generally accepted threshold in these forums.

My aggregate utilization hasn't really changed in a year except for one month when it was rose to 4% as I did some increased spending to get some signup bonuses. So I'm puzzled by this statement now showing up.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New Utilization Breakpoint?

It's just front-end fluff software at work here and has no real-world bearing on your score. It may as well say that ideal usage is < 1% (because it is in actuality) but if it did say that it wouldn't mean that < 1% means a better score than < 8% (for example).

There are some people out there that have reported small score gains inside of the commonly talked about 8.9% threshold; some have said they see a couple more points in crossing below say 5%. For every one of those people, though, there are probably 10 that report no scoring improvment at all along the path from 8% down to 1%.

In conclusion no, there is not a new 6% breakpoint, even if it is suggested by CMS front-end software.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New Utilization Breakpoint?

One thing to observe is that there's almost never a practical reason to care about a hypothetical advantage of 5% vs. 8.99% (say). That's because a person is either applying for credit soon, or he's not.

If he's applying soon, he might as well just lower it to 1% -- that's easy to do whereas lowering it precisely 5% or 8.99% or whatever takes more careful fiddling with payments.

If he's not applying soon, then it typically doesn't matter what his scores are, as long as he keeps his total U under 29% and individual U under 69%.

It's still fun to wonder about, however, so thanks again to our OP for bringing this up.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New Utilization Breakpoint?

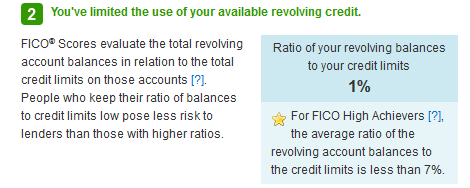

For what it's worth. I got this on my most recent 3b.

BK Free Aug25

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New Utilization Breakpoint?

That's another fine example of fluff front-end software above. In this case, it cites 7%. The OP referenced 6%. We know 8.9% just from shooting the breeze on this forum. We've also heard 5%. I think it's fair to say that these threshold suggestions are consistently inconsistent.

What we do know for certain is that a very small percentage such as 1%-3% is going to maximize the utilization sector of the FICO pie on all files, so if one is really looking to ensure they are squeezing out every possible point landing somewhere in the 1%-3% range is more than likely a safe bet. Whether the next threshold is at 5%, 6%, 7% etc. could be profile-dependent, so as a best practice coming in at 1%-3% is what I would suggest if you want to be "safe" when it comes to this topic.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New Utilization Breakpoint?

@Anonymous wrote:That's another fine example of fluff front-end software above. In this case, it cites 7%. The OP referenced 6%. We know 8.9% just from shooting the breeze on this forum. We've also heard 5%. I think it's fair to say that these threshold suggestions are consistently inconsistent.

What we do know for certain is that a very small percentage such as 1%-3% is going to maximize the utilization sector of the FICO pie on all files, so if one is really looking to ensure they are squeezing out every possible point landing somewhere in the 1%-3% range is more than likely a safe bet. Whether the next threshold is at 5%, 6%, 7% etc. could be profile-dependent, so as a best practice coming in at 1%-3% is what I would suggest if you want to be "safe" when it comes to this topic.

Can we assume this is just for revolving credit and does not apply to SSL? It'd be hard to maintain 1-3% on SSL

Starting Score: Ex08-732,Eq08-713,Tu08-717

Starting Score: Ex08-732,Eq08-713,Tu08-717Current Score:Ex08-795,Eq08-807,Tu08-787,EX98-761,Eq04-742

Goal Score: Ex98-760,Eq04-760

Take the myFICO Fitness Challenge

History of my credit

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New Utilization Breakpoint?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New Utilization Breakpoint?

@Anonymous wrote:That's another fine example of fluff front-end software above. In this case, it cites 7%. The OP referenced 6%. We know 8.9% just from shooting the breeze on this forum. We've also heard 5%. I think it's fair to say that these threshold suggestions are consistently inconsistent.

What we do know for certain is that a very small percentage such as 1%-3% is going to maximize the utilization sector of the FICO pie on all files, so if one is really looking to ensure they are squeezing out every possible point landing somewhere in the 1%-3% range is more than likely a safe bet. Whether the next threshold is at 5%, 6%, 7% etc. could be profile-dependent, so as a best practice coming in at 1%-3% is what I would suggest if you want to be "safe" when it comes to this topic.

I think the phrase "consistently inconsistent" is the probably best way I've heard to to describe threshold estimations...

Great username, btw.. liver shots were always my go to back in the day.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New Utilization Breakpoint?

@Anonymous

Great username, btw.. liver shots were always my go to back in the day.

Thanks ![]() I've always appreciated them greatly and think in many ways they're a lost art today compared to the old days. Complete game-changers, no doubt!

I've always appreciated them greatly and think in many ways they're a lost art today compared to the old days. Complete game-changers, no doubt!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New Utilization Breakpoint?

@Anonymous @BrutalBodyShotsThanks

I've always appreciated them greatly and think in many ways they're a lost art today compared to the old days. Complete game-changers, no doubt!

A lost art indeed, my friend...