- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: The AZEO Method...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

The AZEO Method...

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The AZEO Method...

@Anonymous wrote:i just saw your posting.

i am VERY new on here.

i noticed that your American Express card was being reported. I thought AMEX does not report to the credit agencies. I am correct? Is this perhaps a different type of AMEX card?

thank you

The penalty does not specifically relate to AZ cards reporting. It is for: "No recent revolving account activity". AMEX charge cards are not included in revolving account activity (Fico 4, Fico 8 and Fico 9 models). For some people AU cards are not included either (Fico 8 and Fico 9 models). Others have reported having a store card excluded as well.

So potentially you could report AZE3 with an AU credit card, AMEX charge card and a store card showing a balance and still experience the: No recent revolving account activity penalty. Store cards appear to be a mixed bag on how they are treated.

If one wants to play AZEO, the card reporting should ideally be a personal card (not AU) and be a known revolver (Visa, Mastercard, Discover card, cobranded store card or AMEX credit card). Not sure about Diner's Club and some other odd cards.

*** Although confusing, AZ is optimal for the # accounts with balance scoring factor. The score drop which happens as a consequence of AZ relates to a completely different scoring attribute - lack of recent revolving activity.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The AZEO Method...

@Anonymous wrote:I have a Discover IT, CapOne Quicksilver, and CapOne

Each of those reports the statement balance.

So all you have to do is let one of the 3 report a small balance before you pay it off, while you pay off the others prior to the statement date.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The AZEO Method...

I am still learning but I was made to understand by calling my cards that the due date and the date they report are also two different dates which may or may not be helpful info.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The AZEO Method...

@Anonymous wrote:I am still learning but I was made to understand by calling my cards that the due date and the date they report are also two different dates which may or may not be helpful info.

Right. Here's an example, drawn from how a typical credit card works. Suppose you have a card that prints its statement on the 2nd of every month. That is the Statement Date.

On the date that the statement prints, the CC issuer will report the statement balance (aka the Amount Owed at the top of the statement) to the three credit bureaus. This is the Date Reported.

Thus, the Date Reported and the Statement Date are (for almost all CC issuers) the same date.

Imagine in this example that you have a statement balance of $400 on May 2. That $400 has been reported to all three bureaus.

Roughly 25 days after the Statement Date is the DUE DATE. The CC issuer is giving you a "grace period" of about 25 days to make a payment on that $400. If you pay the full $400 during that period, then you will not owe any interest. Paying that full $400 is called Paying In Full or PIF. Note that when I person is PIF-ing he often is NOT paying the card to zero. In this example, if you paid $400 on May 15, your card might will have new charges that have brought the balance to (say) $500.

So to recap, the Due Date always refers to how long you had to make a payment on the last statement. The Due Date has nothing to do with the date the CC issuer reports to the three bureaus.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The AZEO Method...

@Anonymous wrote:I have a Discover IT, CapOne Quicksilver, and CapOne

OK. All 3 of those report the statement balance.

So for optimal revolving utilization, all you need to do is pay 2 of them down to zero before the statement date, and let 1 of them report a small balance which you then pay off shortly after the statement date.

The primary purpose of AZEO is to make sure you're not hurting yourself on revolving utilization across all FICO scoring models. AZEO has more of a positive impact on your mortgage scores than it does on your FICO 8's and 9's.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The AZEO Method...

Hi. Brand new to this forum.

I have groomed my credit to the Exceptional level (some months even a perfect score). I just saw AZEO mentioned on this forum. The card I use most is a Citi 2x card with a $65k available line. Some months the balance gets rather high & I make interum payments to keep the balance at a resonable level. This month I paid the entire balance before the statement cut off. Because I haven't used any other credit cards this cycle, my revolving credit usage this month will be 0 - I never knew that this could be a bad thing. How many points can I expect to lose?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The AZEO Method...

As an aside, starting your own thread in the future if you have a question will likely yield you more exposure and responses relative to bringing an old thread back to life.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The AZEO Method...

Yikes! But great that it's a quick fix. I think I might have freaked if I saw that drop without knowing why it happened.

Thanks for the quick reply & the posting advice.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The AZEO Method...

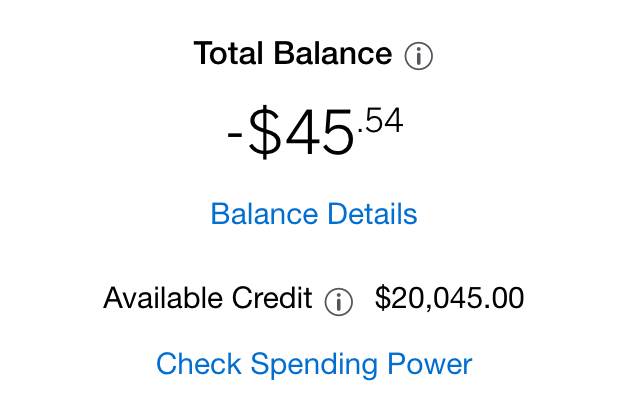

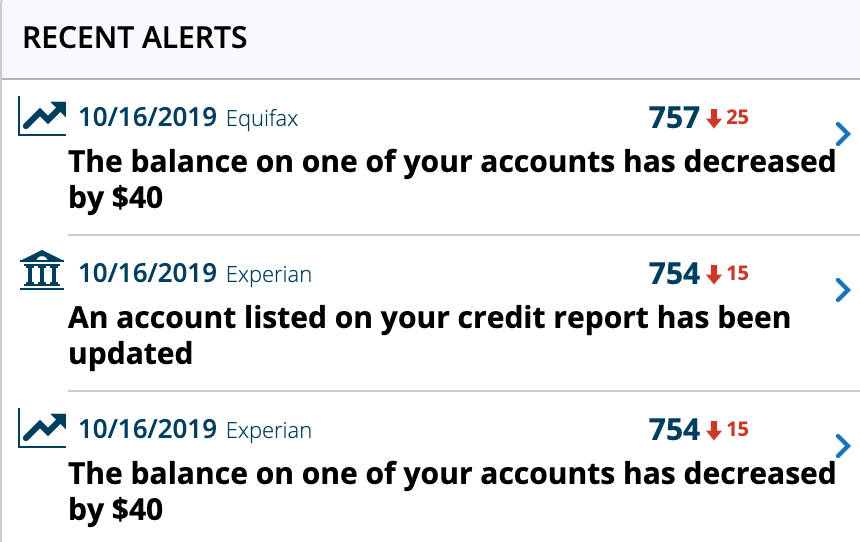

I was expecting a score drop today and it came right on time. I downgraded my BCP to the non AF version and Amex gave me a partial refund for the Annual fee. (I didn't know this at the time of the downgrade). Since this is my AZEO card that I carry a small balance on my score tanked. Once they refunded me, it was too short of notice for me to prevent the damage because the statement closed at the same time. TransUnion is slower to report, that will happen in the next few days. I will quickly correct this, by letting a small balance report on another card.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The AZEO Method...

What credit monitoring system is this ?

@grower1 wrote:I've been trying AZEO since learning of it here on the forum. Does this look about right? My next goal is to grow my CLs on my cards.