- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Score low and risk high apparently....

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Score low and risk high apparently....

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Score low and risk high apparently....

As you can see below, there is quite a bit of green, but my score is 640. They say my risk of getting into "serious trouble is 25%. I recently applied for Affirm 0% financing to buy a $1,000 product and was denied.

Obviously I am a high risk borrower, but it seems like from all the Above Average ratings and calculating the percentage impact, that I should be at least average.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score low and risk high apparently....

I think Affirm is a weird one. They approved me for $2,900 for a Peloton workout machine but only $700 on a virtual card. Walmart is $1,300.

my scores and reports aren't as good as yours

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score low and risk high apparently....

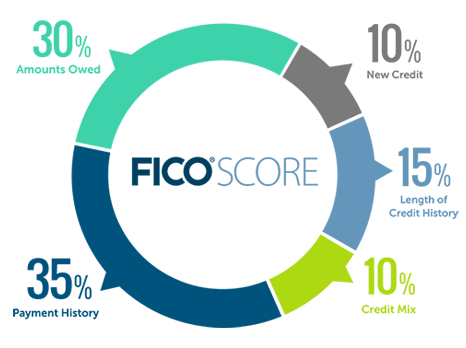

It's because your debt is relatively high considering you have a "fair" rating which counts for 30% of your scores.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score low and risk high apparently....

As noted above, your utilization at 75% had a significant factor in your denial. When seeking credit, it's recommended to optimize your report.

https://www.myfico.com/credit-education/whats-in-your-credit-score

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score low and risk high apparently....

Your utilization is very high and that makes you a risky borrower.

If you cannot pay it without getting a personal loan, that right there explains why you're considered a "higher risk" at this time.

With such high utilization, getting a personal loan under anything resembling decent terms is going to be very hard.

You will probably need to make a plan on how to get utilization down a bit to a more manageable levels, then see what you can do personal loan wise.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score low and risk high apparently....

How recent is the 30-day late?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score low and risk high apparently....

The 30 day late was from 2018.

The high ratio makes up 30%, but having 70% great seems like it would mean more.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score low and risk high apparently....

The 30-day late might have a significant effect on your score, though it's possible it does not.

Do you have any other derogatories?

I had a 30-day late which lowered my score about 70 points in 2013....but the effect of it waned considerably in a few months.

75% utilization stifles the score. 60% utilization stifled mine. My score went up over 100 points when I reduced my utilization from 60% to 4%.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score low and risk high apparently....

No other derogatory items. If my score was 840, or whatever perfect is, even if the util. Makes up 30% and was as bad as possible, that shouldn't be able to drop it this much. I am no math whiz, but I know this doesn't add up.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score low and risk high apparently....

Take heart.....credit cards aren't rushing to have me as a client, either......