- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Strange FICO

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Strange FICO

2 months ago my TU FICO was 740 (both Barclays and Discover). Then I applied for a credit card.

I didn't get my score last month.

So, now my TU FICO score 9 days ago was: 740 (Discover). I applied for 2 more credit cards (4 and 2 days ago).

Now today, my TU FICO score is: 740 (Barclays).

It just seems strange, is all...

TU-8: 804 EX-8: 805 EQ-8: 788 EX-98: 767 EQ-04: 752

TU-9 Bankcard: 837 EQ-9: 823 EX-9 Bankcard: 837

Total $443,800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Strange FICO

Do you have a thick file?

Reason I ask is because I've had that happen and in some cases after new apps have seen my scores go up

Have you done your research of the CC?

Does it fit your spending?

Do you have a plan for the bonus w/o going into debt?

Can you afford the AF?

Do you know the cards benefits? Is it worth the HP?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Strange FICO

@myjourney wrote:Do you have a thick file?

Reason I ask is because I've had that happen and in some cases after new apps have seen my scores go up

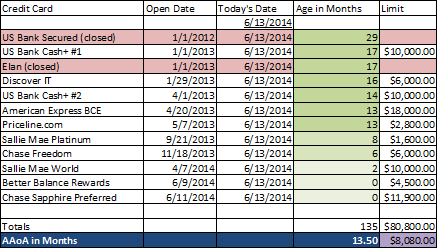

Perhaps that is best answered in the form of... a Spreadsheet!

Hmm, AAoA is wrong, should be 11.25

TU-8: 804 EX-8: 805 EQ-8: 788 EX-98: 767 EQ-04: 752

TU-9 Bankcard: 837 EQ-9: 823 EX-9 Bankcard: 837

Total $443,800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Strange FICO

@Themanwhocan wrote:

@myjourney wrote:Do you have a thick file?

Reason I ask is because I've had that happen and in some cases after new apps have seen my scores go up

Perhaps that is best answered in the form of... a Spreadsheet!

Hmm, AAoA is wrong, should be 11.25

Wow that's interesting then with that amount of new credit in slightly over 2 years ....I'll admit I'm stumped

I guess its that old saying ....Don't look a gift horse in the mouth Lol

Congrats on the new BofA card ...it has blue in it I see Lol

Have you done your research of the CC?

Does it fit your spending?

Do you have a plan for the bonus w/o going into debt?

Can you afford the AF?

Do you know the cards benefits? Is it worth the HP?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Strange FICO

Anecdotally I only take a drop in my FICO from a new tradeline when I cross an AAOA boundary.

No boundary, no drop.

In your case, going from 13 to 11 months with those new cards, is still way under the 24 months minimum (may be 23.X not certain how that rounding works as I got a squirrley datapoint in my own analysis) and as such your AAOA defaults to 1 year in either case. Ergo, no change, no drop.

This is from someone though who never has much in the way of reported balances so neither my utilization changes, nor does it throw off the calculation on number of tradelines reporting a balance as I always put what lipstick I can before I apply and usually my cards initially report a $0 balance.

As such to sum up the 4 things in my and others' experience which cause changes in scores for a new tradeline reporting, discounting inquiries for the moment:

- AAOA changing, either positively (Amex backdating) or the typical negatively across a breakpoint.

- If you see a change in aggregate utilization over a breakpoint as a result of the new CL's, you may get a score increase (or decrease if you're trying to max out that new tradeline in the first month and it first reports w/high balance... it happens)

- If you carry balances on a couple cards, and you get a new $0 tradeline, that may be a scoreboost.

- Likewise if you carry balances on a couple of cards and you get a new card which first reports a balance, you may see a score drop.

My own thread detailing a change in AAOA and taking a score drop, vs. other accounts reporting and not taking a hit with a FICO 8 score:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Strange FICO

@Themanwhocan wrote:2 months ago my TU FICO was 740 (both Barclays and Discover). Then I applied for a credit card.

I didn't get my score last month.

So, now my TU FICO score 9 days ago was: 740 (Discover). I applied for 2 more credit cards (4 and 2 days ago).

Now today, my TU FICO score is: 740 (Barclays).

It just seems strange, is all...

Well i had a somewhat strange occurrance was only minor bump , but before i appled for CSP last month my score was 804, and after i took double HP, which included TU, I got an slight bump to 807

EX Fico 804 11/16/16 Fako 800 Credit.com 11/16/16

EQ SW bank enhanced 11/16/16 839 CK fako 822 11/16/16

TU Fico discover 10/19/16 814 Fako 819 Creditkarma 11/16/16

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Strange FICO

An inquiry is never a positive in the FICO algorithm though it can be zero points lost. Something else occurred between updates.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Strange FICO

@Revelate wrote:An inquiry is never a positive in the FICO algorithm though it can be zero points lost. Something else occurred between updates.

I am not sure , i think my util may have been really really low like .01% and that counted negatively. it was back up to 3.5 % when i got bump . I just thought it was weird with an HP my score didn't go down

EX Fico 804 11/16/16 Fako 800 Credit.com 11/16/16

EQ SW bank enhanced 11/16/16 839 CK fako 822 11/16/16

TU Fico discover 10/19/16 814 Fako 819 Creditkarma 11/16/16

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Strange FICO

I did get a couple of small SP CLI, which increased the two Cash+ cards to $10,000 each. Which Transunion considers to mean they are "Premium Bankcard Account"'s.

So 2+ months ago I had one Premium bankcard, and by getting a $10,000 limit Sallie, and then 1 month later getting 2 more via CLI, I did go from 1 to 4 such accounts (4 of my 8 active accounts). Then the 2 accounts added this week made it 5 of 10 active accounts are Premium. For whatever that is worth...

Does FICO place a premium on the number of Premium Bankcards? I guess thats a good question...

TU-8: 804 EX-8: 805 EQ-8: 788 EX-98: 767 EQ-04: 752

TU-9 Bankcard: 837 EQ-9: 823 EX-9 Bankcard: 837

Total $443,800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Strange FICO

@Themanwhocan wrote:2 months ago my TU FICO was 740 (both Barclays and Discover). Then I applied for a credit card.

I didn't get my score last month.

So, now my TU FICO score 9 days ago was: 740 (Discover). I applied for 2 more credit cards (4 and 2 days ago).

Now today, my TU FICO score is: 740 (Barclays).

It just seems strange, is all...

Had your new cards even reported at the time Barclays FICO score was pulled.

Walmart, Discover and DCU always do a soft pull a few days before they provide the FICO score. I don't have Barclays, but I would think that they do they same thing.