- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- New installment loan effect - updated 8/2016

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

New installment loan effect - updated 8/2016

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New installment loan effect - updated 8/2016

I started this thread to document some future data points on the effect of a new installment in a fairly new, credit-cards-only profile. I just joined Alliant Credit Union and will be applying for a Savings Secured loan. Will update here regularly as soon as I'm approved for the loan.

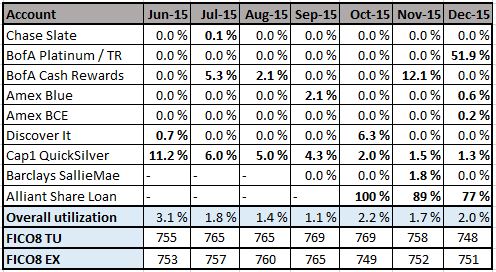

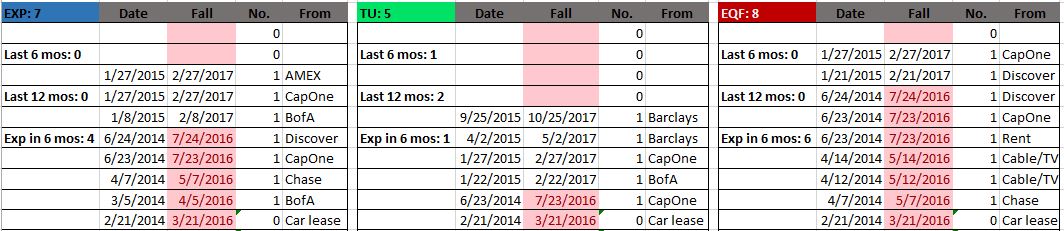

Some background info: Clean profile, no lates, nothing bad in any account. I usually micromanage so only 1 of my cards report each month, in addition to the Quicksilver (has a balance at 0% APR). All the AU cards are my wife's, so I kinda get to decide on those, too.

| Card | Opened | Age (mos) | CL | Notes | INQs | Removed by |

| Chase Slate | 10/2013 | 22 | 6000 | Auth user | ||

| BofA Platinum | 3/2014 | 17 | 1000 | Unsecured 1/15. PC'd 10/15 | TU - 5 | 3/16 - 5/17 |

| Auth user (terminated) | ||||||

| BofA Cash Rewards | 1/2015 | 7 | 1500 | EQ - 9 | 3/16 - 2/17 | |

| Amex Blue | 1/2015 | 7 | 3500 | |||

| Amex BCE | 1/2015(?) | 7 | 10,000 | Auth user. Backdated to 1/2008 | EX - 8 | 2/16 - 2/17 |

| Discover It | 1/2015 | 7 | 5000 | |||

| Cap1 QuickSilver | 1/2015 | 7 | 10,000 | Auth user | ||

| 7 open cards (3 AUs) | ~ 11 months | 37,000 |

I usually get LENGTH OF TIME ACCOUNTS HAVE BEEN ESTABLISHED and LACK OF RECENT INSTALLMENT LOAN INFORMATION as negative key factors.

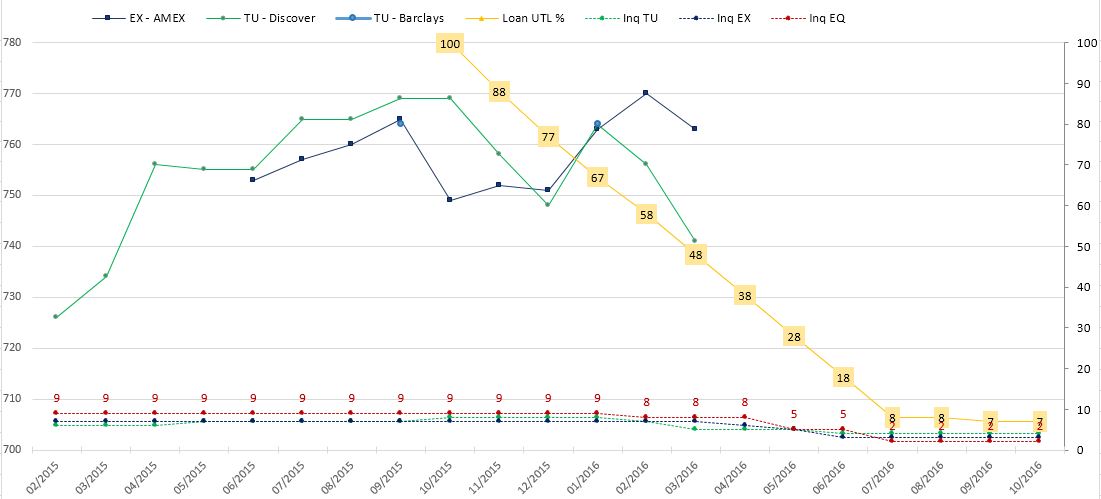

Update 3/2016: Got 2 new accounts in Sep/15 (SallieMae) and secured loan (first report info included in 10/2015)

My negative key factors are now 1) lenght of time accounts have been established and 2)Proportion of loan balances to loan amounts is too high (who knew? ![]() )

)

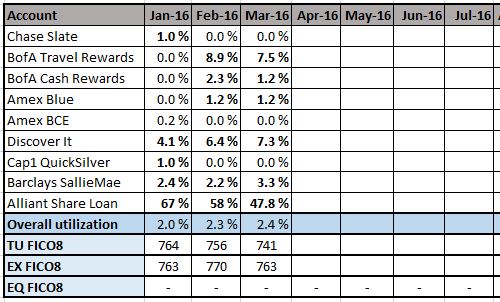

Edit: discussion about Feb-Mar/2016 datapoints

Update August/2016: New account Citi Double Cash in March/2016, right after the previous update. Algo got rid of 2 AU accounts. Scores took a small hit after the new account, but 4 months later with inquiries down to 4 in each bureau, and the secured loan finally reporting below 9% util, I saw a nice jump to TU-778, EX-788 and EQBankcard-799. All of this with utilization well above 55% for my Citi (0% for 18 months, aggregate util still below 9%) and 4-5 of my 7 cards reporting a balance. So I guess just another datapoint of how well the secured loan technique works!

Note: No updated spreadsheet data this time, running a bit tight with spare time :-/

Last update: NOV 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New installment loan effect

A new installment loan will most likely be pretty much a wash for scoring purposes.

While it improve credit mix, that is a low-weighted category, and a new account will necessarily reduce your avg age of accounts, and may add a hard pull.

More important in future endeavors may be a decision regarding whether you wish to retain the AU accounts.

As you build and thus potentially seek better/higher credit, the presence of AUs might create an issue with potential creditors if they also do a manual review.

Whenever a consumer has accunts of another reporting to their credit report, their score cannot be used to evaluate only their own personal risk.

If a potential creditor does a manual review and realizes that you have AUs, they may choose to question the value of your score in their decision making.

There may come a time as one moves up the credit ladder when a decision should be made to ditch AUs, particularly when applying for credti that is apt to involve a more detailed manual review.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New installment loan effect

Hi RobertEG,

Thank you! I appreciate your observations, and I'm very much aware of your points. The main goal of this loan is to try to improve my auto scores for the future, besides FICO 08, of course. Also, I'm curious to see what happens when lack of installments it's not longer a valid reason ![]() .

.

A new installment loan will most likely be pretty much a wash for scoring purposes.

Since I'm taking the loan anyways, I will try to provide a few data points to try and see how much influence one can really expect. It should be a fairly cheap loan, I'm looking at $52 in interest over the course of 5 years.

Regarding AUs, that's my next main goal, along with letting my inquiries fall and my accounts age. Since I'm in no hurry, I'm differing that for some time in the future, probably by the end of next year.

Last update: NOV 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New installment loan effect

From reading the other threads here it seems that if a person has no installment loans at all some posters report a positive effect on FICO 08 vs. seeming no effect on FICO 04. Perhaps you could add FICO 04 to your tracking scores to compare with any changes in FICO 08. Thanks for posting your info. This will be interesting to watch.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New installment loan effect

@manyquestions wrote:From reading the other threads here it seems that if a person has no installment loans at all some posters report a positive effect on FICO 08 vs. seeming no effect on FICO 04. Perhaps you could add FICO 04 to your tracking scores to compare with any changes in FICO 08. Thanks for posting your info. This will be interesting to watch.

Wow, that would be a boomer! I assumed, also from my readings here, that Auto Scores always improve with a succesful installment loan reporting for a few years, which is why the Alliant Savings Secured was chosen (you can pay early to reduce the debt ratio quickly). I've never seen my FICOs 04, except one time at a dealership when they said it was horrible. Since my credit file was non-existent at that time, it made sense when I started learning here.

The only way I know to get those is here on MyFICO, and can't seem to convince myself with their prices. I have "free reports" from CK, and my thinking was if my files are clean, the only thing I need is time and an installment loan.

Last update: NOV 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New installment loan effect

@axlm wrote:

@manyquestions wrote:From reading the other threads here it seems that if a person has no installment loans at all some posters report a positive effect on FICO 08 vs. seeming no effect on FICO 04. Perhaps you could add FICO 04 to your tracking scores to compare with any changes in FICO 08. Thanks for posting your info. This will be interesting to watch.

Wow, that would be a boomer! I assumed, also from my readings here, that Auto Scores always improve with a succesful installment loan reporting for a few years, which is why the Alliant Savings Secured was chosen (you can pay early to reduce the debt ratio quickly). I've never seen my FICOs 04, except one time at a dealership when they said it was horrible. Since my credit file was non-existent at that time, it made sense when I started learning here.

The only way I know to get those is here on MyFICO, and can't seem to convince myself with their prices. I have "free reports" from CK, and my thinking was if my files are clean, the only thing I need is time and an installment loan.

DCU membership is really the only way to track FICO 04 scores outside of Equifax Scorewatch's product; or repeated MF pulls.

Historically we've had good data that FICO 04 does have mix of credit and that any installment loan will help that if you have none; but it's not affected by installment utilization. Having the history on there at all likely maxes out that part of the scorecard for FICO 04.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New installment loan effect

@Revelate wrote:

@axlm wrote:

@manyquestions wrote:From reading the other threads here it seems that if a person has no installment loans at all some posters report a positive effect on FICO 08 vs. seeming no effect on FICO 04. Perhaps you could add FICO 04 to your tracking scores to compare with any changes in FICO 08. Thanks for posting your info. This will be interesting to watch.

Wow, that would be a boomer! I assumed, also from my readings here, that Auto Scores always improve with a succesful installment loan reporting for a few years, which is why the Alliant Savings Secured was chosen (you can pay early to reduce the debt ratio quickly). I've never seen my FICOs 04, except one time at a dealership when they said it was horrible. Since my credit file was non-existent at that time, it made sense when I started learning here.

The only way I know to get those is here on MyFICO, and can't seem to convince myself with their prices. I have "free reports" from CK, and my thinking was if my files are clean, the only thing I need is time and an installment loan.

DCU membership is really the only way to track FICO 04 scores outside of Equifax Scorewatch's product; or repeated MF pulls.

Historically we've had good data that FICO 04 does have mix of credit and that any installment loan will help that if you have none; but it's not affected by installment utilization. Having the history on there at all likely maxes out that part of the scorecard for FICO 04.

@Anonymous for clarifying, @Revelate. I was grossly confusing Auto Scores with FICO04 in general.

@Anonymous I don't think I'm gonna join yet another CU right now, so we will have to pass on F04 info. Sorry @manyquestions!

Last update: NOV 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New installment loan effect

Finally received my welcome package in the mail (with a $50 coupon if I open a checking account, btw) and completed the online sign up. Initiated the funding of the savings account yesterday, hope it's available soon.

Also received a welcome? call from some account management lady, really nice and helpful. So far, dealing with Alliant it's been a pleasure!

Last update: NOV 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New installment loan effect

A few updates:

There were some changes to my profile, since I applied for SallieMae on 9/26 (it was going away, and I was gardening to apply for it sometime next year). Approved, so now I have an additional inquiry on TU and my AAoA went down a couple of months (one advantage of fresh, new files ![]() ). Account reported super fast on 9/28.

). Account reported super fast on 9/28.

Today received an alert on CK about a new account reporting. It was finally Alliant reporting $500@100% util, no payments yet. Opened 9/1, alert on 10/10 but it says it was last reported 9/30, not sure why CK didn't pick it up earlier.

What I find weird is that my Discover TU score didn't blink and reported 769 on 10/4 (same as previous month), when new account and inquiry from SM should have been accounted for already. Still waiting for AMEX refresh.

Since I rely on CK reports and free scores from Amex and Discover, everything it's kinda confusing right now, but hopefully things will stabilize in coming months.

Edit: forgot to report a couple of soft CLI's on Amex and Disco, both now at $8000. And my useless but oldest BofA Platinum was converted to Travel Rewards.

Last update: NOV 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New installment loan effect

You are doing great!

The installment loan will help with your credit history on a manual review. People with good scores have been unable to get auto loans at prime rates because they lacked installment loan history.

Like other posters have mentioned and you have already agreed, once your personal cards are 2 years old you might consider dropping the AUs. The only credit a husband and wife should share are auto loans and mortgages. And you really should share auto loans and mortgages.

Starting Score: EQ 653 6/21/12

Current Score: EQ 817 3/10/20 - EX 820 3/13/20 - TU 825 3/03/20