- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Outstanding Debt penalty?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Outstanding Debt penalty?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Outstanding Debt penalty?

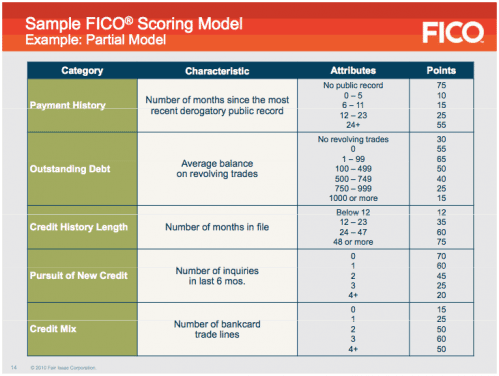

I came across this article from last year about fico scoring. A Rare Glimpse Inside the FICO Credit Score Formula (doughroller.net) According to this figure, I'd be taking a large penalty for the dollar amount of that balance greater than $1000. Is this true and has anyone observed this behaviour? AZEO with sub $99 balance vs AZEO with greater than $1000 balance?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Outstanding Debt penalty?

This must be an old article that was reposted because the comments following it are from as far back as 2012.

Also, one commenter debunks it and claims he works for Fair Isaac, even though he was challenged:

I work at Fair Isaac. Sorry to pop your bubble, but that Powerpoint slide is NOT representative of the FICO scoring formula. It’s part of a training curriculum we use with people outside our company. The slide illustrates a couple of principles we use in some formulas, but it doesn’t represent actual numbers or characteristics of those formulas. You can find good advice for managing your credit score on the company’s myFICO website.

Craig, thanks for your input, and you didn’t pop my bubble. But you may want to take the chart off the myFICO website, as that’s where I found it.

EQ FICO 9 - 770

EX FICO 9 - 758

Citi (2) | Discover | HSBC | BOA | NFCU (2) | WF (2) | Simmons Bank | FNBO (2) | PENFED | BBVA | US Bank | Lowes | Care Credit | Home Depot AU

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Outstanding Debt penalty?

It's just a sample (as it says) to demonstrate a bit more simply of how their formulas may work

It is much much more complex, and it's really anybodys guess on how score changes per change in the credit report

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Outstanding Debt penalty?

Thank you both. I had a lengthier post but didn't want to make it a wall of text.

Now I understand the exact numbers are trade secret and I don't particularly mind if that table is not Fico8, but the idea of a scoring system in general. I was just more or less curious that Fico had a column that contained the actual dollar amount of the debt. And alluded to the idea that there are scoring penalties at all related to the dollar amount of the debt, as opposed to the utilization percentage. Is that a bit clearer what my question is?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Outstanding Debt penalty?

@Credit12Fico wrote:Thank you both. I had a lengthier post but didn't want to make it a wall of text.

Now I understand the exact numbers are trade secret and I don't particularly mind if that table is not Fico8, but the idea of a scoring system in general. I was just more or less curious that Fico had a column that contained the actual dollar amount of the debt. And alluded to the idea that there are scoring penalties at all related to the dollar amount of the debt, as opposed to the utilization percentage. Is that a bit clearer what my question is?

If you wade through the AMA thread that was done by people who work for FICO they mentioned that both % and dollar amount can influence scores.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Outstanding Debt penalty?

Raw dollars are considered in addition to percentages from most of the discussion I've seen on here in recent months. Trying to quantify those raw dollar thresholds and the score impact that goes along with them has been a challenge though when mostly percentages/utilization thresholds have been the focus for many years.

It's perfectly reasonable IMO though that on two otherwise identical profiles that if someone did AZEO with a $99 balance verses a $1000 balance that the $1000 balance could return a lower score outside of utilization percentages. If we're saying this is a $30k card for example and we're talking 1% aggregate utilization and low single-digit individual utilization on the card that would leave raw dollars as the only real difference. Many have suggested that the first dollar threshold may exist at $500.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Outstanding Debt penalty?

@dragontears wrote:

@Credit12Fico wrote:Thank you both. I had a lengthier post but didn't want to make it a wall of text.

Now I understand the exact numbers are trade secret and I don't particularly mind if that table is not Fico8, but the idea of a scoring system in general. I was just more or less curious that Fico had a column that contained the actual dollar amount of the debt. And alluded to the idea that there are scoring penalties at all related to the dollar amount of the debt, as opposed to the utilization percentage. Is that a bit clearer what my question is?

If you wade through the AMA thread that was done by people who work for FICO they mentioned that both % and dollar amount can influence scores.

M'hmm!! I was the one who asked them that very question. They alluded to it. I still hadn't made up my mind and wanted to see if anyone had a DP in this range from $100 to $1000. Where the most optimum point was.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Outstanding Debt penalty?

@Anonymous wrote:Raw dollars are considered in addition to percentages from most of the discussion I've seen on here in recent months. Trying to quantify those raw dollar thresholds and the score impact that goes along with them has been a challenge though when mostly percentages/utilization thresholds have been the focus for many years.

It's perfectly reasonable IMO though that on two otherwise identical profiles that if someone did AZEO with a $99 balance verses a $1000 balance that the $1000 balance could return a lower score outside of utilization percentages. If we're saying this is a $30k card for example and we're talking 1% aggregate utilization and low single-digit individual utilization on the card that would leave raw dollars as the only real difference. Many have suggested that the first dollar threshold may exist at $500.

Thank you! Yep that was what I was curious about. What that raw dollar threshold is. And yep that seems like one of the more elusive DPs nevermind across different scorecards.... We have utilization drilled down seemingly. But haven't seen raw dollars drilled down in the same way. Seems like they said in the AMA that it's less of an effect, but an effect nonetheless.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Outstanding Debt penalty?

To eliminate raw dollars from the equation the best advice is to always roll with a small reported balance... say $10-$20, as that counts for AZEO utilization being optimized and results in no risk of crossing any dollar-related thresholds either.