- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- The many flavors of FICO:__Editions, versions, and...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

The many flavors of FICO:__Editions, versions, and variations

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The many flavors of FICO:__Editions, versions, and variations

@Anonymous wrote:Do you know of any mortgage compaines using FICO 8 score for loans?

You won't find any.

The vast majority of mortgages are underwritten to the rules of one of the GSEs, and they require the use of three specific score models (EQ5/TU4/EX2).

Even in the cases where a bank intends to hold the loan, rather than selling it, they effectively always use those three scores (all their internal risk models are already setup for the Fannie/Freddie rules...)

Unless you're looking at a hard money loan or a really unusual credit union (that holds it's own loans), you just won't see anything else used today.

(And if a new scoring model is switched to at some point, it's possible/likely that the various score/rate breakpoints would be different.)

EQ9:847 TU9:847 EX9:839

EQ5:797 TU4:807 EX2:813 - 2021-06-06

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The many flavors of FICO:__Editions, versions, and variations

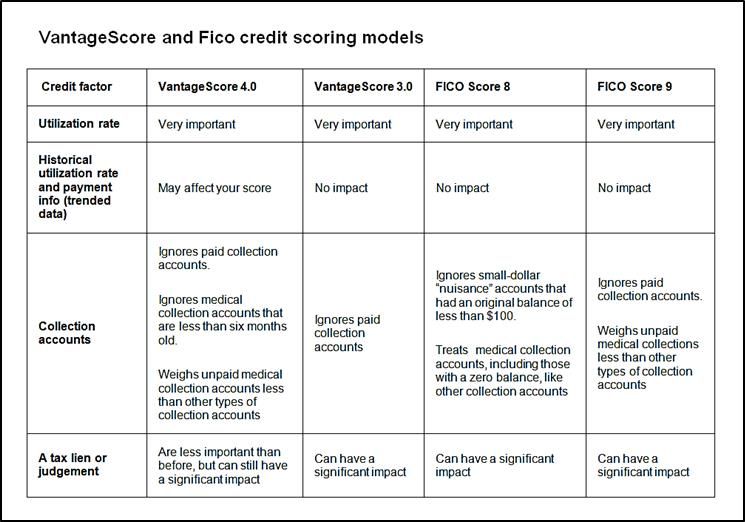

FWIW - Here is a comparison table on how VS4/VS3 and F9/F8 views some important scoring attributes

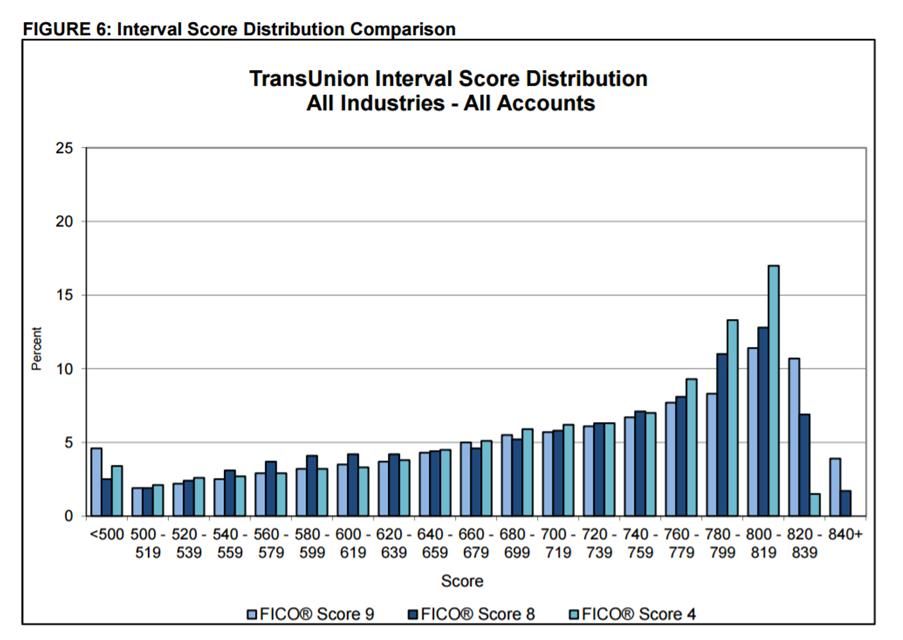

Below is a link to an article on Fico score distributions from TransUnion which compares Fico 04, Fico 08 and Fico 09.

Note the upward shift at the top end with the newer models.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The many flavors of FICO:__Editions, versions, and variations

This is a new reply to an old thread, but that said:

FICO another other score credit report models measure payment behavior, not payment capacity.

Payment behavior answers the question: "will you pay us back?"

Payment capacity answers the question: "can you pay us back?"

Standard FICO, Vantage and other models do not factor income because that was not what Fair Issac and Co (FICO) was trying to understand when their models were created.

Credit score models are designed to measure the past historical patterns of payment behavior (facts within a credit report) to project the likelihood and probability of how someone will pay in the future. They measure repayment probability risk.

Income is a related and important input. That said, just because someone has the capacity to pay does not mean they will, due to personal habits and attitudes. Being a high income earner or high net worth individual means that one CAN pay with less financial stress. Logic suggests that they will pay because they can pay. Behavioral risk models like FICO measures how likely a person will pay. How, from where, from how large a bank account, or under what terms the person pays is not what FICO measures. That is where underwriting comes into play.

Underwriters look at a more complete view of someone requesting credit (credit card, mortgage or other installment). That is where income, bank account levels and other factors - the capacity to pay - gets matched up with FICO scores. Underwriting standards and practices vary from lender to lender, hence the variance of different models (FICO, Vantage, and others...) and which version (FICO 8, Vantage 3, et al).

FICO is a scoring factor for credit decisions. It is an important factor. But it is likely only ONE of the scoring factors, not the only one. When Chase, or Citibank, or any credit union pulls either a credit report or a credit score (related but not the same), they are likely combining and enriching it with income and banking information from existing or other sources. You become aware of when your credit file is pulled, but often not from other sources that measure capacity. Capacity is a factor, but behavior is as important if not more important.

Hoping that is clear and helpful.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The many flavors of FICO:__Editions, versions, and variations

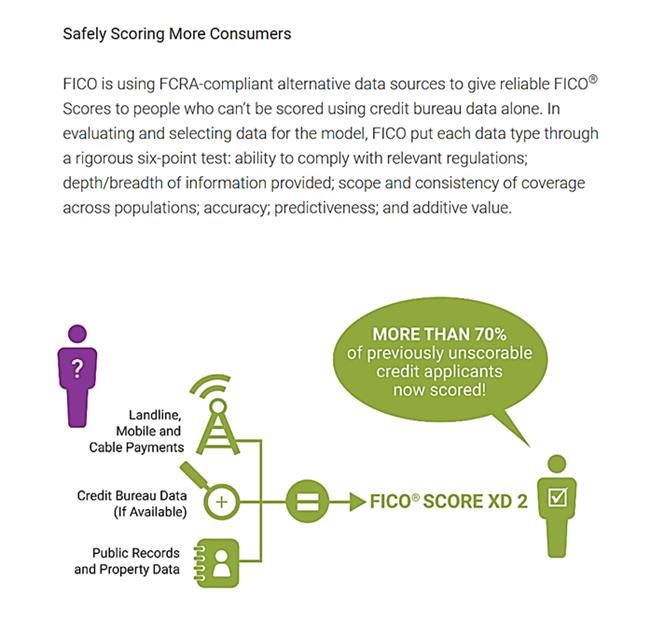

Pasted below, news excerpt on another flavor of Fico, Fico XD along with a link. This has been reported in other threads but, thought it should be mentioned in this thread as well. It's primary focus is to quantify risk for those new to credit. Discover card uses this model to evaluate applicant profiles that don't have a standard Fico score.

https://www.fico.com/en/products/fico-score-xd

FICO® Score XD 2 utilizes the most recent data from expansive data sources, ensuring the scoring results reflect current behavior trends. FICO Score XD 2 continues to leverage the same proven modeling methodology and scoring range (300-850) as used in traditional FICO® Scores. This helps maintain consistency of scoring results between versions and enables a seamless transition between scores. Further, FICO Score XD 2 replicates advancements made in FICO® Score 9, including predictive enhancements to medical debt collections.

- FICO® Score XD 2 increases coverage and is able to score over 26.5 million previously unscorable consumer files

- 11.8 million of these consumers are without credit files and unscorable by any scoring system relying on traditional credit bureau data alone

- While the traditional FICO® Score is able to score 91 percent of applicants, the inclusion of FICO® Score XD augments the percent of applicants eligible for a FICO-branded score to nearly 98 percent

- Findings demonstrate that consumers with a FICO® Score XD 2 over 620 that go on to obtain credit maintain a high traditional FICO Score in the future – 75 percent scored 620 or higher in the subsequent 24 months

- FICO was recently awarded an Analytics 50 Award for FICO® Score XD

FICO® Score XD 2, developed in partnership with LexisNexis® Risk Solutions and Equifax (NYSE:EFX), utilizes alternative data – data that resides outside of traditional credit files – to generate scores for consumers who do not have credit files or whose credit files contain outdated or limited information. Bankcard issuers can use FICO Score XD 2 in the originations process alongside standard FICO® Scores, which means lenders do not have to replace existing systems.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The many flavors of FICO:__Editions, versions, and variations

Wow so much info thank you

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The many flavors of FICO:__Editions, versions, and variations

I asked this question in another thread, but maybe this is really the right place for it.

From what I've read, FICO 9 ignores paid collections.

Does that include paid charge-offs? The reason I ask, if it wasn't obvious, is that my only derog is a paid charge-off (for $92).

When I read differences between the two, I normally see them list how they handle collections, and then on the next line, how they handle judgments, liens, etc. I do not see the word "charge-off". I don't know whether charge-offs would be handled like collections, or like judgments/liens, for this purpose. Discussions I've found where someone asks the question are normally answered based on info about collections, without any discussion of whether that definitely does or does not apply to charge-offs.

Thanks!

FICO Resilience Index: 64. Cards: 5/24, 2/12, 2/6. Accounts including loans: 8/24, 4/12, 3/6. Card CLs total $213,900, or $240,400 including the AU card. Cards (oldest to newest)

Authorized user / Corporate / Auto loans / Personal loan

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The many flavors of FICO:__Editions, versions, and variations

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The many flavors of FICO:__Editions, versions, and variations

FICO should make an adjustment to accounts charged off and reported as taxable income.

Accounts charged off and converted from debt to equity should not be allowed to be reported/factored as a chargeoff, since the Federal government considered the loss and taxed the person for the full amount of the debt.

This law was created as a legislative recoupment, without allowing for a debtor to decide their conversion.

Since conversion was not an option of a debtor, then the reporting should be removed from a credit report, thus FICO scores should be increased upon removal. An easy fix yet still from stagnant reasoning a very broken system.

I have had people from the insurance industry tell me how bad and unfair FICO is. Because they refuse to correct things that influence FICO scoring.

In better logical words Fico shoud require venders/creditors to report whether or not an account was merely charged off or converted from debt to equity, if debt to equity then all parties are made whole and should NOT be allowed to report as a chargeoff but as an account closed paid off.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The many flavors of FICO:__Editions, versions, and variations

Lexus data is still skewed because they have partnerships of profit interests via creditors that pay them to research in absurdity in which they use unknown data to lessen the integrity of an otherwise would be perfect debtor. Thus lessens the potential profits. Too complicated can be very bad.

I spoke with a representive from Synchrony bank earlier tonight in regards to the Blue envelope fiasco that took place between 2016 and 2018, at first they supposedly were unaware of what happened, then I was advised not to worry about my account and go ahead and make a purchase by the means I decide.

Which made sense.

However my pont being they knew they screwed up. Nexis not good at all at the current moment. Since they want extra data as the Synchrony Rep stated Sychrony cannot legally ask you for any information from the I.R.S. That also extends to third parties, since the first had no legal Right to require, the third you have no connection with.

Something happened that someone made the wrong choice to do some dirty things based on their dependence of a third party they relied upon to dig up derrogatory data on a person, (most likely held some financial interest in Nexus, legally there was no Right tresspassed upon a creditor, and opens them up to legal claims for all accounts closed to date, especially accounts closed by Synchrony. Just saying.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The many flavors of FICO:__Editions, versions, and variations

GWL saturation campaign worked!

FICO Resilience Index: 64. Cards: 5/24, 2/12, 2/6. Accounts including loans: 8/24, 4/12, 3/6. Card CLs total $213,900, or $240,400 including the AU card. Cards (oldest to newest)

Authorized user / Corporate / Auto loans / Personal loan