- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Some light reading for the FICO nerds. Number of c...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Some light reading for the FICO nerds. Number of cards reporting DPs: 80% to AZEO in 20% increments.

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Some light reading for the FICO nerds. Number of cards reporting DPs: 80% to AZEO in 20% increme

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Some light reading for the FICO nerds. Number of cards reporting DPs: 80% to AZEO in 20% increme

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Some light reading for the FICO nerds. Number of cards reporting DPs: 80% to AZEO in 20% increme

@Anonymous wrote:

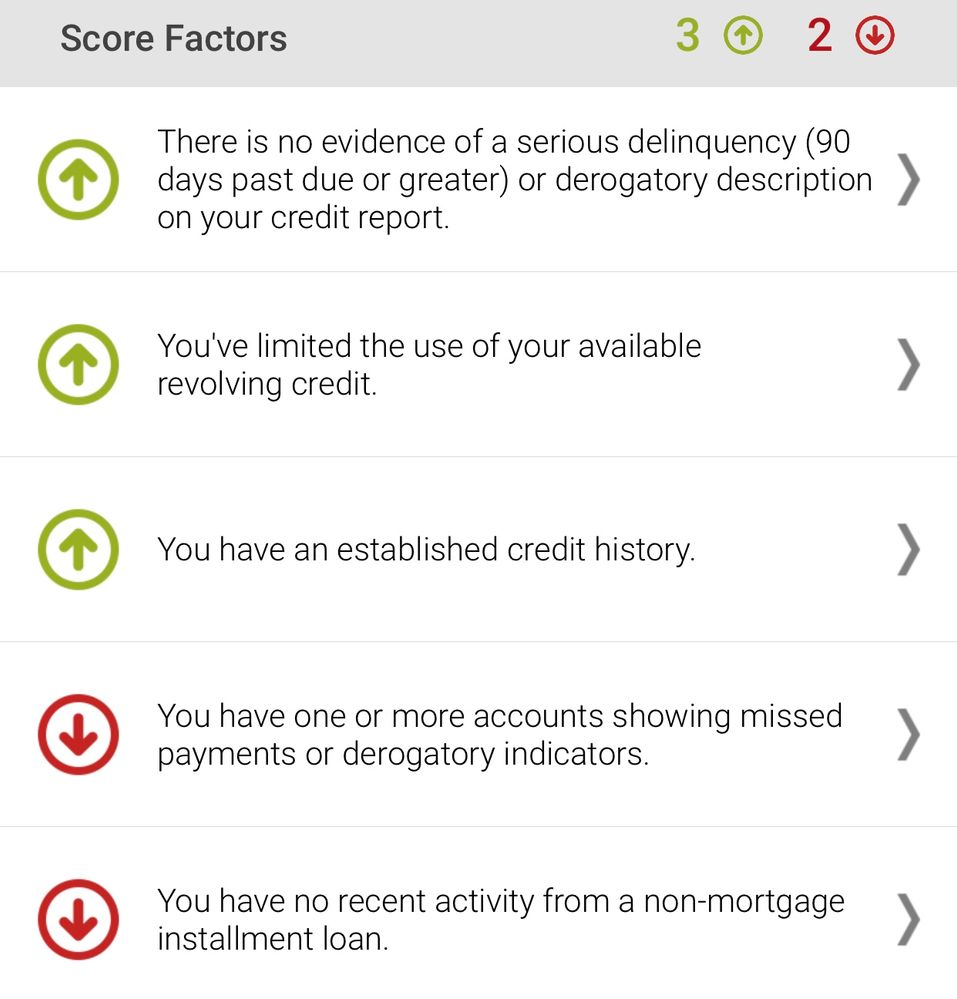

I bet you did see a nice increase. Can you tell me what your negative reason codes are now?

FICO 8 Sep '23 EX 755 EQ 765 TU 739

TCL $199,800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Some light reading for the FICO nerds. Number of cards reporting DPs: 80% to AZEO in 20% increme

@Ficoproblems247 wrote:

@SouthJamaica wrote:

Thanks for the neat data points. I found it interesting.

In my profile FICO 2 reacts abruptly (around 11 points) when I increase or decrease number of accounts with balances at certain thresholds. I wonder if the difference might be that you're in a different scorecard due to having some late payments.

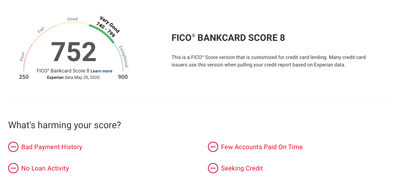

I'm also surprised Bankcard 8 reacted so differently than Classic 8.

I take it you're on a clean scorecard. I am actually surprised my scores are as decent as they are, as I have 28 30 day lates, and 6 60 day lates reporting. Also, no open installment either (3 paid auto loans, and 1 paid mortgage however.) I am just now beginning to really explore the different scoring models a bit more. I wish I could test the other bureaus on a daily basis like I can with EX. I know I could do more drawn out experiments with monthly reporting on the others, but then you have to factor in changes with aging and the like that seem to come around the 1st of every month. Tracking this one was just so clean cut and easy to do as it was all throughout one month. Also, I've just rounded off my rebuilding phase, and am now in just the building phase, so new accounts are going to be the norm as quickly as I can without being a risky borrower/aggressive credit seeker, although I only have 4 more goal cards. Having such a comprehensive understanding of FICO scoring is a huge advantage. I understand that score is certainly not the end all in lending decisions, however if you have mastered what factors increase that actual number, chances are that those same factors are also playing for the most part the same considerations (albeit in different forms of algorithms) in the bank's internal scoring/decision making.

Yes but I never cared for the terminology 'clean' and 'dirty' and never use it.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Some light reading for the FICO nerds. Number of cards reporting DPs: 80% to AZEO in 20% increme

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Some light reading for the FICO nerds. Number of cards reporting DPs: 80% to AZEO in 20% increme

@Ficoproblems247 wrote:

@Anonymous wrote:

I bet you did see a nice increase. Can you tell me what your negative reason codes are now?

I wish we could get decent reason codes, meaning at least 4 for version 8.

Do you have a MF subscription? If you do, you can get 4 reason codes for TransUnion usually when you have a score change. I would be very interested in seeing your third and fourth codes.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Some light reading for the FICO nerds. Number of cards reporting DPs: 80% to AZEO in 20% increme

@Anonymous wrote:I wish we could get decent reason codes, meaning at least 4 for version 8.

Do you have a MF subscription? If you do, you can get 4 reason codes for TransUnion usually when you have a score change. I would be very interested in seeing your third and fourth codes.

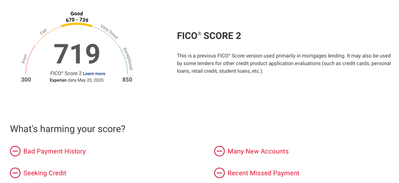

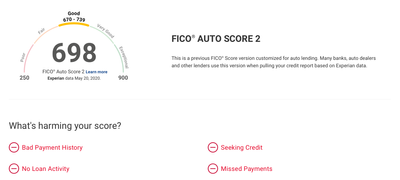

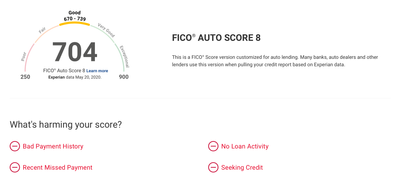

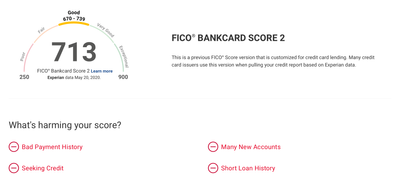

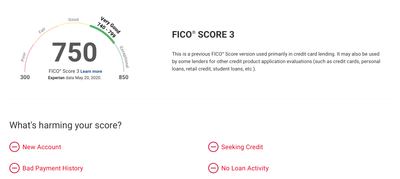

I keep tossing around the idea. With the EX trial offer available to use consecutively, it's hard to justify an additional $40/month for extra scores for 2 bureaus. I may have to try it for a few months, just to see where everything is at. Here are the reason codes for the other scores, they all have 4.

FICO 8 Sep '23 EX 755 EQ 765 TU 739

TCL $199,800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Some light reading for the FICO nerds. Number of cards reporting DPs: 80% to AZEO in 20% increme

@Anonymous wrote:

@SouthJamaicaOut of curiosity what terminology do you prefer?

Well, I have never given it a thought, and have no talent or training in branding, but:

Perfect Payment vs Imperfect Payment

Never Late vs Some Late

Always on Time vs Not Always on Time

Straight Payments vs Missed Payments

Clean vs Spotted

Clean vs Spotty

Consistent vs Sporadic

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Some light reading for the FICO nerds. Number of cards reporting DPs: 80% to AZEO in 20% increme

@Anonymous wrote:

@SouthJamaicaOut of curiosity what terminology do you prefer?

Spotless vs Blemished? ![]()

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Some light reading for the FICO nerds. Number of cards reporting DPs: 80% to AZEO in 20% increme

Thank you @Ficoproblems247 . That is helpful. @Revelate check it out. (post 10 and 17)

@SouthJamaica 😂😂😂👍