- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Scorecard question & score improvement unique ...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Scorecard question & score improvement unique situation help

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Scorecard question & score improvement unique situation help

I have posted a few times on the board but have been reading and reading trying to understand as much as I can. All of you are so knowledgeable and I appreciate all of your very helpful information. You guys rock!

I have quite a few questions so hopefully you can follow this and I can get most of them answered instead of positng separately. So you have all the info at once. If I'm in the wrong thread I'm sorry! Also sorry if this is long I need advice on a few things.

I pay for experian but am thinking about switching to myfico for the monthly reports so I have more info. So that's where I'm getting this info from.

My fico score for ex is currently 712. TU AND EQ SAY 720 but that was a few months ago before I got 2 new cards. I can't pull those yet and why I was thinking about switching to myfico to pay for the monthly reports.

I have 4 revolvers.

Cap1 secured $601 limit it's 10 months old.

Creditone limit $300 it's almost 6 months old.

Synchrony home card $1000 limit it's 2 months old

Chase freedom $500 limit it's 2 months old.

All have a zero balance except synchrony home it has a balance of $180 that I'm paying off slower because I don't know when I'll use this card again and don't want them to close it for not using it. I have 0% apr for a year. All others are at zero. Utilization on synchrony home is @ 18% per that card

Total utilization is 8% across all cards. Synchrony is the only one with a balance.

My credit report say I have 4 revolving accounts, 0 loans, 0 mortgages, and 2 other closed accounts.

I have 2 "charge off" accounts for child support. As I've talked about in other posts I got the amount forgiven with a hardship claim.

The balance is about $1700. It only says derog on TU. It say that on the account itself when you click on the account. If I look at other areas of my report that say derogs, (that would be if you had a late payment or charge off) It says congrats you don't have any derogs in your report. This is why I'm so confused as to weather it counts or not.

I'm at 4/24 right now with cards.

I've been using my chase freedom a lot and paying it off to hopefully show use in hopes of a CLI at 6 months. It's my daily driver that always gets paid to 0. I have put all of my organic spending on it to hopefully show use. I am staying at 4/24 in hopes of a CLI with chase. From what I've gathered they won't give you a CLI if your at or over 5/24. Is that right?

Question is about scorecards is, what scorecard would I be in and how does an old child support chargeoff count towards clean or dirty scorecard. I read the scorecard post trying to understand and I never found an answer about child support. Especially since in my rare situation it's showing as a charge off.

I applied for a hardship and they basically have it as a charge off. It says owed- settled but still has a balance remaining. I believe TU is the only one that says derog. The others show owing but current, pay on time.

One is set to fall off on 3/21, the other is set to fall off 6/22. I got TU to remove one of them that was going to fall off. But isn't child support not considered in fico scoring or is it? I hear some people say yes and some say it's not supposed to. I guess when they fall off completely I'll find out if they were factored in or not.

Basically I'm asking what score card that would put me in. I honestly don't feel the child support is holding my score down but idk.

Also it's from 2013 and I know over time it counts less toward your score. I honestly feel like it's helping the age of oldest account because prior to the child support thing I have never had a revolver, ever. I just started with credit about 10 months ago now.

Basically my goals for the short term future is to get a CLI with chase. I don't even know how I got approved with less than a year of revolving credit except for I bank with them and I saw pre-approved in credit journey, so I applied and they said that I would have to wait for a decision, and I logged into my chase account a few days later and the card was there. I thought I wasn't going to get approved.

I know that cards with chase with a low SL may or may not grow like you hope. That's why I'm trying to show spending to hopefully warrant an increase. My other cards besides synchrony and chase I keep the balance below $30 which would be less than 10%. I have small reoccurring changes on them and don't use them for anything else. I got them to build my credit only and pay them off every month. If I want to do AZEO I will obviously have all at zero except a small amount reporting on one the capital one card every month.

For the longer term my goals would be to be able to finance a vehicle and buy a house within a few years. The vehicle might be sooner than later because I really need a wheelchair van for my disabled toddler.

With that said it brings me to a question about credit mix. I have no loans at all, Ever. I can't get into navy or any of those type of places where you need military affiliation. I live in Washington state. From what I've gathered the best way is to do a loan is to do an SSL and pay it down to below 8.9% for however many years it's for to optimize fico score. Since I have no loans would it make sense for me to get a credit builder loan and if I can't pay it down to 8.9%? because from what I've read it's extremely hard to find a place for an SSL that lets you pay it down right away. What if I just pay on it normal? Would that help my score over time with the credit mix portion? Or am I missing something with this info and should check at my local credit unions and ask if they have any of those or does anyone know of a place for me to get an actual SSL that doesn't require military affiliation?

Would I, or should I even worry about doing any type of ask or credit builder loan if I plan on getting a vehicle loan probably this year sometime?

I've read hundreds and hundreds of posts on here trying to gather as much info as I can. Since this is my first time I don't want to make too many mistakes and hope to have great credit for once in my life to meet those goals.

Is it true that I should get one more bank card revolver? Or 2 if your counting actual bank cards and not store cards? Obviously not right now as I'm holding out for chase but isn't 5 considered where one should be to not be a thin file?

If you need any more info please let me know and I also wanted to ask if you guys need data points from my situation, what should I keep track of? I would love to be able to help contribute with all of the amazing work you guys are doing. Just need to know what to keep track of.

I know that was probably too much info so to recap my questions.

Does chase require you be be under 5/24 for a CLI? Will they approve you for an auto CLI if your over 5/24?

What scorecard would I be in with child support showing as a charge off no other derogs? Does that put me into a dirty scorecard?

Should I eventually get 5 bank card revolvers to not be considered a thin file?

I have my eye on a few goal cards once I get a better score and my accounts age a little. And also holding out for chase so not before I hope to get that CLI.

If I get my score up to get a few of my goal cards, should I get them before score card reassignment meaning new accounts to no new accounts if I have a good enough score to get my goal cards?

Since I know I'll probably be getting a vehicle loan within the year, do I even bother with trying to get a SSL or credit builder loan to help with mix portion?

Is there a place to get one that actually allows you to pay it down to 8.9% or under and it extends the payment date to months/years in the future? That doesn't require military affiliation? And one that you can do for a shorter amount of time not 5 years. I don't have $3000 to put into a loan.

If there is no place to get a SSL and pay it down right away to 8.9% would I benefit from a short term credit builder loan like 1 year and pay it down regularly month by month? Or does that not actually help with credit mix and optimizing fico score?

Do I even bother with a SSL or credit builder loan if I plan to get a vehicle loan?

Will that help satisfy the credit mix portion?

Are there any specific data point that I could keep track of to help out? If so what?

I'm super curious to know what scorecard I'm in and if child support charge off is actually affecting my score. Like if It will go up once it falls off completely. When it does, my oldest card would be almost 2 years old. I am wonder how that drop off in age will affect my score as well.

Thanks for all of your help and please let me know if you need any more information or if I left anything out. I know I'm all over the place but I have had all of these questions for a while now and hoping to not have to spread out all the info. Thanks so much

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Scorecard question & score improvement unique situation help

@Anonymous wrote:I have posted a few times on the board but have been reading and reading trying to understand as much as I can. All of you are so knowledgeable and I appreciate all of your very helpful information. You guys rock!

I have quite a few questions so hopefully you can follow this and I can get most of them answered instead of positng separately. So you have all the info at once. If I'm in the wrong thread I'm sorry! Also sorry if this is long I need advice on a few things.

I pay for experian but am thinking about switching to myfico for the monthly reports so I have more info. So that's where I'm getting this info from.

My fico score for ex is currently 712. TU AND EQ SAY 720 but that was a few months ago before I got 2 new cards. I can't pull those yet and why I was thinking about switching to myfico to pay for the monthly reports.

I have 4 revolvers.

Cap1 secured $601 limit it's 10 months old.

Creditone limit $300 it's almost 6 months old.

Synchrony home card $1000 limit it's 2 months old

Chase freedom $500 limit it's 2 months old.

All have a zero balance except synchrony home it has a balance of $180 that I'm paying off slower because I don't know when I'll use this card again and don't want them to close it for not using it. I have 0% apr for a year. All others are at zero. Utilization on synchrony home is @ 18% per that card

Total utilization is 8% across all cards. Synchrony is the only one with a balance.

My credit report say I have 4 revolving accounts, 0 loans, 0 mortgages, and 2 other closed accounts.

I have 2 "charge off" accounts for child support. As I've talked about in other posts I got the amount forgiven with a hardship claim.

The balance is about $1700. It only says derog on TU. It say that on the account itself when you click on the account. If I look at other areas of my report that say derogs, (that would be if you had a late payment or charge off) It says congrats you don't have any derogs in your report. This is why I'm so confused as to weather it counts or not.

I'm at 4/24 right now with cards.

I've been using my chase freedom a lot and paying it off to hopefully show use in hopes of a CLI at 6 months. It's my daily driver that always gets paid to 0. I have put all of my organic spending on it to hopefully show use. I am staying at 4/24 in hopes of a CLI with chase. From what I've gathered they won't give you a CLI if your at or over 5/24. Is that right?

Question is about scorecards is, what scorecard would I be in and how does an old child support chargeoff count towards clean or dirty scorecard. I read the scorecard post trying to understand and I never found an answer about child support. Especially since in my rare situation it's showing as a charge off.

I applied for a hardship and they basically have it as a charge off. It says owed- settled but still has a balance remaining. I believe TU is the only one that says derog. The others show owing but current, pay on time.

One is set to fall off on 3/21, the other is set to fall off 6/22. I got TU to remove one of them that was going to fall off. But isn't child support not considered in fico scoring or is it? I hear some people say yes and some say it's not supposed to. I guess when they fall off completely I'll find out if they were factored in or not.

Basically I'm asking what score card that would put me in. I honestly don't feel the child support is holding my score down but idk.

Also it's from 2013 and I know over time it counts less toward your score. I honestly feel like it's helping the age of oldest account because prior to the child support thing I have never had a revolver, ever. I just started with credit about 10 months ago now.

Basically my goals for the short term future is to get a CLI with chase. I don't even know how I got approved with less than a year of revolving credit except for I bank with them and I saw pre-approved in credit journey, so I applied and they said that I would have to wait for a decision, and I logged into my chase account a few days later and the card was there. I thought I wasn't going to get approved.

I know that cards with chase with a low SL may or may not grow like you hope. That's why I'm trying to show spending to hopefully warrant an increase. My other cards besides synchrony and chase I keep the balance below $30 which would be less than 10%. I have small reoccurring changes on them and don't use them for anything else. I got them to build my credit only and pay them off every month. If I want to do AZEO I will obviously have all at zero except a small amount reporting on one the capital one card every month.

For the longer term my goals would be to be able to finance a vehicle and buy a house within a few years. The vehicle might be sooner than later because I really need a wheelchair van for my disabled toddler.

With that said it brings me to a question about credit mix. I have no loans at all, Ever. I can't get into navy or any of those type of places where you need military affiliation. I live in Washington state. From what I've gathered the best way is to do a loan is to do an SSL and pay it down to below 8.9% for however many years it's for to optimize fico score. Since I have no loans would it make sense for me to get a credit builder loan and if I can't pay it down to 8.9%? because from what I've read it's extremely hard to find a place for an SSL that lets you pay it down right away. What if I just pay on it normal? Would that help my score over time with the credit mix portion? Or am I missing something with this info and should check at my local credit unions and ask if they have any of those or does anyone know of a place for me to get an actual SSL that doesn't require military affiliation?

Would I, or should I even worry about doing any type of ask or credit builder loan if I plan on getting a vehicle loan probably this year sometime?

I've read hundreds and hundreds of posts on here trying to gather as much info as I can. Since this is my first time I don't want to make too many mistakes and hope to have great credit for once in my life to meet those goals.

Is it true that I should get one more bank card revolver? Or 2 if your counting actual bank cards and not store cards? Obviously not right now as I'm holding out for chase but isn't 5 considered where one should be to not be a thin file?

If you need any more info please let me know and I also wanted to ask if you guys need data points from my situation, what should I keep track of? I would love to be able to help contribute with all of the amazing work you guys are doing. Just need to know what to keep track of.

I know that was probably too much info so to recap my questions.

Does chase require you be be under 5/24 for a CLI? Will they approve you for an auto CLI if your over 5/24?

What scorecard would I be in with child support showing as a charge off no other derogs? Does that put me into a dirty scorecard?

Should I eventually get 5 bank card revolvers to not be considered a thin file?

I have my eye on a few goal cards once I get a better score and my accounts age a little. And also holding out for chase so not before I hope to get that CLI.

If I get my score up to get a few of my goal cards, should I get them before score card reassignment meaning new accounts to no new accounts if I have a good enough score to get my goal cards?

Since I know I'll probably be getting a vehicle loan within the year, do I even bother with trying to get a SSL or credit builder loan to help with mix portion?

Is there a place to get one that actually allows you to pay it down to 8.9% or under and it extends the payment date to months/years in the future? That doesn't require military affiliation? And one that you can do for a shorter amount of time not 5 years. I don't have $3000 to put into a loan.

If there is no place to get a SSL and pay it down right away to 8.9% would I benefit from a short term credit builder loan like 1 year and pay it down regularly month by month? Or does that not actually help with credit mix and optimizing fico score?

Do I even bother with a SSL or credit builder loan if I plan to get a vehicle loan?

Will that help satisfy the credit mix portion?

Are there any specific data point that I could keep track of to help out? If so what?

I'm super curious to know what scorecard I'm in and if child support charge off is actually affecting my score. Like if It will go up once it falls off completely. When it does, my oldest card would be almost 2 years old. I am wonder how that drop off in age will affect my score as well.

Thanks for all of your help and please let me know if you need any more information or if I left anything out. I know I'm all over the place but I have had all of these questions for a while now and hoping to not have to spread out all the info. Thanks so much

@Anonymous you've got quite a lot there so I may miss something, but I'm gonna go try to answer it.

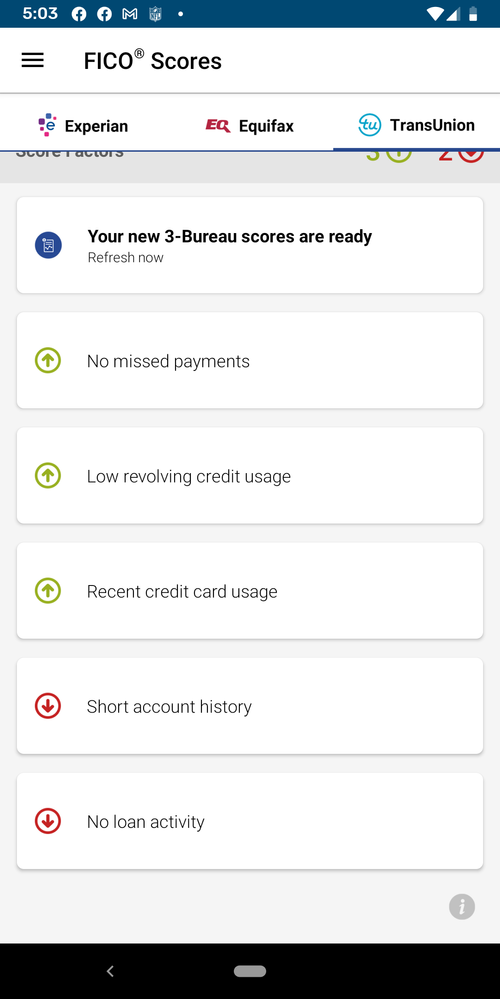

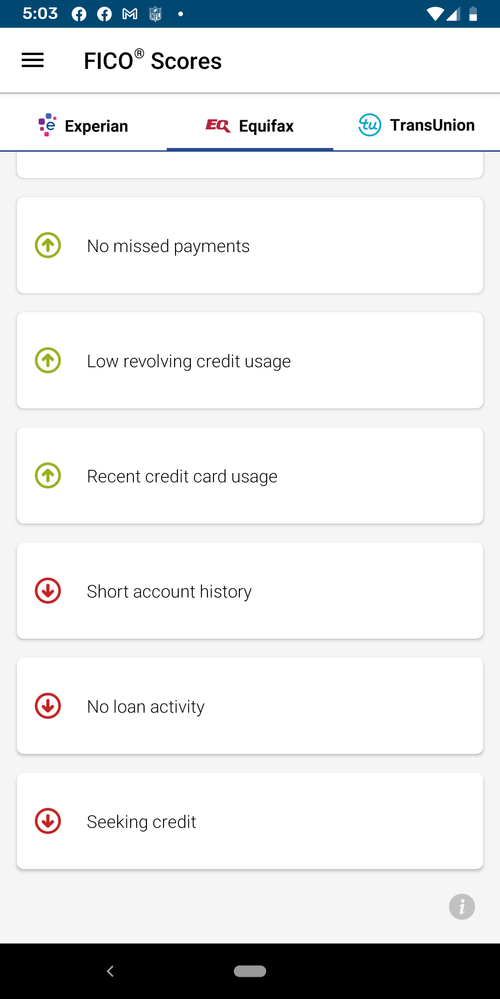

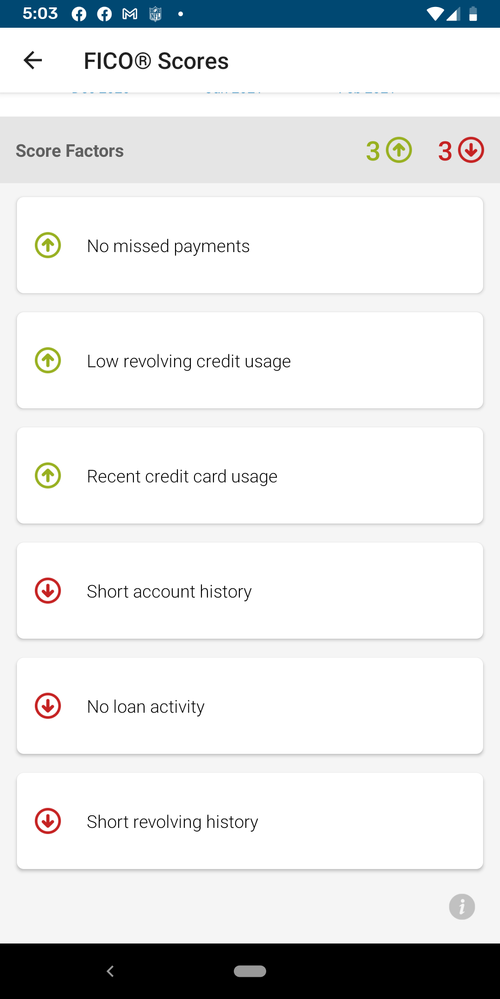

OK give us your negative Reason Codes from all three bureaus even the old ones and that will help us determine what scorecard you're in. And if you have it for all versions provide it for all versions please.

The 5/24 rule is aimed at new accounts not CLIs, but I'm sure they do consider how many accounts have been opened recently in making their determination and it also impacts your scores as well, so...

also we need to know exactly how that account is reporting. You need to access your reports from annualcreditreport.com.

auto CLIs from Chase are very rare, but showing spend is the only thing you can really do to warrant it and it will help even if you have to initiate it yourself. Yes the relationship probably helped with getting the card. AZEO is best to maximize your score, but when you get ready to go for the CLI, be sure to use a bankcard.

there are plenty of credit unions that offer loans that would qualify to be used with the SSL strategy. Whether or not that makes sense for you depends on whether or not the lender that's going to give your your auto loan uses version 8/9 or whether they use the old versions. Yes the SSL strategy increases your score on 8/9, but not the old scores, not really.

So if you have a lender that's going to use 8/9 it might make sense to execute that strategy ahead of time to get your score up for the car loan. But if they use the old scores then it's not really worth doing. Once you get the car loan the first loan will be obsolete.

I recommend 5 to 7 revolvers. 5 is fine. I recommend you read the Scoring Primer linked at the top of my signature to learn more.

getting an MF subscription may be a wise idea if you've got these credit plans, so you can monitor your scores.

it's better to wait till you're in a no new account scorecard, so you have a higher score.

yes it will still help you if you just get a loan and pay it off organically. But you maximize version 8/9 when you pay it under 9.5%.

by the way there are links and information on some institutions that may help you execute the SSL strategy should you choose to do so. Good luck.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Scorecard question & score improvement unique situation help

@Anonymous Re: chase cli

There were reports by several people a few months ago that chase was denying cli for being over 5/24, this started during COVID so not sure if it still applies and if it does when/if chase will loosen up.

Completely agree about auto cli, my oldest chase card is almost 7 years old and I have never received a cli from them.

@Anonymous I personally would not bother with a SSL/credit building loan if you are planning on getting a car loan in the near future since your score is in the low 700s you should be able to get a decent rate. I am sure others will disagree with me on this but I if I was you I would just garden until your car loan.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Scorecard question & score improvement unique situation help

@dragontears wrote:@Anonymous Re: chase cli

There were reports by several people a few months ago that chase was denying cli for being over 5/24, this started during COVID so not sure if it still applies and if it does when/if chase will loosen up.

Completely agree about auto cli, my oldest chase card is almost 7 years old and I have never received a cli from them.

@Anonymous I personally would not bother with a SSL/credit building loan if you are planning on getting a car loan in the near future since your score is in the low 700s you should be able to get a decent rate. I am sure others will disagree with me on this but I if I was you I would just garden until your car loan.

@dragontears Good information about the CLIs! thank you!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Scorecard question & score improvement unique situation help

@Anonymous thanks so much for answering all of my millions of questions. I figured it might be easier than to ask all of these separately and then had to give this info over and over, the long post scars people off, so thank you for taking the time.

The problem with anual credit report.com is when I get to the Equifax part, it asks the security questions about a car loan I have never had, and therefore I get the info wrong so I can't get into EQ on anual credit but I can LOG onto EQ directly. I wish I could just use my log in instead of answering those questions because I have never had any type of loan and therefore can't answer the questions. Ugh

Ok where do I find these reason codes? I can go try it now and just screenshot it and put it here. Thanks for your help I appreciate it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Scorecard question & score improvement unique situation help

Reason codes, in the form of reason statements, come with your scores if your particular FICO source provides them. In the case of Experian, they give re-phrased reason statements in the "What's hurting/harming your score?" fields.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Scorecard question & score improvement unique situation help

@Anonymous wrote:@Anonymous thanks so much for answering all of my millions of questions. I figured it might be easier than to ask all of these separately and then had to give this info over and over, the long post scars people off, so thank you for taking the time.

The problem with anual credit report.com is when I get to the Equifax part, it asks the security questions about a car loan I have never had, and therefore I get the info wrong so I can't get into EQ on anual credit but I can LOG onto EQ directly. I wish I could just use my log in instead of answering those questions because I have never had any type of loan and therefore can't answer the questions. Ugh

Ok where do I find these reason codes? I can go try it now and just screenshot it and put it here. Thanks for your help I appreciate it.

@Anonymous you're very welcome and it may be the longest post I've dealt with other than my own LOL.

you need to go to LEXIS-NEXIS and pull your full file disclosure now. They are another credit reporting agency that focuses on other types of information. This is where the questions are likely being drawn to verify your identity.

So you need to pull that report and you need to have that information corrected. Otherwise you might find yourself trying to renew your tag, dealing with the DMV, anything, and end up with the same questions.

@Slabenstein answered about the negative Reason Codes.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Scorecard question & score improvement unique situation help

@Anonymous I realize I may have missed a couple of your questions so I wanted to discuss a little further. First off I'm pretty sure the child support accounts are counting for your age of accounts. I'll reserve my comments on its effects until we have the negative Reason Codes.

next, as far as Credit mix is concerned, all accounts are believed to count towards thick/thin, so if you were in a clean card, you would likely be thick now because of the child support. When it drops (if you have not added any more accounts), it could make you thin which could cause you to lose points, which would be independent of any points gained for it's negativity, if it's being counted as a negative.

The deal is the number bankcards affects your base score. The ideal number is not known. The store card still helps your number of accounts with a balance metric. I recommend 5 to 7 revolvers to optimize this metric. Personally I do not recommend store cards unless they make economic sense to you.

I will say this, you said you have plans for a vehicle and mortgage in a few years. Well, when those child support accounts drop, you will go into a young Scorecard (you would be in a mature Scorecard now if clean.)

When your oldest account, which is now 10 months old turns 2 years old, most people experience a drop in mortgage scores, as they switch from young to mature Scorecard on that version.

Therefore in 14 months, you will likely lose some mortgage points. You will gain them back. It's also nice to go an extended period of time without any new accounts or inquiries for getting a mortgage. From recent data points, maybe at least 18 months optimally, if not longer.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Scorecard question & score improvement unique situation help

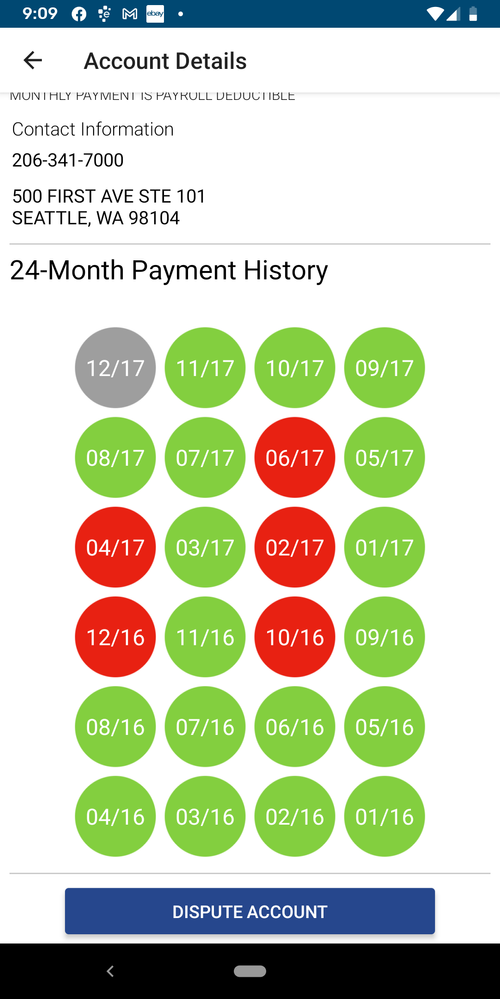

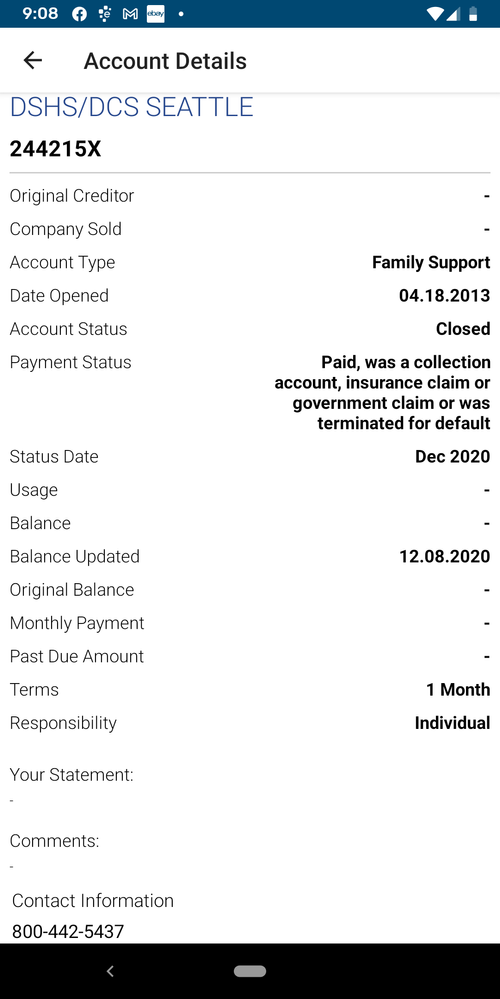

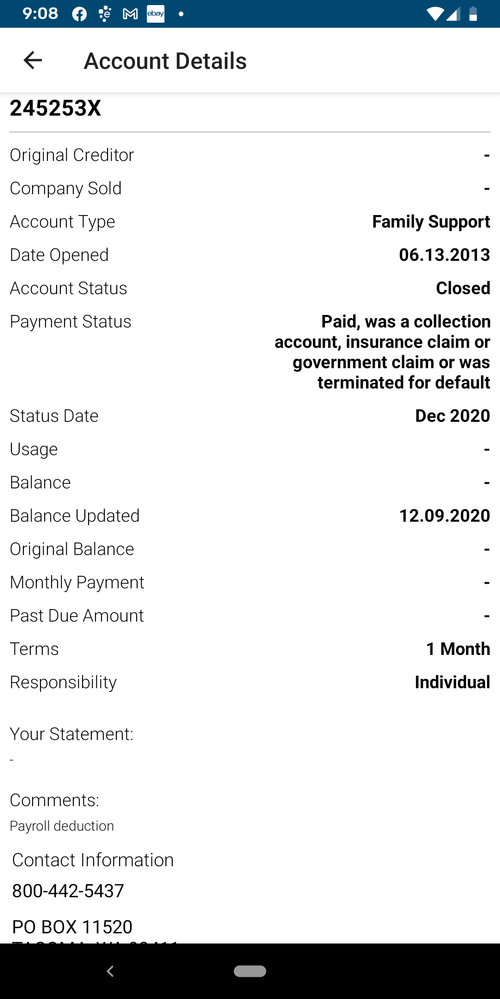

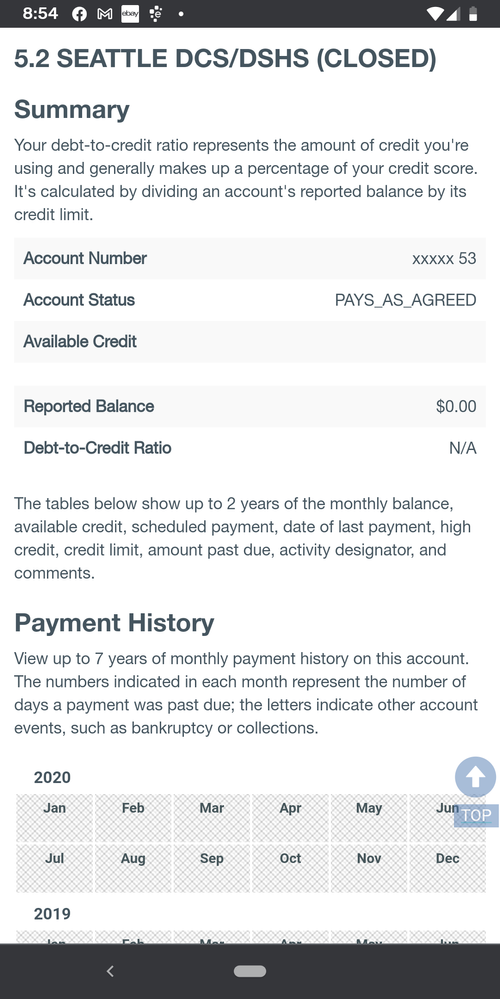

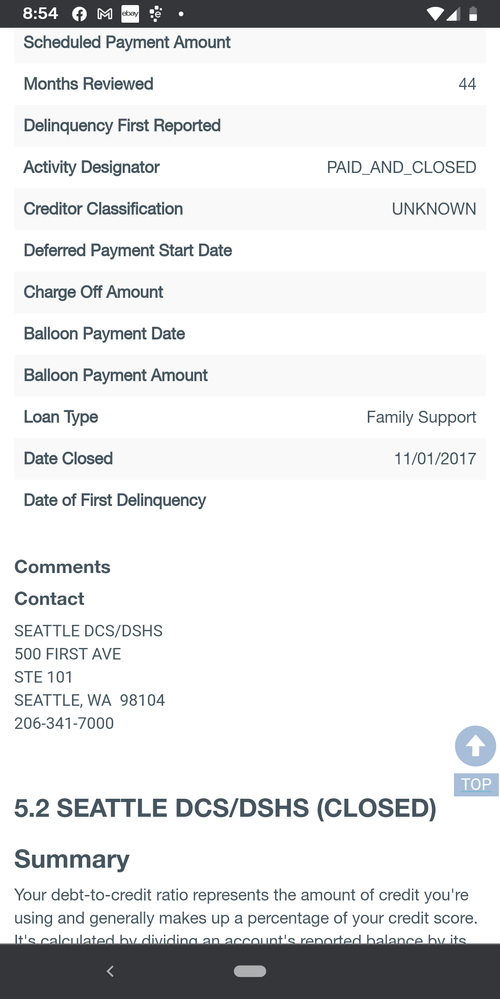

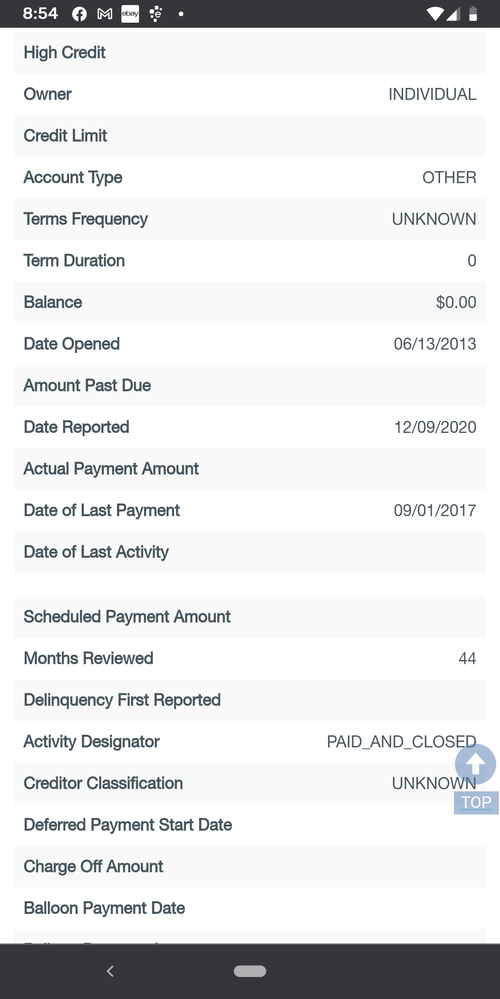

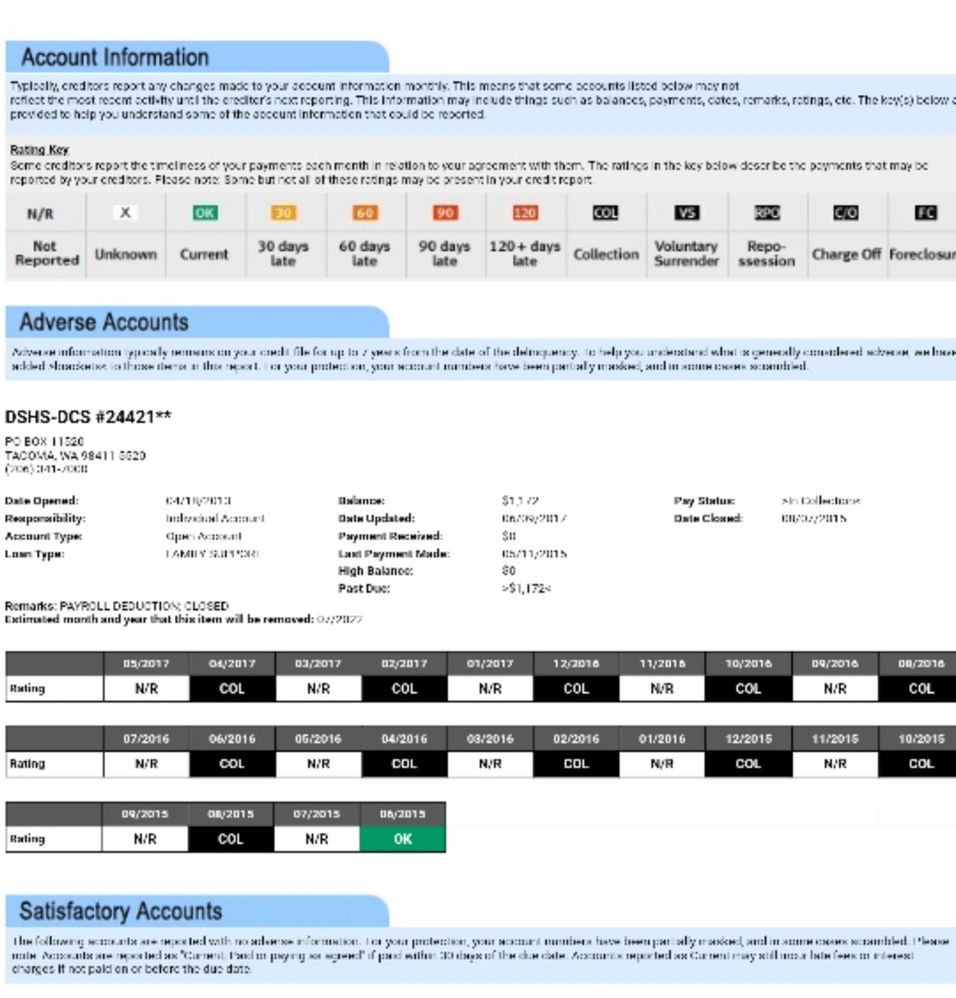

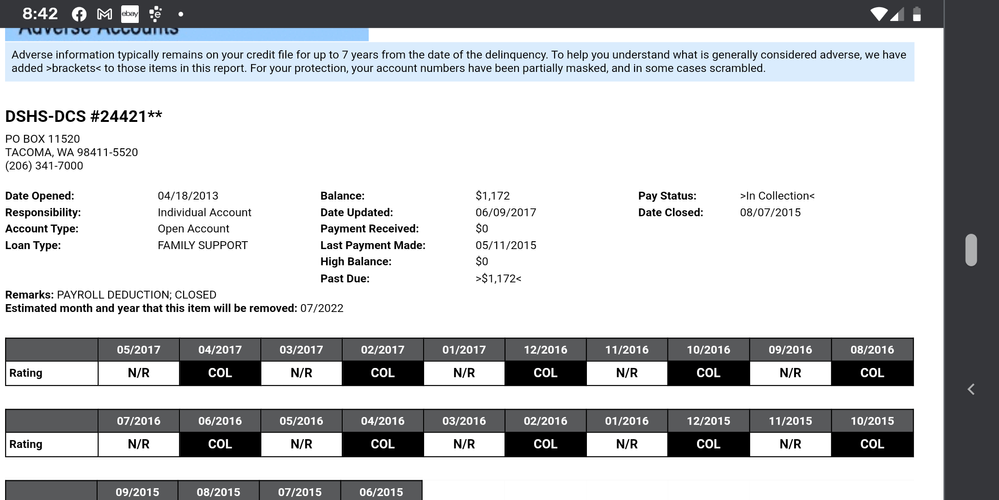

@Anonymous hey sorry I took so long to get back. Well this time when I pulled all 3 credit reports from anual credit I was able to answer all of the questions correctly and I screen shot all 3 of them, the whole thing. Lol but as far as negative reason codes, I see those on my experian, Equifax, transunion, but I don't think I saw any on the anual credit report.

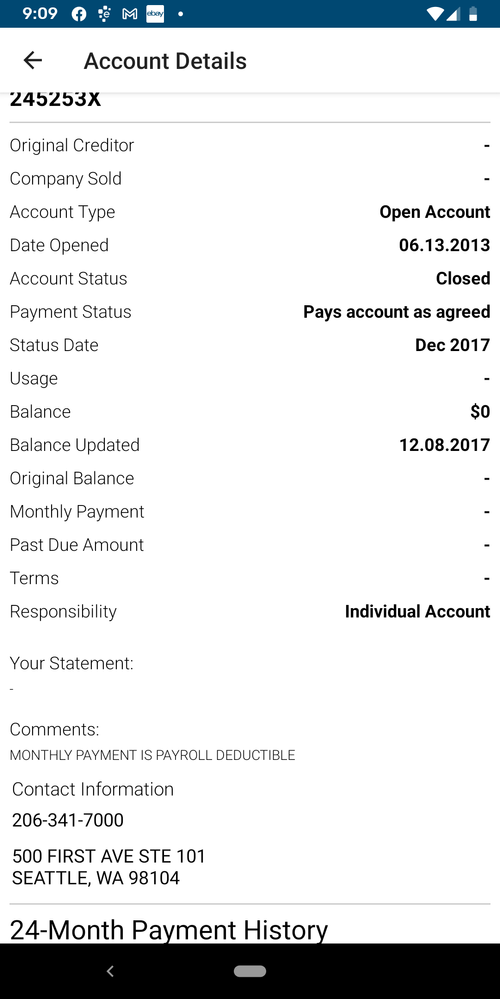

Yes the child support is helping my age of credit. Idk if it's hurting me but I feel like I'm going to take a huge dip in score when they do drop off. Because then the longest card I will have will then be 2 years old. So sorry if I sound redundant here, but I looked carefully on anual credit and didn't see score codes. But I see them on Experian very easily. Are those the ones you need? I'll upload what I have and show you what the child support looks like. Which shows multiple 120 days late. I'll show you what I have and then hopefully you can tell me if this is what you need. When I looked through each credit report on annual credit report I didn't see any reason codes anywhere. 😩 Thanks for your help! Also for some reason on Feb 1st my credit score jumped to 724 which I'm not sure why but I'm not complaining. Next month my oldest card will be 1 year old.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Scorecard question & score improvement unique situation help

Most of what I’m looking at says paid as agreed even though there are delinquencies in the payment grid. It’s my belief that the penalty comes from the data field, not the grid, and this seems to support that.

If these were being counted negatively against you, your negative reason codes should show “serious delinquency” and I do not see that in the negative reason codes. Do you have any from EQ/TU?

And the last screenshot shows in collection but there doesn’t appear to be a corresponding collection account. And it does not say chargeoff or a number of days late.

Also are those from the various different versions of Experian?