- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Recovering credit score points from a late pay...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Recovering credit score points from a late payment.

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovering credit score points from a late payment.

So,I have a little bit of a dilemma and question.I am just shy of my 1 year anniversary from a Chapter 7.About 5 months ago,I got a Cap 1 Platimum unsecured card.Made solid on time payments for the first 4 months,but screwed up this month.I thought I had scheduled a payment from my BofA Checking account,but in fact I didn't.Just paid the past due amount today...9 days late.As a result my credit score dropped 61 points(AARGH).My question is,how long,with no further late payments(I didn't even have any late payments pre-Chapter 7)will it take me to recover those lost points?And does anyone have any helpful tips to recover it?Thanks in advance.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Recovering credit score points from a late payment.

When you say you were 9 days late, do you mean 9 days past your due date or 39 days past your due date, meaning 9 days late on avoiding a 30 day late payment? If you lost 61 points, it sounds like you were > 30 days late. If this is not the case and you were only 9 days late (past your due date) you shouldn't have had that reported to the CRAs, so you would be able to get that removed.

If you were indeed > 30 days late, your best bet is to request a GW adjustment from the creditor. You could try this with a phone call, but I recommend writing letters. If you can convince them to remove it, you'll see those points come back immediately (when it's removed). If they don't, you have to wait for it to lose it's impact, which will take time. Most say that 30 day late payments only adversely impact FICO scores for about 2 years, so maybe after 1 year you get back around 30 points and perhaps after 2 years you get back the other 30 or so. These things are profile-dependent, so they are tough to quantify.

My suggestion is go for a GW adjustment and attempt to get those points back right away rather than waiting 2 years.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Recovering credit score points from a late payment.

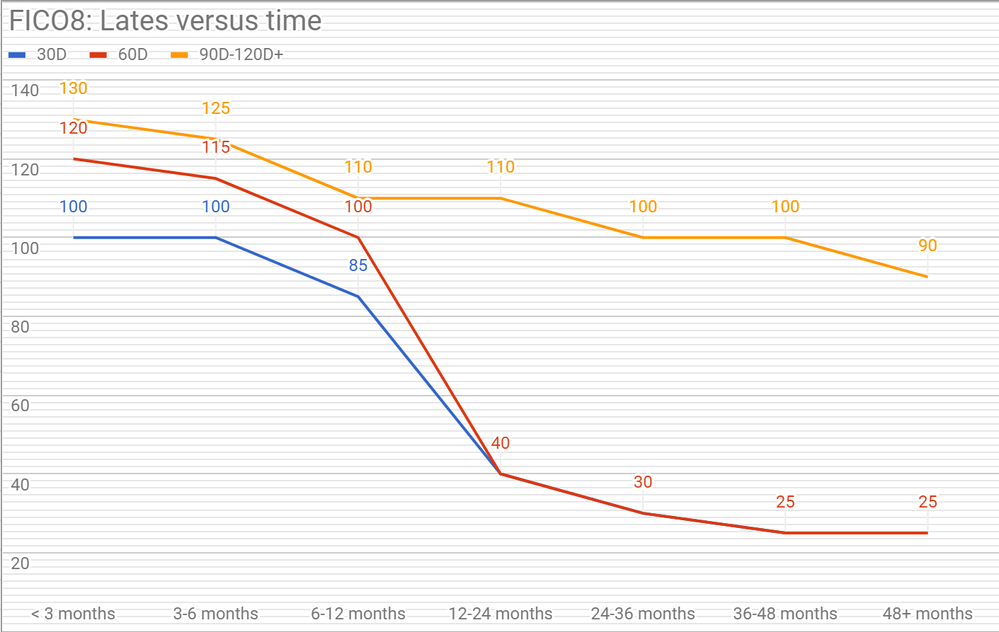

This graph is a generalization based on my research into late payments and FICO scoring. This is just a generalization but has proven correct for many folks. Because you likely have a BK reporting, your points lost are less than someone who has a clean profile, so you didn't lose all 100 possible points but 60.

As you can see, ONE 30 day late corrects itself in 12 months and probably get 40 points back in a year.

I built a late payment forecasting spreadsheet for people who have multiple lates if you want it, but it won't help you because 1 late is well matched to the graph above.

One thing I would do is pay on time for 6-12 months and then send Capital One a goodwill saturation method chain of letters to see if they will remove it.

Note that a 30D late means you were 39 days late, not 9 days late. You missed TWO payments.

Set up autopay. Today. Immediately. On all credit cards.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Recovering credit score points from a late payment.

Thanks for the replies.To clarify...the payment was due Dec 1st,and I paid today,December 9th...so definitely not 30 days+.I just got off the phone with Cap 1,and I explained my shortsightedness,and they were gracious enough to remove the $25. late fee.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Recovering credit score points from a late payment.

I think I may have found part of the problem.Last month I got a Lend Up Arrow Card,with a $1000 limit(I have only charged $150 to date).When I looked at my TransUnion and Equifax reports tonight,this card has yet to show up on either as an open account.So my total amount due from Cap 1 was $290 out of a $500 limit,which translates to a whopping 58% credit utilization.Do you think they may be part of the sudden and sharp decrease,because from what I am reading online,most card issuers don't report accounts as late to the bureaus until 30+ days after.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Recovering credit score points from a late payment.

If you're not seeing a late notation of 30D, you didn't get one. 9 days late will NOT mark you as late.

Your FICO score drop was probably due to utilization both aggregate and individual. Do you have a calculator to calculate your current utilization aggregate and individual? If not, PM me I'll send you one and you can report back with the #s.

High aggregate utilization + high individual utilization MAY cause a high drop in scores. Where are you getting your scores from? MyFico or CCT or something?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Recovering credit score points from a late payment.

So as of this moment,my credit utilization is 58%($290 amount owed divided by $500 credit limit).Once my $167 payment that I made tonight,and the $25 late fee(which Cap 1 is crediting me)is posted on Monday,that brings my amount owed to $97.That brings the Cap 1 utilization down to 19%.The Lend Up card that hasn't been reported to the bureaus yet,has a $166 balance on a $1000 limit,which brings that utilization to 17%.Combined they will have a $267 balance out of a $1500 limit with a credit utilization of 18%.I got my scores from both Credit Karma and Cap 1's CreditWise.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Recovering credit score points from a late payment.

Oh is that your ONLY credit report reporting?

You definitely will get dinged for 59% utilization since it's both aggregate AND individual.

Individual 59% could ding you for as much as 15-20 points.

Aggregate 59% could ding you for as much as 40 points. That's 60 points right there!

Pay it down to 8% total and you'll recover as much as 60 points.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Recovering credit score points from a late payment.

Cool.Thanks so much for all the helpful advice.Very much appreciated.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Recovering credit score points from a late payment.

@ABCD2199 Do you have any feel for how multiples stack up, especially in the 90+ category? (ie, how many points penalty am I possibly at)

These are my only baddies. I've started a GW campaign on this, but I expect to have to wait out the 24 months.

2020-02-07 FICO 08: TU 789

2020-02-10 FICO 08: EX 752

Gardening, mostly, again until... soon(I need to replace my car)