- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Score Increase for passing 28.9% aggregate Thresho...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Score Increase for passing 28.9% aggregate Threshold (28 points)

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Score Increase for passing 28.9% aggregate Threshold (28 points)

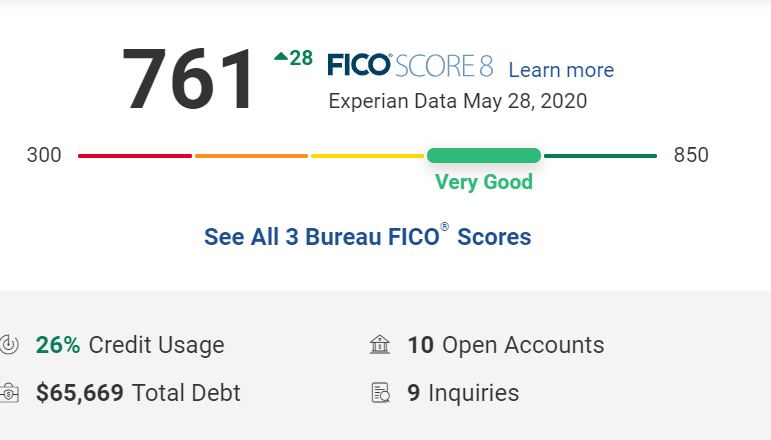

I have a data point for the Aggegate 28.9% threshold. Yestarday I was at 30% aggregate Utilization (29.6 - experian reported as 30%). With my Paypal card balance reporting it dropped to 26% giving me a 28 point boost in score.

I'm on a Thick/clean/Aged scorecard with no baddies.

I know when I was searching one of the things i looked for was examples of what score bum i could expect at individual and aggregate levels ofr sharing for those who may be looking to achieve certain scores and what boost they can expect. For full comparison I have 0 lates/100% ontime payments, 9 hard inqueries (2 younger than 1 year/scoreable), 7 tradelines, 5 of them reporting 0 balance. and like 45K in installment loans (Car/student loans).

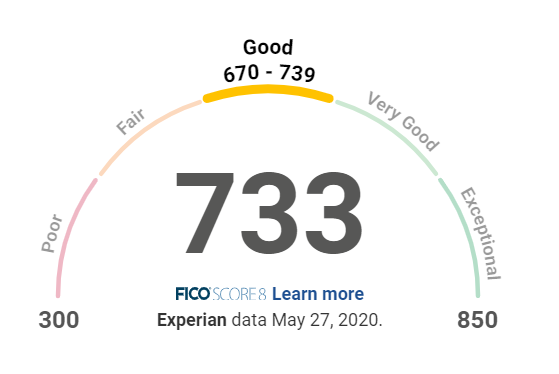

This was yestarday the 27th:

This is from today the 28th:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score Increase for passing 28.9% aggregate Threshold (28 points)

@Anonymous wrote:I have a data point for the Aggegate 28.9% threshold. Yestarday I was at 30% aggregate Utilization (29.6 - experian reported as 30%). With my Paypal card balance reporting it dropped to 26% giving me a 28 point boost in score.

I'm on a Thick/clean/Aged scorecard with no baddies.

I know when I was searching one of the things i looked for was examples of what score bum i could expect at individual and aggregate levels ofr sharing for those who may be looking to achieve certain scores and what boost they can expect. For full comparison I have 0 lates/100% ontime payments, 9 hard inqueries (2 younger than 1 year/scoreable), 7 tradelines, 5 of them reporting 0 balance. and like 45K in installment loans (Car/student loans).

This was yestarday the 27th:

This is from today the 28th:

Questions:

1. Was the PayPal balance above 30%?

2. If so, did it drop from above 30% to below 30%?

3. What percentage on the other reporting tradeline?

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score Increase for passing 28.9% aggregate Threshold (28 points)

@SouthJamaica wrote:

1. Was the PayPal balance above 30%?

2. If so, did it drop from above 30% to below 30%?

3. What percentage on the other reporting tradeline?

Before:

| Account | Balance | Limit | Ratio |

| Walmart | $0.00 | $1,450.00 | 0.0% |

| Paypal | $1,662.00 | $3,500.00 | 47.5% |

| Venture | $2,960.00 | $7,000.00 | 42.3% |

| Amazon | $4,991.00 | $6,000.00 | 83.2% |

| Amex | $5,262.00 | $8,500.00 | 61.9% |

| QuickSilver | $0.00 | $9,000.00 | 0.0% |

| CareCredit | $0.00 | $15,000.00 | 0.0% |

| Total | $14,875.00 | $50,450.00 | 29.5% |

** Experian reported this as a 30% balanced **

After:

| Account | Balance | Limit | Ratio |

| Walmart | $0.00 | $1,450.00 | 0.0% |

| Paypal | $0.00 | $3,500.00 | 0.0% |

| Venture | $2,960.00 | $7,000.00 | 42.3% |

| Amazon | $4,991.00 | $6,000.00 | 83.2% |

| Amex | $5,262.00 | $8,500.00 | 61.9% |

| QuickSilver | $0.00 | $10,000.00 | 0.0% |

| CareCredit | $0.00 | $15,000.00 | 0.0% |

| Total | $13,213.00 | $51,450.00 | 25.7% |

** Experian reported this as a 26% balance **

Nothing below changed to my other credit report details before or after:

- 100% ontime payment for revolving and installments, not laters, no derogs

- No collections, settlements, negatives, baddies

- 9 hard inqueries (2 less than 1 year/scoreable)

- 52K in installments (2 student loan, 1 Auto)

- AoOA: 18 years

- AoORA: 6.5 years

- AAoRA: 4.7 years

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score Increase for passing 28.9% aggregate Threshold (28 points)

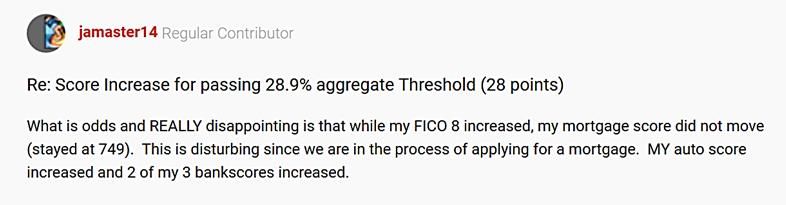

What is odds and REALLY disappointing is that while my FICO 8 increased, my mortgage score did not move (stayed at 749). This is disturbing since we are in the process of applying for a mortgage. MY auto score increased and 2 of my 3 bankscores increased.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score Increase for passing 28.9% aggregate Threshold (28 points)

@Anonymous wrote:

@SouthJamaica wrote:

1. Was the PayPal balance above 30%?

2. If so, did it drop from above 30% to below 30%?

3. What percentage on the other reporting tradeline?

Before:

Account Balance Limit Ratio Walmart $0.00 $1,450.00 0.0% Paypal $1,662.00 $3,500.00 47.5% Venture $2,960.00 $7,000.00 42.3% Amazon $4,991.00 $6,000.00 83.2% Amex $5,262.00 $8,500.00 61.9% QuickSilver $0.00 $9,000.00 0.0% CareCredit $0.00 $15,000.00 0.0% Total $14,875.00 $50,450.00 29.5%

After:

Account Balance Limit Ratio Walmart $0.00 $1,450.00 0.0% Paypal $0.00 $3,500.00 0.0% Venture $2,960.00 $7,000.00 42.3% Amazon $4,991.00 $6,000.00 83.2% Amex $5,262.00 $8,500.00 61.9% QuickSilver $0.00 $10,000.00 0.0% CareCredit $0.00 $15,000.00 0.0% Total $13,213.00 $51,450.00 25.7%

Nothing below changed to my other credit report details before or after:

- 100% ontime payment for revolving and installments, not laters, no derogs

- No collections, settlements, negatives, baddies

- 9 hard inqueries (2 less than 1 year/scoreable)

- 52K in installments (2 student loan, 1 Auto)

- AoOA: 18 years

- AoORA: 6.5 years

- AAoRA: 4.7 years

Thank you. Great that you have your data so well organized ![]()

So you went from having 4 (more than half of your cards) > 30% to having 3 (less than half).

And you went from having 3 (less than half of your cards) reporting at zero to having 4 (more than half) reporting at zero.

Those events most likely affected your points as well.

So it's quite difficult (try impossible) to isolate out which factors got you which points:

1. Aggregate dropping below 29%

2. Number of zero balances rising from less than half to more than half

3. Number of >30% balances dropping from more than half to less than half

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score Increase for passing 28.9% aggregate Threshold (28 points)

@Anonymous wrote:What is odds and REALLY disappointing is that while my FICO 8 increased, my mortgage score did not move (stayed at 749). This is disturbing since we are in the process of applying for a mortgage. MY auto score increased and 2 of my 3 bankscores increased.

Yeah the mortgage score is an ornery cuss. Very stubborn.

Thankfully, if I'm not mistaken, yours is good enough to get you the lowest rates anyway.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score Increase for passing 28.9% aggregate Threshold (28 points)

@SouthJamaica wrote:

@Anonymous wrote:What is odds and REALLY disappointing is that while my FICO 8 increased, my mortgage score did not move (stayed at 749). This is disturbing since we are in the process of applying for a mortgage. MY auto score increased and 2 of my 3 bankscores increased.

Yeah the mortgage score is an ornery cuss. Very stubborn.

Thankfully, if I'm not mistaken, yours is good enough to get you the lowest rates anyway.

My lender wants a middle score of 760. although right now they are still giving me a great rate. but when borrowing 500K every bit counts.

I'm hoping there is something with the mortgage score where its a delay in scoring/reporting. I'd think too many positive things happened to not even see 1 point. like if it was 3 points id be like, that sucks id hope for more but 0 seems suspicious to me... although that could just be wishful thinking.

I have more positive impact coming:

- Venture card paid in full, CLI to 7,750 (Crossed 28.9, 8.9, and another revolver with no balance)

- Reports on June 4

- Amazon paid down to 4612, CLI to 8000 (Crossed 68.9)

- Reports on June 3

- AMEX paid down to 4772 (no threshold crossed)

- Reports last day of the month

- CareCredit CLI to 20000

- Reports last day of the month

- Aggregate from 26% to 17%

- Achieve AZE2 (5/7 reporting no balance)

Also not sure if its a thing but aggregate available credit will soon increase to 50,000. only mention it because vantage score on creditwise shows that as the minimum for "Excellent". but i know vantagescore is irrelevant.

If the next wave doesnt get my middlescore to 760 its going to be depressing. all i can really do from there is pay down the last 2 and go AZEO but 9K will take 6 months or so to pay down after the chunk i already threw at this.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score Increase for passing 28.9% aggregate Threshold (28 points)

@Anonymous wrote:

Before:

Account Balance Limit Ratio Walmart $0.00 $1,450.00 0.0% Paypal $1,662.00 $3,500.00 47.5% Venture $2,960.00 $7,000.00 42.3% Amazon $4,991.00 $6,000.00 83.2% Amex $5,262.00 $8,500.00 61.9% QuickSilver $0.00 $9,000.00 0.0% CareCredit $0.00 $15,000.00 0.0% Total $14,875.00 $50,450.00 29.5% ** Experian reported this as a 30% balanced **

After:

Account Balance Limit Ratio Walmart $0.00 $1,450.00 0.0% Paypal $0.00 $3,500.00 0.0% Venture $2,960.00 $7,000.00 42.3% Amazon $4,991.00 $6,000.00 83.2% Amex $5,262.00 $8,500.00 61.9% QuickSilver $0.00 $10,000.00 0.0% CareCredit $0.00 $15,000.00 0.0% Total $13,213.00 $51,450.00 25.7% ** Experian reported this as a 26% balance **

Nice table. Your 28 point Fico 8 score increase (733 => 761) is in-line with your profile.

I wonder if your Mortgage Fico score did not update with new data. ZERO movement would be a bit odd given you reduced # cards reporting a balance from above 50% to below 50%. Of course, EX is not as sensitive to # cards reporting from my many years monitoring. Rest assured, your EQ Fico mortgage score has gone up. How many INQ under 12 months do you have on EQ, TU and EX?

Some services don't update Fico mortgage scores except as a manually requested pull on a monthly or quarterly basis or as a paid pull. What service are you using?

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score Increase for passing 28.9% aggregate Threshold (28 points)

@Thomas_Thumb wrote:

@Anonymous wrote:Before:

Account Balance Limit Ratio Walmart $0.00 $1,450.00 0.0% Paypal $1,662.00 $3,500.00 47.5% Venture $2,960.00 $7,000.00 42.3% Amazon $4,991.00 $6,000.00 83.2% Amex $5,262.00 $8,500.00 61.9% QuickSilver $0.00 $9,000.00 0.0% CareCredit $0.00 $15,000.00 0.0% Total $14,875.00 $50,450.00 29.5% ** Experian reported this as a 30% balanced **

After:

Account Balance Limit Ratio Walmart $0.00 $1,450.00 0.0% Paypal $0.00 $3,500.00 0.0% Venture $2,960.00 $7,000.00 42.3% Amazon $4,991.00 $6,000.00 83.2% Amex $5,262.00 $8,500.00 61.9% QuickSilver $0.00 $10,000.00 0.0% CareCredit $0.00 $15,000.00 0.0% Total $13,213.00 $51,450.00 25.7% ** Experian reported this as a 26% balance **

Nice table. Your 28 point Fico 8 score increase (733 => 761) is in-line with your profile.

I wonder if your Mortgage Fico score did not update with new data. ZERO movement would be a bit odd given you reduced # cards reporting a balance from above 50% to below 50%. Of course, EX is not as sensitive to # cards reporting from my many years monitoring. Rest assured, your EQ Fico mortgage score has gone up. How many INQ under 12 months do you have on EQ, TU and EX?

Some services don't update Fico mortgage scores except as a manually requested pull on a monthly or quarterly basis or as a paid pull. What service are you using?

my credit report across all the beaurues is identical as far as inqueries. 9 inqueries, 2 less than 12 months/scroeable

im resisting the urge to pull a 3B report since i have some major balance changes coming between now and the 5th

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score Increase for passing 28.9% aggregate Threshold (28 points)

Any update on the mortgage scores? I'm waiting a few more days to pull my scores as well. Curious if TU or EQ gained points?