- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Reached 850, Finally

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Reached 850, Finally

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

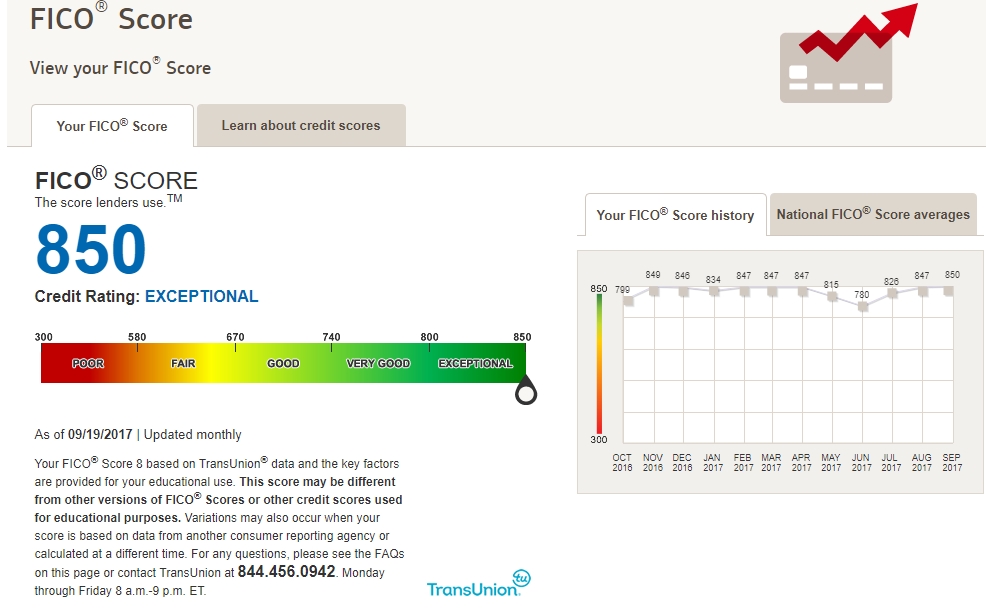

Reached 850, Finally

I checked Amex this morning, they have been update my EX fico 8 every 2 weeks

I got 850 today.

Still remmber years ago, verizon refuse to open a post paid account for me due to bad credit.

Last month was 840 because i can not pay pending charge on citi in time to make it zero balance

This month, one account report 7%, the rest are zero, HP for CSR on EX over 12 month threshold.

AAoA 7.55, Oldest account 22 years (thanks AMEX BD)

Opened a Alliant SSL late last year, boost my score around 30-35 points (thanks CreditGuyInDixie)

EX819 1HP|TU797 1HP| EQ(Fico8 BankCard)841

EX819 1HP|TU797 1HP| EQ(Fico8 BankCard)841

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Reached 850, Finally

Congrats. Great work. DW and I are stuck between 740 to 760 we have no installment loans house and car paid for. I think it an average age issue in our case.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Reached 850, Finally

Sweet noobody!

A couple of questions to spin off of the AAoA and AoOA that you provided... One, what is your AoYA? Two, how many scoreable inquiries do you have?

Last, how do you get your Amex score every 2 weeks? Do you have 2 different Amex account, each providing a monthly score 2 weeks apart or do you have a single account that somehow gives you scores twice monthly? Thanks!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Reached 850, Finally

@Anonymous wrote:Sweet noobody!

A couple of questions to spin off of the AAoA and AoOA that you provided... One, what is your AoYA? Two, how many scoreable inquiries do you have?

Last, how do you get your Amex score every 2 weeks? Do you have 2 different Amex account, each providing a monthly score 2 weeks apart or do you have a single account that somehow gives you scores twice monthly? Thanks!

Last account(CSR) was opened 9/5/16. so NO scoreable inquiry.

I guess that answer the AoYA question also.

I have Two personal AMEX accounts, they just update FICO every 2 weeks for the past year. Maybe be more, as i did not notice before that.

EX819 1HP|TU797 1HP| EQ(Fico8 BankCard)841

EX819 1HP|TU797 1HP| EQ(Fico8 BankCard)841

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Reached 850, Finally

The date of your CSR opening answers the AoYA question, but keep in mind it doesn't necessarily answer the scoreable inquiry question. Scoreable inquries can come from events that don't involve opening accounts. One example would be requesting a HP CLI from a creditor. I know this isn't the case for you, but I just wanted to make that point clear.

When you say you have two Amex accounts that update every 2 weeks, do you mean each account updates every 2 weeks? What types of accounts are they? I have not heard of Amex accounts updating FICO score more than once monthly, so this has me interested!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Reached 850, Finally

@Anonymous wrote:The date of your CSR opening answers the AoYA question, but keep in mind it doesn't necessarily answer the scoreable inquiry question. Scoreable inquries can come from events that don't involve opening accounts. One example would be requesting a HP CLI from a creditor. I know this isn't the case for you, but I just wanted to make that point clear.

When you say you have two Amex accounts that update every 2 weeks, do you mean each account updates every 2 weeks? What types of accounts are they? I have not heard of Amex accounts updating FICO score more than once monthly, so this has me interested!

I have ONE login for two (BCE & SPG) amex personal cards, when i click "view fico score" link, I get updated Fico8 every two weeks like clock work.

2016/6/15 6/30 7/30 8/14 9/1 9/15 9/29 10/16 10/30 11/13 12/15

2017/1/1 1/15 1/29 2/12 2/26 3/16 3/30 4/16 4/30 5/14 5/30 6/15 6/29 7/16 7/30 8/17 8/31 9/14

EX819 1HP|TU797 1HP| EQ(Fico8 BankCard)841

EX819 1HP|TU797 1HP| EQ(Fico8 BankCard)841

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Reached 850, Finally

Understood, that's pretty cool. I wonder if those that have 3 or 4 Amex cards get score updates 3-4 times per month. I never realized that having additional cards meant additional provided scores.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Reached 850, Finally

I am NOT saying the reason Amex update my score twice a month is because I have two accounts. I really do not know.

My guess is most people just ASSUME Amex update once a month, not paying enough attention to when the score actually update.

EX819 1HP|TU797 1HP| EQ(Fico8 BankCard)841

EX819 1HP|TU797 1HP| EQ(Fico8 BankCard)841

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Reached 850, Finally

I don't think it's an assumption. My score updates every month on the 22nd or 23rd. It's never updated more than once a month or ever on a date other than those 2 in a year and a half.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Reached 850, Finally

got TU score from BOA today, 850 also, i do not have access EQ fico8, only bank card score from citi

EX819 1HP|TU797 1HP| EQ(Fico8 BankCard)841

EX819 1HP|TU797 1HP| EQ(Fico8 BankCard)841