- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Study: AAoA / Oldest Account and max FICO scor...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Study: AAoA and max FICO score (Forum Survey)

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Study: AAoA / Oldest Account and max FICO score Survey

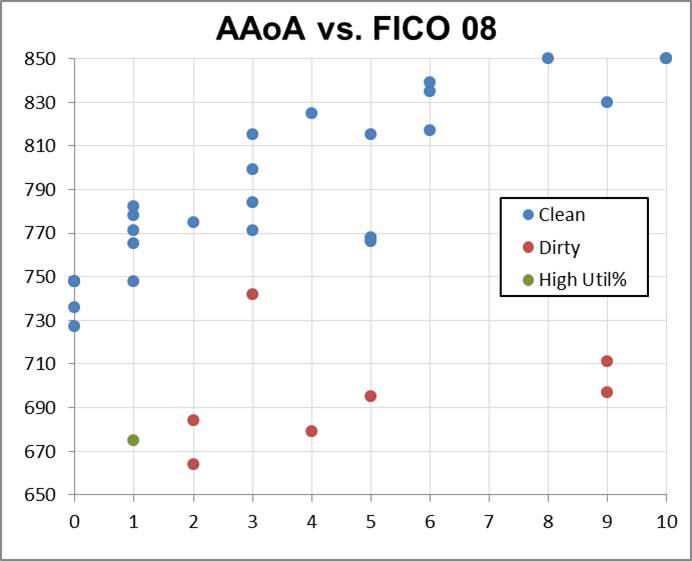

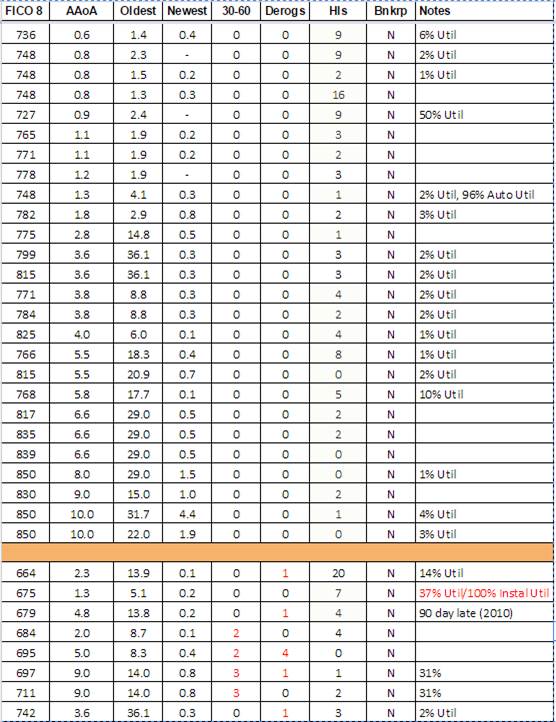

@olehammer wrote:Updated 2/22 16:00

Summary

- Maximums by AAoA: <1 year: 748, 1 year: 771, 2 year: 775, 3 year: 784, 4 year: 825

- 675 lowest clean file impacted by Util of 37%. Data suggests potential for large score bump when brought below 9%.

- 800+ has required minimum AAoA of 3 years

This is a interesting chart and I see a lot of potential feedback.

Some AAoA feed back, but no really definitive.

What I see here is:

1. The value of having an old open credit card. Seems this is a point maker.

2. Low CC utilization, obviously a point maximizer

3. Three or less Hard pulls, this would have between 6-10 point hit, if more than 45 days apart.

4. Looks like with a clean report, 2 years of AAoA, and one 2 year old CC, possible to break 760, which would qualify for best interest rates on loans or cards.

Would be interested to see:

1. Who has active installment loan and at what UTI of the loan it is. An active installment loan that is mostly paid can be worth 20 to 30 points, which is enough to skew the AAoA feed back. In opposing relation an active installment with high amounts owed would reduce score 10-20 points.

Here are my thoughts. Not that I think you should recreate the wheel. What you have has plenty of feedback. Just a refinement, now that there is enough info on your chart that can be analysed. Below I am sort of guessing with the derogatory tradelines less and more than 4 years old. All of them are point reducers, but thinking perhaps those that are older than four years old might illuminate the difference in point reduction since most drop off report in seven years.

Critria:

1. Current FICO8 score

2. Current AAoA in years

3. Oldest open/active credit card in years

4. Youngest open/active credit card in years

5. Total credit card utilization in percentage

6. Amount of open/active installment loans

7. Total combined installment loan utilization in percentage

8. Total amount of Hard inquiries less than 1 year old

9. Number of derogs less than 4 years old (any derogatory 30-60 days late, collection, bankruptcy)

10. Number of derogs more than 4 years old (any derogatory 30-60 days late, collection, bankruptcy)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Study: AAoA / Oldest Account and max FICO score Survey

Would be interested to see:

1. Who has active installment loan and at what UTI of the loan it is. An active installment loan that is mostly paid can be worth 20 to 30 points, which is enough to skew the AAoA feed back. In opposing relation an active installment with high amounts owed would reduce score 10-20 points.

I do. Currently showing a balance of $22 on an original amount of $2050. It's paid and will soon report as such. I expect a drop in my scores in the 25 point range.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Study: AAoA / Oldest Account and max FICO score Survey

@Anonymous wrote:Would be interested to see:

1. Who has active installment loan and at what UTI of the loan it is. An active installment loan that is mostly paid can be worth 20 to 30 points, which is enough to skew the AAoA feed back. In opposing relation an active installment with high amounts owed would reduce score 10-20 points.

I do. Currently showing a balance of $22 on an original amount of $2050. It's paid and will soon report as such. I expect a drop in my scores in the 25 point range.

Sounds like you may be in need of a shared secured loan from Alliant or SDFCU.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Study: AAoA / Oldest Account and max FICO score Survey

@Anonymous wrote:Would be interested to see:

1. Who has active installment loan and at what UTI of the loan it is. An active installment loan that is mostly paid can be worth 20 to 30 points, which is enough to skew the AAoA feed back. In opposing relation an active installment with high amounts owed would reduce score 10-20 points.

I do. Currently showing a balance of $22 on an original amount of $2050. It's paid and will soon report as such. I expect a drop in my scores in the 25 point range.

Great - Look forward to seeing a before/after score summary relating to loan closure for both Fico 08 and Fico 09 - if you are willing. As mentioned in another thread, I speculate Fico 09 may not differentiate between open/closed loans from a mix perspective. If so, no need for an open loan if you have a few closed ones on file.

Alternatively, it might be that Fico 09 is set up to allow full points for the "amount of debt" category based on credit card factors alone - (individual/aggregate utilization and # open accounts reporting a balance).

If someone does have an open installment loan, then some re-allocation of points may occur relating to balance/loan ratio ... unless Fico 09 no longer looks at high balance/loan as a negative in scoring. Now that would be interesting! The balance/loan metric would be "relatively" easy to test for those that take out $500 loans - if Fico 09 scores are updated on a regular basis.

Need more data on this.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Study: AAoA / Oldest Account and max FICO score Survey

I currently have no open installment loans,But I just found a posting where their was a 30+ credit point loss when an installment loan reported closed/paid as agreed.fused posted an 850 Fico score across all credit bureaus. Here's the link.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Study: AAoA / Oldest Account and max FICO score Survey

I see your point on the FICO9 Thomas_Thumb, however, there is still a few years before the FICO9 is adopted by the largest commercial banks. Longer for the smaller credit unions. Additionally, there are other FICO scores to think about. But it's CAPTOOL's call.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Study: AAoA / Oldest Account and max FICO score Survey

@DIYcredit wrote:I currently have no open installment loans,But I just found a posting where their was a 30+ credit point loss when an installment loan reported closed/paid as agreed.fused posted an 850 Fico score across all credit bureaus. Here's the link.

@Anonymous wrote:

I see your point on the FICO9 Thomas_Thumb, however, there is still a few years before the FICO9 is adopted by the largest commercial banks. Longer for the smaller credit unions. Additionally, there are other FICO scores to think about. But it's CAPTOOL's call.

DIY credit - Thanks. I am familiar with the Fico 08 drop, curious if Fico 09 behaves the same

Slimshady66,

The beauty of a 3B report is you/we/I could compare how all the Fico models react - except Fico NextGen. ![]() I don't mean to suggest others should spend money unnecessarity. However, if someone has before/after data for Fico 09 on loan closures or openings, I do encourage posting it.

I don't mean to suggest others should spend money unnecessarity. However, if someone has before/after data for Fico 09 on loan closures or openings, I do encourage posting it.

For me credit scores are a hobby (obsession?) so I purchase a 3B report every 3 or 4 months (no credit monitoring). The time spent here sometimes help keep me out of the bars. ![]()

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Study: AAoA / Oldest Account and max FICO score Survey

@Anonymous wrote:

@Anonymous wrote:Would be interested to see:

1. Who has active installment loan and at what UTI of the loan it is. An active installment loan that is mostly paid can be worth 20 to 30 points, which is enough to skew the AAoA feed back. In opposing relation an active installment with high amounts owed would reduce score 10-20 points.

I do. Currently showing a balance of $22 on an original amount of $2050. It's paid and will soon report as such. I expect a drop in my scores in the 25 point range.

Sounds like you may be in need of a shared secured loan from Alliant or SDFCU.

I actually already have another installment loan that I'm six months in to. It hasn't reported, and I haven't pushed them to do so yet because I want to see what the drop is when I go to none active. After that I'll contact them.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Study: AAoA / Oldest Account and max FICO score Survey

Slimshady66,

The beauty of a 3B report is you/we/I could compare how all the Fico models react - except Fico NextGen. ![]() I don't mean to suggest others should spend money unnecessarity. However, if someone has before/after data for Fico 09 on loan closures or openings, I do encourage posting it.

I don't mean to suggest others should spend money unnecessarity. However, if someone has before/after data for Fico 09 on loan closures or openings, I do encourage posting it.

For me credit scores are a hobby (obsession?) so I purchase a 3B report every 3 or 4 months (no credit monitoring). The time spent here sometimes help keep me out of the bars. ![]()

Thomas_Thumb,

Understood, just for evaluation purposes. I like that. So about the time FICO9 kicks in you will have some answers. That will make you my go to, when that happens. ;-)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Study: AAoA / Oldest Account and max FICO score Survey

@Anonymous wrote:Would be interested to see:

1. Who has active installment loan and at what UTI of the loan it is. An active installment loan that is mostly paid can be worth 20 to 30 points, which is enough to skew the AAoA feed back. In opposing relation an active installment with high amounts owed would reduce score 10-20 points.

I do. Currently showing a balance of $22 on an original amount of $2050. It's paid and will soon report as such. I expect a drop in my scores in the 25 point range.

Installment loan just reported paid.