- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Understanding Your Score - Equifax

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Understanding Your Score - Equifax

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Understanding Your Score - Equifax

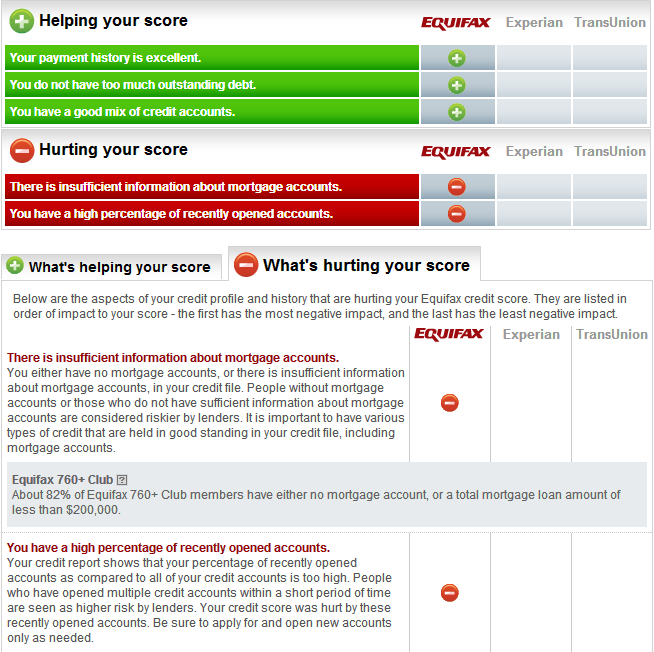

@Anonymous wrote:Yes, I knew opening the accounts would reduce my AAoA and I would take a big drop in my scores. What I am trying to determine is what percentage EQ is needing to remove the negative indicator as a reason for a score drop. Just exactly what percentage can you open in a year and not have that used as a reason for hurting your score, according to EQ?

As you see I am at 90% of all my credit accounts opened in the last 12 months. But what if I only had 60% or 30% opened in the last year, would that be a negative as well? Figured someone that subscribed to one of the EQ packages would have some info and perhaps noticedthis under their report. Curious to if someone who did open a lot of accounts had a % number on their account I could use for a reference.

If someone had the same 'hurting my score' comment as me, but yet they had 50% opened in the last year compared to all credit accounts, then I would have a better idea of what or how many of my cards needs to be a year old to make a difference according to EQ.

Not quite sure what you mean here. AFAIK, the EQ "reason" is just a summary, you are not losing extra points because of this reason. Your score is down because of the new accounts (some mixture of Inqs if they are on this report, and reduction in AAoA). Obviously, with a smaller number/percentage the impact would be less, and indeed this reason might then not appear in the top N, but the reason itself has no impact.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Understanding Your Score - Equifax

Alright. I have a few cards in May that will be a year old. Hoping to get a slight score increase. Another question, if an account was opened May 9th, 2012, just exactly how would lenders or the bureaus determine a year mark? May 9th, June 1st, or the next statement cycle (June 9th). I'm getting close to a year mark on some accounts and want to get a better idea of when things may fall into place for the better.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Understanding Your Score - Equifax

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Understanding Your Score - Equifax

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Understanding Your Score - Equifax

Do you subscibe to any of the EQ products? If so, do you see what I see? I wonder if your 50% throws a flag up on EQ like mine does at 90%.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Understanding Your Score - Equifax

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Understanding Your Score - Equifax

i have Equifax's service as well but my new accounts hasn't reported yet. I was at 766 (FAKO) and 1 discover inquiry brought me down to 756 (FAKO as well). I am probably going to be 650-720 region once my new accounts report ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Understanding Your Score - Equifax

@BrokaToe wrote:

@tcbofade wrote:Hmmm. I didn't know that either.

Right now, I've got 32 "active" credit accounts...six of them opened in the last 12 months. The last one was in August of 12.

I wonder if this will help my EQ score come August...

interesting thought tcbofade. That would definitely be something to keep an eye out for. If you see a small jump in August and nothing else has changed, then that could be the reason. If you don't mind me asking, are all 32 of those accounts credit cards?

Oh heavens no...

(only 29 of them are...)

Fico 9: EX 812 04/15/25, EQ 804 04/08/25, TU 792 02/15/25.

Zero percent financing is where the devil lives...