- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Significant top end buffer increase?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Significant top end buffer increase?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Significant top end buffer increase?

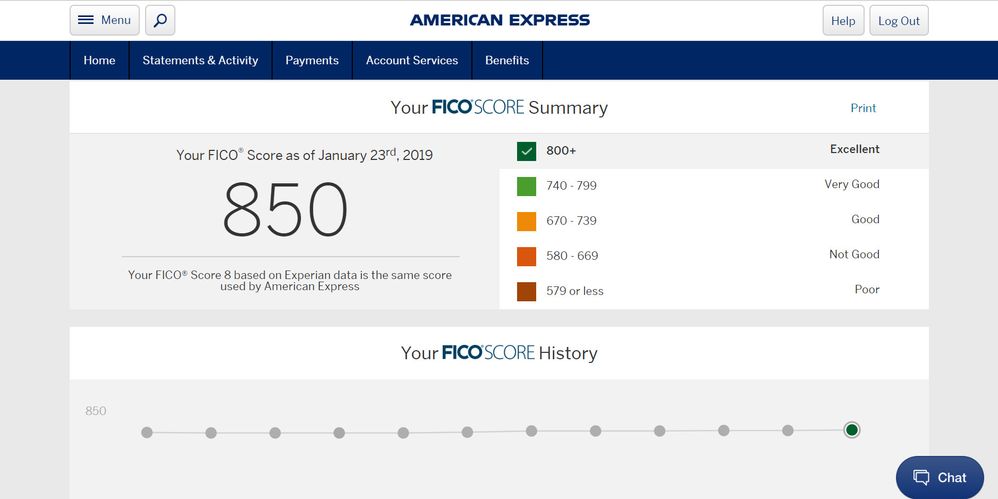

Congrats BBS! Logged into Amex tonight and noticed the 850. Always close, but the planets must of finally lined up.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Significant top end buffer increase?

@Anonymous wrote:Is it possible there’s an 18 month AoYA threshold?

Possible sure. I know some scoring models will give you age of accounts too low reason statements (or similar ones) for AoYA under 2 years and I think TT said it may be possible to see one even at 3-5 years, although at that point I wouldn't expect the scoring impact to be significant. 24 months though I think could be noteworthy, although I doubt it would be as big as the typical 15-20 points seen at the reaching of 12 months, or we would have heard from people on this forum about it. It's possible that at the mid-point of 18 months some points could be seen, but again I wouldn't expect it to be the 16 or so that I'm looking for here.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Significant top end buffer increase?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Significant top end buffer increase?

Who really knows...

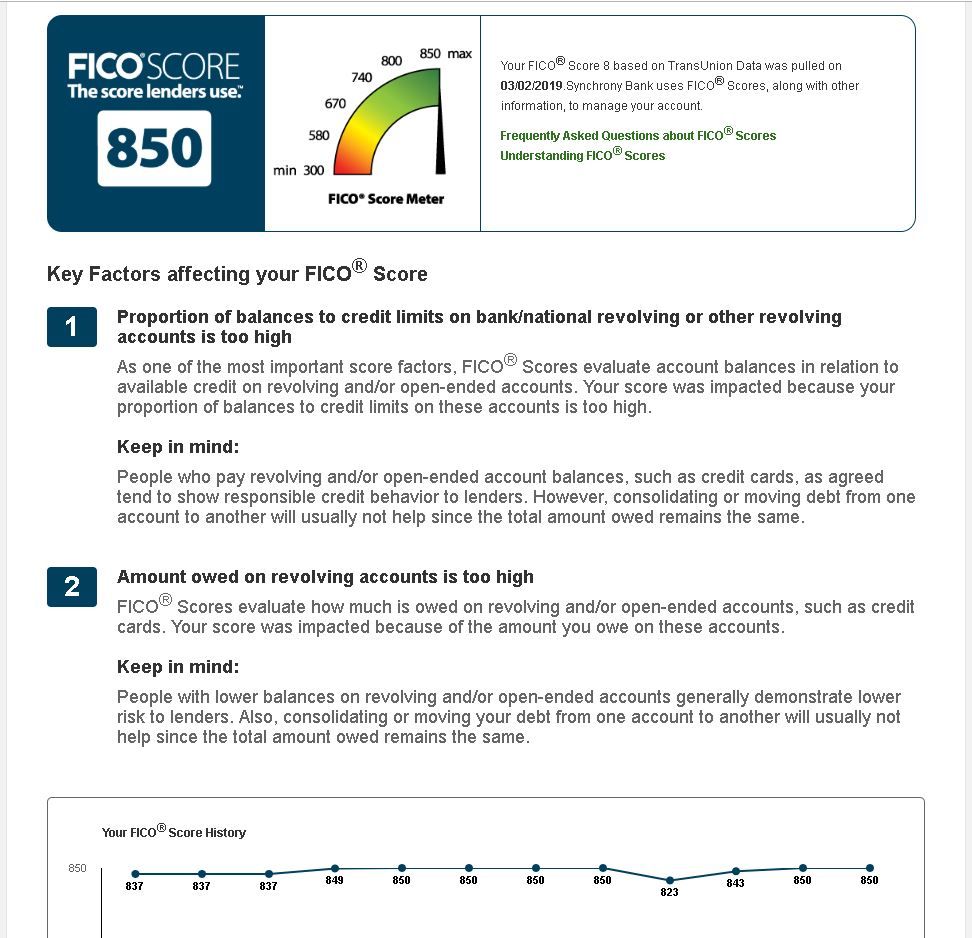

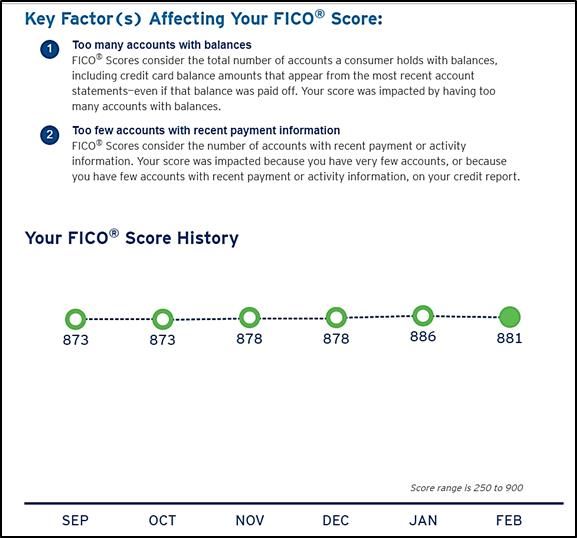

On my 850, they are showing items that are affecting my score.... Really ? ?

CSP 29.9k, Citi DP 58.5k, Chase Sams MC 20k, Amex Hilton Surpass 35.6k, Hawaii Air 26k, Discover More 56k, Chase SWA 3.5k, WF PLOC 30k, B of A Visa 63.3k, Wells Plat Visa 8.3k, RC Willey 5k, Pen Fed Visa 50k, Pen Fed PLOC 25k, Lowes 25k, CSR 28.8k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Significant top end buffer increase?

@Anonymous wrote:

@Anonymous wrote:Is it possible there’s an 18 month AoYA threshold?

Possible sure. I know some scoring models will give you age of accounts too low reason statements (or similar ones) for AoYA under 2 years and I think TT said it may be possible to see one even at 3-5 years, although at that point I wouldn't expect the scoring impact to be significant. 24 months though I think could be noteworthy, although I doubt it would be as big as the typical 15-20 points seen at the reaching of 12 months, or we would have heard from people on this forum about it. It's possible that at the mid-point of 18 months some points could be seen, but again I wouldn't expect it to be the 16 or so that I'm looking for here.

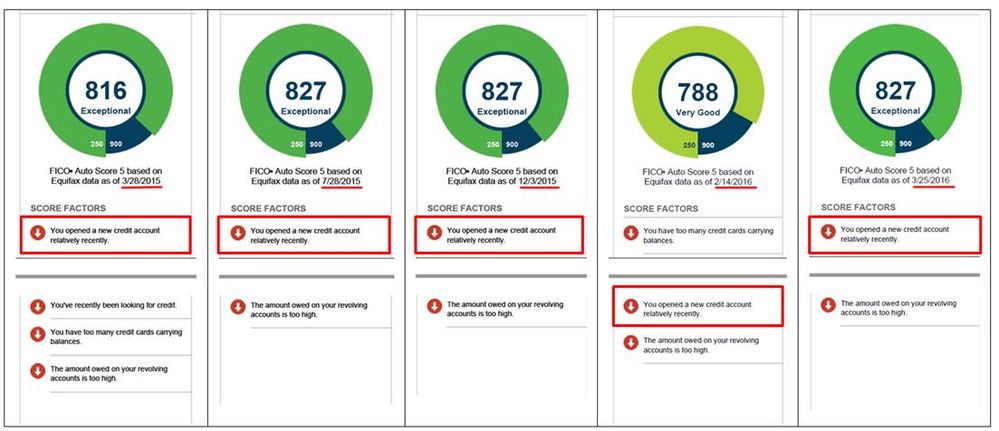

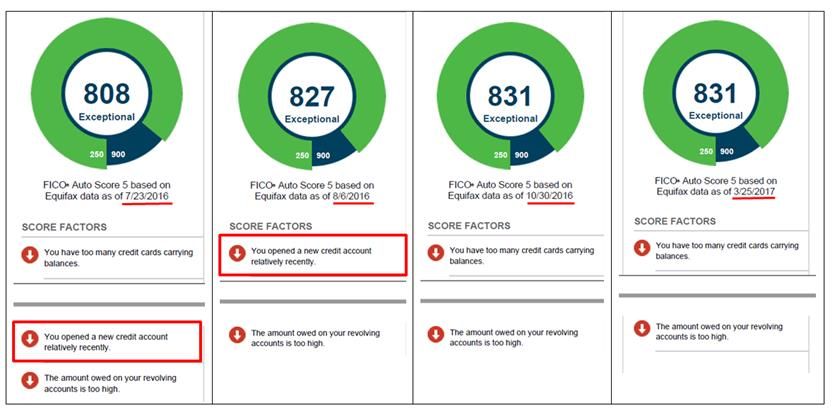

The "new account relatively recently" disappeared as a negative reason statement on my reports at exactly 5 years. It was either the 2nd ranked or top ranked negative statement on all my EQ score reports from 3/2015 thru 8/2016. It did not show up on any reports from 10/2016 onward - Note: my most recent account reached 5 years 9/2016.

Remaining "relatively recently" impact on score at 4 to 5 years under 5 points - IMO.

Since my lone EQ INQ for a CLI aged to 12 months in December, I'm back to the same two reason statements on EQ BCE.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Significant top end buffer increase?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Significant top end buffer increase?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Significant top end buffer increase?

The only scores I have regular access to are my FICO 8's and then EQ BCE 8 and TU FICO 4, simply because I get them through my accounts. It wasn't until very recently (whenever I started that 28 scores thread) that I ever acquired my full list of FICO scores. So, unfortunately I have no other [score] basis of comparision against that TU FICO 8 score. I do know that the 2 negative reason statements that I see with my TU FICO 4 score have nothing to do with revolving credit use, as both point to length of time accounts have been established. Those codes have been the same for probably a solid year.

Birdman, it's possible to receive the negative reason statement of "too many accounts with a balance" if someone has just 2 accounts with a balance... one being a revolver and one being a loan. I've seen it personally on my profile. I do not believe the impact here is much at all and it's honestly more of a filler statement. By dropping either of those accounts to a $0 balance (to achieve 1 less account with a balance) I'd be taking a larger penalty for "no revolving credit use" or "no recent installment loan information."

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Significant top end buffer increase?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Significant top end buffer increase?

BBS where are you getting your TU 04 score regularly?