- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Scoring impact from max-out of single card?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Scoring impact from max-out of single card?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Scoring impact from max-out of single card?

I'm looking for some data here if anyone has it. Has anyone with a clean file and aggregate utilization ideal gone from their highest individual card at < 8.9% utilization to maxed-out or vice versa? I'm looking to get an idea of the scoring impact in going from ideal utilization to worst case utilization on a single card. It's important to rule out aggregate utilization as being a variable here though, so before/after aggregate utilization must stay below 8.9% to isolate the single card.

While I'm looking for a maxed out individual card here, if you have the score change associated with a single card moving to a high percentage that's not maxed out and have the score change associated with that it would be fine to share as well.

The best I have is going from my highest utilization card being < 8.9% to 59% where aggregate utilization moved from ~3% to ~5% and I saw FICO 8 score changes of 7, 5 and 8 points. This was before I had 850 scores, so there was no buffer possibility at play. Unfortunately now I cannot do any further testing due to top end buffer.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Scoring impact from max-out of single card?

My HELOC is currently costing me around 15-20 points on EX FICO 2, will have a better datapoint for you later on that front.

Dirty file I lost 7 points /yawn.

A few people have tested over time it's just not a big deal.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Scoring impact from max-out of single card?

What is the utilization % on your HELOC? As I recall you mention that is being counted as a revolving account for you on Fico 8 - yes? Also, do you still have a PLOC that is counting as a revolving account?

Assuming UT is quite high on the HELOC, that may negate potential score impact for the token card reporting a > 90% UT test. If one account already is reporting a high UT%, adding a 2nd one may be inconsequential unless it significantly impacts aggregate UT%.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Scoring impact from max-out of single card?

@Anonymous wrote:

The best I have is going from my highest utilization card being < 8.9% to 59% where aggregate utilization moved from ~3% to ~5% and I saw FICO 8 score changes of 7, 5 and 8 points. This was before I had 850 scores, so there was no buffer possibility at play. Unfortunately now I cannot do any further testing due to top end buffer.

Actually, if you have access to BCE scores that are not maxed out, then cause/effect testing is still viable. Industry option algorithms utilize their classic counterpart as a base. Besides, some creditors actually use industry option scores.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Scoring impact from max-out of single card?

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Scoring impact from max-out of single card?

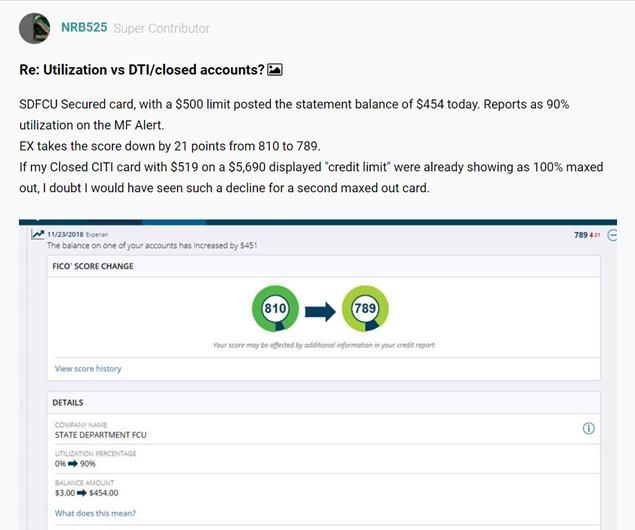

No, I had not been following the thread but, like the data point. I assume you are referring to the below which shows a 21 point drop maxing out a card (90%) utilization that was previously at 0%. I suspect your next highest card was already above 29% so your point loss potentially could have been a bit higher.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Scoring impact from max-out of single card?

@Thomas_Thumb wrote:What is the utilization % on your HELOC? As I recall you mention that is being counted as a revolving account for you on Fico 8 - yes? Also, do you still have a PLOC that is counting as a revolving account?

Assuming UT is quite high on the HELOC, that may negate potential score impact for the token card reporting a > 90% UT test. If one account already is reporting a high UT%, adding a 2nd one may be inconsequential unless it significantly impacts aggregate UT%. Ye

Ye of little faith ![]() . I'm not a scoring idiot haha.

. I'm not a scoring idiot haha.

You're right currently it's at 95% reported; however, with DCU's reporting it's going to at not much come the end of this month and the HOA fee wouldn't land till the month after with how DCU reports. It would be clean.

And no, the PLOC counts as a revolving account under FICO 8 both for revolving activity and limits but the HELOC does not.

The HELOC utilization matters at least on the following scores: EX FICO 2, EX FICO 3, TU FICO 4, and it doesn't appear to on EQ FICO 5 but I'm not 100% certain on that one, just it doesn't factor on reason codes but it might just be pushed off the table.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Scoring impact from max-out of single card?

Yes, the series started with a card at 33%, one at 50+. Adding the 90+ reduced scores to

EQ 793 TU 806 EX 789

After everything went to 20% max:

EQ 832 TU 839 EX 840

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Scoring impact from max-out of single card?

So then, the first answer here is a 21 point drop on an obviously clean file. Looking forward to hearing a few more, if possible.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Scoring impact from max-out of single card?

@NRB525 wrote:Yes, the series started with a card at 33%, one at +50%.

Then adding the 90% reduced scores to:

EQ 793 TU 806 EX 789 - Then, after these cards went to less than 20% max:

EQ 832 TU 839 EX 840

EQ +39 TU +33 EX +51

So, if I am reading your data correctly, Going from one card over 50% UT plus a 2nd card in max out territory (90%) to no cards over 20% may have gained you 25 to 35 points depending on CRA. Additional point gains likely relating to aging. Aggregate utilization maintained in the 4% to 5% range for both cases?

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950