- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Ready to quit!

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Ready to quit!

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Ready to quit!

@Anonymous wrote:

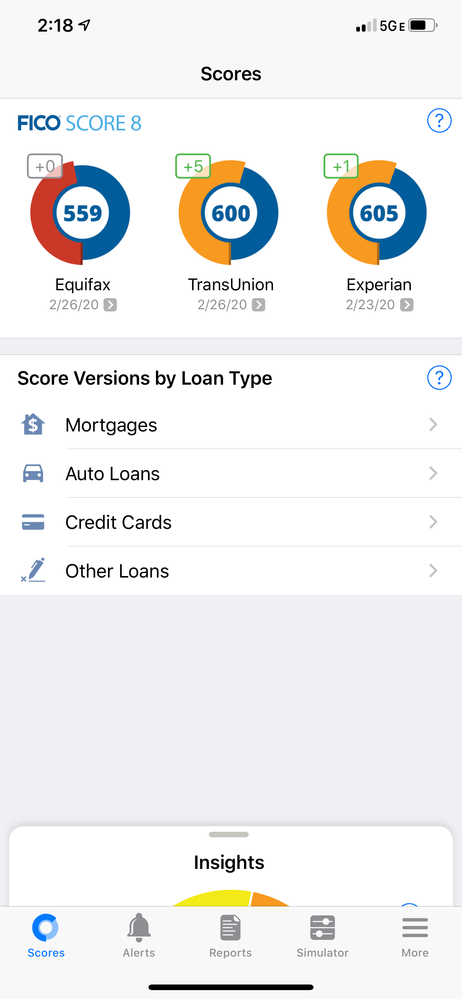

Here is from myfico.com 🤦🏼♂️🤷🏼♂️ I'm so confused even more what to believe!!!

Look at the score dates. They differ. That EX score is from 2/23. Your Experian.com alerts are from 2/26 and 2/27. So something changed between that time to cause a score drop. You'll probably get another alert from myFICO in a day or two reflecting the Experian changes because myFico alerts are always delayed.

Starting FICO 8s | 09/2017: EX 641 ✦ EQ 634 ✦ TU 647

Starting FICO 8s | 09/2017: EX 641 ✦ EQ 634 ✦ TU 647Current FICO 8s | 04/2022: EX 796 ✦ EQ 793 ✦ TU 790

Current FICO 9s | 04/2022: EX 790 ✦ EQ 788 ✦ TU 782

2022 Goal Score | 800s

My AAoA: 4.6 years not incl. AU / 4.9 years incl. AU

My AoOA: 9.2 years not incl. AU / 11.2 years incl. AU

Inquiries: EX 0/12 ✦ EQ 0/12 ✦ TU 0/12

Report Status: Clean

Garden Status:

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Ready to quit!

What did you dispute? Is your dispute still open?

When you dispute an account it is COMPLETELY removed from factoring into your score (which is why disputes have to be removed before a mortgage). If the dispute is not completed your score "lost" an account that has been open since 2012.

@Anonymous wrote:I think it closed today but I had to dispute it and it was opened that day maybe that's why?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Ready to quit!

I paid my student loans off several months ago well I noticed on Experian it didn't update so I sent in the information that I paid it off and that it should reflect that and they did close it and put the balance at zero in my favor as they did see that I paid it in full.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Ready to quit!

Dispute can up and exclude the entire tradeline.

If it's not fully resolved all that positive history poof and I suspect that to be more likely than any installment utilization change though that might've contributed. What was the balance before it was updated to paid/closed?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Ready to quit!

Why do people feel the need to dispute the paying off of a TL? It does take time for it to cycle on all 3 CB's, It's called patience.

The only things that should be disputed are incorrect items.

Aside from that why did you even open an SSL, if you were going to close the "current" loan before it even reported?

Most people that open an SSL do it because they don't have an installment loan, and want the "credit mix" boost. Others do it to have in place before their current loan is about to be paid and closed. To keep said credit mix in play.

If you knew the reasons for opening an SSL, you should have also known not to pay off the Student until the SSL was reporting for at least one cycle and at less that 50% UT or lower. To help with scoring.

Apologies if this sounded brash, I was just curious as to why someone making all these changes were upset with the results.

It's a simple matter of time for everything settle down and align.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Ready to quit!

Also keep in mind that loan, the inquiry was buffered by 30 days so that’s going to come in here somewhere to. And IIRC, OP has collections and is in a dirty card, so there’s not gonna be a new account penalty. HP, AAoA, Aggregate installment utilization, and other possible changes.