- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Started Using Upgraded Amazon Prime Visa - Sco...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Started Using Upgraded Amazon Prime Visa - Score Jumped 18 Points

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Started Using Upgraded Amazon Prime Visa - Score Jumped 18 Points

@JLK93 wrote:

You mentioned 2 student loans. Are these loans still open?

Yes. Both are still open:

- Loan #1: Original Loan Amt $4,616.29 Current Balance $3,738.70

- Loan #2: Original Loan Amt $13,331.64 Current Balance $10,796.66

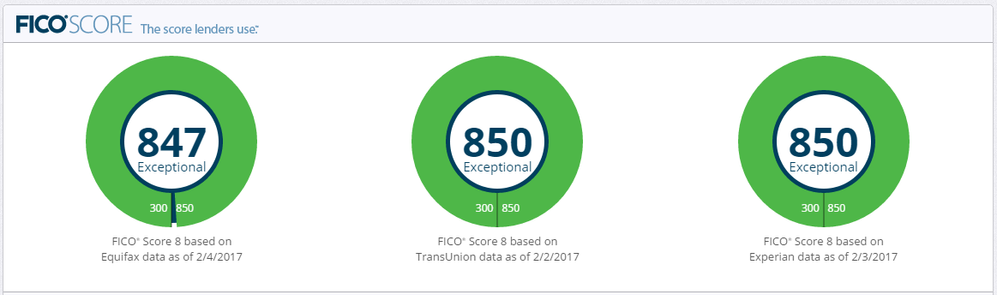

EX myFICO 850 - EQ myFICO 850 - TU myFICO 850

Goal Score: 800+ across the board! *DONE!!!*

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Started Using Upgraded Amazon Prime Visa - Score Jumped 18 Points

@gamegrrl wrote:

@JLK93 wrote:You mentioned 2 student loans. Are these loans still open?

Yes. Both are still open:

- Loan #1: Original Loan Amt $4,616.29 Current Balance $3,738.70

- Loan #2: Original Loan Amt $13,331.64 Current Balance $10,796.66

Thanks gamegrrl.

What we need is the calculations to be done with all of the loans, including the student loans and the heloc.

And, all of the loans including the student loans but excluding the heloc.

You've already provided most of the data. If you provide the original and amounts remaining for the heloc we can make the calculations.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Started Using Upgraded Amazon Prime Visa - Score Jumped 18 Points

I've been updating my "data post" on page 4 of this thread with all the numbers so that they're all in one place. Here's the HELOC info.

- HELOC balance ($52,713.57) is 0.915 of credit limit ($57,600.00)

EX myFICO 850 - EQ myFICO 850 - TU myFICO 850

Goal Score: 800+ across the board! *DONE!!!*

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Started Using Upgraded Amazon Prime Visa - Score Jumped 18 Points

gamegrrl:

I think you did pass 2 thresholds.

(1) Youngest account aging to 1 year. I'm fairly certain this is the first threshold

(2) There are 2 possibilities for the second threshold.

A. With your HELOC included I calculate that you have 80% remaining on your loans. 80% is a major threshold for mortgage loans. Other posters have had their scores increase to 850 when passing the 80% threshold for mortgage loans. If your HELOC is being scored as a mortgage loan, and the aggregate balance of the loans is also being scored according to mortgage loan scoring rules, this would be a major threshold for an 850 score. Of course, no one knows for sure how HELOC loans are scored. And, the remaining balance should be slightly under 80%. So, maybe I made some slight miscalculation.

B. The 2nd possibility for the 2nd threshold would be if the HELOC is not being included in the overall loan utilization. I calculate that your remaining balances are slightly above 70% with the HELOC excluded. Once again, no one knows how HELOCs are scored. So, If I made a slight miscalculation and your remaing balance is under 70%, this could be the second threshold. I think this is the less likely possibility. If your HELOC is not being scored as a mortgage it is difficult to explaing your 835 Experian score prior to the recent increases.

It is curious that the 2 calculated remaining balances are so close to known thresholds. The first calculation of a remaining balance of 80% is extremely close.

It more I think about it it, I believe the HELOC is being scored as a mortgage. That seems to be the most realistic explanation of your previously elevated scores and the current 850 scores.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Started Using Upgraded Amazon Prime Visa - Score Jumped 18 Points

JLK93: This is fascinating! Thank you for the work you've put in on this.

I'll just keep doing what I'm doing and not open any new accounts. It would sure be cool if I could get those last five remaining points on EQ!

EX myFICO 850 - EQ myFICO 850 - TU myFICO 850

Goal Score: 800+ across the board! *DONE!!!*

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Started Using Upgraded Amazon Prime Visa - Score Jumped 18 Points

gamegrrl,

It is curious that your scores were already so high before the recent increases. It is unusal to have scores in the 830s without a mortgage loan. This is especially true with the youngest account less than 1 year old. Generally, without a mortgage loan, it is unusuall to have FICO scores above the approximately 815 with youngest account less than 1 year old. This leads me to believe that your HELOC is being scored as a mortgage loan. It think that is why your scores were already elevated.

If I am correct, the fact that your overall balances were under 95% could be the cause of your previously elevated scores. It seems that your overall loans may have been scored according to mortgage loan scoring rules. Of course, this is partially speculation.

It is also possible that your HELOC at 91.5% was the cause of your previously elevated scores. No one knows for sure the exact thresholds for mortgage loans or how they are scored in aggregate. It is possible that a mortgage loan, on its own, could have a scoring impact independent from other loans.

In any event, it will be interesting to see what happens with your EQ score. I suspect that it will go to 850 very soon.

You have provided us with some great data.

Congratulations of your scores!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Started Using Upgraded Amazon Prime Visa - Score Jumped 18 Points

I pulled a 3B credit report here at MyFICO on Dec 15, 2016. I just looked at it, and the HELOC has a "Loan Type" of Mortgage on the TU report, and on EX and EQ, it's listed as a Line of Credit under Revolving and Open Ended Accounts.

[Edited to Add: I was getting ready to log out and thought I would look at my dashboard again. EQ went up two points, so I'm now three little points away from a trifecta!]

EX myFICO 850 - EQ myFICO 850 - TU myFICO 850

Goal Score: 800+ across the board! *DONE!!!*

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Started Using Upgraded Amazon Prime Visa - Score Jumped 18 Points

@gamegrrl wrote:I pulled a 3B credit report here at MyFICO on Dec 15, 2016. I just looked at it, and the HELOC has a "Loan Type" of Mortgage on the TU report, and on EX and EQ, it's listed as a Line of Credit under Revolving and Open Ended Accounts.

[Edited to Add: I was getting ready to log out and thought I would look at my dashboard again. EQ went up two points, so I'm now three little points away from a trifecta!]

Congratulation on getting 2 points closer to your goal!

Unfortunately, how the HELOC is listed on myFICO is meaningless as to how it is being scored by FICO.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Started Using Upgraded Amazon Prime Visa - Score Jumped 18 Points

Well phooey!!!

EX myFICO 850 - EQ myFICO 850 - TU myFICO 850

Goal Score: 800+ across the board! *DONE!!!*