- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Testing "all-zero-but-one" theory -- Never mind, d...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Testing "all-zero-but-one" theory -- Never mind, dropping this experiment. Too much work.

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Testing "all-zero-but-one" theory

Well, I have something of a data point today. I've actually stumbled into three cards reporting zero balances over the last short time, tracked here on MyFICO TU updates. I had to reconstruct nearly all of this because many of these balance changes were not called out by EX and EQ.

June 25 CapOne $10k card: $141 to zero to set the interest rate charges to zero and get on PIF mode. Hilton went $487 to $501 same day.

June 28 Chase Freedom $1.5k card $187 to zero because Chase does that mid-cycle thing. D'oh!

June 30 SDFCU $500 Secured card: $3 first report, PIF new charges prior to statement, reported zero. Also Hyatt $155 to $85.

July 2 Freedom: The $20 new charge reported (mid-cycle again).

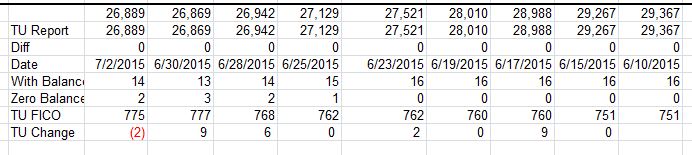

This worksheet is read right to left following the date sequence, and the With Balance are cards that have any balance reported that day, Zero Balance are cards that have zero balance that day. This is of 16 open CC (excludes 2 closed CC with balances, Diners hidden, and LOC). The TU FICO is from MyFICO alerts.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Testing "all-zero-but-one" theory

@Anonymous wrote:Hey SJ. What do you mean by "jump my utilization"?

I meant that the experiment is to start adding small balances to all the accounts as they post rather than to get the utilization up to a certain number to start.

Right now the total utilization is .3%. If over the next 30 days, each account posts at 1%, the total will be 1% at the end of the 30 days, but before then it will be something less than that until lthe 30 days are over.

The only thing I'm testing for is the theory that zero balances are better than small balances.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Testing "all-zero-but-one" theory

@Anonymous wrote:Thanks for that! I in the middle of doing the opposite. Letting 4 report a decent balance for 2 months.(nothing over 20%). Total UT is still far under 10% . Trying to shake things up to get a higher score down the road a bit quicker. We can see what happens.

I'm really curious about how that works out. It's based on some pretty complex stuff about letting FICO 'get used' to you. I wonder if you're giving the FICO algorithm too much credit.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Testing "all-zero-but-one" theory

@NRB525 wrote:Well, I have something of a data point today. I've actually stumbled into three cards reporting zero balances over the last short time, tracked here on MyFICO TU updates. I had to reconstruct nearly all of this because many of these balance changes were not called out by EX and EQ.

June 25 CapOne $10k card: $141 to zero to set the interest rate charges to zero and get on PIF mode. Hilton went $487 to $501 same day.

June 28 Chase Freedom $1.5k card $187 to zero because Chase does that mid-cycle thing. D'oh!

June 30 SDFCU $500 Secured card: $3 first report, PIF new charges prior to statement, reported zero. Also Hyatt $155 to $85.

July 2 Freedom: The $20 new charge reported (mid-cycle again).

This worksheet is read right to left following the date sequence, and the With Balance are cards that have any balance reported that day, Zero Balance are cards that have zero balance that day. This is of 16 open CC (excludes 2 closed CC with balances, Diners hidden, and LOC). The TU FICO is from MyFICO alerts.

I'm not sure I understand it, but is it saying:

with 3 accounts reporting zero balances your score was 777?

with no accounts reporting zero balances your score was 751?

your overall posted balances stayed around the same?

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Testing "all-zero-but-one" theory

@SouthJamaica wrote:

I'm not sure I understand it, but is it saying:

with 3 accounts reporting zero balances your score was 777?

with no accounts reporting zero balances your score was 751?

your overall posted balances stayed around the same?

Fortunately for me (not so fortunate for FICO testing) there are a lot of other things going on in my file leading to the June score increases:

The last of any cards or LOC that were individually over 50% utilization were reduced below 50% by the May reports, so June is "reconfirming" that they are down.

Overall utilization is just a shade over 20% now, and that is another key score change level when that gets to - goes below 20% (based on some FICO simulator).

I've stopped apping, so a bunch of new cards and INQ from late in 2014, Jan 2015 start to age/reduce impact.

The 2 point score drop today with a card going from $0 to $20 is interestnig. As the SDFCU and CapOne come back on line later this month, will be interesting to see if they also cause any decline. I think there is still going to be a lot of other factors, particularly I may be crossing the 20% overall CC utilization this month, and aging of new accounts, INQ, continues of course.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Testing "all-zero-but-one" theory

@NRB525 wrote:

@SouthJamaica wrote:

I'm not sure I understand it, but is it saying:

with 3 accounts reporting zero balances your score was 777?

with no accounts reporting zero balances your score was 751?

your overall posted balances stayed around the same?

Fortunately for me (not so fortunate for FICO testing) there are a lot of other things going on in my file leading to the June score increases:

The last of any cards or LOC that were individually over 50% utilization were reduced below 50% by the May reports, so June is "reconfirming" that they are down.

Overall utilization is just a shade over 20% now, and that is another key score change level when that gets to - goes below 20% (based on some FICO simulator).

I've stopped apping, so a bunch of new cards and INQ from late in 2014, Jan 2015 start to age/reduce impact.

The 2 point score drop today with a card going from $0 to $20 is interestnig. As the SDFCU and CapOne come back on line later this month, will be interesting to see if they also cause any decline. I think there is still going to be a lot of other factors, particularly I may be crossing the 20% overall CC utilization this month, and aging of new accounts, INQ, continues of course.

Whoa dude you have 770+ TU FICO 8 with that many balances reporting? Go zero most of your accounts, take that 800 if your file is anything like LG's who tested this previously.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Testing "all-zero-but-one" theory

@SouthJamaica wrote:

@Anonymous wrote:Thanks for that! I in the middle of doing the opposite. Letting 4 report a decent balance for 2 months.(nothing over 20%). Total UT is still far under 10% . Trying to shake things up to get a higher score down the road a bit quicker. We can see what happens.

I'm really curious about how that works out. It's based on some pretty complex stuff about letting FICO 'get used' to you. I wonder if you're giving the FICO algorithm too much credit.

I'm 99% confident that is the case.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Testing "all-zero-but-one" theory

@Revelate wrote:Whoa dude you have 770+ TU FICO 8 with that many balances reporting? Go zero most of your accounts, take that 800 if your file is anything like LG's who tested this previously.

The 775 is nice, but the more important number is $26,889. I'd rather see that go down, then 800 will be here soon enough.

And, I am in these cards for the long term, meaning they all get some form of use. Not smelly socks ![]()

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Testing "all-zero-but-one" theory

@NRB525 wrote:

@Revelate wrote:Whoa dude you have 770+ TU FICO 8 with that many balances reporting? Go zero most of your accounts, take that 800 if your file is anything like LG's who tested this previously.

The 775 is nice, but the more important number is $26,889. I'd rather see that go down, then 800 will be here soon enough.

And, I am in these cards for the long term, meaning they all get some form of use. Not smelly socks

Maybe a dumb question since I don't know your goals within a year, but with your scores and today's cheap money environment, why haven't you just gone and airstruck those balances with a debt consolidation loan from any number of lenders who'd be falling over themselves to give you one in the current market?

Is that 26K sitting on 0% offers or something?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Testing "all-zero-but-one" theory

@Revelate wrote:

@NRB525 wrote:

@Revelate wrote:Whoa dude you have 770+ TU FICO 8 with that many balances reporting? Go zero most of your accounts, take that 800 if your file is anything like LG's who tested this previously.

The 775 is nice, but the more important number is $26,889. I'd rather see that go down, then 800 will be here soon enough.

And, I am in these cards for the long term, meaning they all get some form of use. Not smelly socks

Maybe a dumb question since I don't know your goals within a year, but with your scores and today's cheap money environment, why haven't you just gone and airstruck those balances with a debt consolidation loan from any number of lenders who'd be falling over themselves to give you one in the current market?

Is that 26K sitting on 0% offers or something?

Yes. Most all of the historically high balances were taking advantage of Forever offers at low APR during the credit bubble. Some ended up on less favorable but not terrible rates like 7.9% on my BofA AMEX. As of mid-2014 I started getting the 0% offers again.

BofA MC $4,000 0% to Nov 2016 (re-upped after that expired in May 2015) 4% fee.

BofA AX $5,400 0% to May 2016, was 4% fee, renewal planned

USBk $5,500 0% to Feb 2016, 3% fee. Latest USBank are 2.99% on 3% fee. This was the one 0% that came available so I jumped on it.

Each of the above three was at very high utilization when the 0% was taken. All below 50% now.

Chase Slate $5,000 on 4.99% Forever offer since Feb 2008 when it was $16k.

The rest are shorter term low APR "keep the card busy" items, but my list of PIF cards is growing.

The CapOne is my BT resource. The no BT Fee allows me to park the items off an expiring BT, then pay the 3% or 4% fee to get the funds back on the longer term 0% or low APR offer. Even if the funds stay there, it's only 10.9%APR, so 1% per month.

The two closed cards are $1k at 7.99% on locked terms and $1.6k at 1.99% on a Forever offer, both maintaining the accounts to extend the year 2000 card history as long as possible.

Interest cost for June was $85 including $27 on the LOC I took a cash advance on and am paying down. Average monthly interest in 2015 has been $125.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765