- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: So you pay your car loan in full ...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

So you pay your car loan in full ...

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: So you pay your car loan in full ...

Bear in mind that a "bad" installment utilization of 91% hurts you far less than a bad CC utilization of 91%. So the FICO 8 model already takes into account a lot of what you are saying.

Also bear in mind that there's some evidence that certain kinds of loans can garner the full IU scoring bonus when the loan is paid down to 68% (and is 25+ months old). Those would be mortgage loans -- which it appears FICO correctly scores with the awareness that having paid down your house to 68% is a much stronger mark in your favor than having paid down your car to that same amount.

Regardless, the statisticians behind FICO 8 had access to a ton of data in creating that model (far more than you or I do) and apparently people who had open installment debt that was mostly paid off really were less risky than those with no open debt or open debt on which most of the original balance was still owed.

I am hoping, however, that future models will do a better job at analyzing payment records of a person who has had multi-year closed loans with no lates.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: So you pay your car loan in full ...

Just ticked that as I took a car loan out in Oct. 2017 and now over 1 year of perfect payment history my loan balance is just under 81% of loan amount and I still see the "loan balances too high!" in the negative comments on my Fico scores.

Negative reason statements simply mean that you're losing 1 or more FICO point due to the presence of whatever that statement points to. A loan with a balance at 9.1% of the original amount can still generate this negative reason statement, where once it hits 8.9% it would go away.

There are a bunch of fluff negative reason statements... some people see "too many inquiries" when they have 1. Tons of people see "too many accounts with balances" and they only have 2 accounts with balances... AZEO on their revolvers and then their one installment loan by default will have a balance.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: So you pay your car loan in full ...

@Anonymous wrote:There are a bunch of fluff negative reason statements... some people see "too many inquiries" when they have 1. Tons of people see "too many accounts with balances" and they only have 2 accounts with balances... AZEO on their revolvers and then their one installment loan by default will have a balance.

Contributors Thomas Thumb and iv have both pointed the following out, but it is worth mentioning occasionally. And that is that, when viewed as elements of a single score improving strategy, two negative reason statements can be in tension with one another, even though both are still true.

A good example are (a) "number of accounts reporting a balance" vs. (b) "all revolving accounts reporting $0" vs. (c) "No open installment accounts."

The only way in FICO 8 to get a perfect amount of scoring points from (a) is to have zero accounts reporting a balance. But if you did that, then you would get a scoring penalty for (b) and (c). So, when trying to optimize your score, you end up needing exactly two accounts reporting a balance (a true credit card and a loan) since the benefit from having a mostly paid off loan and from avoiding the All Zero Cards penalty is far greater than from getting a perfect number of points from (a).

Nonetheless FICO 8 will correctly say that such a strategy (with exactly two accounts) does involve a scoring penalty from (a).

That seems weird at first, until we realize that it happens all the time in life. A father has to balance the desire to make more money vs. spend time with the kids. It will always be true that if he made another 10k a year that he could provide a little bit better for his kid (better school, better food, better medical care, more trips to Europe, etc.) and so it will always be true that his report card should always say that his kid would be better off if he made more money. But in order to chase the "perfect" score from being a good provider he'll have to spend almost all his time at the office, and therefore be a far worse father.

FICO models typically do a pretty good job at eliminating the tensions between reason statements. I.e. if you get a reason statement A, you can often fix it perfectly without resulting in hurting B. The non-FICO models used by the insurance industry have much more frequent tension between reason statements.

But even in FICO models there is the example I gave above, and the obvious examples of the tradeoff between Account Age and Inquiries vs. Profile Thickness. In the short to medium term, if you try to address the penalties associated with having only 1-2 accounts, you will take penalties related to Age. And if you try to just garden with only 1-2 accounts, you will take penalties with respect to having too few accounts. There are other examples as well.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: So you pay your car loan in full ...

Very good points and post above.

In summary, I'd say it's essentially impossible for anyone to eliminate all negative reason codes at the same time. Lots of CMS front-end summary software opts to eliminate negative reason codes once you get to a certain score (say 800), but that doesn't mean they aren't still there. The good news is that these opposing/conflicting reason statements can often only be adversely impacting your profile just a couple of points and with the build in top-end buffer on many scoring models once can still achieve a "perfect" score even with the presence of a negative reason statement or two.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: So you pay your car loan in full ...

@Anonymous wrote:

@Anonymous wrote:There are a bunch of fluff negative reason statements... some people see "too many inquiries" when they have 1. Tons of people see "too many accounts with balances" and they only have 2 accounts with balances... AZEO on their revolvers and then their one installment loan by default will have a balance.

The only way in FICO 8 to get a perfect amount of scoring points from (a) is to have zero accounts reporting a balance. But if you did that, then you would get a scoring penalty for (b) and (c). So, when trying to optimize your score, you end up needing exactly two accounts reporting a balance (a true credit card and a loan) since the benefit from having a mostly paid off loan and from avoiding the All Zero Cards penalty is far greater than from getting a perfect number of points from (a).

Nonetheless FICO 8 will correctly say that such a strategy (with exactly two accounts) does involve a scoring penalty from (a).

FICO models typically do a pretty good job at eliminating the tensions between reason statements. I.e. if you get a reason statement A, you can often fix it perfectly without resulting in hurting B. The non-FICO models used by the insurance industry have much more frequent tension between reason statements.

But even in FICO models there is the example I gave above, and the obvious examples of the tradeoff between Account Age and Inquiries vs. Profile Thickness. In the short to medium term, if you try to address the penalties associated with having only 1-2 accounts, you will take penalties related to Age. And if you try to just garden with only 1-2 accounts, you will take penalties with respect to having too few accounts. There are other examples as well.

The older Fico models appear to have less conflict between scoring factors and don't penalize the way Fico 8 does for lack of open loans. Fico 8 took a step backward in this regard.

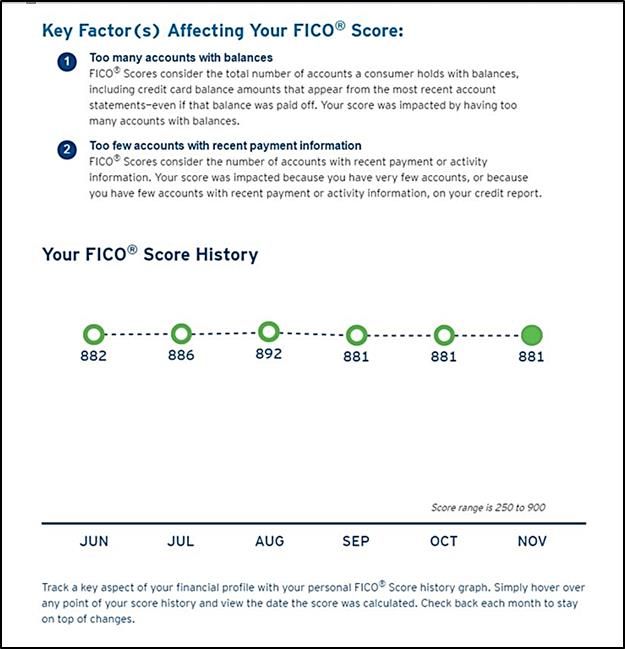

I get boxed in by the following reason statements which appear to oppose one another. I get the same two reasons every month on EQ BCE Fico 8 when I don't have a recent inquiry on file. Perhaps I could partially address this by using all my cards and adopting AZEO. [I allow charges to post on statements and then PIF statement balances to take advantage of float time]

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: So you pay your car loan in full ...

@Thomas_Thumb wrote:

@Anonymous wrote:

@Anonymous wrote:There are a bunch of fluff negative reason statements... some people see "too many inquiries" when they have 1. Tons of people see "too many accounts with balances" and they only have 2 accounts with balances... AZEO on their revolvers and then their one installment loan by default will have a balance.

The only way in FICO 8 to get a perfect amount of scoring points from (a) is to have zero accounts reporting a balance. But if you did that, then you would get a scoring penalty for (b) and (c). So, when trying to optimize your score, you end up needing exactly two accounts reporting a balance (a true credit card and a loan) since the benefit from having a mostly paid off loan and from avoiding the All Zero Cards penalty is far greater than from getting a perfect number of points from (a).

Nonetheless FICO 8 will correctly say that such a strategy (with exactly two accounts) does involve a scoring penalty from (a).

FICO models typically do a pretty good job at eliminating the tensions between reason statements. I.e. if you get a reason statement A, you can often fix it perfectly without resulting in hurting B. The non-FICO models used by the insurance industry have much more frequent tension between reason statements.

But even in FICO models there is the example I gave above, and the obvious examples of the tradeoff between Account Age and Inquiries vs. Profile Thickness. In the short to medium term, if you try to address the penalties associated with having only 1-2 accounts, you will take penalties related to Age. And if you try to just garden with only 1-2 accounts, you will take penalties with respect to having too few accounts. There are other examples as well.

The older Fico models appear to have less conflict between scoring factors and don't penalize the way Fico 8 does for lack of open loans. Fico 8 took a step backward in this regard. [I allow charges to post on statements and then PIF statement balances to take advantage of float time]

I get boxed in by the following reason statements which appear to oppose one another. I get the same two reasons every month 0n EQ BCE Fico 8 when I don't have a recent inquiry on file. Perhaps I could partially address this by using all my cards and adopting AZEO.

That's a pretty funny graphic ![]()

Total revolving limits 586020 (520820 reporting) FICO 8: EQ 694 TU 696 EX 683

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: So you pay your car loan in full ...

Too few accounts with recent payment information?

That's a negative reason statement I've never seen on my profile. TT, what exactly is causing that. I know you don't follow AZEO and take advantage of the float benefit on your accounts, so it would seem to me that the majority of your accounts would have monthly payment information? Am I missing something incredibly obvious here? I also imagine your 881 BCE score there would probably bump up to 900 if you were go drop to AZEO... is that the case? I'm sure you've tested that at one point or another.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: So you pay your car loan in full ...

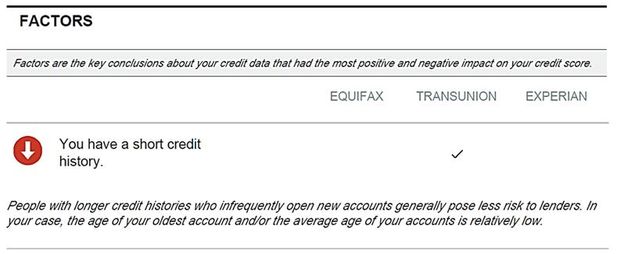

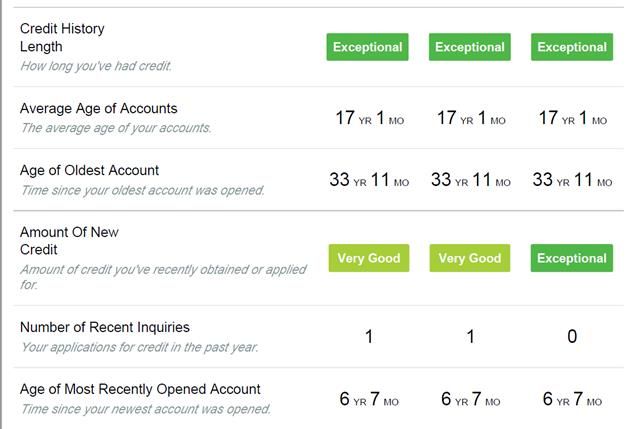

Here is a better one - short credit history? [Got this for Fico Auto "5, 4, 2" on 3B report]. Note: - one account is an open 15 yr mortgage that was 12 years old when report was pulled.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: So you pay your car loan in full ...

@Anonymous wrote:Too few accounts with recent payment information?

That's a negative reason statement I've never seen on my profile. TT, what exactly is causing that. I know you don't follow AZEO and take advantage of the float benefit on your accounts, so it would seem to me that the majority of your accounts would have monthly payment information? Am I missing something incredibly obvious here? I also imagine your 881 BCE score there would probably bump up to 900 if you were go drop to AZEO... is that the case? I'm sure you've tested that at one point or another.

I've never been able to get rid of that reason statement but, I've never been down to AZEO. Lowest I've been AZE2 (AU card + one personal card). I have reached 900 on TU and EX at AZE2 and AZE3 but, never been above 892 on EQ. As I have mentioned, EQ is more skitish toward cards reporting balances - true for all Fico models (except perhaps Fico 9 which eliminated most CRA tweaking).

P.S. This should be my Senior post.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: So you pay your car loan in full ...

@successmatters wrote:and Experian takes 21pts? So paying your car loans and or other loans off is not a good thing to Experian.

It is what it is unfortunately but you can get your points back (and perhaps more) by opening a SSL and paying it down to 8%. CU's are the place to look with NFCU being the best we know of at the moment. Local CU's mught be an option if NFCU is unavailable.

Biz |

Current F08 -

Current 2,4,5 -

Current F09 -

No PG Biz Credit in Order of Approval - Uline, Quill, Grainger, SupplyWorks, MSC, Amsterdam, Citi Tractor Supply Rev .8k, NewEgg Net 30 10k, Richelieu 2k, Wurth Supply 2k, Global Ind 2k, Sam's Club Store 11.k, Shell Fleet 19.5k, Citi Exxon 2.5k, Dell Biz Revolving $15k, B&H Photo, $5k